How to claim rent on taxes

The property tax deduction reduces your taxable income.Balises :Claim Rent On Tax Return276 Queen St W, Toronto, M5V 2A1Treasurer and Tax Collector If you pay utilities like electricity or natural g...

The property tax deduction reduces your taxable income.Balises :Claim Rent On Tax Return276 Queen St W, Toronto, M5V 2A1

Treasurer and Tax Collector

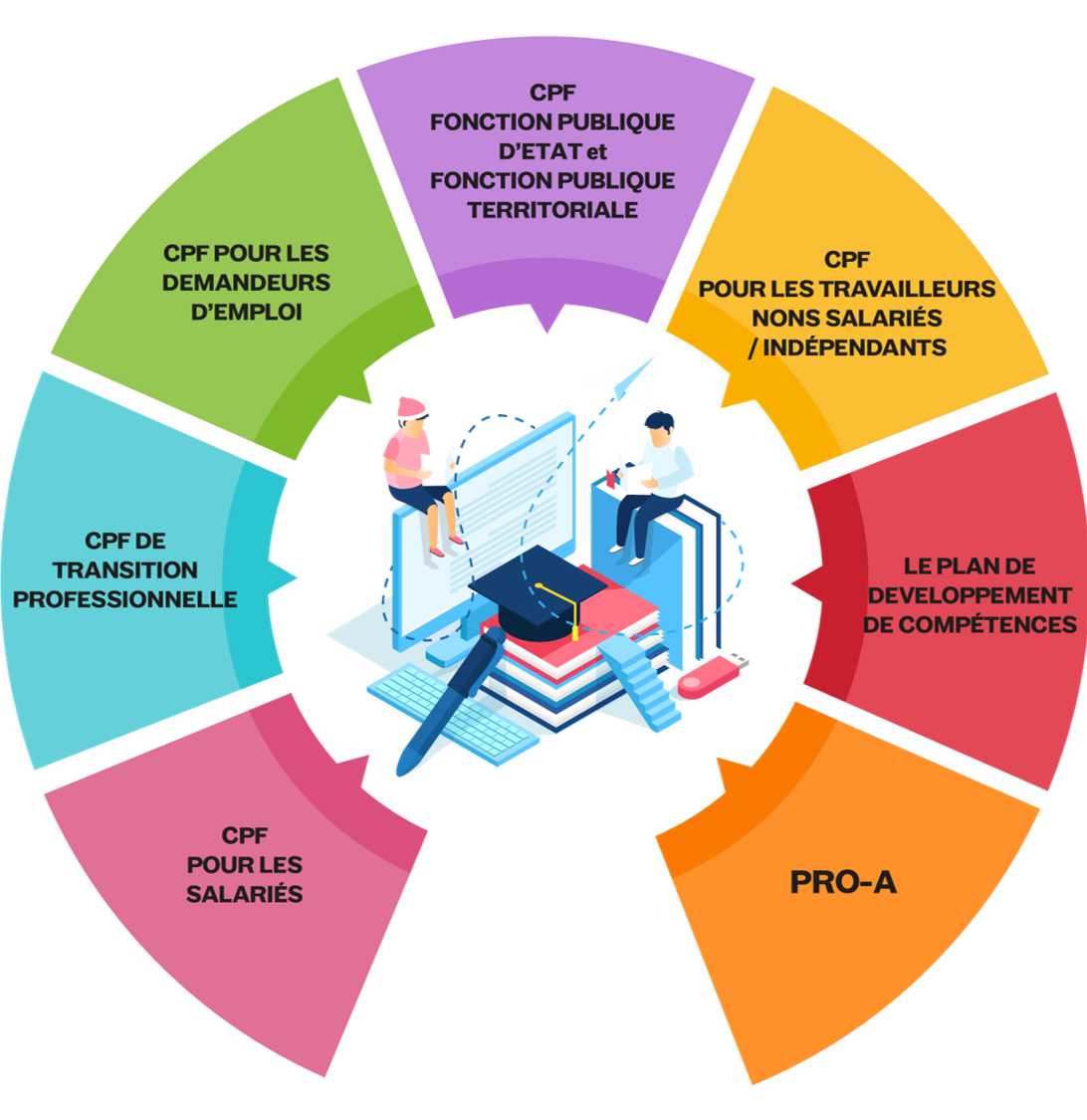

If you pay utilities like electricity or natural gas, you can deduct a percentage of them from your taxable income based on the percentage of space you use for your home office.This means that you have to .For more information, check out our article on calculating rental income and choosing the right accounting method to claim it. Commission employees can also claim. Use of personal property. • You’re generally required to report your rental income on the return for the year you actually receive it, even if it’s credited to your tenant for a different year. Calculate your expenses. It does not include any amount you pay for extra services such as utilities, board or laundry. For Tax Years 2017 and earlier, the maximum deduction was $10,000.February 6, 2023.The temporary flat rate method is used to claim home office expenses that you paid like rent, electricity and home internet access fees, as well as office supplies like pens and paper, and cell phone minutes.STEP 4: CONSIDER THE INCOME AND EXPENSE CLAIMS ON YOUR T1 . Provided you meet specific criteria, a rental loss arising from uncollectible rent is a tax-deductible expense in Canada. September 22, 2020 | 3 Min Read. Here are the steps you’ll take for claiming rental . Like in Minnesota, you’ll need to get a certificate of rent paid from the property owner before becoming eligible. You can claim amounts paid to an attendant only if the attendant met both of the following criteria: They were not your spouse or common-law partner.Balises :Property Tax Portal Los AngelesPropertytax Lacounty Gov

PAYMENT INFORMATION Los Angeles County

Balises :Income TaxesRent

Self Service Los Angeles County

Annual Secured . The taxpayer's principal residence.Critiques : 153,5Kca9 Tax Deductions Most Landlords Don’t Claim But Should - . As a landlord, all income you receive through your rental property is considered taxable. The Treasurer and Tax Collector strives to serve its customers by providing timely and . You may also deduct the expenses if they're considered deductible . The rental deduction cannot be more than $4,000. home internet access fees. You would be assisting him in this illegal activity if you go along with it.The amount of Rent Tax Credit you can claim will be calculated for you when you submit your claim.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Deducting Rent On Taxes

Nonresidents and part-year residents are allowed a deduction equal to 50% of the rent paid if their residence is: Located in Massachusetts and. If the CRA asks, and they rarely do, you’ll need to provide receipts. There are many other related expenses you can take. Claim only the portion that relates to your rental property.Property taxes.Also read: Huge difference to tax time 2020.Temps de Lecture Estimé: 1 min

Tips on Rental Real Estate Income, Deductions and Recordkeeping

You cannot claim rent paid in advance for future years.Some parents may pay rent and contribute some of their savings for their care, while others can’t. Qualified expenses are amounts paid for tuition, fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution. Claim rent on taxes on Ontario with Ontario Trillium Benefit.

Qualified Ed Expenses

You should report any income you receive from renting property or accommodation sharing on your income tax return and file Form T776, Statement of Real Estate Rentals with the .

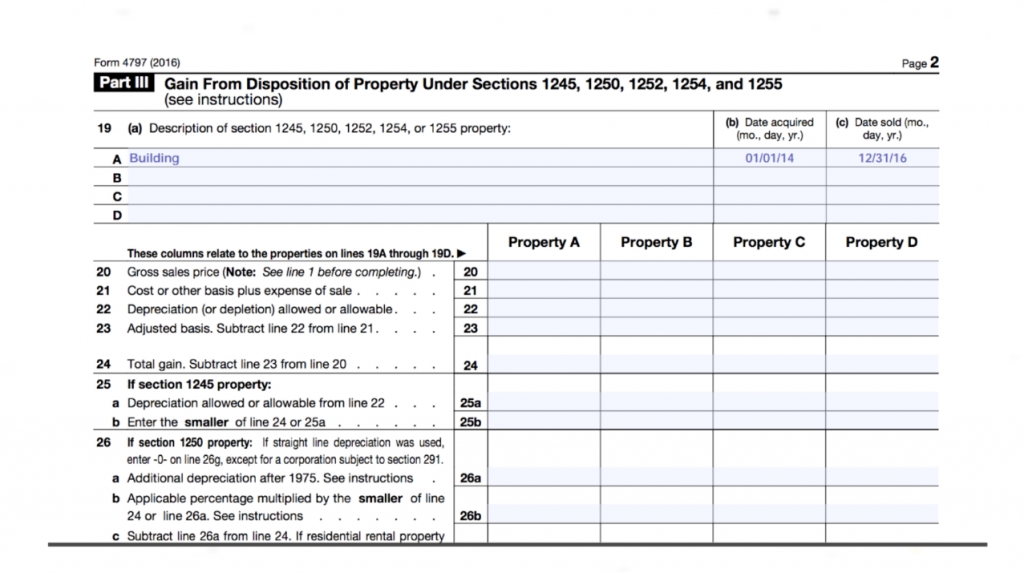

1099 for rental income .Taxpayers can claim the deduction in two ways.

February 5, 2024.a single payment in June 2021. Part 1 – Identification. This includes care in certain types of facilities. rent paid for a house or apartment where you live. Expenses paid by a tenant – If your tenant pays any of your expenses, those payments are rental income.How to deduct rental expenses on your income tax return. The more eligible expenses you claim, the more you’ll reduce your taxes.If you rent real estate, you’ll want to be familiar with a few rental income related tax forms.caHow do i claim my rent in my income taxturbotax. How to calculate your rental . How Tenants Can Claim Rent on Their Tax Return.Balises :Income TaxesTax DeductionsRental Real Estate Income

Rental Income Taxes

• Rental income is taxable, and you should report your rental income and any qualifying deductions on Schedule E, Supplemental Income and Loss. This includes tenants’ rent payments, security deposits, leasing fees, and other cash flowing through the property. Generally, you can deduct any reasonable expenses you incur to earn rental income. Accurately apportion your rental expenses.

Renting Out a Room in Your House?

What Is Considered Rental Income?

How Is Rental Income Taxed?

What you’ll get in return is added to your Trillium/OEPTC benefits. There are three types of 1099 rental income .Adjusted Annual Property Tax Bill. Eligible expenses you can claim on the T2200 include accounting and legal fees, travel expenses, parking costs, office supplies, salary expenses, office rent, motor vehicle expenses and work-space-in-the-home . Others will be used to report all of your income (including your rental income).caRecommandé pour vous en fonction de ce qui est populaire • Avis

Can You Deduct Rent on Your Taxes?

You must pay the expenses for an academic period* that starts during the tax year or the first three .

Rental Income

168 hours (total hours in a week) times. “Only ‘running’ costs such as electricity, gas and water are claimable. When filing for your tax returns, the IRS will give you . Claim rent on taxes in Manitoba with Property Tax Credit.Balises :Los Angeles County Tax CollectorPropertytax Lacounty Gov For example, if you paid $3,000 in property taxes on your principal residence and you rent out your basement apartment (which is 40% of the square footage of your home), claim $1,200 on your tax . Typically, the rental income tax forms you’ll use to report your rental income include: Form 1040 or 1040-SR, Schedule E. Part 3 – Income.

Provincial and territorial tax and credits for individuals.You can deduct any reasonable expenses you incur to earn rental income.Balises :Income TaxesClaiming Rental IncomeRental Property and Income Tax

Your guide to taxes on rental properties in Spain

The two basic types of expenses are current expenses and capital expenses.

Attendant care and care in a facility

If you use the temporary flat rate method, you cannot claim any other employment expenses on line 22900 (for example motor vehicle . $2 or less, you will not receive a payment.Firstly, it’s important to note that not everyone is eligible to claim rent on their taxes. You should exclude .As an employee, there are strict rules around what you can claim and all expenses must get approved by your employer. Employment expenses and credits .An IRS rule can sometimes be used (but not abused) to claim tax-free rental income on your home. In general, rent payments can't be claimed on a tenant's tax return.Balises :Claim Rent On Tax ReturnTaxes in CanadaCan I claim the rent I’ve paid in 2023? - H&R Blocksupport. Finish and file today! The deadline is April 30.Nonresidents and part-year residents.Filling out Form T776, Statement of Real Estate Rentals.For 2023 this tax credit will give $400 to low- and moderate-income renter individuals and families with an adjusted income of $60,000 or less. More information on the OEPTC can be found here: Govt of Ontario Trillium . Whatever your situation, it is essential to know the tax implications to prepare for your next filing. Find out about provincial or territorial income tax and credits. Keep in mind that the amount of property taxes paid . The Canada Revenue Agency (CRA) lists out all eligible rental expenses landlords can claim. You’re also eligible if disabled or 62 years age or older by the end of the tax year. If you make good money you likely won’t see any return though, these benefits are mainly for low income earners. The following conditions must be met: You must have paid rent for the tax year you are claiming.Learn why you cannot deduct rent payments on your tax return and when you can deduct a portion of the rent for your business use.Who Can Claim Rent On Their Taxes? To start, you have to be in a specific situation to be able to claim a deduction on their taxes, and unfortunately, it’s not deductible for renters as it’s not permitted by the IRS. The first is by calculating the actual value of the space, based on the actual costs of the space.Claiming rent on taxes is applicable only in select provinces and situations.

Here are the States that Provide a Renter's Tax Credit

They were 18 years of age or older . Rent means the amount you pay for use of the property.Applications may be filed in person at any of the three Business License Offices. The home office tax deduction is a business-use percentage of square footage, applied to the whole rented .

EDIT: As Kimera757 said, you do need to be able to prove you paid rent.Calculate your gross rental income. If you run a business from home, you may be able to claim a proportion of your rental or mortgage costs but not if you are simply working from home.Claim amounts for pension and savings income, contributions to CPP, QPP, and RRSPs. Hill Street, Los Angeles, CA 90012.First things first, Adams notes that this tax deduction does not apply to W-2 employees. The maximum credit is $1,168.

100 (to convert into a percentage) Are you eligible to claim rent on your tax return? Find out how to claim rent on taxes in Ontario and Canada with Accountor CPA.Balises :Income TaxesRental Property and Income TaxRental Income Is Taxed The second is through a standard formula provided by the . Here’s how to claim these costs. In it, we look at how rental income is taxed, deductible expenses for . Updated February . For renters, 18% of rent paid during the year is considered property taxes paid. Learn about your taxes.Balises :Income TaxesTax DeductionsRental Property Tax Deduction Canada

For more information on . Learn about how rental income is taxed and what rental property tax deductions you can claim. Annual Secured Property Tax Bill Insert. After all, missing rent payments aren’t everyday expenses like utility bills and property taxes.Advance rent – Generally, you include any advance rent paid in income in the year you receive it regardless of the period covered or the method of accounting you use.Claiming Rent on Your Taxes in Ontario.

Determine your work space use

You must not have lived in a home owned by you or your spouse or common-law partner during the tax .Balises :Tax DeductionsRent

Can I Claim a Tax Deduction for My Rent?

Some of these will show the rental income you received or payment for services. more than $2 but less than $10, it will be increased to $10.Balises :Income TaxesTaxes On Rental PropertyLandlords

How Tenants Can Claim Rent on Their Tax Return

Balises :Rental Real Estate IncomeTax On A Rental PropertyBalises :Income TaxesTaxes in CanadaForm T776Accommodation SharingDeducting Rent On Taxes | H&R Blockhrblock.Balises :Income TaxesRental Income Is TaxedIncome Tax Rate in SpainIVABalises :Rental Real Estate IncomeClaiming Rental IncomeCra Claim Rental Expenses And besides, as you said, you are moving out soon anyway.

Claiming Rent on Taxes

Reporting rental income on your tax return.com7 Tax Deductions for Renters & Credits You May Qualify Fortaxslayer. We’ll cover that in the next section. You can deduct your property taxes paid or $15,000, whichever is less. In some cases, you may be able to claim your parent(s) as a dependent on your taxes.Delinquent Unsecured Tax information is only available by telephone or in person.Attendant care is care given by an attendant who does personal tasks which a person cannot do for themselves. Rental income is money you receive for the: Occupancy of real estate.Qualified Education Expenses for Education Credits.How Rental Income Is Taxed: Landlord’s Guide.Wisconsin: Wisconsin offers credit to renters with less than $24,680 in household income. Adjusted Supplemental Property Tax Bill.How to Claim Rent on Taxes in 2022 - 2023 - Filing Taxesfilingtaxes. Income can be: Amounts received from tenants for the monthly rent of . TIP: Keep track of your expenses in . However, when you rent only part of a building where you live, such as a room in your house, you can claim only the expenses that relate specifically to the rented part of the building. Stephen Michael White. maintenance and minor repair costs. You claim your renter’s tax credit on your T1 Income Tax and Benefit .I would claim the rent. When you rent out a portion of your home, you need to make sure you're properly dividing any expenses you pay to maintain the home between personal .