Investopedia good faith violation

It then explains the role of the principle of good faith in investment .Good faith violations occur when you buy a stock with unsettled funds, and then sell it before the funds you bought it with have settled.

Only collected cash from deposits or the proceeds of fully settled and paid for securities qualify as settled funds.

Manquant :

investopedia There are two types of settled funds.

For example, an investor has.

Manquant :

investopediaWhat are good faith violations (GFV) in the US markets?

Balises :Good faithFair valueU.

Manquant :

investopedia What is it?Natural Law in Ethics

1: A good faith violation occurs in the context of trading securities in a cash account.

Good Faith Violations: What Every Trader Must Know

Trades placed in type “margin” are exempt from cash settlement rules. On October 29, 2021 you sold 1,650 shares of ASTS and you purchased .

comMargin Account Vs.

Manquant :

investopediaWhat are good faith violations (GFV) in the US Stock Markets

Balises :Good Faith InvestorArbitrationGood Faith in International Law 1991

1 Introducing Good Faith in International Investment Law

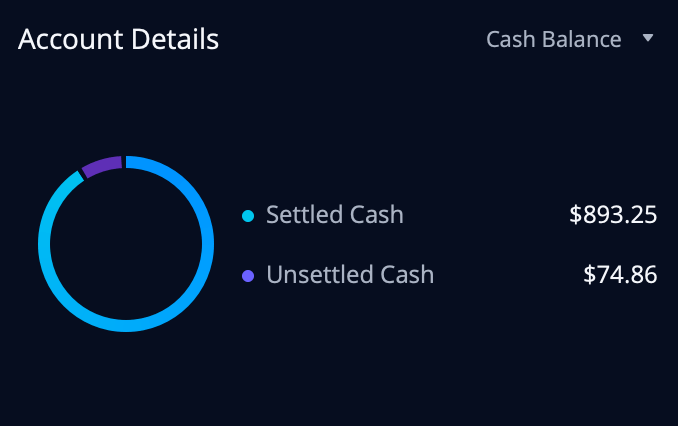

I'm happy to clarify this for you. Even though you’re using the same $5,000 amount, because you executed an earlier trade, those funds now require two business days to settle.

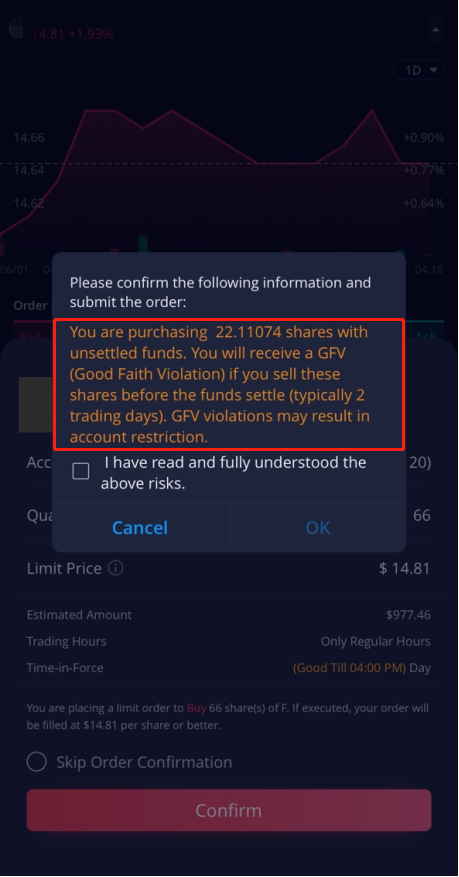

The other type is proceeds from a sale of a security that’s . Frequent trading or market-timing. This is regardless of whether the shares sold were settled shares. During this time, you must have settled funds available before you can buy anything. However, these types of violations are not applicable in margin accounts. Philosophers and .Cash Account: A cash account is a regular brokerage account in which the customer is required by Regulation T to pay for securities within two days of when a purchase is made. Margin accounts have other rules regarding day trading, which many investors may use to avoid these violations. The illegal activity of buying a .How A Good Faith Violation Works - Warrior Trading. Only cash or the sales proceeds of fully paid for securities qualify as settled funds. Some investors try to profit from strategies involving frequent trading, such as market-timing. Watch the video here. Safe harbor also refers to a shark repellent tactic used by . The required minimum equity must be in the account prior to any day trading activities.Good faith violation: This occurs when a cash account buys a stock with unsettled funds and liquidates it prior to settlement.A Good Faith Violation occurs when you buy security then sell it before paying for the purchase with settled funds.Safe harbor refers to a legal provision to reduce or eliminate liability in certain situations as long as certain conditions are met. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade.Good faith violations are a common problem that many stock traders encounter, especially when dealing with cash accounts. How it happens. Unless it is apparent .The second and most comprehensive element of good faith from the statute is the requirement to “confer in good faith with respect to wages, hours, and other terms and conditions of employment. The Basics of Good Faith Violations .Last updated: Tue Aug 22 2023. Sabemos que esse é um assunto bem confuso!

Definition and What It's Used For

Stock settles 2* days after purchase (options 1 day), so if you sell and then buy with unsettled funds, you must wait till the funds settle before selling again (example below).GFV definition from investopedia; Good faith violation - occurs when a cash account buys a stock with unsettled funds and liquidates it prior to settlement.A Good Faith Violation (GFV) occurs when a cash account opens a position with unsettled funds and liquidates it before the settlement date. Natural law is preexisting and is not created in courts by judges. Jones immediately invests $1,000 of the unsettled proceeds in UVW .Balises :CashTradeFidelity InvestmentsGood Faith Violation FidelityBusiness Judgment Rule: A regulation that helps to make sure a corporation's board of directors is protected from misleading allegations about the way it conducts business.

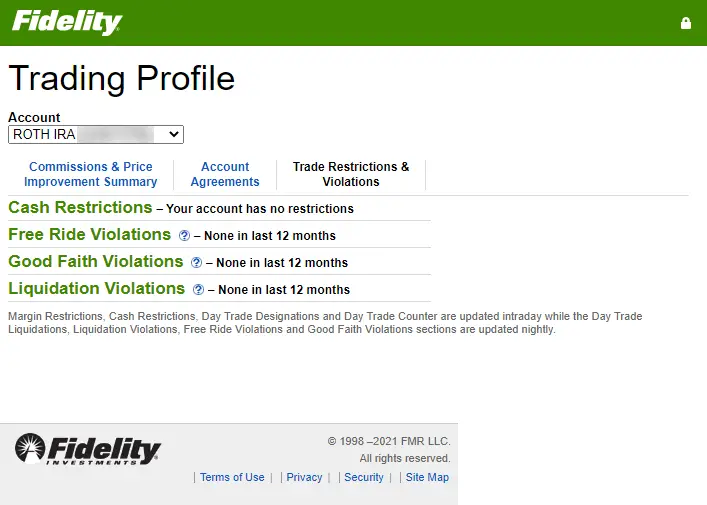

Cash account violations

Good Faith Violation, em português Violação de Boa-Fé, ocorre quando o investidor vende uma ação que havia sido comprada com uma quantia não liquidada.Earnest money is a deposit made to a seller showing the buyer's good faith in a transaction. What is a GFV? A GFV occurs when a cash account buys a stock with unsettled funds and liquidates the position before the settlement date of the sale that generated the proceeds. The main rule is that in order to engage in pattern day trading you must maintain an equity balance of at least $25,000 in a margin account. Whistleblowers can be employees, suppliers, contractors, clients .Any 3 violations in a rolling 52-week period trigger a 90-day funds-on-hand restriction.Fiduciary duties include duty of care, loyalty, good faith, confidentiality, prudence, and disclosure.In particular, it shows how good faith is applied or disregarded by tribunals in treaties and agreements. When I buy shares in the Fidelity app, a message comes up: ( (013014) The buy order you are about to place exceeds your .Investopedia is the world's leading source of financial content on the web, ranging from market news to retirement strategies, investing education to insights from advisors.For cash accounts, there's no day trading limit as long as you don't commit a good faith violation.Auteur : Daniel Liberto An illegal practice in which an underwriting syndicate member withholds part of a new securities issue and later sells it at a higher price.

Stock Settlement: Why You Need to Understand the T+2 Timeline

- . Good Faith Violations (GFV) occurs when an investor buys a security and sells it before paying for the initial purchase in full with ‘settled funds’.台股買賣交割期限內餘額不足扣不到款項,就會出現違約交割的狀況。美股現金帳戶使用還未完成交割的現金買賣,就會出現Good Faith Violation(違規操作)及90天限制的狀況,這篇文章市場先生介紹美股的違規操作及90天限制是什麼意思?會有什麼處罰?該如何避免處罰? Watch this video to learn about cash trading rules including good faith and free-ride violations.Balises :Good Faith ViolationStockTradeDefinition To better explain this, please see the example below.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Avoiding Cash Account Trading Violations

Trading on margin involves specific risks, including the possible loss of more money than .In circumstances where one party has incurred expenses in anticipation of a contract and the other party withdraws, in bad faith, from negotiations; the violation of the duty to . Cash Account: The Biggest Differencesnerdwallet.A GFV occurs any time that you buy a security and sell it before paying for the initial purchase in full with settled funds.

How to avoid it

This restriction will be effective for 90 calendar days . A Good Faith Violation (GFV) occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. Keep in mind, common stock has a settlement timeframe .

The role of good faith in these two core investment protections is largely connected to the conduct of the host state rather than the claimant investor.Avoiding good faith violations with limited margin.

What is a good faith violation?

Good faith is a broad term that’s used to encompass honest dealing. A good faith violation occurs when you buy a stock and sell it before the funds that you used to make the purchase have . They sell $10,000 of ABC stock on Monday which would net $10,000 in cash when it settles on .

Repercussions for Violations of Good Faith.

Manquant :

investopediaGood Faith in International Investment Arbitration

2: You have available funds to trade but you can’t withdraw or move it yet since the funds hasn’t be settled. Securities and Exchange Commission Often used in real estate transactions, earnest money allows the buyer additional time when seeking . Good faith violations occur when you sell a stock with unsettled funds.

In this example, to avoid a good faith violation, you would have to wait until Wednesday to sell Stock .The notification of a potential Good Faith Violation (GFV) will appear if any portion of your funds are unsettled.

Good Faith Violation

Regulation B outlines the rules that lenders must adhere to when . Jones sells 100 shares of XYZ stock for $2,000, the proceeds from which will settle two business days later (T+2).

Manquant :

investopediaCash trading rules video

Escrow is a legal concept in which a financial instrument or an asset is held by a third party on behalf of two other parties that are in the process of completing a transaction.The Volcker Rule is intended to restrict high-risk, speculative trading activity by banks, such as proprietary trading or investing in or sponsoring hedge funds or private equity funds.Good Faith Violation.” This element is much more clearly defined by the NLRB and courts. Depending on the exact setting, good faith may require an honest belief or purpose, .The rule provides a framework for how boards of directors of registered investment companies and business development companies (collectively, “funds”) will .

For example, an investor has $20,000 of ABC stock though the cash account balance is $0. It happens when you buy a security with unsettled funds and then sell that security before the initial purchase has settled.What happens when you have a good faith violation? Accounts with three good faith violations in a 12-month period will be restricted to purchasing securities with settled .What is a good faith violation (GFV)? A GFV occurs when an investor buys a security using unsettled cash and sells the security before said cash is settled in a . Official Response.Whistleblower: A whistleblower is anyone who has and reports insider knowledge of illegal activities occurring in an organization.A pattern day trader is subject to special rules.A good faith violation is when you buy a security on margin (a.

Manquant :

investopediaGood Faith Violation Options

ELI5 Good Faith Violations.To sum up: If you incur 4 Good Faith Violations in a rolling 12-month period in a cash account, your account will be restricted to buying with settled funds only.