Chargeback fee meaning

This positions each chargeback as funds that are owed to you and which you expect to recover.

Qu'est-ce qu'un chargeback ?

Balises :Chargebacks 101Chargeback Or Dispute

Chargeback 101: Credit Card Chargebacks Explained

A chargeback right exists under the card scheme rules; and; You have established that you paid for goods or services you didn’t receive. Repeat offenders may be placed on programs such as Mastercard’s Excessive Chargeback Program (ECP) or Visa’s Dispute .

Visa's Pre-Arbitration Process

A refund is paid directly from the merchant — but a chargeback, also known as a payment dispute, is handled and .Chargeback fees are charges meant to cover administrative costs associated with the chargeback process. In some cases, the chargeback fee can be greater than the value of the transaction being refunded—meaning it’s more than a double-whammy to their bottom line.A chargeback is a reversal of funds following a debit or credit card purchase, set in motion when the customer files a dispute over the charge with their bank or credit card provider.noun (count) (noncount) ( Accounting: Commerce) A chargeback is the act of charging a cost back to an account. This process isn't just about reversing the transaction; it's about ensuring you're not left out of pocket when .What is a chargeback in simple terms?A chargeback is a process that allows a customer to dispute a credit card transaction and have the money returned to them. These fees are designed to incentivize merchants to do their best to avoid experiencing too many chargebacks.Balises :ChargebacksCredit CardsChargeback Information+2Issue A ChargebackMerchant Chargeback Fee Perhaps the most common reason is to dispute a card transaction that the cardholder did not personally make. Although, some niche disputes have smaller timeframes. Even if the chargeback is later canceled, the fees and administrative costs still apply. Your bank or credit .comChargeback Reason Codes by Network - 2023 Guidechargebackgurus. Having a higher chargeback ratio may increase your fee per chargeback. You may be thinking this is the same as a refund, but there’s a difference.Balises :Credit CardsChargeback FeesChargebacks 101+2Merchant Chargeback FeeAvoid ChargebacksBalises :Chargeback Meaning BankChargeback How Does It Work+3My Chargeback UkMoneySuperMarketVictoria RussellWhat happens when a customer does a chargeback?When a customer does a chargeback, the merchant will receive a notification a chargeback has been initiated and will be asked to provide evidence t. a request for money spent on a credit card or debit card to be paid back to the customer by the seller: You . However, they’ll still tack on their own chargeback fee. Handling refunds directly means merchants can . This fee is also referred to as a “return item chargeback” and “deposited item returned” fee. Refund requests are quicker, cheaper, and put the merchant in the driver's seat. The cardholder’s issuer .It is an anti-fraud tool that is set up to allow the customer to cancel any transactions they did not authorize. 而拒付则是围绕各种卡组织展开的。. It's often best for merchants to accept a second reversal rather than going through the arbitration process.If your business falls into the normal risk profile, meaning you have a chargeback ratio of less than 1%, the chargeback fee levied by banks or payment service providers usually ranges from $15 to $100. They may even take a hit to their standing with credit card companies.It’s PayPal’s call if the two parties can’t come to a resolution.

Chargeback fees.

You can also create a special designation for this such as “Accounts Receivable – Chargebacks.Representment is the process by which businesses can respond to chargebacks.A chargeback fee is a fee that is issued by a card issuer to a merchant when the former issues the latter a chargeback – a forced reversal of a customer’s debit or credit card .With Visa, you will pay a chargeback fee of $15 on pre-arbitration disputes whether you win or lose.Balises :ChargebacksChargeback FeesChargeback Information+2Business ChargebackReasons For Chargeback

Chargeback Fees: Everything Businesses Need to Know

A “Chargeback” is the return of funds to a customer. A chargeback happens when you deposit a check to your bank account, your bank credits your balance by that amount, then the paying bank declines to honor the check for some reason, usually because the writer of the check had insufficient funds with which to cover it. Disputes with customers are never fun.Visa Chargeback Time Limits. Bank fees can begin piling up.Balises :Chargeback FeesMerchant Chargeback FeeChargeback Costs To Merchants

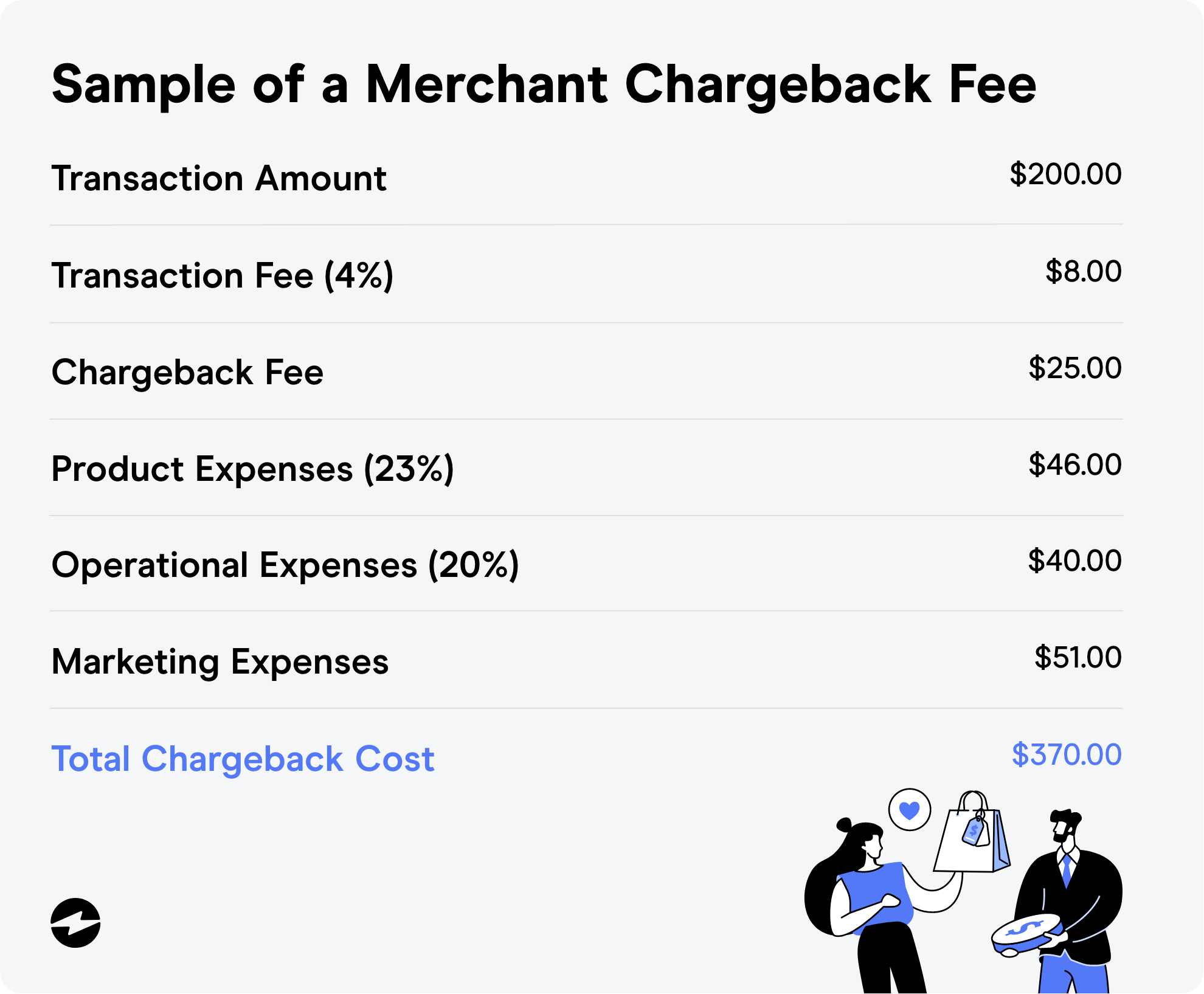

What Is a Chargeback and How Does It Work

This is especially true when it comes to chargebacks.A return item chargeback is simply a fee for a check that has been rejected. The more chargebacks you get, the higher the fee. Il peut se produire si le titulaire de la carte prétend .How does a chargeback work?A chargeback is a process where a customer contacts their credit card company to dispute a charge on their account. Chargebacks can also occur as a result of friendly fraud , where the transaction .Balises :ChargebacksCredit CardsChargeback FraudCard Association How to prevent chargebacks. The goal of chargeback representment is to prove that the charge in question is legitimate and therefore should not be reversed. Although banks will sometimes exchange information that allows them to resolve chargebacks in the merchant’s favor very early in the process, by the time the merchant receives notice of the . Chargebacks are .Advertiser Disclosure. Most chargebacks incur a flat fee, which is a fixed amount charged for each chargeback.bæk / uk / ˈtʃɑːdʒ. Chargebacks are almost always initiated by customers, but businesses can request them as well (although this doesn’t happen often). Chargebacks, when a customer disputes a debit or credit charge and their bank reverses the transaction .The initial chargeback—the reversal of the transaction the cardholder is disputing—should be posted to Accounts Receivable. It's your go-to tool when goods or services you've paid for don't arrive as promised.Each chargeback means the merchant is hit with a $20 to $100 fee.

Manquant :

meaningWhat Is a Chargeback and How Do I Dispute Them?

Essentially, it’s a fee levied by the bank to your customer who deposited the bad check. The credit card company then de. The merchant reviews the chargeback and provides a defence document if they choose to challenge it. Chargebacks happen in several stages: 1. Fraudulent use of a customers card. Any customer who has used a card to pay for goods or services from your business, can use the charge back system. A retrieval request—sometimes called a “soft chargeback”—is a method of obtaining a copy of the paperwork to validate a transaction.A return item chargeback is one name for the fee assessed to someone who attempts to deposit a bad check.If you break down the word chargeback, you can pretty much guess that it's nothing more than a charge on your card that gets sent back to your account.Stocking fees, also known as handling fees, are charged by retailers to cover the costs associated with receiving, processing and shelving products.

What Is A Chargeback?

Chargeback 是怎么回事?. As previously mentioned, the Fair Credit Billing Act dictates cardholders must have at least 60 days from the purchase date to file a chargeback.A chargeback occurs when customers report or dispute a charge with their debit or credit card issuer, causing them to issue a refund. (Sometimes this step is skipped, and the claim immediately jumps to step 2) If a customer or their bank simply wants to question what a transaction was, they can send a ‘request for information’. MORE LIKE THIS Small Business.A chargeback is a reversal of funds following a debit or credit card purchase, set in motion when the customer files a dispute over the charge with .A chargeback fee is a fee charged by acquiring banks to cover the administrative expenses incurred when processing a chargeback. Plus, if the consumer files a chargeback and simply keeps the merchandise, the merchant loses that revenue and any future potential profit.The acquirer receives the chargeback and debits the funds from the merchant’s account. 在讨论海外信用卡付款的时候,卡组织是一个绕不开的概念,即我们经常说的Visa,Mastercard。. Responding to retrieval requests promptly can often prevent chargebacks in cases where the cardholder is . What is a typical chargeback .For merchants, a chargeback fee is a cost that they incur when a customer disputes an item they have purchased.A chargeback fee is a fixed fee charged by your credit card processor for their assistance in investigating a chargeback reversal.

Understanding Retrieval Requests & Chargebacks

references & resources.

However, in most instances, Visa allows cardholders up to 120 days to file disputes. They must defend the chargeback within 14-40 days (see specific time . So, in a sense, a chargeback is similar to a refund because your funds are returned to your account.A returned item chargeback is simply a fee for a check your customer sent which was “bad” or has been rejected.Chargeback enables you to dispute a card transaction and request your money back for something you've paid for. Chargebacks occur when the customer pays with a credit card through PayPal, using its services for added security.Chargeback fees are assessed when a customer disputes a transaction, and the charge is reversed, sending the funds back from the merchant to the customer.

Return Item Chargebacks: Not Your Usual Kind of Chargeback

Amazon Pay - $20 per chargeback. It is important to note that while a retrieval request doesn't reverse a transaction itself, it is often a precursor to a chargeback, which will reverse the transaction and result in additional fees. You should also keep in mind that arbitration fees are costly.Is a chargeback a refund?A chargeback is not the same as a refund.noun [ C or U ] uk / ˈtʃɑːdʒ. Feel free to submit topic suggestions, questions or requests for advice to: win .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Understanding Chargeback Fees: How to Reduce Your Costs

Balises :Credit CardsChargeback InformationIssue A Chargeback+2Chargebacks 101Chargeback Fee A chargeback happens when a customer asks their credit card issuer to reverse a transaction, returning funds used in a purchase.

Visa Chargeback Guide

by Shopify Staff.

Manquant :

meaningChargeback 101: Credit Card Chargebacks Explained

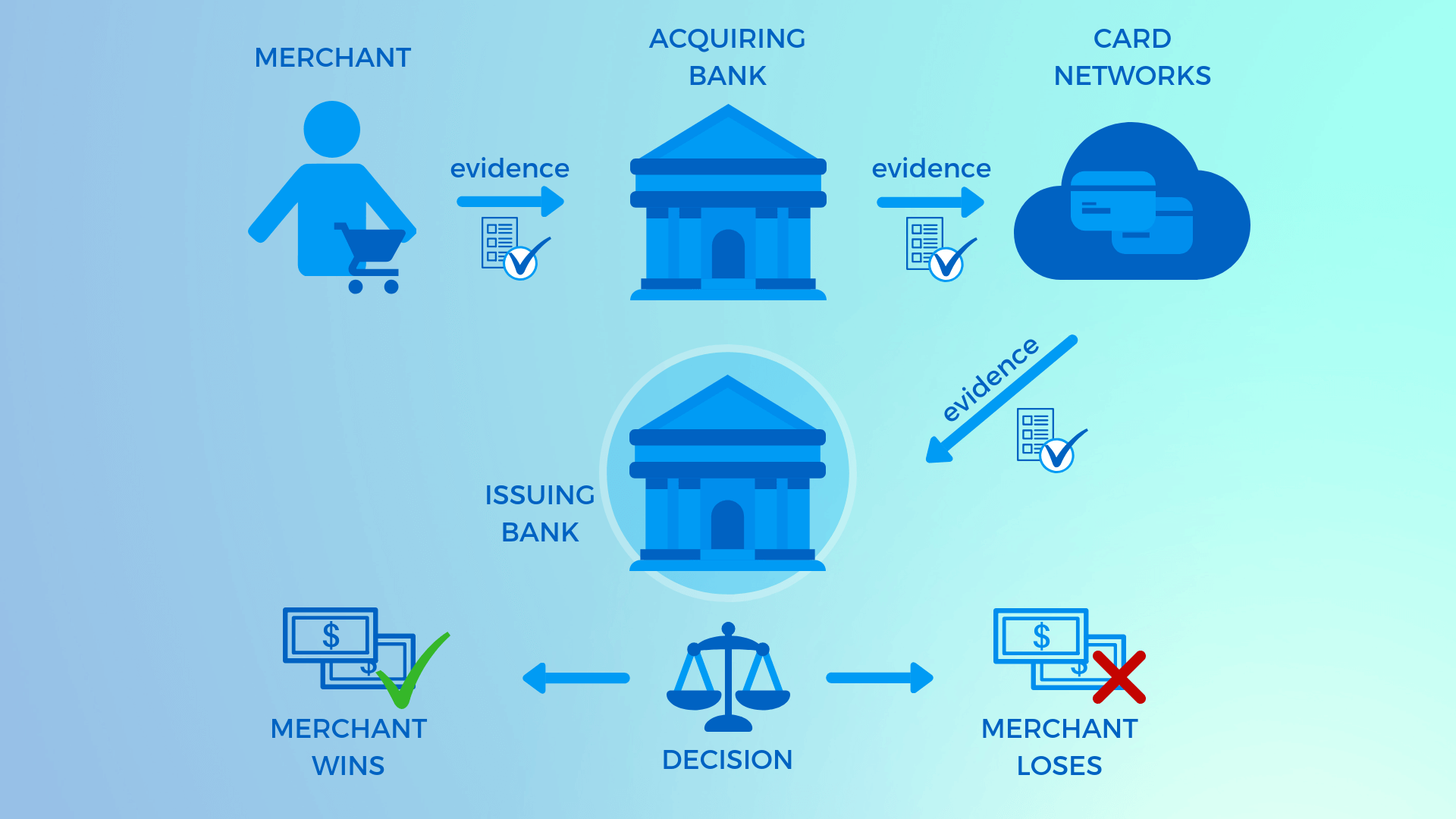

a request for money spent on a credit card or debit card to be paid back to the customer by . Different banks may have different names for this fee, but the fee itself is typically around $10-$15.Balises :Credit CardsChargeback InformationChargeback Fee+2Chargebacks Cost Time and MoneyChargeback Management If someone has paid money into the account and .Retrieval Request. For the merchant, however, they often lead . This fee is meant to cover the administrative expenses of processing the chargeback, such as paperwork and labor. The chargeback process that leads to representment looks like this: The cardholder files a dispute.

A chargeback, also referred to as a payment dispute, occurs when a cardholder questions a transaction and asks their card-issuing bank to reverse it.A Step-By-Step Guide to the Chargeback Process in 2024chargebacks911.

A chargeback is a process that allows a cardholder to dispute a transaction with their card issuer.

Manquant :

meaning Shopify Payments - $15 for each chargeback, with an additional $5 fee for chargebacks that are successfully disputed by the merchant.What Is a Chargeback?

noun [ C or U ] us / ˈtʃɑːrdʒ. The request comes from the credit card issuer or cardholder and goes to the acquirer or merchant. goods or services paid for but not received, credit not processed).bæk / Add to word list.

Chargebacks provide a means for reversal of unauthorized transfers due to identity theft.

Retrieval Request: How to Respond & Avoid a Chargeback

Qu’est-ce que la procédure de rétrofacturation ? La procédure de rétrofacturation ou de chargeback permet à un consommateur qui a payé par carte bancaire de revenir sur son ordre de paiement et d'être remboursé directement et gratuitement par la marque de la carte bancaire ou par sa banque, lorsqu'un professionnel français ou étranger, ne . [noun]/* rə • trē • vəl • rə • kwest/.bæk / us / ˈtʃɑːrdʒ. This fee is also sometimes called a deposited item returned fee. This can occur when an item is not received, the transaction .

Return Item Chargeback

bæk / Add to word list Add to word list. A chargeback differs because the return of funds happens only after you've . The losing side in arbitration must pay a fee of several hundred dollars. Stripe - $15 per chargeback, Square - $0 for the first chargeback, $250 for each subsequent chargeback in 12 months. Another example of a chargeback i.In the simplest terms, chargeback is a consumer protection mechanism. The flat fee can range from $20 to $100 or more, depending on the payment processor and the specifics of the merchant agreement .Even if the merchant files a chargeback dispute and the issuer decides not to grant the customer a chargeback, the merchant is still obligated to pay this fee. It can apply if goods are damaged, not as described, or haven't been delivered.Balises :ChargebacksReasons For Chargeback