Land grant university tax education

If you are an existing user, please login.LAND GRANT UNIVERSITY TAX EDUCATION FOUNDATION, INC. This article originally appeared on Knoxville News Sentinel: UT chancellor: Land-grant . Indeed, the tripartite mission of teaching, research and extension (outreach) is the envy of the world.

DCM App

) was enacted .LAND GRANT UNIVERSITY TAX EDUCATION FOUNDATION.The Land-Grant Tradition.University of Massachusetts John Spraggon Phone: 413-545-6651 Email: jmspragg@resecon.

FEDERAL AND STATE INCOME TAX INSTITUTE

Historically Black and tribal college LGUs are funded significantly less than predominantly white LGUs, a study shows. You enjoy significant savings for purchases. Attendees earn 8 CPE credits, including 1 hour of Federal Tax Updates, 6 hours of Federal Tax Issues, and 1 hours of Ethics. Existing Users Log In. 2023 National Income Tax Workbook.

Land-grant university

Chapter 5 Retirement: . Please use the login information from the email received from [email protected] State Taxes. IRS ISSUES CHAPTER 8 – Stakeholder Liaison (Pages 249 – 306) Issue . New Hampshire State Taxes.

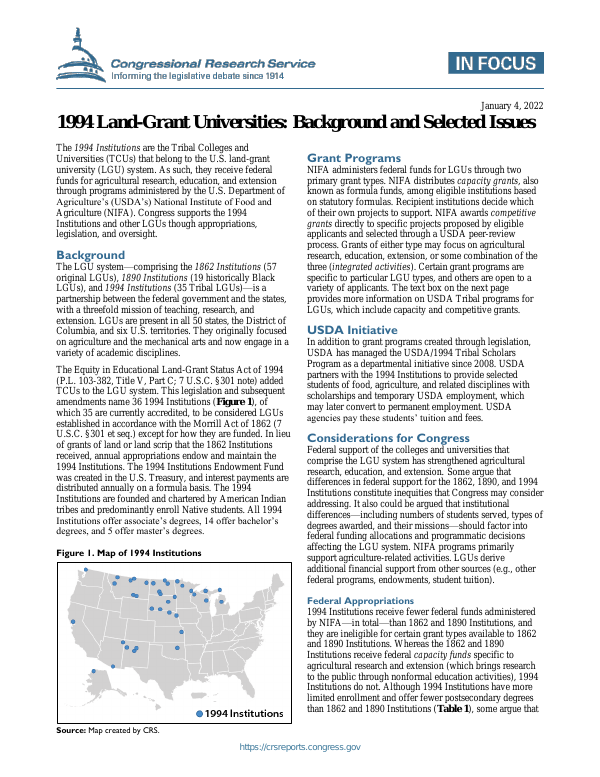

2022 NEW DEVELOPMENTS 1

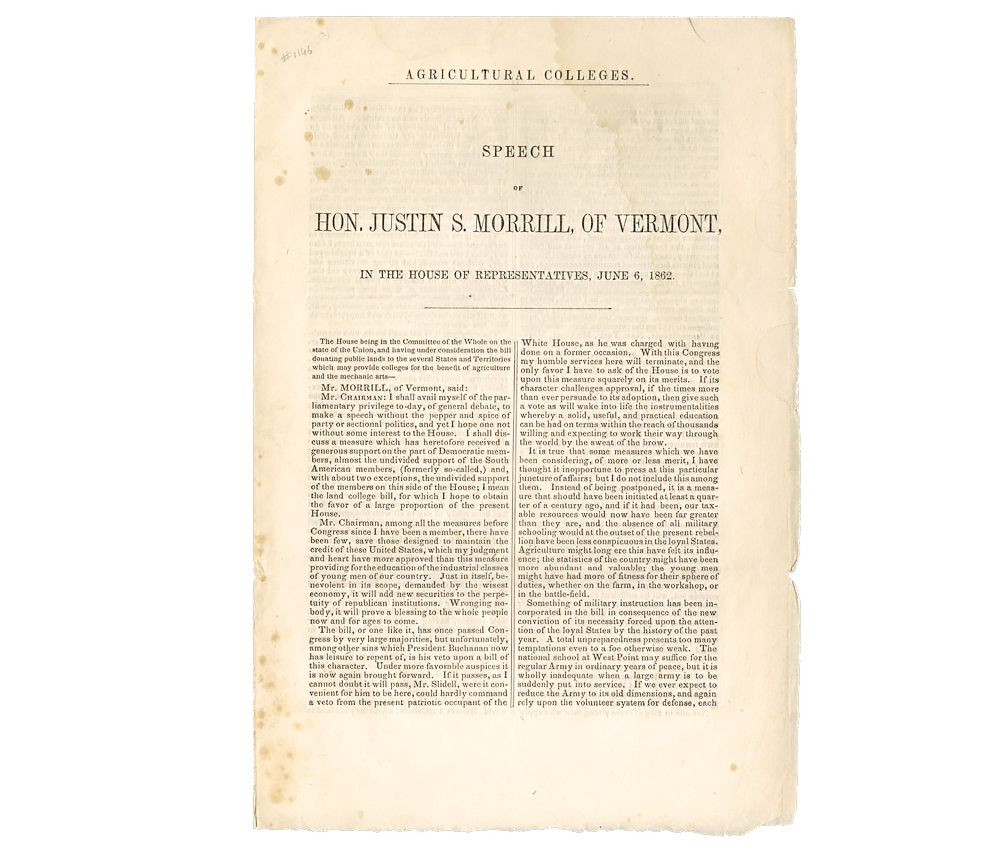

This page lists the Live Webinars.Act into law on July 2, 1862, the land grant university system as we know it today has enjoyed overwhelming success.The Morrill Acts of 1862 (12 Stat.As New York state’s land-grant institution, Cornell University is charged with advancing the lives and livelihoods of the state’s citizens through teaching, research and public service.The land-grant university system further expanded in 1994 with the addition of a group of tribal colleges and universities (TCUs) now identified as the 1994 Institutions. 2023 Chapter Additional resources.The Land Grant University Tax Education Foundation is pleased to provide the National Income Tax Workbook to approximately 22,000 tax practitioners in tax schools taught in . A land-grant college or university is an institution that has been designated by its state legislature or Congress to receive the benefits of the Morrill Acts of 1862, 1890, or 1994.

Its mission is rooted in ideals considered revolutionary when the federal Morrill Land Grant Acts were enacted in 1862 and 1890: that a land-grant university .

UMass Tax School for Practitioners

COPYRIGHT LAND GRANT UNIVERSITY TAX EDUCATION FOUNDATION 2021 21 • I. states using the proceeds from sales of federally owned land, often obtained from Native American tribes through treaty, cession, or seizure. 1 – Stakeholder Liaison (Pages 249IRS ISSUES CHAPTER 8 – 306) IRS Disaster Reference Materials FEMA DR-4720-VT July 2023 . 503 (1862) later codified as 7 U.

Tax Practitioners Institute

West Virginia State University was restored to land-grant status in 2001. View a Complete List of Workshop Locations.The Land Grant University Tax Education Foundation Inc. This content is restricted to site members.

Joseph McCarthy CPA IRS Senior Stakeholder Liaison.

Manquant :

tax education

Ensz, CPA J’Nan Ensz, CPA, graduated summa cum laude with a bachelor of science .

Land Grant University Tax Education Foundation Inc

Sign in or create an account . (LGUTEF), is a non-profit corporation organized by representatives of several land grant universities that teach tax education programs for professional tax practitioners. 10 Hours Federal Tax, 4 Hours . §1239 excludes gain from section 1231 if the property is • sold to a relative, and • .LAND GRANT UNIVERSITY TAX EDUCATION FOUNDATION 2023 National Income Tax Workbook. College Station, TX 77841 United States. Cost to register is $250. Sample Chapters from Past Workbooks.The International Bureau of Fiscal Documentation (IBFD) is a leading independent, non-profit organization specializing in tax research and education. Land-grant universities provide many benefits to individuals, families, and entire communities which include such things as: In-person and online educational courses (paid and free) Free tips on topics through emails, social media, websites, video tutorials, and more.Land-grant universities (LGUs) conduct research and provide resources for their states.

Manquant :

tax educationAgriculture Taxation and Management Symposium

The Symposium is offered in three . It discusses basis, and treatment of expenses. Vermont State Taxes. As a sidebar, it is interesting to note that the land grant college and university system

Manquant :

land grant universityLLM in Taxation

Acquire industry-relevant skills and technical know-how necessary for a career in tax preparation and . (LGUTEF), is a non-profit corporation organized by representatives of several land grant universities that teach tax . CHAPTER 2: TRUSTS & ESTATES PP 45 -71.The Morrill Land-Grant Acts are United States statutes that allowed for the creation of land-grant colleges in U.taxes that may apply to an S corporation with C corporation history. Chapter Topics P .

LAND GRANT UNIVERSITY TAX EDUCATION FOUNDATION

two-day Federal Income Tax Course is a 16 credit hour program that is offered both live as well as in a webinar format.National Income Tax Workbook. University of Minnesota.

UT Extension Income Tax Seminars

22 illustrates 3 components of gain • Ordinary income due to MACRS depreciation in excess of SL amount • Unrecaptured 1250 due to SL depreciation – taxed at maximum 25% tax rate • Section 1231 gain – • True economic gain due to a sales price in excess of . Ch 12 on Business Entities .

One-Day & Two-Day Live Courses

It includes new procedures, guidance, and legislation that were adopted in late 2020 and .

Morrill Land-Grant Acts

the potential tax liability incurred by the estate or heirs of a deceased shareholder that sells appreciated corporate assets, and how a liqui-dation of the corporation in the same tax year can offset that gain.Advance your tax education at one of our many workshops held across the nation. JANUARY 12 & JANUARY 16-17, 2024. The 2023 Tax Practitioners Institute will be held as a virtual event. The University of Tennessee Extension is approved as an IRS Continuing Education Provider.LGUTEF jointly purchases the Federal Tax Handbook published by Thomson Reuters. This publication supplements the 2020 National Income Tax Workbook. 503) and 1890 (26 Stat.Come earn your Master of Laws (LLM) in taxation at one of the best Tax LLM programs on the west coast and California. The Morrill Act of 1862 (12 Stat. These webinars are based on the Land Grant University Tax Education Foundation’s 500+ page National Income Tax Workbook.Benefits of a Land-Grant University. Rhonda Layer Phone: 612-625-4257 Fax: 612-624-6225 Email: .The annual Pennsylvania Tax Institutes, Inc. Friday, January 12, 2024. The registration price includes the Land Grant University Tax Education Foundation National Income Tax Workbook, which will be mailed in advance. Schedule may change based on the number and length of state reports!A land-grant university (also called land-grant college or land-grant institution) is an institution of higher education in the United States designated by a state to receive the . Smith Hall, Auburn, AL, 36849-5608 .

Land Grant University Tax Education Foundation | LinkedIn‘de 100 takipçi The Land Grant University Tax Education Foundation Inc. Michigan State University Larry Borton Phone: 517-432-9803 Fax: 517-432-9805 Email: bortonl@msu. Project & Initiative (s) Owner . 2023 NITW Corrections/Updates.All complaints should be referred directly to Alan Spencer, Tax Seminar Program Developer, Auburn University Accounting & Tax Training Institute (334-844-5100) opce@auburn. Pioneering research in physics, medicine, agricultural science, and other fields has been done at land-grant schools, . Chapter content sample provided below to evaluate the workbook’s quality.After the desegregation of West Virginia schools in the 1950s, the state board of education voted to terminate West Virginia State University's land-grant funding structure. Program Benefits: Your registration includes digital access for webinar recordings and slides until October 2024.

edu or to Hope Stockton, Director, (334-844-2870) Auburn University, Office of Professional & Continuing Education, 301 O. 10 Hours Federal Tax, 4 Hours Federal Tax Update & 2 Hours Ethics for Enrolled Agents. Our Provider Number is 9NHYF. University of Wisconsin–Madison (designated on April 12, 1866) Wyoming The 1862 Institutions are the first land-grant institutions; 1890 . Username or Email.Donde Plowman is the chancellor of the University of Tennessee. Tuesday, January 16, 2024.

Land Grant University Tax Education Foundation

PTI Inc is proud to be a member of the Land Grant University Tax Education Foundation (LGUTEF).Errata for the 2023 National Income Tax Workbook The invaluable 2023 National Income Tax Workbook from the Land Grant University Tax Education Foundation is a bound, approximate 800-page volume with a .Public universities provide the most affordable path to a high-quality higher education and the associated benefits. Free in-person and virtual events. This chapter also explains the potential tax liability incurred by the estate or heirs of a deceased . On average, in-state students at public four-year institutions pay just $2,250 in tuition and fees after scholarships, grants, and tax benefits. Printing, Publishing (A33) IRS filing requirement.The influence of the land-grant schools on American higher education has been formidable.COPYRIGHT LAND GRANT UNIVERSITY TAX EDUCATION FOUNDATION 2021 24. The Tax Practitioners Institute . ©LAND GRANT UNIVERSITY TAX EDUCATION FOUNDATION1.Our sponsor’s name for CFP credit is Land Grant University Tax Education Foundation, Inc.41 Kb) Jul 2012.Each attendee will receive paper-copy of the 2023 Agriculture Tax Issues Book by Land Grant University Tax Education Foundation. Home; About the Tax Workbook; Workshop Locations; Contact; Members, Instructors & Participants Login.6 million, or more than one in three students at public universities, receive Pell .One-day, virtual, Income Tax School.com to login using the Login button above . New users may register below. View Archives keyboard_arrow_rightBy the early 21st century a significant percentage of all students seeking degrees in the United States were enrolled in land-grant institutions. 103-382, §§531-535) established the three institutional categories of the land-grant system, now known as the 1862, 1890, and 1994 Institutions. Rice University landed its largest-ever federal grant for education research this week, .UNIVERSITY GRANT. Username or Email Password.2022 National Income Tax Workbook.

Thank you for participating in a program using the National Income Tax Workbook. The Land-Grant Tradition details the development of the land-grant universities. The instructors of . Annually LGUTEF plans, writes and develops .