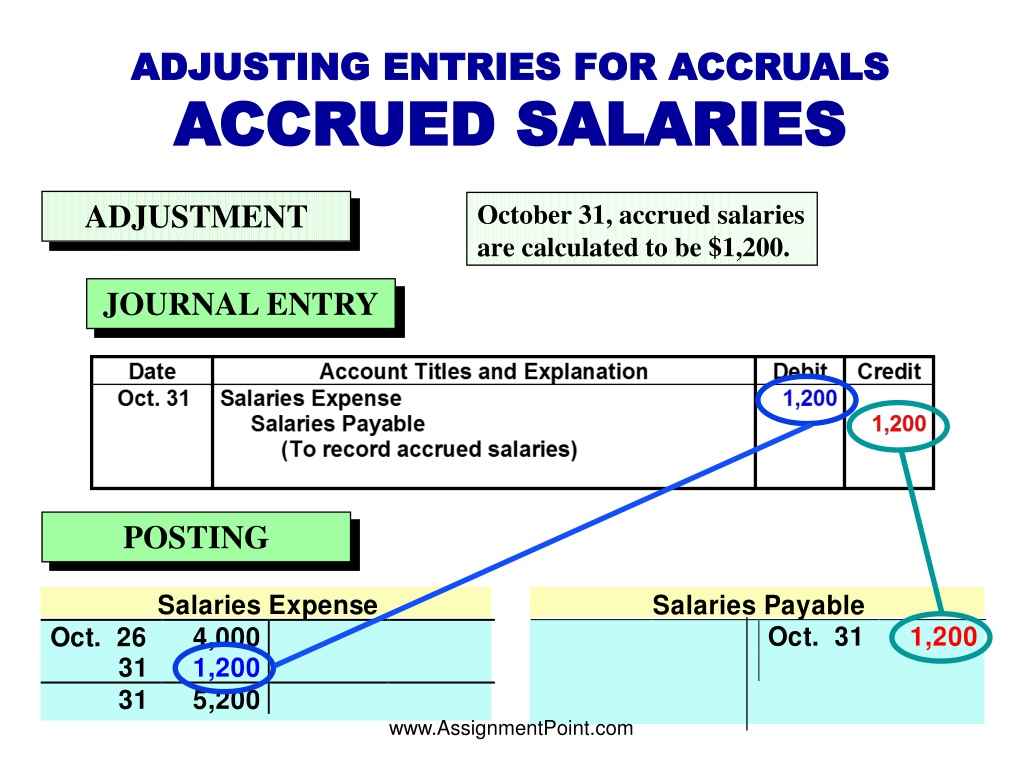

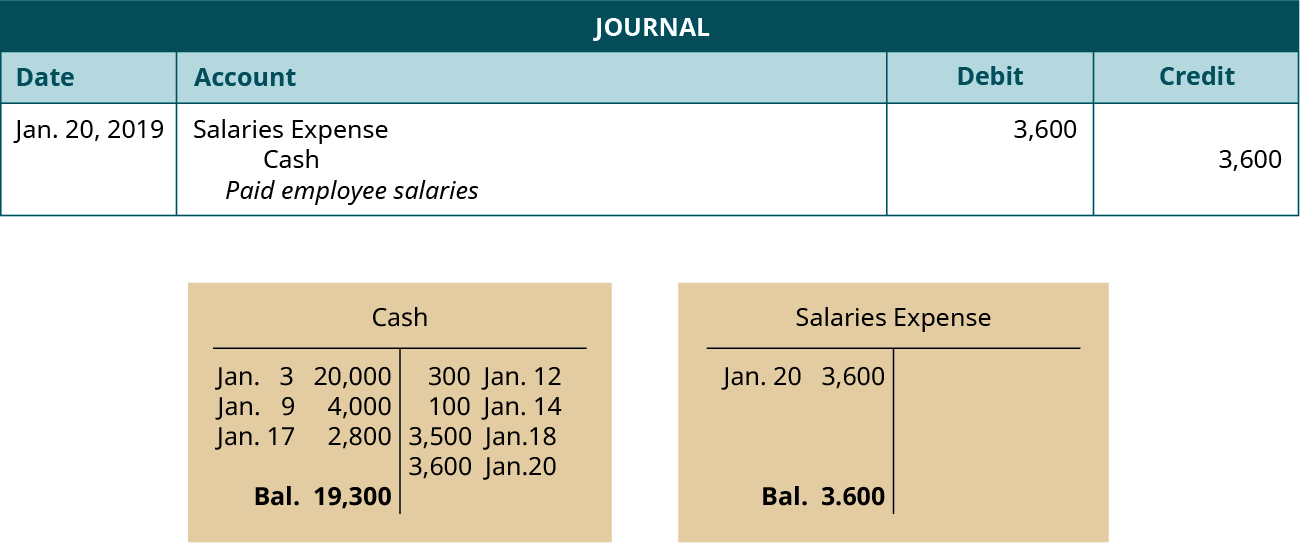

Journal entry for accrued salaries

However, the journal entry for accrued wages is straightforward. debit to Salaries Expense of $500,000 c.Journal entry worksheet Unpaid salaries owed to employees at the end of January are $33, 600. receipt of cash from services renders d. Here are four examples. Note: Enter debits before credits. The amount of taxes and contributions identified was 406 USD.Accrued wages journal entry | Example - Accountinginsideaccountinginside. The company can make the accrued wages .6 USD as accrued wages of Tina.Entry #1: Recording the Expense.

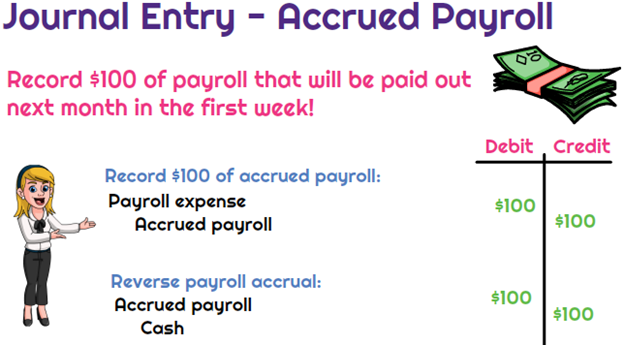

Journal Entry for Reversing Accrued Expenses

20 for each warehouse worker ($93.comAccrued Salaries | Double Entry Bookkeepingdouble-entry-bookkeepi.Finally, the journal entry on 2 January 2020 reflects the second payment of principal and interest.

Solved Journal entry worksheet Unpaid salaries owed to

As the company makes payment at the end of the month, so they can make journal entry by debiting salary expenses and credit cash of $ 11,000.

Adjusting Entry for Accrued Salaries

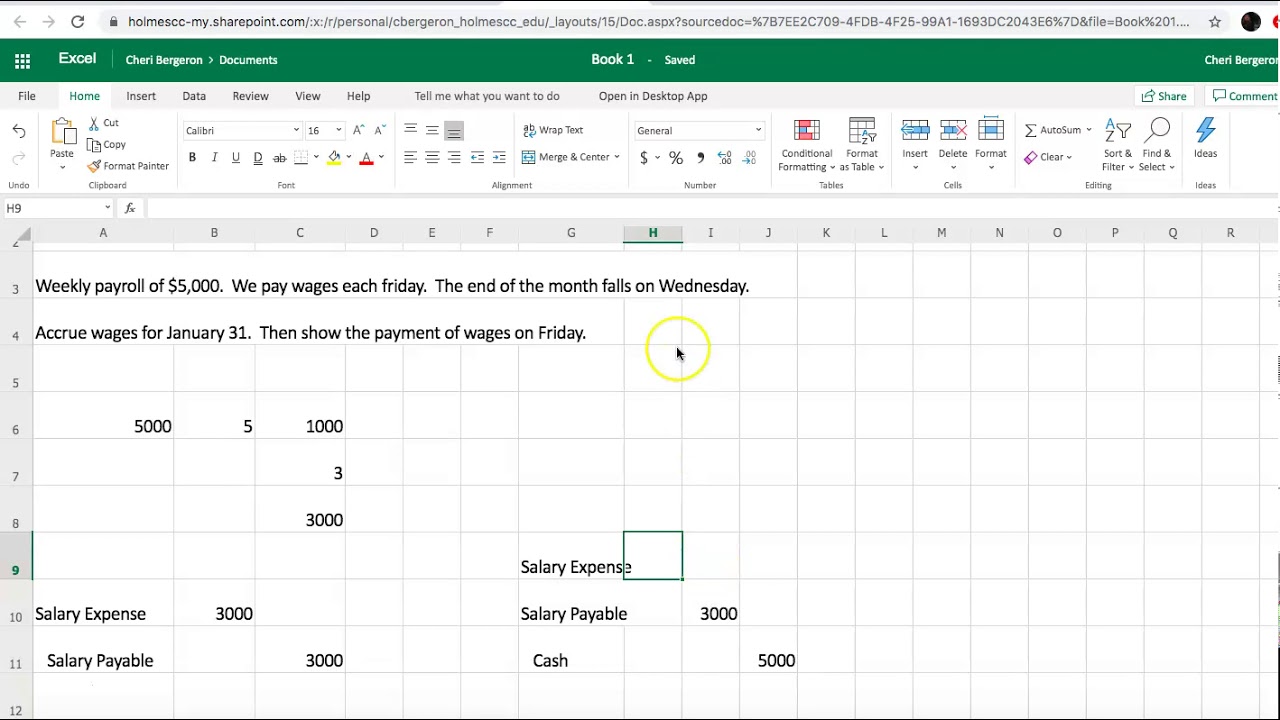

Step 1: Wage accrual.

Salaries Payable

Accrued Payroll = Accrued Commission + Accrued Bonus = $7920 + $2000 = $9920. This way, they can help ensure accurate financial statements, such as balance sheets and income statements. The Friday after, when the company will pay employees next, is July 3. Thus, the journal entry to .Please prepare the journal entry for unpaid wages. Partner’s Current A/c to be credited if capitals are fixed in nature.Journal Entry Examples.For most warehouse workers, the payroll journal entry had the following records: On Sep 30, the wages are $749. Journal entry worksheet \begin{tabular}{llll|l} 1 & . In such cases, Salaries .On 31 January, they pay a salary expense of $ 11,000. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. There is a Salaries Expense Debit entry because, during the ACTUAL disbursal of Salaries, there may be a certain amount of Salary that has accrued but has NOT been reflected in the Salaries Payable.This journal entry is made to eliminate the wages payable of $3,000 that company ABC has recorded in the January 31 adjusting entry. So, the entity debits the expenditure with corresponding credits to the payable.adjusting entry for accrued salaries b.Accrued Expense Journal Entry Example Let’s say a company estimates it used $1,500 of electricity for January, but the utility bill will not be received until February.

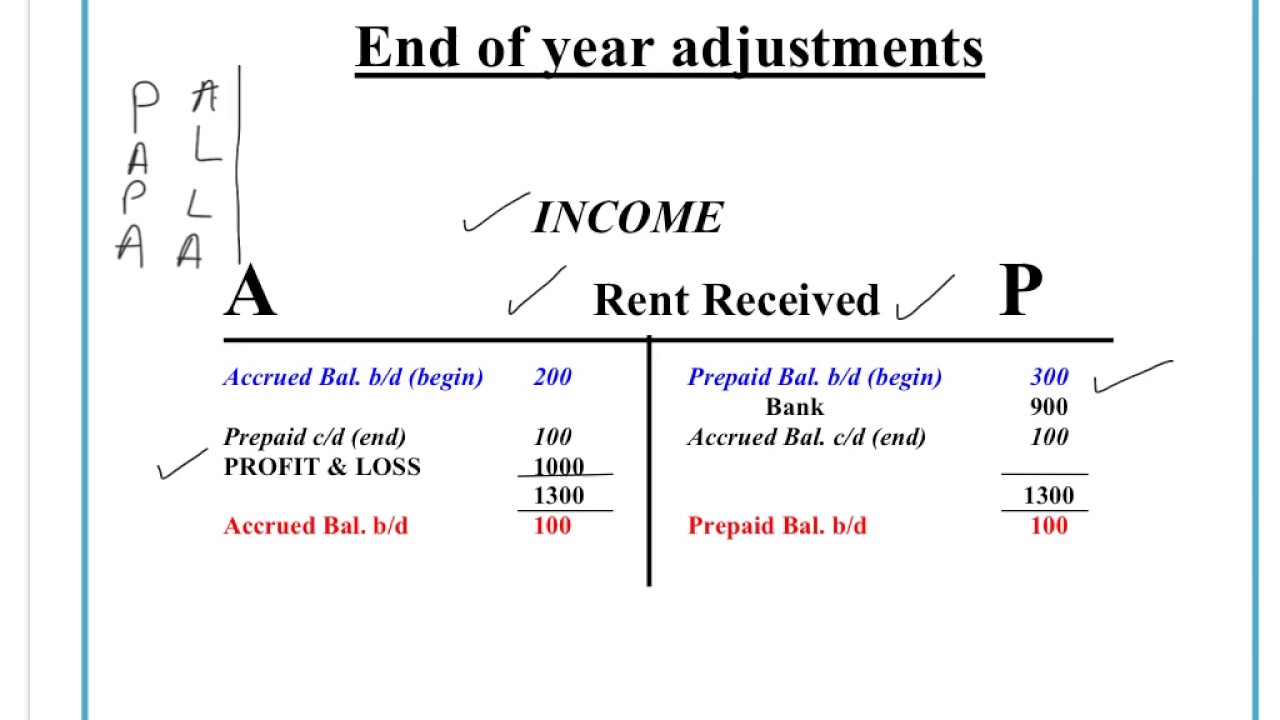

Accruals and Prepayments Defined

Wages are debited to increase the .

Payroll journal entries — AccountingTools

This will guarantee that your accrued payroll is recorded within the correct timeframe.The initial journal entry of an accrued wage is a “debit” to the employee payroll account, with the coinciding adjustment being a “credit” entry to the accrued .

payment of employees' salaries d The subsidiary ledger that includes customer account activity is called the a.A payroll journal entry is a record of employee earnings for an accounting period. Here Payables .Accrued Wages Journal Entry (Debit-Credit) The recognition of accrued wages is meant to record the incurred yet not paid wage expense in a given reporting period.65 per hour x 8 hours). Salary is an indirect expense incurred by every organization with employees.

Accrued salaries definition — AccountingTools

& 6 & 8 \end{tabular} The company has accrued interest on notes receivable for January.

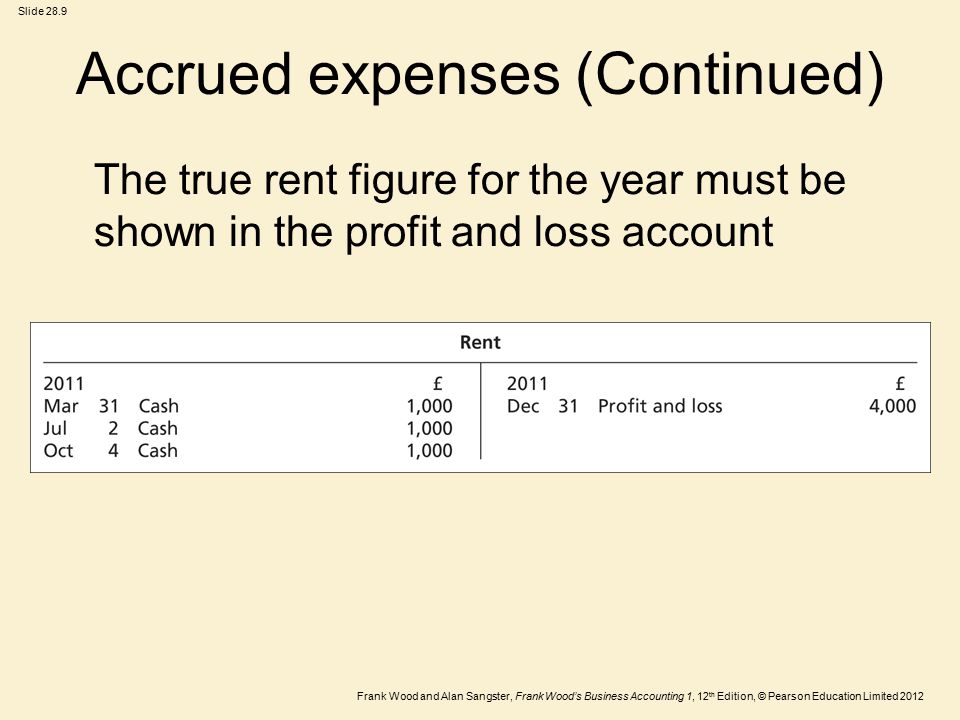

This journal entry is to recognize the liabilities that Jotscroll media company owes to its employees for the work that they . Based on the government payroll guidelines, FICA taxes are $420. Before discussing that, it is crucial to understand accrued wages and their meaning. The entry should be reversed at the beginning of the following reporting period.28 In this example, your accrued payroll for the salaried employee is $818. credit to Salaries Payable of $500,000 b. accounts payable ledger c. Accrued salaries at year-end amounted to $19,600. The journal entry is debiting accrued payable $ 1,000 and credit utilities expense $ 1,000.75, payroll taxes are $80.Here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for your bookkeeping and accounting operation. The company needs to make an adjusting entry at the end of January to recognize the utility expense that has been incurred but not yet paid. An adjustment is necessary because the date that the salaries are paid does not . August 21, 2023. The accrued salaries entry is a debit to the compensation (or salaries) expense account, and a credit to the accrued wages (or . It increases from prior month due to new staffs. The journal entry is debiting wage expense of $ 5,000 and credit wage payable of $ 5,000.

An adjusting entry is .It also records the accrued payable $ 1,000 for the amount owed to supplier. In the next year, when the salaries are paid, the following entry will be made and the outstanding salaries account will be closed. Accrued Salaries Expenses. Let’s consider that Tina earned a 1,000 USD bonus and 800 USD wages for the final week of December.Accrued salaries expense journal entry.The Debiting of Salaries Payable in the above Journal Entry removes the Salary Payable Liability on the Balance Sheet. Salaries expense.

Example and

The journal entry for accrued salaries would include a a.Adjusting journal entry: Assume that June 30, the last day of the month, is a Tuesday.09, and worker insurance is $85.Recommandé pour vous en fonction de ce qui est populaire • Avis

Accrued Salaries

For small businesses that use the accrual .Accrued salaries are the current liabilities at the end of a period for salaries and/or payroll expenses that have been incurred by the company, but are not yet paid for. Employees earn $1,000 per week, or $200 per day.

Journal Entry for Salaries Paid

receipt of cash on supplies returned c.

Accrued wages journal entry

Let’s consider that Leslie earned an 800 USD bonus and 525 USD wages for the final week of December.Accrued payroll is a debt owed to employees.14 and holiday, vacation, .A payroll journal entry is a tracked account of all the payroll expenses being divvied out in the form of salaries and other payroll-related items. In the first entry, you will record your upcoming expenses and how much you owe (since you haven’t run your payroll yet).

Journal Entry for Unpaid Wages

Record the adjusting entry for salaries.

Accounting Chapter 5 Multiple Choice Flashcards

This journal entry records $10,000 as an accrued payroll . Study with Quizlet and memorize flashcards containing terms like Accounts Receivable (Dr. credit to Salaries Expense of $450,000 d.

4 USD is deducted from the 1,800 USD, we will be left with 1,377.Journal Entry for Salary Paid.

How to Record Accrued Payroll and Taxes

defined contribution.Temps de Lecture Estimé: 2 min

What is the Accrued Salary?

accounts receivable ledger To create a reversing entry on the first day of the current month, save the entry and then hit “Reverse”.When the bills are actually paid, the following journal entry reflects the actual payment: 12 months of rent was paid on 1 January 2014 and it was recorded as prepaid . To Partner’s Capital/Current A/C. Each pay period, pay is calculated based on time cards and salary amounts and then expensed. Record the entry to close the revenue accounts using the income summary. Accrued salaries = $19,600 The given adjustment will increase salaries expense and salaries payable . At the end of year, company has to include the wage expense even it is not yet paid. Partner’s Salary A/C.Accounting for Accrued Salaries. The journal entry for the above example will be as follow:

What Is the Offset Journal Entry for Accrued Payroll?

[Journal Entry] Debit.Consider the following details of salary and taxes, which is due on the 1 st of April; you are required to pass journal entries for accrual Journal Entries For Accrual Accrued expense Journal Entry is the journal entry passed to record the expenses which are incurred over one accounting period by the company but not yet paid actually in that . Therefore, for this week, $400 of the $1,000 for the week should be a June expense and the other $600 should be a July expense. It is income earned during a particular accounting period but not received until the end of that . February 9, 2018 accta. An accountant typically includes these entries in the company's general ledger before its financial statements. On 01 Jan 202X+1, company has to reverse the accrued expense by making a journal entry in the opposite way. These financial entries . expense ledger d.

Accrued Payroll

You record the compensation when it's earned, but it's not paid until the next period.Record the adjusting journal entry for accrued salaries and wages at year-end that amounted to $845. The company has to include the unpaid amount in the income statement.Learn how to record accrued salaries in double entry bookkeeping with an example and an accounting equation.Accrued salaries at the end of the month.The journal entry for accrued salary expense or salary payable is as follow: On 02 April 20X9, ABC Co made the payment on such salary accrual. In order to reflect the discrepancy on the general ledger per accrual accounting reporting standards established under GAAP, accrued wages are treated as a debit to . debit to Salaries Payable of $450,000.Discover How to Calculate Payroll Accrual + Journal Entries.The accrued wages entry is a debit to the wages expense account, and a credit to the accrued wages account.

Salary Payable

.Let’s understand the journal entries for accrued payroll by considering the same example of Leslie as we discussed above.

Because companies pay employees wages and salaries periodically, daily journal .The journal entry for accruals is as follows: Dr Expense Account (P&L) Cr Accruals (Balance Sheet) The debit side of this journal increases the expense account . A company closes its books on 31 December each year.Expert-verified.What is the Journal Entry for Accrued Income? Journal Entry for Accrued Income.Key Highlights. In this case, they need to make the journal entry for accrued salaries at the end of the month to account for the expense that happens due to the works that the employees have performed.

Just click Make a copy. A pension plan that requires the employer to make annual pension contributions, with no promise to . Salaries expenses are another example of accrued expenses for which adjusting entries are normally made.About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features NFL Sunday Ticket Press Copyright .

Accrued wages definition — AccountingTools

Please prepare the journal entry for the January salary expense.

How to record payroll journal entries: Types and examples

(You can follow along using the Payroll Journal Entry Template.

This reversal can be accomplished by setting up the initial entry to automatically reverse at the start of the next reporting period. As mentioned, some companies may make the salary payment at the beginning of the next month instead.