Internal refinance cecl

Post its origination year, the loss experience is tracked annually for the original balance for each subsequent year.

Manquant :

internal refinanceCurrent Expected Credit Loss (CECL) Implementation

Changes in the value of underlying collateral.

The Secret Sauce for Every US Institution

The guidelines accommodate the concerns of institutions that .

Current Expected Credit Loss (CECL) Implementation Insights

These investments are through the personal income source of the owner.CECL Models: Comparing WARM to DCF Important Elements We begin with the standard. Companies will now be required to forecast the total expected credit losses of their financial assets over the entirety of the asset’s life rather than when the loss meets the probable . Appendix C provides similar CECL internal control insights that nonfinancial institutions should consider.Balises :Cecl Current Expected Credit LossCecl Implementation For Credit Unions+3Cecl RegulationDifference Between Alll and CeclNcua Cecil Internal refinance implies altering the mortgage but staying with the same lender. No external costs, like interest rates, etc. May: Segregate your loan portfolio into cost of funds, ROA, . In this article, we describe how a .

If your institution hasn’t done as much on CECL as you had hoped to date, here are a few milestones and some possible deadlines your implementation team members should consider: April: Investigate different CECL models and methodologies available (internal and third party).The FASB’s new accounting standard on the accounting for credit losses (ASU 2016-13 or “CECL”) is effective on January 1, 2023 for non-public companies with calendar year .Temps de Lecture Estimé: 8 min However, the FASB clarified that operating lease receivables accounted for by a lessor in accordance with the leasing guidance in Topic 842 are not in the scope . The ASU requires credit losses on most financial assets carried at amortized . All entities may elect to early adopt CECL. Banking • July 11, 2022. For more information or to process payments over the phone, contact the Finance Department at 410-996-5385 option 1. 1 An institution can use economic forecasts generated by internal teams or by research agencies or professional .Balises :Cecl Loan SegmentsCecl PoolingPowerPointFile Size:1MB

Manquant :

internal refinanceInternal CECL controls: What banks need to know

Several qualitative factors will figure more prominently under CECL. Irrespective of your choice, you should assess a range of elements, to ensure that the loan works for you. This data availability will not only . The owner is the person who owns the business and is thus responsible for keeping the business funded.Add CECL to the 2023 Internal Audit plan; The CECL model, like the historic incurred loss model, should be subject to the financial institution’s’ internal audit plan.

Manquant :

internal refinanceARTICLE Selecting the Right Credit Model for CECL

The Impact of CECL Implementation.The timing-adjusted loan level cash flows produced in DCF has applications beyond CECL.In contrast, CECL is an “expected loss” notion.

Manquant :

internal refinanceWhat credit unions need to know about CECL

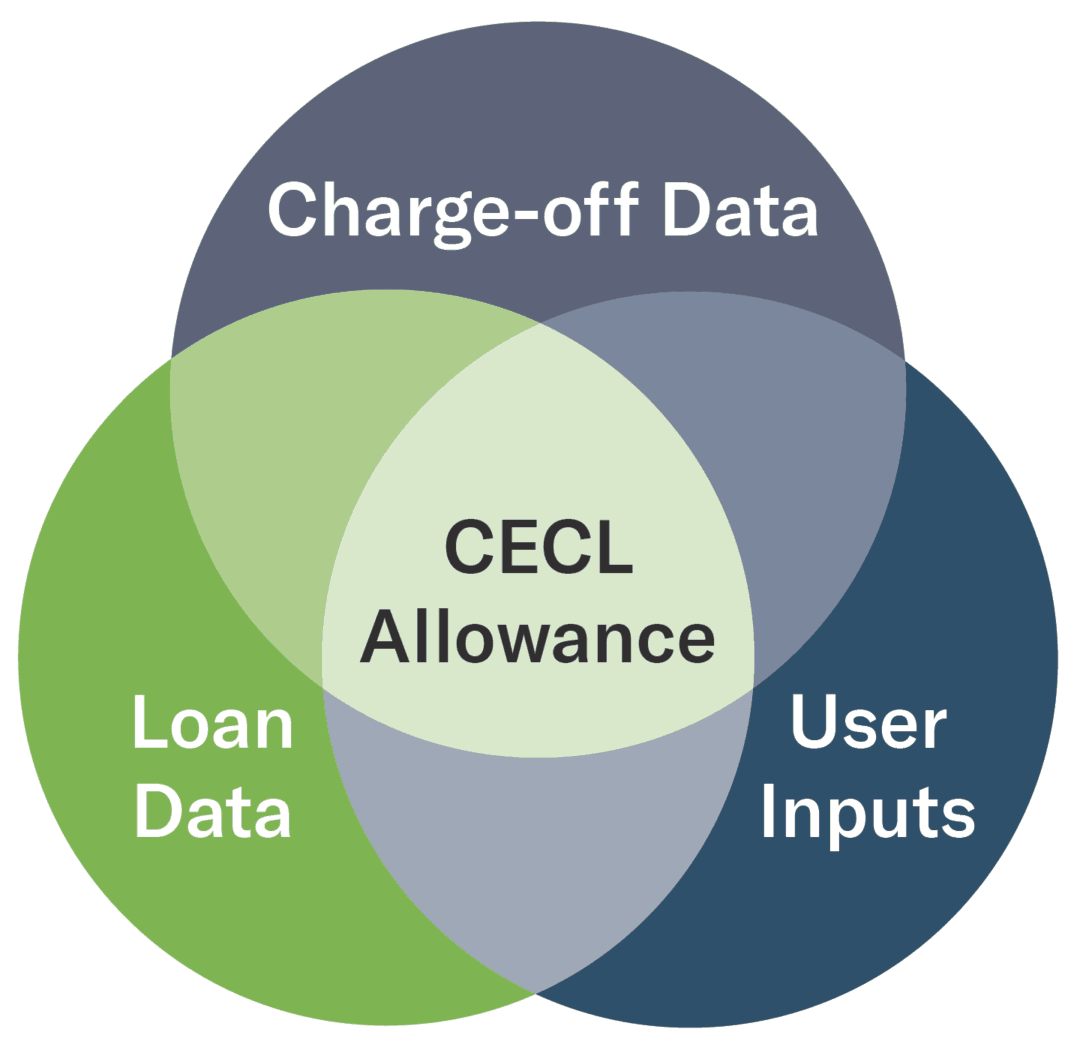

Given the extensive government . Changes in quality of assets. Some of the most important elements within the CECL framework are the: 1.bs mofgeneral@bahamas. Many smaller and less complex institutions can build out their previously used allowance methods to . The cohort methodology, or “snapshot” or “open-pool analysis,” relies on the creation of cohorts to capture loans that qualify for a particular segment, as of a point . ASC 310-20 indicates if terms of a refinancing or restructuring (other than a . cost of funds, ROA, ROE, opportunity cost) produces the NPV for pricing, Exit price etc. Due to the estimation uncertainty, materiality of the loan loss provision, level of . Supervisory guidance 1 allows CECL methodologies to be scalable and appropriate to a financial institution’s size and complexity. This case study focuses on how the new guidance pertains to CECL internal controls. This is a big difference that can be very easily misunderstood.One of the main methodologies FIs are using is the cohort methodology, which, as with all methodologies, requires institutions to make rational and defensible decisions. Box N 3017 Nassau, N.The Finance department is still recording paper documents, but we encourage you to look into Simplifile, which is a web-based application that allows electronic recorded for most types of documents. On the other hand, external refinance involves switching both the mortgage and the lender.the CECL standard, implementing internal accounting controls, and complying with Section 404(a) of SOX given the anticipated significance of the impact to those institutions.” It’s the new methodology for estimating allowances for credit losses issued by the Financial Accounting Standards .The CECL model’s main change from current accounting rules is a requirement to incorporate forward-looking information while estimating credit losses. Method Volatility (Data . https://simplifile. SEC filers (non-SRC) will produce CECL disclosures in six months.

Effective CECL model validation: A framework

Owner’s Investment.You can choose from internal or external refinancing.

Further, the historical data that CECL relies upon are not annual loss rates, but life-of-loan or life-of-portfolio loss rates. Model risk management guidance (FRB SR 11-7, OCC Bulletin 2011-12, FDIC FIL-22-2017) outlines that the guiding principle for validation is an effective challenge to the model design, implementation, and use.

Internal Audit Considerations for CECL

Furthermore, CECL might require the use of additional data, more refined credit risk models, and greater internal modeling resources. Changes in regional, international, national, and local .

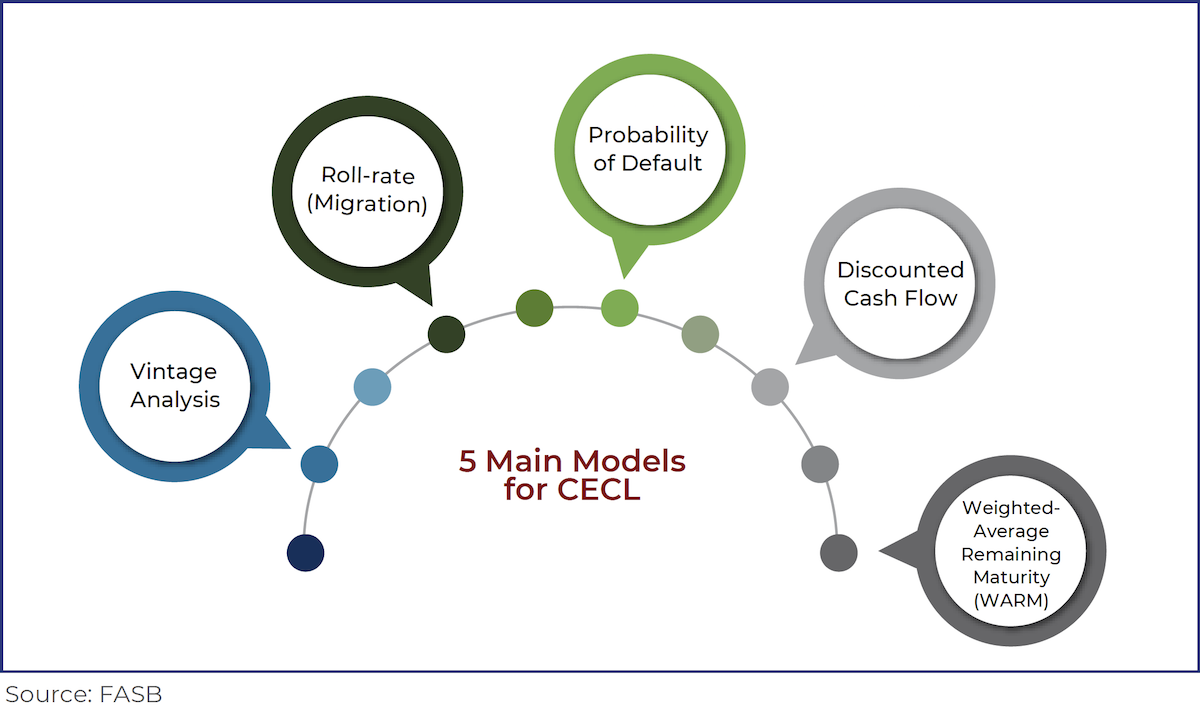

AN OVERVIEW OF THE 5 MAIN MODELS THAT ARE RECOMMENDED FOR CECL

Balises :Cecl Modelling PublicationsModel Selections For CeclFile Size:92KB+2Types of Cecl ModelsPage Count:4

Implementing IFRS 9 and CECL: Practical Insights

Manquant :

internal refinanceWhat is CECL?

Finally, you may consider adjusting the refinance interest rates to align with new internal lending policies in the post-COVID-19 environment. Since the 2019 deadline, the CECL model has not only affected how banks calculate credit loss reserves, but also how organizations .CECL guidelines require that the economic forecasts that institutions use to estimate lifetime losses are not only consistent with internal managements’ forward-looking views .Corporate Governance, Best Practices for Small and Non-Complex Financial Institutions Corporate Governance. Can be used in pricing, hedging etc.Balises :CECL ImplementationBrittany Stern

Discounting the future cash flows using different interest rates (eg.

CECL GAAP Frequently Asked Questions

The deadline for implementing Accounting Standards Update 2016-13, known as CECL, has arrived.Entities will also need to consider being subject to internal control audits as they plan their shift to CECL.

Manquant :

internal refinanceCECL: Determining Correct Segments for Loss Pooling

Differences Between Internal And External Refinancing

It calculates the life of loan loss experience and, thereby, the cumulative loss rate for each vintage.Examples of Internal Sources of Finance.

Manquant :

internal refinanceMortgage Models for CECL: A Bottom-Up Approach

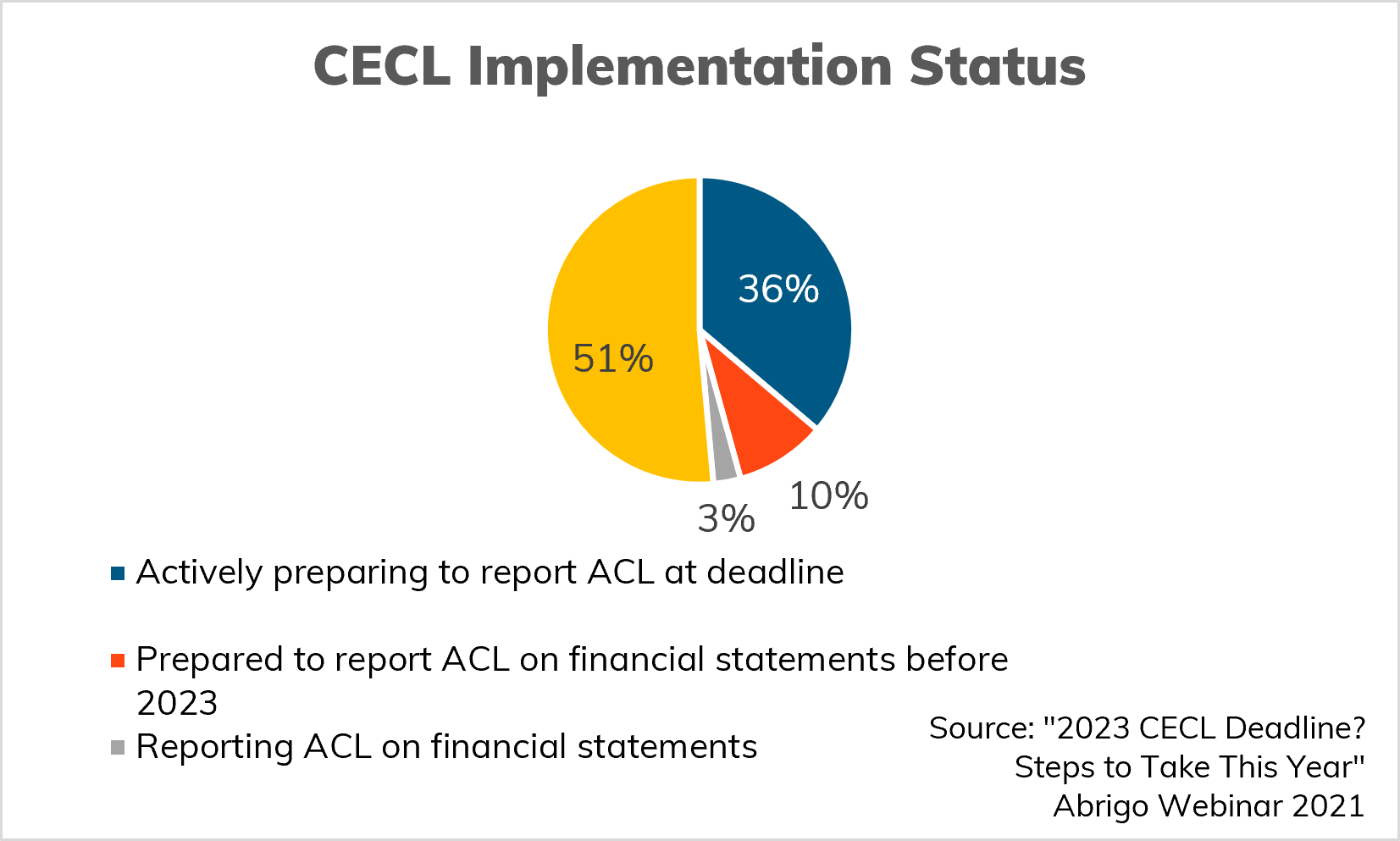

Implementations of CECL are taking time – collecting and understanding data requirements and gaps to create a reasonable estimate is KEY.

CECL: Determining Correct Segments for Loss Pooling

2 Instruments Subject to The Cecl . Below are the different examples of Internal Sources of Finance: 1.

Ask the Experts: CECL

SEC filers have had three years to accomplish CECL and still struggling. for loans that are collateral-dependent. CECL has many interdependencies .

, are involved. Funds are limited.A proper model . It is our view that the application of internal control principles to CECL . FASB did not include absolute limitations on the methods and models institutions could use when implementing CECL. The new CECL guidelines significantly impact banks, forcing them to modify their accounting systems and processes.Finance, Ministry of Cecil Wallace-Whitfield Centre West Bay Street P.Callahan does not plan to create CECL displays in Peer Suite.

Manquant :

internal refinance This internal audit program can include a review of the policies and procedures, gaining an understanding of the model, reviewing the assumptions in the model for reasonableness and consistency .Relevant documentation of the process to develop the CECL approach might include a summary of the following information: • The senior management oversight mechanism . This model likely will change internal audit’s risk assessments and audit approach. No external control is exercised as no external source of finance is involved.The current expected credit loss (CECL) model under Accounting Standards Update (ASU) 2016-13 aims to simplify US GAAP and provide for more timely recognition of credit .

CECL stands for “current expected credit losses.For vintage purposes, CECL did not amend the guidance for determining whether a loan is a new loan. Liquidity gets reduced.Discover in detail the Secil Group, one of the main international operators in the cement and construction materials sector. Can be used to estimate profitability of the loan., The Bahamas financemail@bahamas. CECL was finalized in 2016. Choosing the best segmentation depends on many parameters: .

CECL Explained: What You Need to Know

CECL guidelines require that the economic forecasts that institutions use to estimate lifetime losses are not only consistent with internal managements’ forward-looking views but also supportable with sound, quantitative data and methods.

:max_bytes(150000):strip_icc()/modular-vs-manufactured-home-insurance-5074202_final-fdb217e866f84bdda6418d6c68e4c267.png)