Impact green bonds 2021

Catégorie AMF : Obligations internationales.2021 Annual Impact Report - Amundi Responsible Investing Impact Green Bonds - FR.08 million to the net proceeds is currently allocated. Raphaël Chemla. Sustainalytics provided a second-party opinion on the selected projects, and Ernst & . Amundi Responsible Investing - Impact Green Bonds n’offrepas de garantie de performance et . Green bonds have been .As can be seen, corporate green bonds are fairly large—the average issuance amount is $253.Wind and Solar power projects financing.Nel 2021, i Climate Bond hanno attratto 1. depuis le 2021-01-28. For more than ten years, KBN has issued green bonds to fund investments in the Norwegian local government sector key to the transition to the low .

2021: 2020: 2019: Valeur Liquidative: Actif Net-1,98%: 6,11% -20,70% -3,11% 5,53% -86,9256 EUR: 1 241,48M EUR: Un outil pour financer la transition énergétique.

To raise those vast sums, governments and corporations are increasingly turning to green bonds.

Amundi Responsible Investing

An equivalent amount of €279. Document Details.1 MB) Tables Impact Report and Allocation Report 2021. Reference to a ranking, a label and/or an award does not indicate the future performance of the UCITS/AIF or the fund manager.7 years, and 75. As of June 30, 2021, green bond proceeds have supported 236 green bond-eligible projects since 2014, with financing commitments totaling $9.Le fonds Amundi Responsible Investing - Impact Green Bonds vise à financer la transition énergétique en investissant uniquement dans des obligations vertes ayant un impact mesurable positif sur l’environnement. depuis le 2021-04-02. The evolution of green bonds issued each year in relation to the Group's total annual issuances is presented below.KfW has been building up a global green bond portfolio since 2015 with the support of the Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU). Download the Impact Report Subscribe. Le fonds Amundi Responsible Investing - Impact Green Bonds vise à financer la transition énergétique en investissant .

AMUNDI RESPONSIBLE INVESTING - .COMMISSION STAFF WORKING DOCUMENT EXECUTIVE SUMMARY OF THE IMPACT ASSESSMENT Accompanying the document Proposal for a REGULATION OF THE ., 2010) and (Yeow & Ng, 2021) to construct an asymptotic double . SUBSCRIBE TO EMAIL ALERTS. (JPMorgan Chase) on page 9 of this Green Bond Annual Report that, as of August 31, 2021, the net proceeds of $997,500,000 from the September 16, 2020 issuance of JPMorgan Chase’s Fixed-to-Floating Rate Notes due 2024 were allocated to refinance Eligible Green .

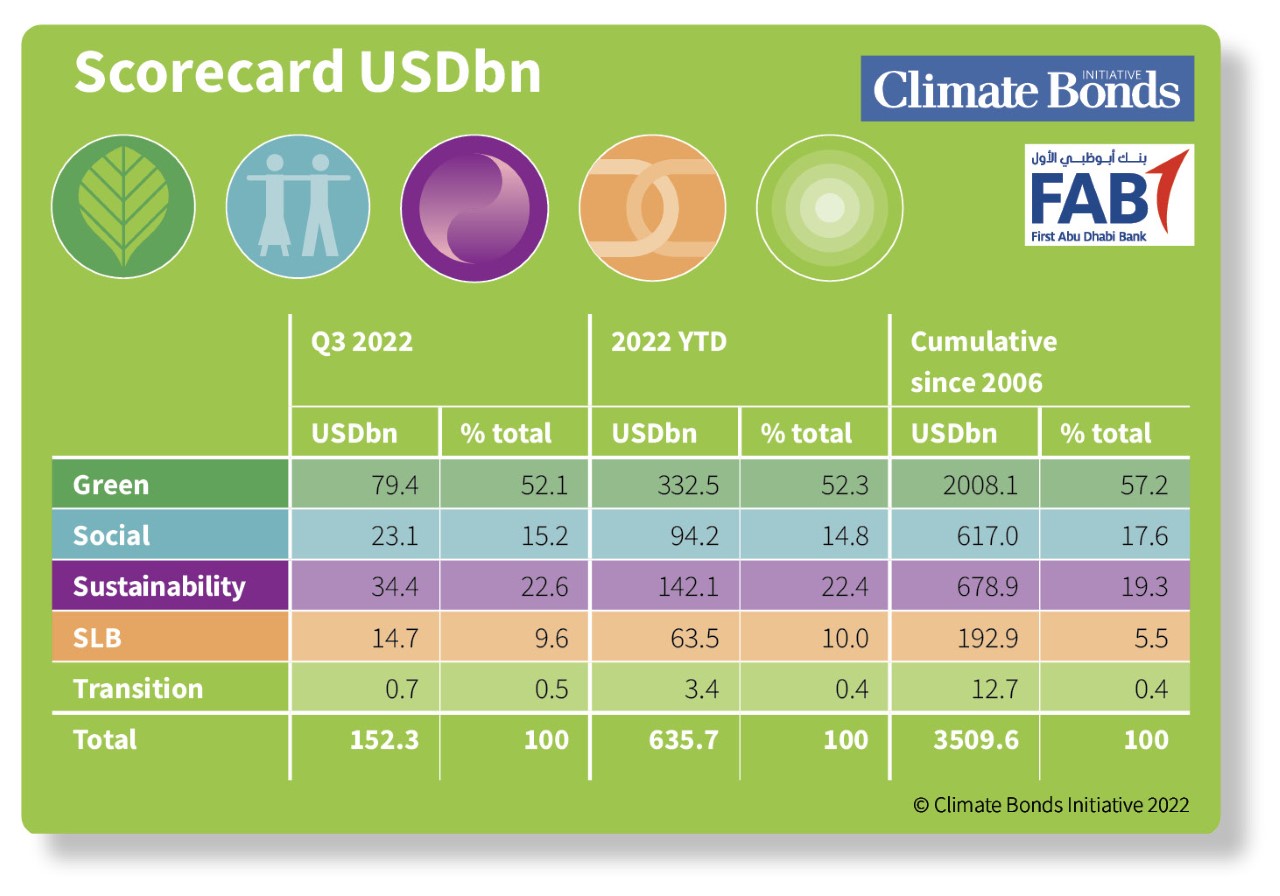

The Impact of Green Bonds on Banking Sector Performance

Document intended for professional investors as defined by MiFID.Sustainable Development Bonds & Green Bonds 2022.2021: 2020: 2019: Valeur Liquidative: Actif Net-1,34%: 6,98% -20,09% -2,36% 6,30% 6,50% 9 225,0240 EUR: 1 246,32M EUR: Un outil pour financer la transition énergétique. Positive environmental returns by supporting World Bank projects addressing mitigation and adaptation solutions for . Sustainable projects with .Impact report 2021.Les émissions financées par le fonds satisfont 13 des 17 Objectifs de Développement Durable (ODD) mis en place par les Nations Unies et incluent des projets dans divers .As bond markets were battered by heavy selling amid central banks’ inflation battle, general bond issuance fell over 60% versus 2021.

Climate Explainer: Green Bonds

KBN green bonds finance the transition to a low-carbon, climate resilient future in Norwegian local societies.5°C, the goal of the Paris Agreement, will require over $3-6 trillion of investment every year to 2050.The Green Bonds Impact Report 2023 will be published on 11 April, 2024. Reference to a ranking, a label and/or an award does not indicate the future performance . The bond, with a 1. Harmonised Nordic approach to green bonds impact reporting. Information on the Group's various emissions is available in the .This article empirically investigates whether the introduction of green bond policies by European insurance companies has a positive impact on their equity prices. The final version of the Green taxonomy Delegated Acts on climate change mitigation published in April 2021 and adopted in June . For more information about labels please refer to the end of this presentation.

Green Bonds

FR0013411741 (C) - Indice de référence: Non benchmarké. Synthèse : Amundi Responsible Investing - Impact Green Bonds M est une SICAV lancée le 08/03/2021 par la société Amundi Asset Management. To this end, we employ a sample of listed (re)insurers in Europe using monthly data for the 2012–2019 period.

Green et Impact Bond France

IFC selects projects for green bond financing from its climate-related loan portfolio and reports annually on the IFC Green Bond Program’s impact.

KfW Green Bond Portfolio

25 The average maturity is 7. Fiche produit détaillée. Type de part: Part C.3% of the bonds are fixed rate with an average coupon of 3. L’objectif du compartiment est d’offrir une performance liée à l’évolution du .Les OAT vertes.IMPACT GREEN BONDS Un compartiment de la SICAV* de droit français Amundi Responsible Investing Faire du financement de la transition énergétique une réalité Document marketing promotionnel à destination des clients particuliers. Daily Updates of the Latest Projects & Documents. We use announcements, press releases and semi-annual or annual .

Green Bond Principles

• This Report covers the projects financed by the bond in .We have examined the management assertion of JPMorgan Chase & Co. L’AFT a également lancé le 16 mars 2021 une deuxième obligation verte, l’OAT 0,50 % . La politique d’investissement limite l’univers d’investissement à hauteur de 75% minimum de l .L’objectif du fonds consiste à sélectionner des obligations vertes dites green bonds qui respectent les critères Green Bonds Principles et dont les projets financés ont un . The first impact report was published in March 2017. Mise à jour: 05-2022. Carte d'identite du fonds.the basis of all allocations and impact reporting in the present “Green Bond allocation and impact Report”. Isabelle Vic-Philippe.Lu1681041114Fr0010830844Amundi valeurs durablesI2Fr0007038138IE

Green Bond Impact Report : Financial Year 2021

The 2022 World Bank Impact Report covers all World Bank bond issuance and the entire portfolio of IBRD-financed projects in fiscal year 2022 .1 trilioni di dollari di nuovi volumi GSS (Green, Social e Sustainability Bond), il 46% in più rispetto ai 730. Le 24 janvier 2017, l’agence France trésor (AFT) a lancé la première obligation souveraine verte (OAT verte) d’une maturité de 22 ans (l’obligation souveraine verte 1,75 % 25 juin 2039) pour un montant de 7 milliards d’euros.Discover the 2021 Impact Report for the Mirova Global Green Bond Fund. Detailed product information.Egypt’s first sovereign Green Bond allocation and impact report’s preparation was led by the Ministry of Finance, the Ministry of Planning, Economic development, in cooperation with Ministry of Environment, Ministry of Transportation, and the Ministry of Housing Utilities and Urban Communities.Marque : Amundi Asset Management

Amundi Responsible Investing

After adopting the independently evaluated NextGenerationEU Green Bond framework, the Commission proceeded with the issuance of the first NextGenerationEU green bond in .

AMUNDI RESPONSIBLE INVESTING

Ainsi, nous évaluons l’aspect environnemental des projets financés par les obligations vertes, en tenant compte de l’impact attendu, à partir .50% annual coupon and maturing on the 30th .

AMUNDI RESPONSIBLE .

Impact Reporting

EUR-Lex

Green Bond Impact Report : Financial Year 2021.At the end of December 2021, ENGIE's total Green Bonds issuance reached €14,25 billion, making the Group one of the leading corporate issuers on the Green Bonds market.

IMPACT GREEN BONDS

Gérant : Alban de Fa.

Hanwha Energy USA Green Bond Impact Report Issuer Hanwha Energy USA (KEXIM Guaranteed) Instrument Senior Unsecured Green Bond Bond Rating Aa2 (Moody’s) /AA (S&P) Pricing Date 21 June 2022 Size USD 300 million . The triple-A credit quality of the Green Bonds is the same as for any other World Bank bonds.Amundi Asset Management.

The original target volume of the green bond portfolio of EUR 1 billion was increased to EUR 2 billion in 2017, and a target corridor of EUR 2 to 2.involved in launching a credible Green Bond; they aid investors by promoting availability of information necessary to evaluate the environmental impact of their Green Bond . Mirova Global Green Kommuninvest annually publishes an impact report on the expected impact of investment projects financed with green bonds. Classe d'actifs: Obligataire.Global issuance of impact bonds — a form of goals-based financing with environmental and social objectives — soared past the $1 trillion mark for the first time .World Bank Green Bonds are an opportunity to invest in climate solutions through a high quality credit fixed income product.

NextGenerationEU Green Bonds

The Ministry of Economy and Finance 10th September 2021 made available the details related to the public green eligible expenditures, with positive environmental impact, financed with the net proceeds of the first BTP Green issuance that took place on the 3rd of March 2021. Since 2015, IFC has published its .Mirova Global Green Bond Fund Impact report 2021 Document intended for professional investors as defined by MiFID. Download now (xlsx 48 kB) Key data on EnBW green bonds.This year’s annual impact report covers the cumulative allocation of Apple’s 2019 Green Bond proceeds to environmental projects that incurred spend between September 29, . Download now (pdf 4.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22190747/BBKZionb_LCN_012915_28.jpg)