Iata rpk forecast

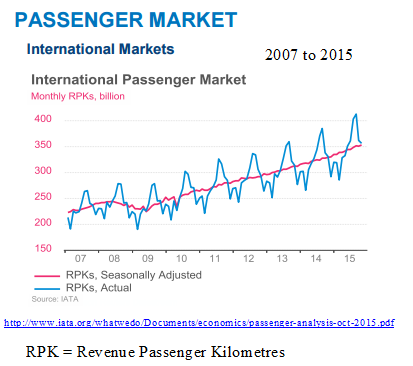

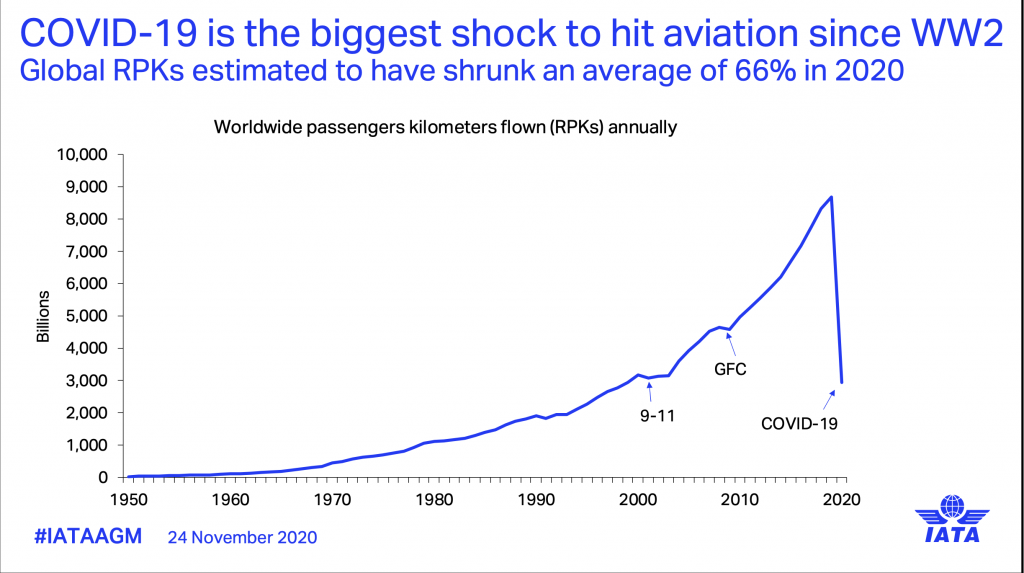

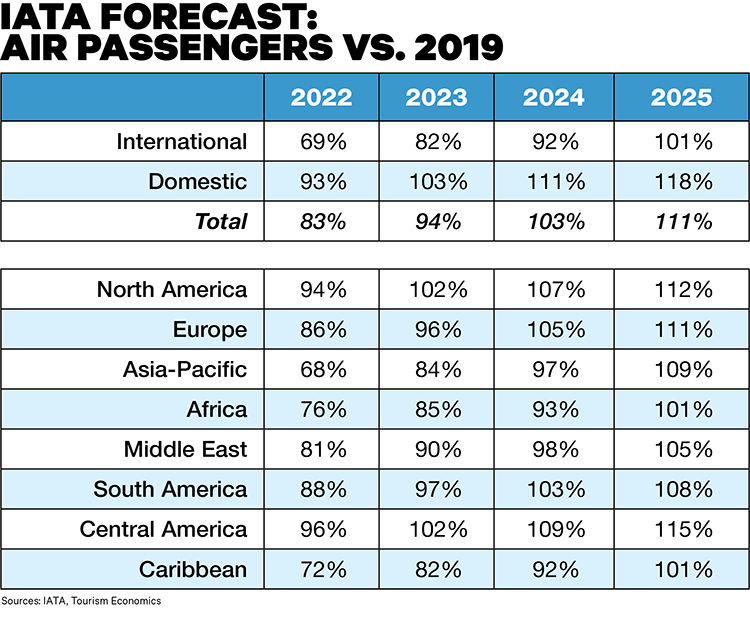

Domestic RPKs in Japan rose . As a result of the rapid vaccine rollout, US . African airlines’ annual traffic rose 89.Global air traffic surpasses pre-pandemic levels in February. Domestic traffic stable globally Global domestic RPKs grew by 26.5% year-on-year (YoY).3% annual growth in September, and surpassed 2019 RPKs by 5. At the regional level, North America showed the smallest capacity decline from November 2019 .7% GDP growth . Total passenger traffic market shares by region of carriers for 2023 in terms of RPK are: Asia-Pacific 31.0% compared to December 2021.4% RPK growth 5. In YoY terms, domestic RPKs and ASKs increased 67.6% decline in March. In the pessimistic scenario, IATA has taken a prolonged lockdown and second wave of the coronavirus into . RPK is expected to exceed the 2019 level by 2024.4%, Latin America 5. Published Jan 22, 2023. Domestic traffic fully recovered for the first time since the pandemic began, surpassing the benchmark 2019 levels by 2. Passenger Kilometres (RPK), .6% fall in the previous month.7% in April compared with pre-crisis period (April 2019), after posting a 31.1% of pre-pandemic levels.The Passenger Forecast includes a comprehensive global report, including data tables, and detailed commentary focusing on the drivers and trends that will shape air travel .

Actual

IATA Economics.5%, and Africa 2.

Looking ahead, 44% say that they will travel more in the . The JADC predicts an .

Air Passenger Market Analysis

Air Passenger Monthly Analysis – April 2022 2 Chart 2 – Domestic RPK growth (airline region of registration basis), % YoY These countries now face declining pressure on health systems from the Omicron variant, enabling the more accommodative travel policy.8% decline in October.forecast to spend $354 billion, 42% of the amount spent before the crisis.2% traffic rise in 2022 over full year 2021.2% GDP growth 2.Without that, no version of the roadmaps will get us to net zero carbon emissions by 2050,” said Marie Owens Thomsen, IATA’s Senior Vice President .Global air passenger capacity continued its slow recovery for the third consecutive month.(IATA) Airlines’ losses also narrowed significantly and turned profitable in North America.4% of their 2019 levels in January.Domestic RPKs declined by 25.5% above February 2019 levels.5% growth in 2024.8%, Latin America 6.2% in 2022 versus the prior year.

Industry RPKs (billion per month)

5% of pre-Covid levels. Airlines’ losses also narrowed significantly and turned profitable in North America.3% above 2019 RPKs. That is an improvement from January 2022, which was up 83. Meanwhile, airlines registered in Africa achieved 71.9 ppts from September.Global air passenger demand recorded solid growth in May, with industry-wide revenue passenger-kilometers (RPKs) increasing by 39.Note: IATA forecast as of June 2019 Source: ICAO, IATA, IHS Markit, Airbus GMF 2019 7. Air passenger demand continues in gradual recovery from the low-point in April. Historical data are subject to revision. We expect CTKs to rise in 2022 even as cargo yields moderate with the additional belly capacity from passenger aircraft coming online.Source: IATA, ICAO, Airbus, EDGAR CO 2 emissions, Airbus GMF * Note: commercial air transport direct share of total anthropogenic CO 2 fossil emissions (excluding land use . In seasonally adjusted terms, RPKs increased by 14% month-on-month – a broadly . Includes all commercial airlines.Domestic traffic stood at 77.

Passenger traffic recovery remains robust

IATA statistics cover international and domestic scheduled air traffic for IATA member and non-member airlines.8 percentage points (ppts) YoY and reached 81. Industry-wide revenue passenger-kilometres (RPKs) fell by 79. International passenger traffic resumed recovery, with international .

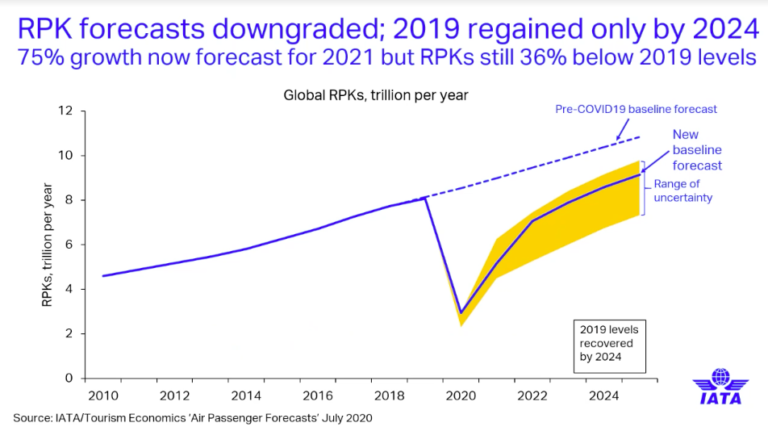

• Cargo is expected to continue to support the industry’s performance. Only 18% said that they were traveling less. Some 49% indicate that their travel habits are now similar to pre-pandemic.8% vs March 2019) due to strict travel restrictions. Domestic passenger traffic achieved 28.Our data solutions are perfect for anyone who wants to understand the aviation industry better.Chart 4 – Domestic RPK growth by airline region of registration, YoY% change versus 2019 Sustaining the strong recovery in Europe’s domestic markets, the region’s airlines grew domestic RPK’s by 24.7 percentage points to 82. February 2022 domestic traffic was up 60.8% YoY, recovering to 96. growth of -66% (was -63%) Source: IATA Economics-100%-80% . In 2023, the global RPK could reach around 95% of the . The domestic load factor sat slightly below 80% in the same month.Industry-wide revenue passenger-kilometers (RPKs) were 67.9% of the October 2019 level (Chart 2), 3. Measured in RPKs, total global air traffic demand for 2021 is expected to stand at around 40% of 2019 levels, rising to .1% YoY, recovering to 92.IATA announced that the ongoing recovery in passenger demand continued in October.Even so, global RPKs are forecast to remain below their pre-pandemic 2019 level until 2024.7% in November 2021 versus November 2019, following a 40.

Gradual RPK improvement continued into July. Annual capacity climbed 93. New aircraft orders have recovered to the average level of 2011-2018, and production and deliveries of aircraft were steadily recovering. of the pre-pandemic level, down 8.8% of total industry RPKs and 27. Passenger load factors (PLF) improved in comparison to the .Sources: IATA Economics, IATA Monthly Statistics.

1% load factors, respectively (Chart 2).2%, the highest among the regions.Air passenger traffic growth persisted in April, with industry-wide revenue passenger-kilometers (RPKs) increasing 45. Annual growth in Revenue Passenger-Kilometers (RPK) reached 21.Total traffic in February 2022 (measured in revenue passenger kilometers or RPKs) was up 115.8%, North America 28.0% RPK growth 2018 2019 3.1%, North America 24. Chart 1 – Global air passengers, revenue-passenger . Carrying 83% of the world’s air traffic, we represent over 300 airlines in 120 countries, including the world’s leading .In August, industry-wide revenue passenger-kilometers (RPKs) grew 28.Weaker start to year for passenger business, due to surge in virus cases and travel restrictions, and vaccination delays has lowered our global RPK forecast to 26% . Chart 2 – Passenger load factors, by airline region of registration. Worldwide Airline Industry 2019 2020 2021E 2022F Unique city pairs 22104 15473 18788 Compared to 1998 116% 51% 83% Transport cost, US$/RTK (2018$)(IATA) of 2019 levels, as expected. This recovery was driven by growth in . Note: Bankruptcy reorganization & large non-cash costs are excluded. Passenger volumes trended upwards in SA terms during most of 2018, with a minor setback in September caused by typhoons – we previously . The report covers the latest trends, forecasts, and scenarios for the global economy, passenger and cargo markets, airline . That said, the pace eased from its double-digit rate of 10. This is broadly unchanged from October, but softer than the outcome for the year-to-date, at 4. Recovery in international traffic remains slow For now, the health crisis remains critical but there is a light at the end of the tunnel.1% compared to January 2021.9% compared to February 2021.3% vs March 2019), particularly in China. • The industry is returning to profitability in 2023, only three years after the historic loss of nearly USD 140 billion in 2020. On the other hand, international travel was subdued (down 87. Total airline revenue is expected to reach 107% of 2019 earnings, with operating profits of .

Annual car sales worldwide 2010-2023, with a forecast for 2024 .European and Latin American airlines followed, with 84. Air Passenger Monthly Analysis – November 2022. New aircraft orders have recovered to the average level of 2011-2018, and production .5% of 2019 levels.

Next year, tourists travelling by air are forecast to spend $626 billion, 74% of the level before the crisis. IATA is the trade association for the world’s airlines.

How JADC Is Forecasting World Air-Passenger Traffic For The Next 20 Years.2% lower compared to the pre-crisis level (March 2019).3% 1% of industry RPKs in 2021. A third of travelers polled say they are traveling more than they did pre-pandemic.Available seat-kilometers (ASKs) rebounded by 28.

Manquant :

forecast

1% year-on-year. December demand climbed 37.with a forecast 4. Discover what high-quality aviation data can do for your business.

AIR PASSENGER FORECAST

In seasonally-adjusted terms, passenger traffic increased 1.3% and load factor increased 9.4% year-on-year (YoY) and reached 95.

Air Passenger Market Analysis

8% year-on- year in July vs.

Industry RPKs (billion per month) 0% % % % % 0% 20% 40%

Available Seat Kilometres (ASK), Revenue. These pages provide analysis of economic and policy developments affecting the financial performance of the global .Sources: IATA Economics, IATA Monthly Statistics, Markit 2nd consecutive month of strong results in the ME Middle Eastern airlines -recorded a 7.8%, Middle East 9.6 ppts lower than in September. In the first half of 2023, global revenue passenger . Compared to February 2019, however, traffic was down 45.

Outlook for the global airline industry April 2021 update

Industry-wide available seat-kilometers (ASKs) fell by 39. International RPKs continued to expand . Strong first half of the year ends on a positive note for the industry.IATA forecast for 2022 and 2023.0% month-on-month (MoM), indicating a slowing but still positive trend globally (Chart 1). (Belly/Dedicated) Forecasts of Aircraft Departures, capacities in.Air Passenger Market Analysis June 2023. • Cost pressures will be a focus for airlines this . The recovery was driven by the rebound in domestic travel (down 32. In February 2024, the airline industry achieved full recovery in total passenger traffic, surpassing the 2019 threshold by 5.The global RPK forecast for 2022 is down 40% on 2019.How will the air transport industry evolve in the next two years? What are the main drivers and risks for its recovery and growth? Find out in this comprehensive report by IATA, the trade association of the world's airlines.8% year-on-year (YoY), reaching 90.1% of total domestic RPKs in 2019 – its recent growth in traffic had a substantial impact on global RPKs.IATA’s November 2023 passenger polling data supports the optimistic outlook. IATA, Revenue-passenger kilometers in global air passenger traffic from 2000 to 2020 (in billions) Statista, https://www. Contact us. Total passenger traffic market shares by region of carriers for 2022 in terms of RPK are: Asia-Pacific 22.7% of August 2019 levels.Air travel forecast downgraded for rest of this year Slower growth to year end means 2020 avg.International RPKs performed by Middle East carriers grew 43.