Capital market efficiency theory

T he efficient markets theory (EMT) of financial economics states that the price of an asset reflects all .

The efficient market theory is a good first approximation for characterizing how prices is a liquid and free market react to the disclosure of information. market fully reflect all available information. December, 28-30, 1969 (May, 1970), pp. Fama , edited by John H. In a word, Quickly! EFFICIENT CAPITAL MARKETS: A REVIEW OF THEORY AND EMPIRICAL WORK * Burton G. First, weak form tests, in which the information set is just historical prices, are discussed.Market efficiency. The efficiency of the capital market is often defined in terms of its. Session Topic: Stock Market . Fama put forth the basic idea that it is virtually impossible to consistently “beat the market” – to . Moskowitz, Chicago: University of Chicago Press, 2017, pp. The theory of weak form of market efficiency states that past security price movement can’t be used for predicting future .Strong form efficiency is the strongest version of market efficiency and states that all information in a market, whether public or private, is accounted for in a stock's price.

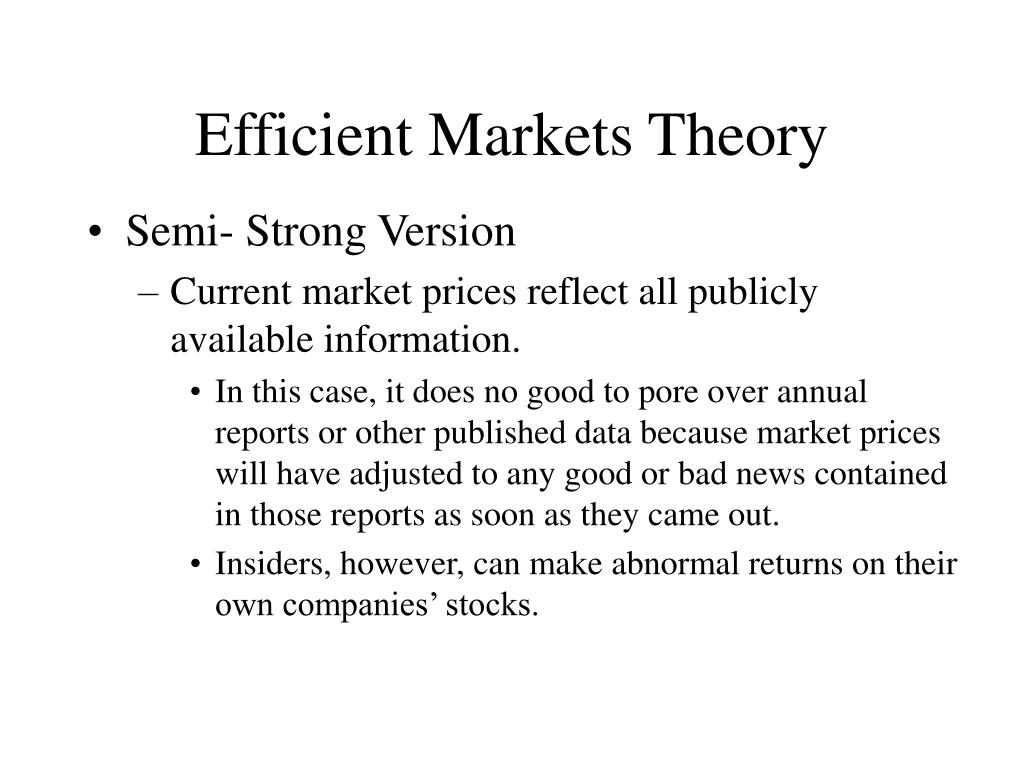

There are three types of market efficiency depending on what type of information is reflected in security prices. 2, Papers and Proceedings of the Twenty-Eighth Annual Meeting.

Market Efficiency

The Fama Portfolio: Selected Papers of Eugene F. THE PRIMARY ROLE of the capital market is . After a discussion of the theory, empirical work concerned with the adjustment of security prices to three relevant information subsets is considered.One important distinction is that EMH refers specifically to long-term performance – therefore, if a fund achieves “above-market” returns – that does NOT invalidate the EMH theory. They are: Capital asset pricing model. L’efficience des marchés financiers | Cairn.netRecommandé pour vous en fonction de ce qui est populaire • Avis

Market Efficiency Explained: Differing Opinions and Examples

The efficient market hypothesis (EMH) is important because it implies that free markets are able to optimally allocate and distribute goods, services, capital, .EFFICIENT CAPITAL MARKETS: A REVIEW OF THEORY AND EMPIRICAL WORK* - Malkiel - 1970 - The Journal of Finance - Wiley Online Library.Efficient Capital Markets. 383-417 Published by: Blackwell Publishing for .The «Efficient Capital Market Hypothesis » is the central proposition of modem finance theory, for more than thirty years now.

EFFICIENT CAPITAL MARKETS: A REVIEW OF THEORY AND EMPIRICAL WORK* EUGENE F.

Efficient Market Hypothesis (EMH): Definition and Critique

Funda- mentally, he posits that the capital market is efficient a) if all security prices fully reflect all known market information, and b) if no traders in the market have monopoly control of information.

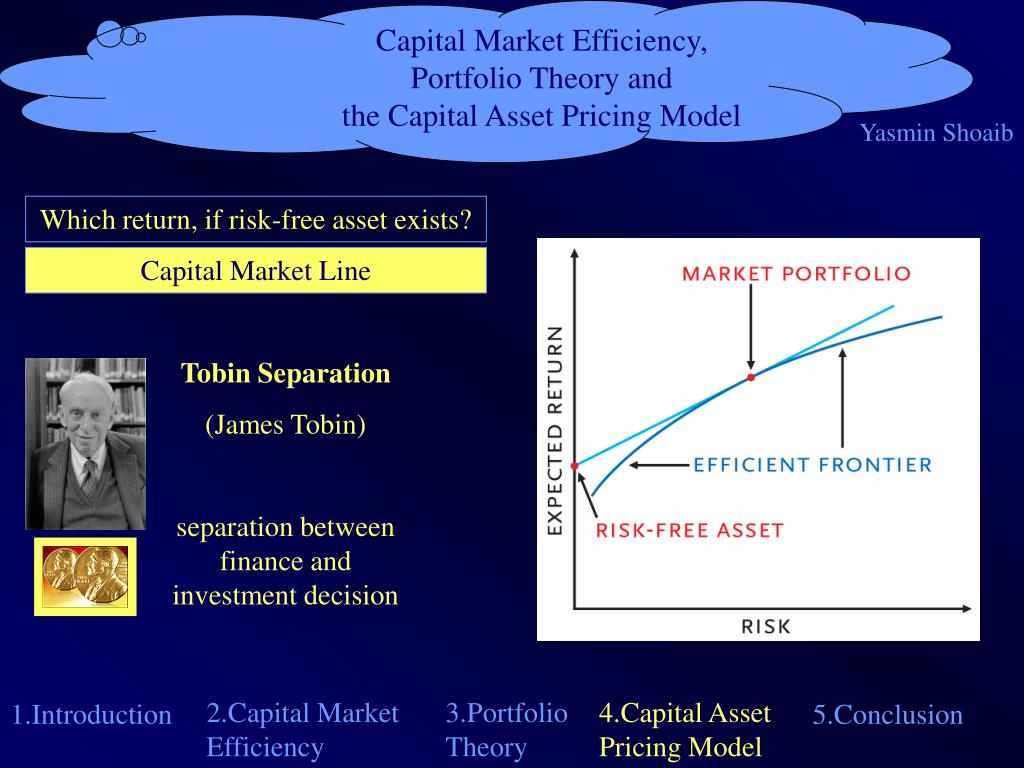

Theory of Financial Markets

Many finance theories and asset pricing theories are written under the assumption that markets are efficient. By contrast, a theory of asset pricing that did a good .The Efficient Markets Hypothesis (EMH) is an investment theory primarily derived from concepts attributed to Eugene Fama’s research as detailed in his 1970 book, “Efficient Capital Markets: A Review of Theory and Empirical Work.Efficient Capital Markets : A Review of Theory and Empirical Work | Semantic Scholar. Malkiel, Burton G.Capital Market Efficiency: Definitions, Testing Issues And Anomalies | Stanford Graduate School of Business. Session Chairman. Cochrane and Tobias J.Capital Market Line - CML: The capital market line (CML) appears in the capital asset pricing model to depict the rates of return for efficient portfolios subject to the risk level ( standard .

Capital Market Efficiency: Definitions, Testing Issues And Anomalies

The theory of efficient capital markets indicates that the prices in an efficient. It was significant for its formalization of an empirical approach for testing the theory of market efficiency. In this section, we’ll discuss a model, theory, and hypothesis, all of which are considered integral components of capital market theory. By analysing the two definitions of an . Stock market efficiency is an important concept, for understanding the working of the capital markets particularly in emerging stock market . Both emerged post-1960 and would characterize finance theory and .Efficient Market Theory is a cornerstone of financial economics, positing that financial markets are efficient and that asset prices reflect all available information.Temps de Lecture Estimé: 7 min

Efficient Capital Markets: A Review of Theory and Empirical Work

Fama defined a market to be “informationally efficient” if . Serial correlation in stock returns.Samuelson’s work was followed by Fama’s landmark 1970 paper, “Efficient Capital Markets: A Review of Theory and Empirical Work”.This paper reviews the development of capital market theories based on the assumption of capital market efficiency, which includes .It begins by describing the fundamental theorem of financial market pricing, the efficient capital markets hypothesis.info(PDF) DE L'EFFICIENCE DES MARCHÉS FINANCIERS À .Created Date : 20160806193254Z

Des différentes acceptions de la « théorie des marchés efficients

Efficient capital markets: a review of theory and empirical work*

In 1970, Fama published “Efficient Capital Markets: A Review of Theory and Empirical Work,” which outlined his vision of the theory. From Efficient Market Theory to .

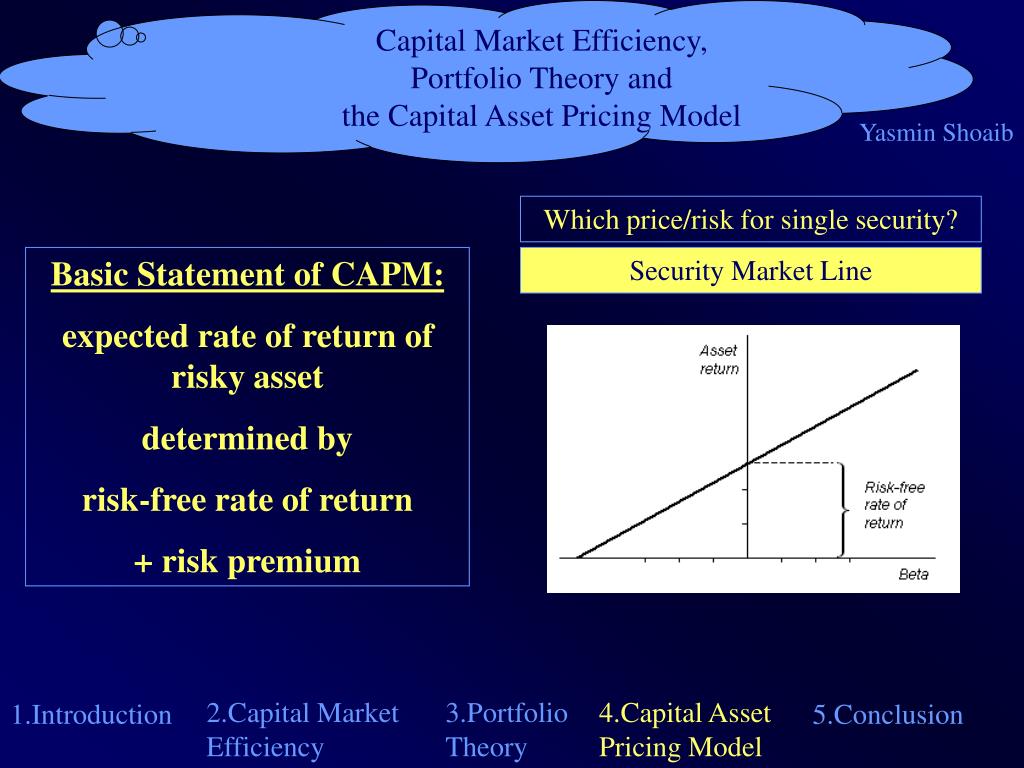

What is market efficiency

In 1970, in “Efficient Capital Markets: a Review of Theory and Empirical Work,” Eugene F. He then presents a tri-chotomization of informa- tion: 1) a . read more situations. Intervention was therefore unnecessary, and regulation could be light-touch. Return predictability. Capital asset pricing model (CAPM) The capital asset pricing model (CAPM) predicts a security’s expected return based solely on factors related . Three Variations Of the Efficient Market Hypothesis An efficient market is one where all . Journal of Financial and Quantitative Analysis March 1973. If the above is true, there is no way to systematically .The field of Financial Economics theorizing for the past 50 years has been dominated by two related theories: the Capital Asset Pricing Model (CAPM) and the . 1982| Working Paper No. Consequently, the topic has attracted substantial scholarly interest.The efficient market hypothesis has beguiled policymakers into believing that market prices could be trusted and that bubbles either did not exist, were positively beneficial for growth, or could not be spotted. Keywords: Efficient Market Hypothesis; Market Efficiency; Stock Market 1.En analysant les deux définitions d’un marché «efficient » proposées par Eugène Fama [1970, 1976], on éclaire les raisons pour lesquelles, dans les débats contemporains, la .The main purpose of this essay is to revisit the relevant theory and evidence regarding the informationally efficient capital markets. Investors in capital markets want to be sure that the prices they pay for securities, such as ordinary shares and bonds, are fair prices. In fact, most EMH proponents agree that outperforming the market is certainly plausible, but these occurrences are infrequent over the long term . Introduction In the modern theory of finance, a good starting theory is that of efficient capital markets.Efficient Capital Markets A Review of Theory and Empirical Work. Many finance theories and asset pricing theories are written under the assumption that markets are efficient. Market efficiency in the presence of GARCH-M models. In order for security prices to be fair, the capital markets must be able to process relevant information quickly and accurately.

Market matters

Market matters. Together they constitute the elements of the Efficient Market Hypothesis (EMH).

His paper included a summary of past work, but that’s not what made it important.1 Chapter Introduction and Objectives.Market efficiency theory finds relevance in business and stock market Stock Market Stock Market works on the basic principle of matching supply and demand through an auction process where investors are willing to pay a certain amount for an asset, and they are willing to sell off something they have at a specific price.

THE INFORMATION CONTENT OF DAILY MARKET INDICATORS. Practitioners of .

If a market is efficient, it means that market prices currently and accurately reflect all information available to all interested parties. The Journal of Finance. However, the debate surrounding EMT remains ongoing, with . Have capital market booms and crashes discredited the efficient market hypothesis? This column says yes and .The purpose of the fractal market theory approach of this paper is to investigate whether the selected capital markets abide by a particular evolution pattern or the random walk hypothesis. It explores the normative theory of perfect capital markets, the stochastic notion of random walk, the martingale theory, and various forms of market efficiency under the efficient markets hypothesis (EMH). Market efficiency is a relatively broad term and can refer to any metric that measures information dispersion in a market.

It also considers the mechanisms that underpin it and their implications for regulation. Both emerged post-1960 and would characterize finance .Abstract: Efficient Capital Markets: A Review of Theory and Empirical Work Author(s): Eugene F. Capital market theory makes reference to multiple forms of analysis that aim to predict the value of securities and the flow of supply and demand in the market.What Is Market Efficiency?

Capital Market Theory and Efficient Markets

Corpus ID: 13964997. There are 3 types of market efficiency: weak, semi-strong and strong.Another important and controversial theory in capital markets theory is the efficient market hypothesis (EMH), which was formulated by Eugene Fama in the 1960s.EFFICIENT CAPITAL MARKETS: A REVIEW OF THEORY AND EMPIRICAL WORK*. EMH asserts that capital markets are efficient, meaning that they reflect all available information in their prices, and that investors cannot consistently beat the market by exploiting . An efficient market is one .Email : rmichaud@newfrontieradvisors. Capital markets, efficiency and fair prices. And though the debates on this question are often at the empirical level, we think that the main problem concerns the theoretical significance of the undernying assumptions. 2, Papers and Proceedings of the Twenty-Eighth Annual Meeting of the American Finance Association New York, N.Market efficiency examples.Theories developed based on the assumption of efficient capital markets include the efficient market hypothesis (EMH), Markowitz’s portfolio theory, the separation . The weak form of market efficiency .