Bank guarantee letter

This article explores the definition, applications, benefits, and intricacies of letters of guarantee, shedding light on their significance in the world of finance and commerce. While different, both bank guarantees and letters of credit assure a third party that if the borrowing party can't repay what it owes, the .It is issued usually as SWIFT MT760 (guarantee format) and advised by the beneficiary’s bank, or directly to the beneficiary as a letter. Secure Your Business Transactions with Aspire.

How Bank Guarantee Letter Could Help Secure a Transaction

The most crucial concern is whether the amount guaranteed is repayable. Recommended Articles.

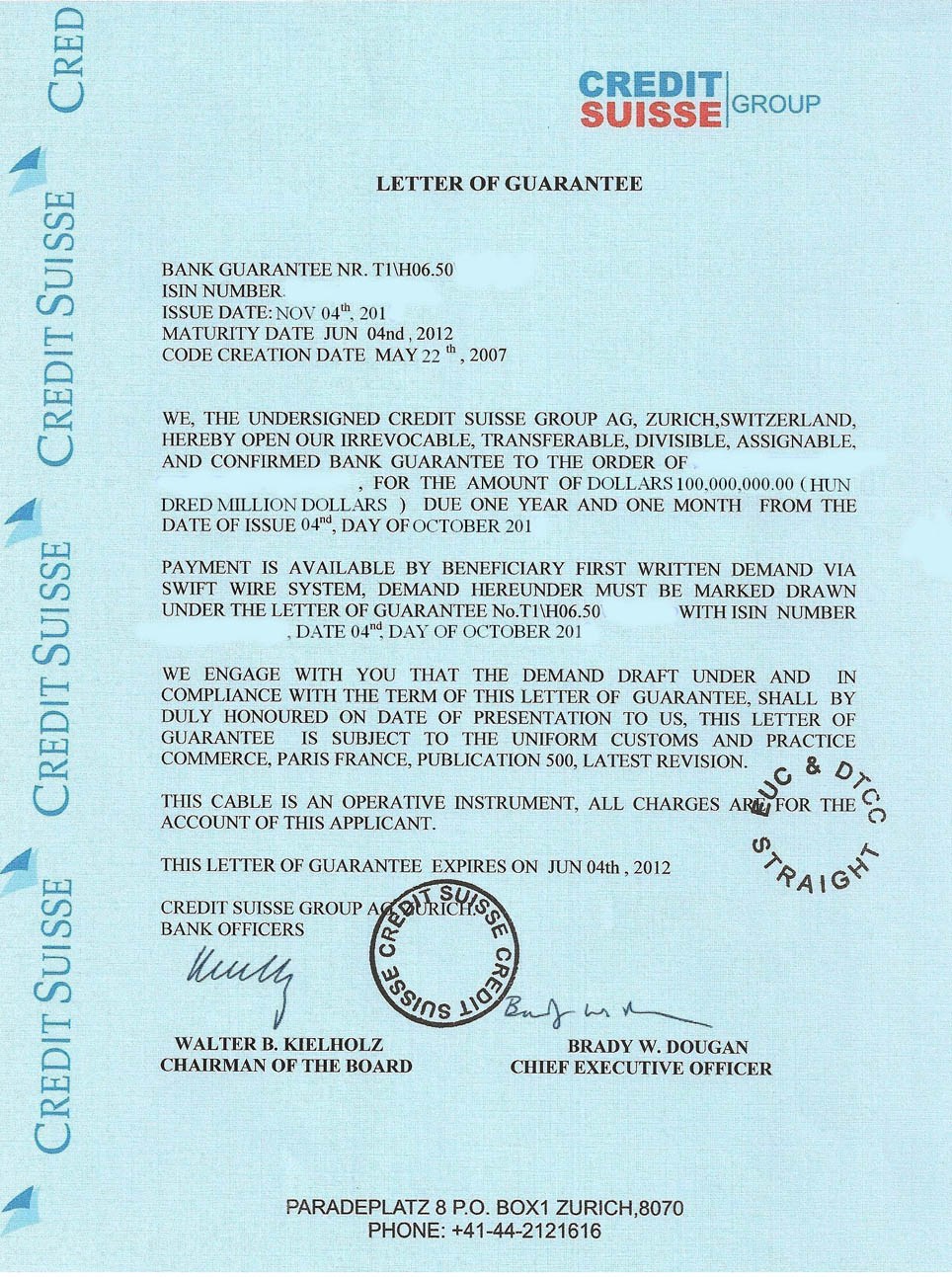

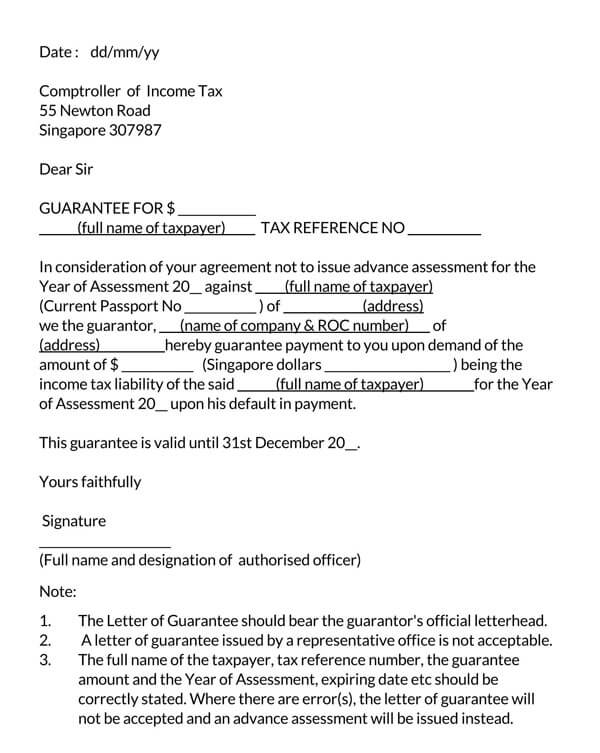

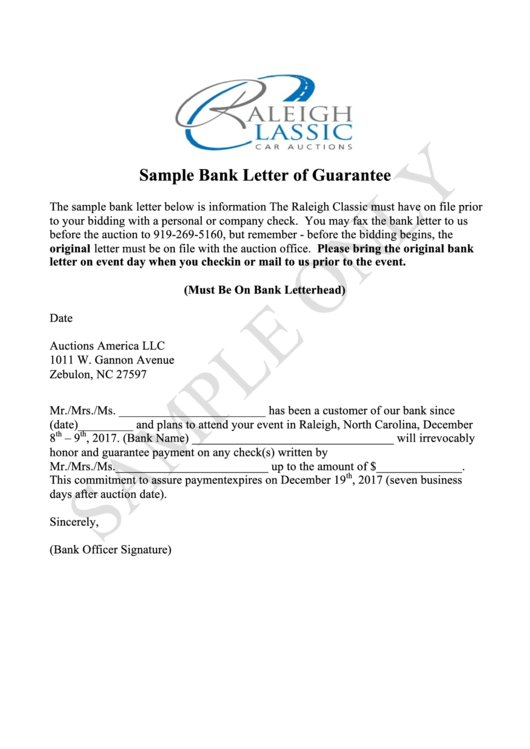

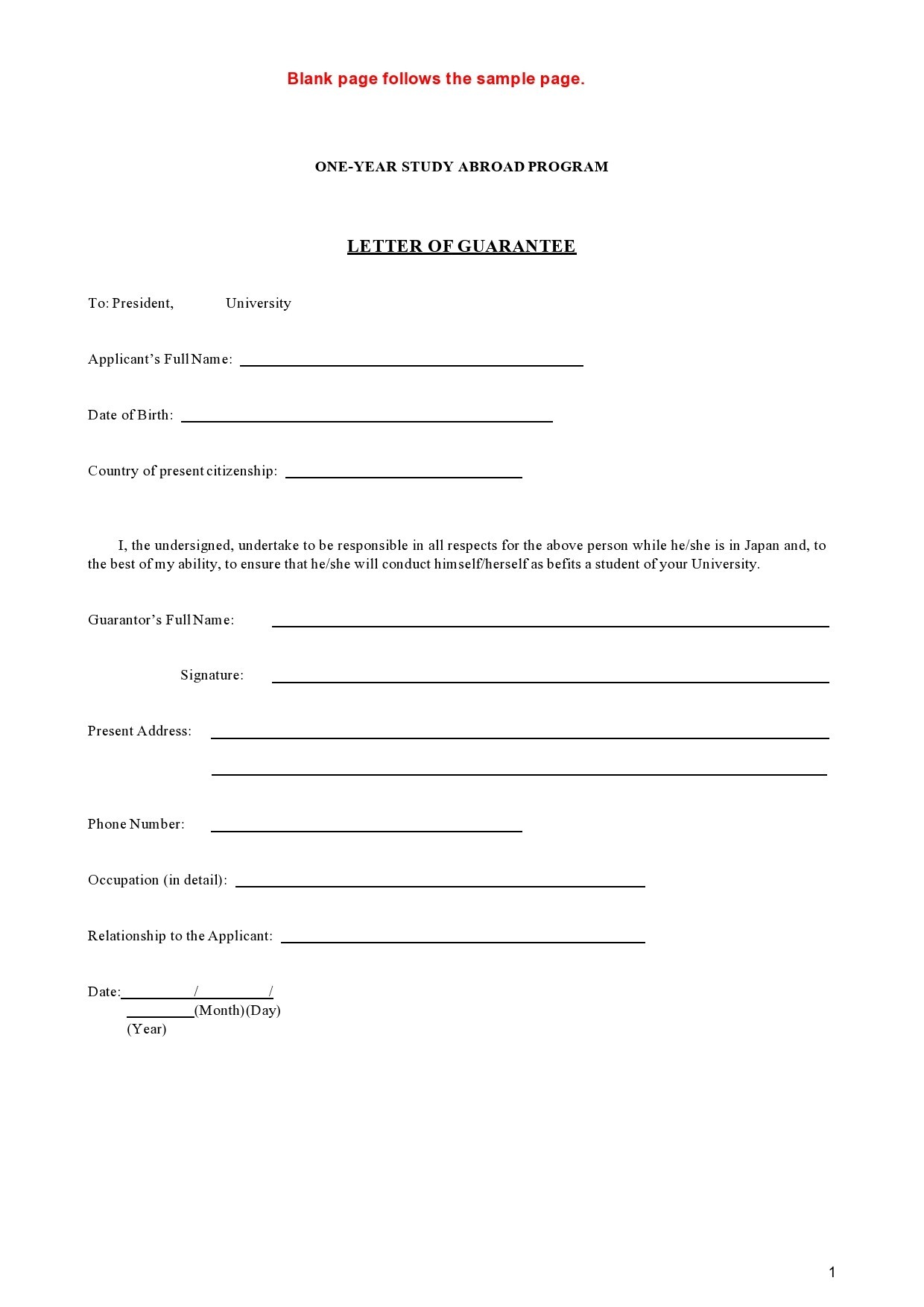

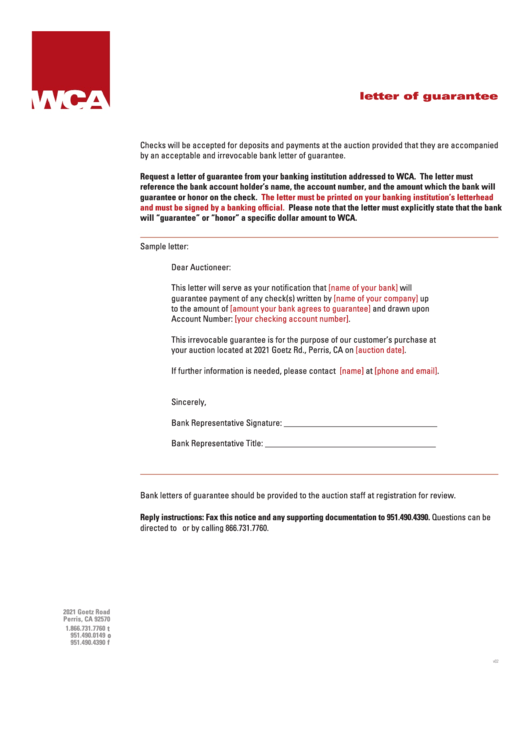

Letter of Guarantee

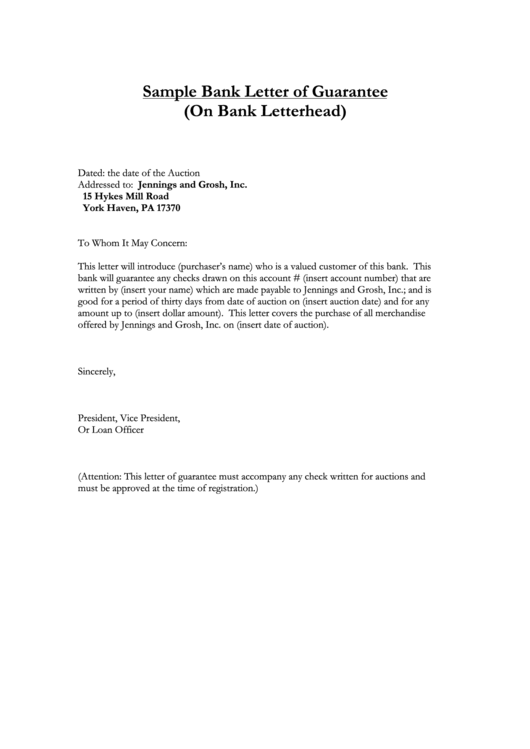

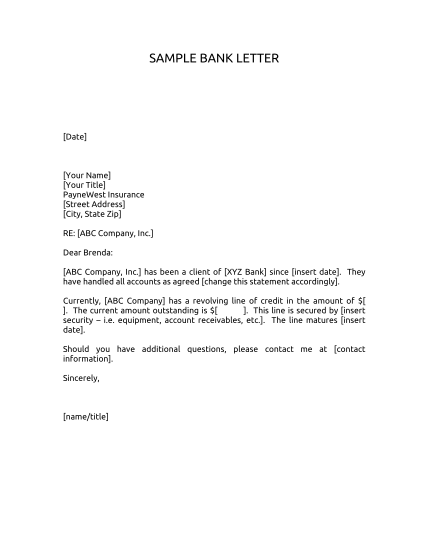

The letter is a legal document that a bank issues on behalf of a client who has contracted to buy products from a supplier. The guarantee can be used to essentially . Claiming under a Bank Guarantee. I am [Your Name], representing [Your Company/Organization], and we have entered into a contractual agreement with [Counterparty's Name/Organization] for [Nature of the Transaction .The bank guarantee can be released once the conditions agreed upon in the . This is to request you kindly release and return the bank . Advance Payment Bond.

Bank Guarantee Vs Letter of Credit

Bank guarantees may be used to cover a wide range of purposes, but some common .

How They Work, Types, and Examples

Bank Guarantee

【貿易】L/G Letter of Guarantee(保証状)の意味と使い方とは?

bank guarantee n — garantie bancaire f.A bank guarantee and a letter of credit are both promises from a financial institution that a borrower will be able to repay a debt to another party, no matter what the debtor's financial circumstances. Standby Letters of Credit Operates similar to a Bank financial guarantee, with the main difference being that it is governed by the current version of UCP or ISP98. Better Way Finance is a leading and reputed Bank Guarantee services provider in Dubai.Bank Guarantee Vs Letter of Credit.

A bank credit facility will be needed to enable Santander to issue bank guarantees on your behalf. Reduction of fiscal burden by reducing the need for direct government guarantees.Bank Bonds and Bank Guarantees provides a purchaser the security of a guarantee if there is a failure by the seller to meet its contractual obligation. Every organization has unique needs. Guarantee letter dapat menjadi salah satu alat bayar berupa surat jaminan yang dikeluarkan perusahaan atau instansi dengan masa . Letter of guarantee has a variety of categories and uses, applicable .

Performance Bond vs. Application to Bank for Aadhaar Seeding to Avail DBT Benefits – Sample Letter for Subsidy Benefits . It is a ‘promise’ to make payment to a third party under certain circumstances – such as the failure of obligations from the buyer.

Overview on Letter of Guarantee

To avoid confusion of bank, it is common to issue non conditional .A bank guarantee offers security for an asset or project—or guarantees consumers or suppliers that they can meet their obligations. Find out the benefits, types, application .BANK GUARANTEE / STANDBY LETTER OF CREDIT APPLICATION FORM. The bank guarantee was in a standard form requiring BNP Paribas to make payment on demand without reference to Fluor. Several factors are considered before submitting an application for a bank guarantee. Learn about different types of bank guarantees, how they work, and why they are used in international trade . Banks normally charge 0.A bank guarantee is a financial instrument that a bank acts as the guarantor of the liabilities of a borrower/applicant.Bank Guarantee is a guarantee in the form of letter issued by a bank which results in an obligation to pay against the party that receive the guarantee (beneficiary), if the guarantor breach the contract (default). An LC represents a commitment made by the .Reduction of government risk exposure through sharing with private sector investors. Please note that the said bank guarantee has expired on __/__/_____ (date). The bank only pays that amount if the opposing party does not fulfill the obligations outlined by the contract. This article explores the definition, .What is a letter of credit? Letters of credit, also known as documentary credits act like promissory notes.Guarantee Letter Format with Example Template | Downloadwordexceltemplates. No clauses should be ambiguous or contradictory.

What Is a Bank Guarantee?

Subject: Request to return bank guarantee. A bank guarantee refers to the security or assurance the financial institution provides to an external party when the borrower cannot repay the debt or satisfy its financial liability. This can be used to . This frees your company from having to secure an agreement using other assets such as cash or bonds. Learn all about it here! I / We hereby request and authorise you to issue a Guarantee / Bond with the following details: .com2024 Letter of Guarantee - Fillable, Printable PDF & Forms | . Dictionnaire anglais-français. Branch Name _____ Date. It’s a written promise to pay a certain amount of money .

Request Letter To Bank For Bank Guarantee

A Bank Guarantee is a way for companies to prove their creditworthiness. What is a Banker's Guarantee? A banker’s . On behalf of a call writer, a bank may provide a guarantee letter stating that the writer is the owner of the .A bank guarantee letter is a promise from a bank that it will assume liability for a debtor if its contractual obligations are not met.A letter of credit (LC), also called a credit letter, is a legal document assuring sellers that payments will be made by the buyer, in full and on time. Effects of Bank Guarantees. Bank Guarantee. the are similar to American commitment letters of credit. Letters of guarantee assure the provider that payment will still be made even if the bank's client defaults. However, these charges vary depending on the risk that the lender undertakes. Use L/G as collateral instead of securities to streamline your finances. Wherever you do business, we have solutions to help. You may be required to provide security to cover this facility.A bank guarantee/standby letter of credit should fulfil the following criteria: Clear and understandable wording. It may be issued for .Bank guarantees represent a much more significant commitment for banks than letters of credit.The bank guarantee may also take the form of a standby letter of credit, if that is preferred.A bank guarantee is a promise from a bank that if a party defaults on a debt or obligation, the bank will cover the other party’s loss. Content of a Bank Guarantee Payable on Demand.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Letters of Credit (LCs) versus Bank Guarantees (BGs)

Temps de Lecture Estimé: 8 minA letter of guarantee is a crucial financial instrument issued by a bank to ensure payment in various business transactions. note that a bank .L/G( Letter of Guarantee、レターオブギャランティー)という言葉をそのまま訳せば「保証状」ということになります。. There may be a collateral requirement since it functions as an insurance . A Letter of Guarantee from SCB serves as collateral when your company submits a bid or signs a contract with a government agency or other counterpart. It also mentions that the bank will cover the amount if the buyer fails to make the payment and acts as a cash equivalent for the parties involved. It promotes confidence in a transaction that will greatly encourage the process.A letter of guarantee is a written commitment from a bank to pay for the obligations of a customer who has engaged in a sale agreement with a supplier.

Bank Guarantee Release Request Letter Format

Estimated reading time: 4 minutes.A bank guarantee is an assurance that a bank provides to a contract between two external parties, a buyer and a seller, or in relation to the guarantee, an applicant and a .

Bank Guarantees

A Letter of Guarantee (LoG) is a contract issued by a bank on behalf of its client, providing assurance that the client will fulfill their obligations under a specific transaction.

Letter of Guarantee: 18 Templates and Samples (Word

How To Get A Bank Guarantee In South Africa

Standby Letters of Credit.

Project bankability, sustainability, and replicability.

Bank Guarantee vs Letter of Credit: Differences and How to Choose

Letter of Guarantee: Definition, Purposes, and Example

_____ (bank guarantee details) submitted to you for _____ (purpose).bank guarantee letter - Traduction française – Linguee. In such cases, the bank refunds the amount to the party who issued the guarantee.A letter of guarantee is a contract issued by the bank on behalf of their client to back the credit risk the supplier assumes in a transaction where they have entered a sales or . Number 0763 026 532 / 832. Learn about the history, types, . だから、B/L はまだ提出できませんが、 . For any queries or clarifications on the Application Form, please call the Trade Operations Department on Telephone . caution bancaire f.If you want to cancel a bank guarantee that does not have an expiry date or cancel a bank guarantee before the expiry date of the guarantee, ABN AMRO will need a letter of release form from the beneficiary.Bank guarantees represent a more significant contractual obligation for banks than letters of credit do.Learn how to protect your business or customers with bonds, guarantees and standby letters of credit from NatWest Business. Standby Letters of Credit are commonly used instead of traditional bank guarantees in the US, Canada, Australia and South America, for instance Colombia, Brazil, Argentina, Bolivia, Mexico and Peru. Dear Sir/ Madam, I write this letter in reference to the bank guarantee reference no.75% quarterly on the total amount. A bank guarantee, like a letter of credit, guarantees a sum of money to a beneficiary; however, unlike a letter of credit, the sum is only paid if the opposing party does not fulfill the stipulated obligations under the contract. Learn how to apply for a bank .A bank guarantee letter; A Stamp paper (as per the State Stamp Act) A resolution passed by the board of members in case of a public/private limited company; Bank Guarantee Charges.Dear Sir/Madam, I am writing to request a Bank Guarantee in support of a business transaction to facilitate mutual trust and confidence between the parties involved.sample letter to bank requesting the issuance of guarantee; bank guarantee request letter; Post navigation. Learn the definition, examples, types . Estimated reading time: 4 minutes.

bank letter n — lettre de .Letter of guarantee, also known as security, refers to the written commitment to the beneficiary issued by Bank of China on request of an applicant, guaranteeing the applicant or the guaranteed party will fulfill the obligations of contract entered in with the beneficiary.

Last modified Monday December 12, 2022.

Guarantee letter adalah jenis kontrak yang diterbitkan oleh pemberi atau penjamin dana contohnya bank atas nama pelanggan yang telah menandatangani kontrak untuk membeli barang dari pihak penjual. Performance Bond. Banking warranties were mostly seen at internationally business merger, although they may plus individuals could need a guarantee to rent property inbound some countries.Bank guarantees are largely used outside the U. Conduct business with confidence, even where you lack established relationships, through the use of guarantees and standby letters of credit. Issuance of a Bank Guarantee. The letter guarantees to . When are they used? A guarantee may be needed when one of your counterparties requires you to provide a bank guarantee to support a commitment you are giving.A letter of guarantee is a contract issued by a bank on behalf of a customer who has entered into a contract to buy goods from a supplier.Product Detail.