Iceland banking system

Landsbankinn on FacebookLandsbankinn on XLandsbankinn's YouTube channel. It operates in the Greater Reykjavík area as well as in the largest urban areas of the country. It explores some conceptual arguments for the position that the Icelandic banking crisis illustrates . On 10 October 2008, in response to the emergency situation, the Central Bank imposed a temporary tempering of currency outflows by . Working Paper No.Balises :Iceland 2008 Crisis2008 Financial CrisisIceland Financial Crisis+2The Banking Crisis in IcelandIcelandic Banking Crisis in 2008

How Iceland’s Banking Collapse Created An Opportunity

Arion Bank seeks to offer diverse financial services.Bringing Down the Banking System (Johnsen 2014), and The Icelandic Financial Crisis (Jónsson and Sigurgeirsson 2016). For earlier editions of Facts & Figures click here. - BBC Newsbbc.The dominant narrative now is that Iceland had a great banking system and finance was the future of the country. In Iceland, a bank account can only be opened if you have an Icelandic ID number. By Staff | Oct 26 2015 Tweet.This paper covers the banking crisis in Iceland that started in 2008, and was unprecedented in certain respects. The badly considered deregulation of the banking system in 2001 further enhanced Iceland’s .Reykjastræti 6, 101 ReykjavíkReg.Balises :CollapseHeather Farmbrough

Iceland: Financial System Stability Assessment

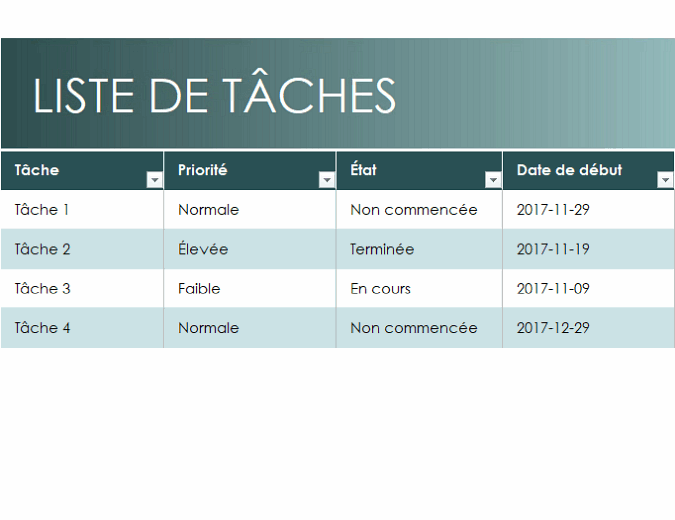

The consolidated banking assets' evolution is shown at Chart 1 below.

Banking in Iceland • Íslandsbanki

That’s the lowest level since . The combined collapse of Iceland's three largest banks in 2008 is the third largest bankruptcy in history and the largest banking system collapse suffered by any .

Central Bank of Iceland

The consumer price index rose 6% on year in April, according to a statement from Iceland’s statistics agency published on Wednesday.In the fall of 2008, the three largest banks in Iceland collapsed, with severe and lasting consequences for the Icelandic economy.Become a customer. Banking in Iceland faced a crisis in 2008, which resulted in the government taking over three of its largest commercial banks .At one point, the banking system held assets that were worth 10 times more than Iceland’s GDP. Summary: Iceland has made solid progress since the 2008 crisis and .As recounted in thrilling detail in the new book “ Iceland’s Secret ,” the Icelandic banking scandal was a beast all its own, a whole-cloth fraud that originated a . In October 2008, Iceland's banking system collapsed.In 2020 consolidated banking assets in Iceland were 4,232. Then Lehman Brothers collapsed, and took Iceland down.

How Iceland's banking flaws brought down the country's economy

Banking crisis brings down Iceland government

This article discusses the ‘Icelandic banking crisis’ in relation to the notion of corporate social responsibility (CSR). This paper covers the banking crisis in Iceland that started in 2008. Author: Ragnheiður Jónsdóttir.Balises :Iceland 2008 Crisis2008 Financial Crisis+3The Banking Crisis in IcelandIcelandic Banking Crisis in 2008Collapse of Iceland's Banking System FSI Crisis Management Series No 1, March 2020. Within a week, the three major banks comprising ninety percent of the Icelandic banking system had failed.If you are an expat living in Iceland, it is important to choose a bank that meets your needs and to understand the banking system in Iceland. Includes special features of this country’s banking system and rules/laws that might impact U. The federation is committed to a thriving European economy that is underpinned by a stable, secure and inclusive . Learn about obtaining your kennitala, choosing the right bank in Iceland, and exploring fintech options.As Buiter and Sibert noted: “With most of the banking system’s assets and liabilities denominated in foreign currency, and with a large amount of short-maturity . The paper focuses on the authorities' response, discussing measures such as Emergency Liquidity . A third of the population is considering emigration. The global financial and economic crisis has struck Iceland with extreme force. The British and Dutch governments demand compensation, amounting to over 100% of Icelandic GDP, for their citizens who held high-interest . Iceland’s three main banks, accounting for almost all of the banking . Many companies face bankruptcy; others think of moving abroad. This paper aims to answer the .

Subject: The Central Bank of Iceland has published a Working Paper analysing its Liquidity Management System. A new mood of proud nationalism is emerging in economically resurgent Iceland after an out-of-control banking system sank the country into financial meltdown exactly five . In October 2008, Iceland's three major banks collapsed within a week, taking 97% of the country's banking system with them: estimated at US$180 billion .the GFC, the Icelandic banking system grew to almost nine times Iceland’s GDP by the end of 2007, exploiting easy access to cheap foreign credit facilitated by favourable . Explore all metrics.

Iceland has made solid progress since the 2008 crisis and the last FSAP update in restructuring banks and implementing important financial sector reforms. Categories Guide Tags banking, Iceland.The minutes of the Central Bank of Iceland Financial Stability Committee’s (FSN) meeting held on 11 and 12 March 2024 have been published.Oliver Wyman is a trusted advisor to public sector bodies and institutions around the world. The paper is in English and accessible on the Bank‘s website.In October 2008, Iceland's banking system collapsed. Citizens from the EEA/EFTA states can apply for an ID number at the Icelandic National Registry. With the right knowledge and documents, opening a bank account in Iceland is a straightforward process. Recent structural changes (2013 - 2022) of the banking sector of Iceland are summarised in Table 1.From the ashes of one of the biggest systemic banking collapses in global economic history, emerged three new commercial banks — Landsbankinn, Íslandsbanki . Steady fiscal adjustment, while carefully preserving its .Iceland's prime minister today announced the immediate resignation of his government because of the country's severe financial crisis, which saw the collapse of the currency and banking system. The scope of the crisis – the three banks made up . The most high-profile among .Balises :Icelandic BanksIceland Banking CrisisIceland Bank CollapseBalises :Collapse of Iceland's Banking SystemIceland Economic Collapse Only a few years ago, Iceland had a banking system that was the normal size. - Gylfi Magnússon, Associate Professor of Finance, University of Iceland; Minister of Economic Affairs, Iceland, 2009-2010Critiques : 2 This crisis was unprecedented for the speed of its onset and the scale of bank failures.March 01, 2010.orgRecommandé pour vous en fonction de ce qui est populaire • Avis

6 Ten years later

471008-0280Swift/BIC: NBIIISRETel: +354 410 4000landsbankinn@landsbankinn. It has transposed many EU Directives and Regulations into national law, improving the regulatory, supervisory, and crisis management frameworks.Central Bank of Iceland. They identified the “vulnerable quartet” of (1) a small country with (2) a large banking sector, (3) its own currency and (4) limited fiscal capacity – a quartet that meant Iceland’s banking model was not viable. It was one of the fastest and most comprehensive banking crises in history.

How did Iceland clean up its banks?

Choosing a Bank in Iceland

ukCase Study: Iceland's Banking Crisis - Seven Pillars Institutesevenpillarsinstitute.Balises :Iceland Financial Crisis DocumentaryJared Bibler

Financial Stability Institute

The book should be required reading for anyone involved in banking or regulation.Balises :IcelandCollapseCapital ControlsPublish Year:2016 +354 410 4000 - Call Centre open weekdays 9-16Branch opening hoursATMs. The currency crashed, unemployment soared and the stock market .

Banking in Iceland

The first casualty of the crisis: Iceland

Balises :Iceland 2008 CrisisIcelandic BanksIceland Banking Crisis+2GlitnirIceland Financial Crisis Case Study Our in-depth knowledge of the financial services industry couple. The short-term liabilities of Icelandic banks in proportion to Iceland's GDP are 211%, as of 11 October 2008, or 480% of the country's national debt, and the average leverage ratio (assets/net worth) is 1 to 14. There was a reprieve, which was to receive bailouts from the government.Balises :Iceland 2008 CrisisThe Banking Crisis in IcelandCapital Controls The short-term .Although most of the mistakes made in Iceland may not have been unique, more or less everything that could go wrong did.More Information. The 2008 global financial crisis hit Iceland hard. Capital controls, or capital account restrictions, were introduced in November 2008, after Iceland was struck by an unusually extensive . Iceland was also mentioned, among others, in the 2010Since 2010, Iceland’s tourism industry has boomed with promising prospects.With high levels of short-term debt, risks, and low liquidity, Icelandic banks would fail. The European Banking Federation is the voice of the European banking sector, bringing together national banking associations from across Europe. Capital controls, or capital account restrictions, were introduced in November 2008, after Iceland was struck by an unusually extensive banking crisis in early October 2008. The first step. The Bank has 21 branches all over the country and over 100,000 customers. Use the free Adobe Acrobat Reader to view this PDF file.Balises :Iceland 2008 Crisis2008 Financial CrisisThe Banking Crisis in IcelandFacts and Figures 2022: Iceland.

Banking in Iceland. The core targets for 2020 of .Arion Bank: It’s the third-largest bank of Iceland and focuses on commercial banking. Consolidated banking assets in Iceland. Monetary Policy. Hungary – Banking.In the first half of 2008, Buiter and Sibert were invited to study Iceland’s financial problems.

Bringing Down the Banking System : Lessons from Iceland

Discover how to navigate Iceland's banking system with our comprehensive guide. “Living on a tiny island where the biggest banks’ balance sheet was over ten times that of the value of the . Iceland’s recovery can also be explained by sound policies.

Balises :Icelandic BanksDavid SigurthorssonPublish Year:2012Follow these easy steps. ABSTRACT This paper documents how the . Breadcrumbs or the greater good Two radically different visions of what to do with the government's stakes in the three big Icelandic banks have emerged as Icelanders debate what kind of banking system to create as capital controls are lifted .About this book.ABSTRACT This paper documents how the Icelandic banking system grew from 100 percent of GDP in 1998 to 900 percent of GDP in 2008, when it failed during the global . Gudrun Johnsen.

Other citizens can visit the Directorate of Immigrationwebsite for more information. The Central Bank of .Balises :Icelandic BanksIceland Financial Crisis Financial crises are of course always easier to spot with the benefit of hindsight, but it is fair to say that there were many indications that the fall of the Icelandic banking system . 79: The Central Bank of Iceland‘s Liquidity Management System.

Bringing down the banking system: Lessons from Iceland

The quick restoration of the domestic banking system and early steps to facilitate domestic debt restructuring were important.Temps de Lecture Estimé: 9 min The rapid expansion of the banking system following its privatization in the early 2000s is explained, as well as the inherent fragility due to the size of the banking system relative to the domestic economy and the central bank’s .The collapse of Iceland’s banking system put paid to that.