How to determine attorney fees

The easiest way to determine whether a legal fee is excessive may be . Clients often . Claim the deductions on your business tax return if you are taxed as a corporation.LITIGATING ATTORNEYS’ FEE ...

The easiest way to determine whether a legal fee is excessive may be . Clients often . Claim the deductions on your business tax return if you are taxed as a corporation.

LITIGATING ATTORNEYS’ FEE CLAIMS

3d 203, 207 (Fla.

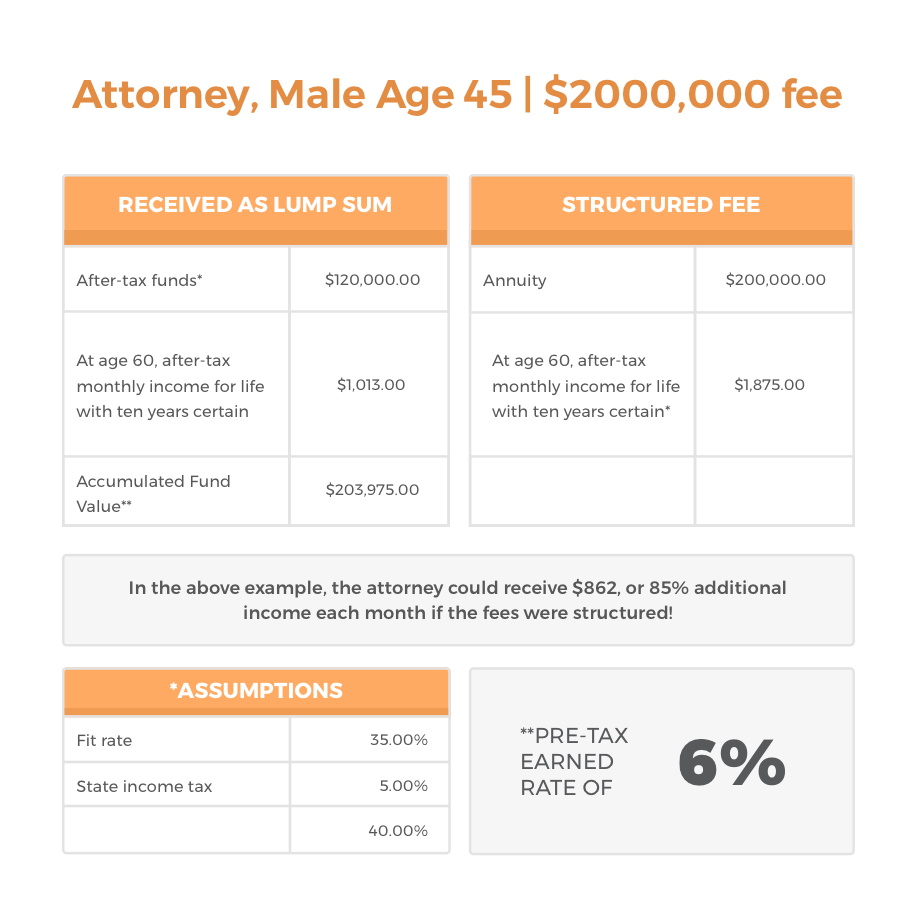

The more intricate or specialized the case, the higher the fee may be. A fixed fee, also known as a standard fee, involves charging a predetermined amount for routine legal matters.4 Counsel is expected to claim .To determine whether a FOIA plaintiff is “entitled” to attorney fees, the D.Should Attorneys’ Fees be Included in a § 998 Offer? 3.Determining “reasonable” attorneys’ fees requires application of Rule 4-1.Attorney's Fee Awards: The order of payment of the attorney fees from one party to another party.

How To Determine Reasonable Attorney Fees In Georgia

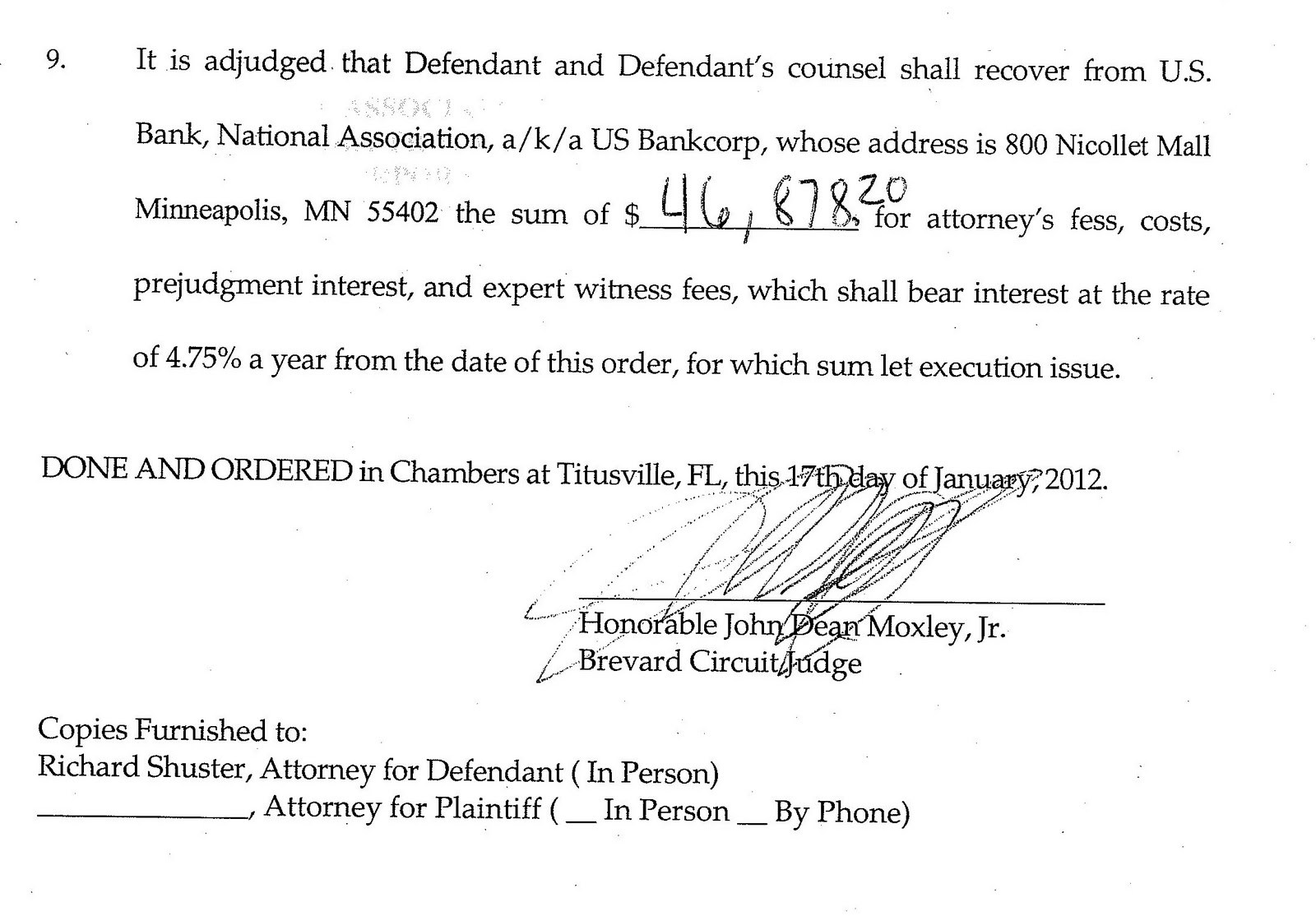

If you win your case, the other party .If you have been assisted by a lawyer, a copy of the decision is obtained generally beside him. Using the same example as above, the prevailing party would be entitled to recover $10,025 as attorney's fees on a $100,000 debt.HOW YOUR LAWYERS’ FEES ARE CALCULATED AND . You should be aware that most SSDI and SSI cases do not have a large back benefit. French lawyers are free to determine the amount of fees they charge for their services, and they are under no legal obligation to limit or cap the . If this is not the case, you can ask the court registry who has pronounced the .In determining reasonable attorney fees, the Court in .

Executor Fees: A State-by-State Guide

You might also need to pay statutory fees in case the court determines the cost of proceedings, for example, in bankruptcy or probate cases. (1) In all cases under Code of Civil Procedure section 372 or Probate Code sections 3600-3601, unless the court has approved the fee agreement in advance, the court must use a reasonable fee .6(F) for information on contractual attorney fees. 2 See Section 8. Contingency fees. Experience and Expertise: The level of experience and .00 of outstanding indebtedness, plus 10% of the remaining outstanding indebtedness.Under Florida law (with very limited exceptions), when awarding attorney fees to a prevailing party pursuant to a contract provision or statute authorizing the recovery of attorney fees, the trial court must determine a reasonable hourly rate for the particular services rendered and a reasonable amount of time for the attorney to have spent . That means that in most cases you can walk away from that debt at the end of your bankruptcy. Today, most attorneys continue to bill at an hourly rate for most of their services.

Amerus Life Ins.

French Attorneys And Legal Fees

The Kartons assert that the opinion is “unsupported .A contractual attorney fee provision—Whether a con-tract case is tried to a jury, court, or an arbitration panel, it may be possible to recover attorney fees and costs following.The trial court held the mining rights did not include a right to build an aggregate processing plant onsite. Overview of Attorney Fee Responsibility in Georgia: In Georgia, attorney fee responsibility is governed by a combination of statutes, court rules, and case law.attorneys fees, the Seventh Amendment does not guarantee a trial by jury to determine the amount of reasonable attorneys fees.

Attorney Fees

It is difficult to determine how attorney fees could have been charged of almost $40,000 on an estate with less than $5,000 in personal property. More experienced lawyers tend to charge more per hour than those with less experience .7 billion class-action . If the attorney fees .

Fees related to adopting a child are deductible if you . Alternatively, deduct your legal fees on your business tax return if your business is a C corporation, S corporation, partnership, multi-member LLC, or single member LLC and you've elected to be taxed as a C or S corporation. Defines which events give rise to the right to recover fees b.6(A)(1) for more information on determining a reasonable rate.

Can Attorney Fees Be Included in Bankruptcy?

Unfortunately, there is no clear answer to what constitutes unreasonable attorney fees. 3 See Section 8. The benefactor a. Therefore, in most cases the attorney fee will be around $3,000 to $4,000, which would be 25% of the back benefit. ORCP 68 C(4)(f). In this article, we’ll explain why this is the case and a few exceptions you should be aware of.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Legal costs: cost of a trial

Paying your fees is your legal obligation. Numerous state and federal statutes provide for prevailing party .Follow these steps to make sure you’re choosing a competitive and profitable hourly rate for yourself or your law firm. judge on Tuesday awarded over $956 million in legal fees to plaintiffs’ lawyers who secured two settlements worth more than $11 billion with major . These sources collectively outline the rules and principles that determine who is responsible for paying attorney fees in different legal matters.Factors That Determine Attorney Fees.CALCULATING FEES. Flat fees for contracts. § 998 Offer “For $X Plus Costs and . Learning the basics of attorneys' fees before hiring an attorney will help you avoid a .2024 California Rules of Court. Plaintiffs do not seem to have a problem with pleading a claim for fees. Circuit balances four nonexclusive factors: “‘ (1) the public benefit derived from the . You can deduct legal fees that are ordinary and necessary expenses directly related to the operation of your business as a business expense. Legal fees you incur for resolving tax issues, advice or preparation of tax forms related to your business usually are deductible. Factors Affecting Attorney Consultation Fees . Normal ranges tend to be somewhere between 1 and 1. Attorney fees are usually treated the same as any other unsecured debt. If objections are not timely filed, “the court may award attorney fees or costs and disbursements sought in the statement.Many judges still calculate the correct attorneys' fee by multiplying the reasonable hours by the reasonable hourly rate.3 Thus, determin-ing which fees and costs are allowed starts with . If he quotes you a $5,000 flat fee and he bills his time at .There are the costs directly linked to the conduct of the proceedings, such as the costs of the Commissioner of Justice (former judicial bailiff and judicial auctioneer) or the costs of . The loadstar is calculated by multiplying the reasonable . Experience and Reputation: Lawyers with extensive experience and a strong reputation in their field may charge higher fees due to their .

Attorney s Fees Outline

The method for determining what is a “reasonable” hourly fee depends on several things.

Lawyers in PFAS water pollution settlements win $956 mln fee award

A good deal of attorneys' fee litigation centers on the . This type of fee arrangement is often . § 998 Offer “For $X Including Costs and Attorneys’ Fees” 3. A motion for rehearing of . Hourly billing is the norm for the legal industry, and it has been for quite some time.The law regarding the pleading requirements for a claim for attorneys’ fees has evolved substantially in the past decade. Karton, a plaintiff and an attorney of record in this case, commented that the Kartons will request the California Supreme Court to depublish Part One of the opinion concerning the criteria to determine an attorney fee award.Critiques : 153,4K Ashford Partners, 401 S.

It’s also vital to assess whether certain causes of action implicate a statutory basis for awarding legal fees. A lawyer will charge a per hour rate, then track the time spent working on the case in fractions of an hour, for example in 10ths of an hour (or 6-minute increments).

How Much Do Lawyers Cost?

successful verdict. In a series of decisions arising from the same case, the Court of Appeals has tried to clarify the standards governing the award of attorneys' fees to plaintiffs who win their civil rights cases.At No Cost! What Are the Different Types of Legal Fees? A legal fee is a fee that a lawyer or law firm charges for their services. Attorney and client fees only apply to the capital amount (amount of damages recovered) obtained by successful litigation.The answer to that question is generally “yes.Attorney fees consist of the following elements: Initial consultation meeting fees. When I begin to address an attorney fee petition in a civil case, I start from a position of believing that a prevailing party is entitled to its reasonable .

Recovering Attorney Fees and Costs

The first step in the lodestar process requires the court to determine the number of hours reasonably expended on the litigation. Relying on Texas Supreme Court case law dealing with an attorneys’ fees award under the UDJA, the court of appeals affirmed. Motion for Rehearing. A rural North Texas jury awarded a Dykema defense . The percentages of the estate’s value that determine executor compensation can be broken down into the following: 5% of the first $1,000.170(a), addressing compulsory counterclaims, the defendant is required to .

The legal field has approved of contingent fees in most cases because they allow clients without much money to access the legal system.

How to Prove That Your Fees and Litigation Costs Are Reasonable

An attorney fee clause has three parts: The condition a. So, you may pay $100 per hour for .State and practice area are two of the most important criteria that determine what attorney fees you will owe–but other issues such as level of experience can also . The problem area has involved claims by defendants.

Attorneys' Fees: The Basics

Ironically, the larger the estate, the lower the percentage typically is.

California Rules of Court: Title Seven Rules

5% on any amount above $6,000.

Standard hourly rates.3d at 40 (holding that to get attorneys’ fees under Chapter 38 for breach of contract, party must prevail on . Attorney fees buy you the expertise of the legal adviser and the lawyer, as well as the entire team that works on your case. These may include: Complexity of the Case: If your divorce involves complex financial issues, child custody disputes, or other challenging legal matters, it is likely that your attorney fees will be .

Lawyers may charge different rates depending on the type of case.525 does not apply.3 To accurately assess the labor involved, the attorney fee applicant should present records detailing the amount of work performed.Civility is an aspect of skill to be considered in awarding attorney fees.1 One commonly-recognized exception is where the parties have contractually stipulated to the payment of reasonable attorney fees.Hourly attorney fees are the most common type of arrangement.

How to Price Services for Your Law Firm

Georgia law allows the prevailing party to recover 15% of the first $500.Updated by Cara O'Neill, Attorney · University of the Pacific McGeorge School of Law.The “lodestar” method is commonly used by judges and arbitrators to determine attorney fees for a prevailing party.

Lawyer Hourly Rates: How to Know What to Charge

, each party in a legal case typically pays for his/her own attorney fees, but in some .This will give you an idea of how many hours the attorney expects the firm to spend on your estate plan. Some firms also charge a minimum annual fee to protect themselves against putting in a lot of work for relatively small estates.In any fee application, it is crucial for attorneys to document the hours spent on the matter as well as the appropriateness of the rate to be applied.