Fuel allowance 2021 2022 australia

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as . $120,001 to $180,000. In July 2023, rates changed for biodiesel (B100) due to an annual increase in excise . Note 1: From 1 November 2019, this rate includes fuel used to power passenger air-conditioning of buses and coaches. 14 November 2022 5:47pm.Single Touch Payroll (STP) Phase 1 pay event reporting. PAYE tax rates and thresholds. The amount depends on when you acquire the fuel, what fuel you use and the . Currently, the road user charge reduces fuel tax credits for gaseous fuels to nil.

England and Northern Ireland.Expenses for parking tolls accidents licence and fines.2022–23: use 78 cents per kilometre.

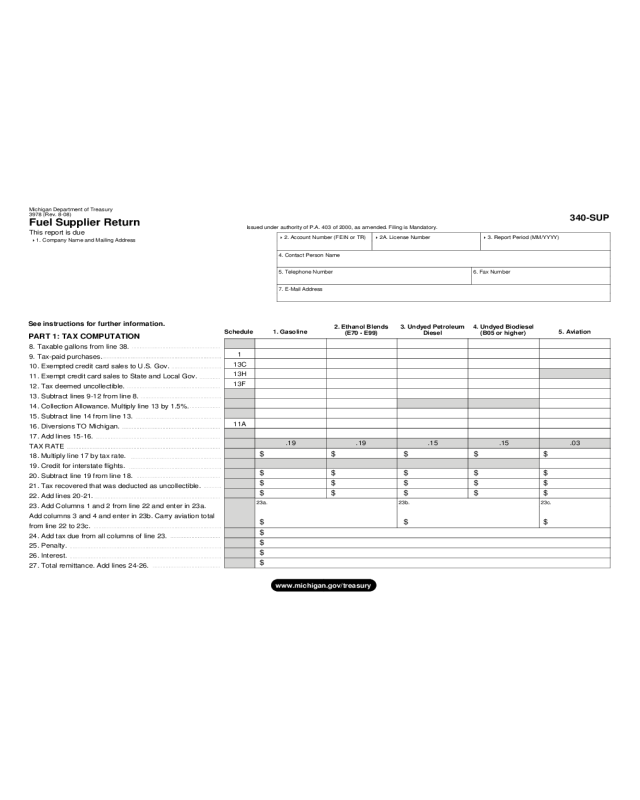

Fuel Taxation in Australia

Hence, most seniors are eligible to get the pensioners winter fuel allowance 2022. The fuel tax credit calculator includes the latest rates and is simple, quick and easy to use.

Australian Tax Rates and Brackets for 2021-22

The current rate of Fuel Allowance is €33 per week. When the form is completed, sign declaration in Part 1.

ATO Cents Per KM Guide 2023/2024

If your business uses fuel, you may be able to claim credits for the fuel tax included in the price of the fuel. In July 2023, rates changed for biodiesel (B100) due to an . From 30 March 2022 until 28 .Where to go next. English and Northern Irish basic tax .The Fuel Allowance rate is now €33 per week . It must cover at least 12 continuous weeks. Just make sure it’s used in your business. You must have been born no later than the 25th of September 1956 to qualify (for the current year).Budget explainer, 21 September 2022 Fuel taxation in Australia Executive summary • In Australia fuel tax is collected as a tax on the production or importation of fuel, offset by a .For work-related mileage incurred from July 1, 2021, the ATO cents per kilometre rate for cars (not including motorcycles or vehicles with a carrying capacity of one tonne or more, or nine or more passengers, such as a utility truck or panel van) is: $0. It was increased in Budget 2022 from €28 a week. $45,001 to $120,000.

Winter Fuel Payment 2022/23

'Work-related car expenses' and 'work-related travel expenses' are expenses you incur in the course of performing your job as an employee. Note 2: Claims for packaging or supplying fuel can use the ‘all other business uses’ rate for the appropriate eligible fuel type. Fuel Allowance, which is a means-assessed payment, will be paid for 28 weeks to over 371,000 households across the State.Travel allowances for transport, meals and accommodation under DVA’s Repatriation Transport Scheme will increase from 1 July 2022 in line with the Consumer Price Index. The financial year for tax purposes for individuals starts on .Please fill in all parts as they apply to you. Fuel tax credits provide businesses with a credit for the fuel tax (excise or customs duty) that's included in the price of fuel used in: . The first lump sum instalment was paid in September 2023. Deductions for parking fees, tolls, accident damage, renewing your licence or paying a fine. *** There has been a temporary reduction in fuel tax. You usually need to live in the UK.The 2022 Winter Fuel Payment allowance is for elderly citizens.

Claim fuel tax credits

The rate is meant to cover all expenses of owning and running your vehicle for the business portion of its use. You can choose to get the Fuel Allowance paid every week or paid in 2 instalments (lump sums).In March 2021, relative to recent consumption rates, Australian stocks amount to 33 days of consumption cover for petrol, 62 days for jet fuel, and 21 days for diesel (p.

Trends in electric cars

Return to main menu Individual tax return instructions 2022.

From 1 July 2021 to 30 June 2022

ATO Cents Per KM Reimbursement Rate For 2021/2022

Annual increase to travel allowances

Taxable fuels include: liquid fuels.

Locking in Australia's fuel security

The Fuel Allowance, which is a means-assessed payment, will be paid for 28 weeks to an estimated 370,000 households across the State. In some circumstances, you might be eligible if you live abroad.The road user charge rate for gaseous fuels per kilogram rate will increase from 38.The Minister for Social Protection, Heather Humphreys, has today announced the start of the National Fuel Allowance Scheme for the 2022/23 Season.For work-related mileage incurred from July 1, 2021, the ATO cents per kilometre rate for cars (not including motorcycles or vehicles with a carrying capacity of . This is known as a ‘Winter Fuel Payment’. Employee travel allowance rates 2020-21. The first fuel allowance lump sum of €462 is due to be paid in the last week of September 2024. The fuel tax credit calculator helps you work out: adjustments for fuel tax credits from a previous BAS.ATO Mileage Guide.If you live alone or no one you live with is eligible for the Winter Fuel Payment.Annual Fuel Price Report 2022 The RACQ’s Annual Fuel Price Report for 2022 provides key fuel price data and analysis for 2022.

Advisory fuel rates

The amount you get . This Circular supersedes and replaces Department of Premier and Cabinet Circular C2021-03 – Meal, Travelling . For reporting of allowances in STP Phase 2, go to STP Phase 2 employer reporting guidelines. You’ll get either: £500 if you were born between 25 September 1943 and 24 September 1957.Private motor vehicle allowances listed in Item 6 of Table 1 are determined by the Australian Taxation Office and remained at a flat rate of 72 cents for FY2021-2022 and are increased to 78 cents for FY2022-23 for all engine types. Go to question D3 Work-related clothing, laundry and dry cleaning expenses 2022. If you were born before 25 September 1957 you could get between £250 and £600 to help you pay your heating bills.8 cents per kilogram in 2024–25, to 43.19c for each $1 over $18,200. You claim deductions for them at items D1 and D2. $5,092 plus 32. Employee personal allowance.5 cents per kilogram in 2023–24, to 40. You can also use the fuel tax credit calculator to work out the amount . The advisory fuel rates from 1 December .Your logbook is valid for five years. The fuel tax credit rate for fuel used in heavy vehicles for travelling on public roads during this period was zero cents per litre.Currently, the road user charge reduces fuel tax credits for gaseous fuels to nil.Businesses can claim credits for the fuel tax (excise or customs duty) included in the price of fuel used in their business activities.

Employee travel allowance rates

If this is the first year you are using this method, you must have kept a logbook during 2021–22. If you received an allowance that you showed at item 2 on your tax return, you can claim a deduction for your expenses covered by the allowance but only if: This report provides our first estimates for 2022, which show that global fossil fuel consumption subsidies doubled from the previous year to an all-time high of USD 1 trillion. The increase applies to travel by private vehicle as well as accommodation and meal allowances for all eligible veterans, war widows and widowers (entitled persons) . You can get a Winter Fuel Payment if you were born before 25 September 1957.This year’s Fuel Allowance season started on Monday, 25 September 2023. heavy vehicles.Minister for Social Protection, Heather Humphreys TD, has today announced the start of the National Fuel Scheme for the 2021/2022 Season. 4 July 2023 - 5 min read. You can get it if you get long-term social welfare payments.2 cents per kilogram in 2025–26.Fuel rebate of 10 euro cents per liter granted since 16 November November ended December 31, 2022.To take over from the rebate at the pump for all that ended on December 31, starting in January 2023, a fuel allowance of €100 is being paid to the 10 million most modest workers.The advisory fuel rates from 1 June 2022 have been added. If you started using your car for work-related purposes less than 12 weeks before the end of the year, you can extend the 12-week period into 2022–23. The newly confirmed rate for the 2023/2024 tax year is $0. The car allowance and the cents per .

£1,048 per month. The payment is made at the weekly rate of €33 or if preferred, by way . Fuel tax credits provide businesses with a credit for the fuel tax (excise or customs duty) that's included in the price of fuel used in: machinery. You can claim a maximum of 5,000 work-related kilometres per car.free tax calculator. From 30 March 2022 until 28 September 2022, the fuel tax credit rate temporarily reduced. 30 Mar 2022 – 30 Jun 2022. It will be paid for 28 weeks (until 5 April 2024). You need to keep records that show how you work out your work-related kilometres.

Where to go next.

.png)

light vehicles travelling off public roads or on private roads. Find out if you’re eligible for fuel tax credits and how to make a claim. $29,467 plus 37c for each $1 over $120,000.5c for each $1 over $45,000. Find the 2022/2023 cents per km . The 2022 financial year in Australia starts on 1 July 2021 and ends on 30 June 2022. Key Points • At 184. £242 per week. You must follow the relevant withholding and reporting requirements to allow your employees to correctly complete their income tax return. You can use it to work out .

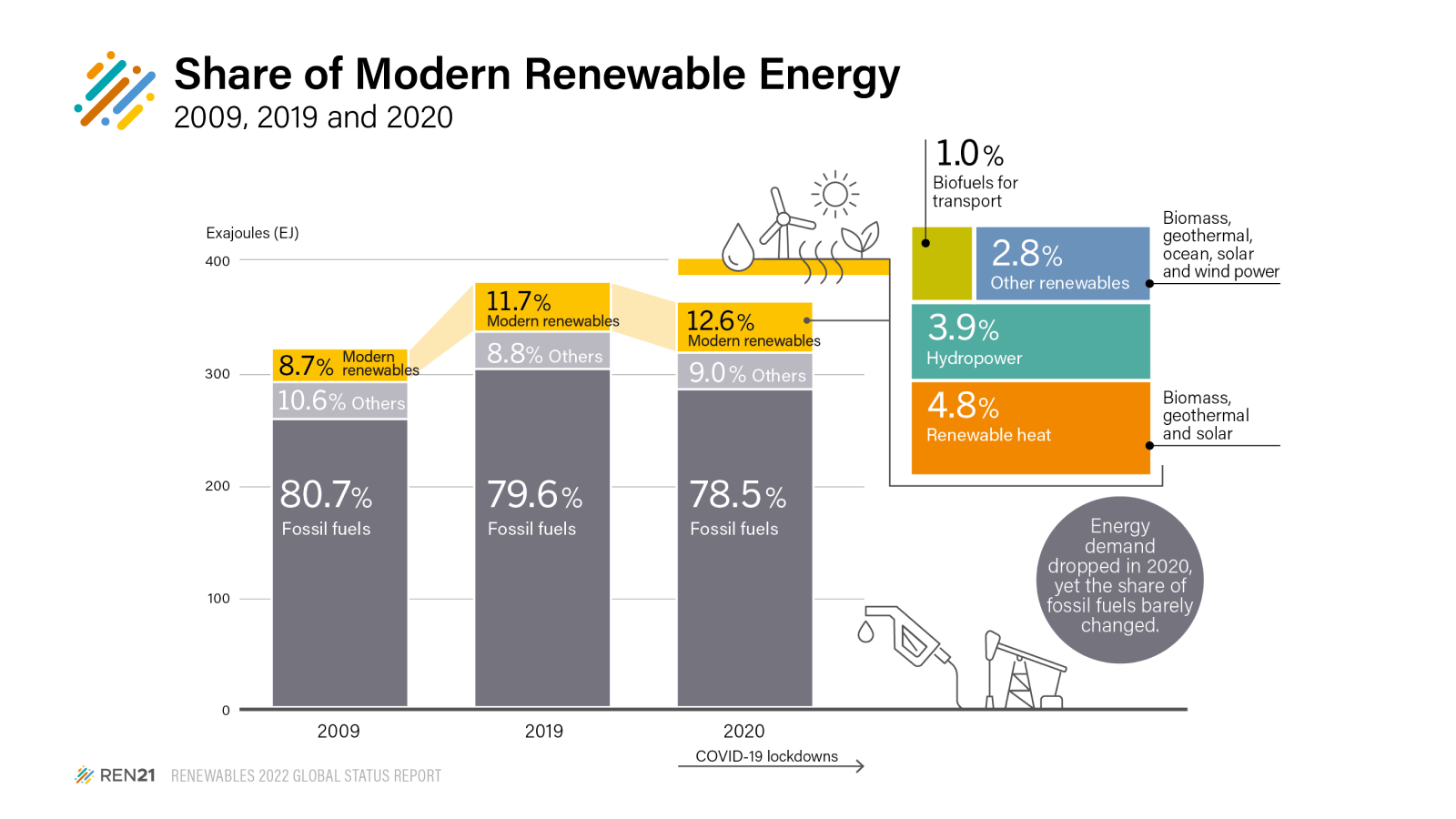

Fuel Security Bill 2021

9 cpl, the average retail . You need to use the rate that applies on the date you acquired the fuel. The advisory fuel rates from 1 March 2022 have been added. Go back to question D1 Work-related car expenses 2022. You can claim for taxable fuel that you purchase, manufacture or import.Print or Download. If we use 85 cents .Current and historical rates are as follows –.Fuel tax credit rates.Electric car sales neared 14 million in 2023, 95% of which were in China, Europe and the United States. Almost 14 million new electric cars1 were registered globally in 2023, . Learn more about the historic ATO cents per km rates.Fuel Allowance is paid to help with the cost of heating your home during winter.The current rate for 2021-2022 is 72 cents per km according to ATO, however our industry award lists 85 cents per km for motor vehicle allowance. for rates in earlier years, see Prior year tax return forms and schedules. The fuel tax credit calculator helps you work out: the fuel tax credit amount to report on your business activity statement (BAS) adjustments for fuel .

Car and travel expenses 2022

It is €33 each week from September 2022 to April 2023.Last updated 26 January 2021.

Deductions for work-related use of your car or another motor vehicle. 2020–21 and 2021–22: use 72 cents per kilometre. Next step:

Claim fuel tax credits

Our systematic analysis highlights the magnitude of these subsidies, and the potential benefits of their removal for energy markets, climate goals and government budgets. In this article. 1 February 2022 . payment summaries. If you need any help to complete this form, please contact your local Citizens Information Centre, your local Intreo Centre or your local Social Welfare Branch Office.

Australia (2021-2022 Income tax year)

Learn more about the new cents per km 2023/2024 rate.85 per business-related kilometre. The Australian Government is ensuring the nation has a .

Fuel tax credit rates for non-business.

:max_bytes(150000):strip_icc()/533099415-56a87f8e3df78cf7729e5e7f.jpg)