Loan portfolio diversification pdf

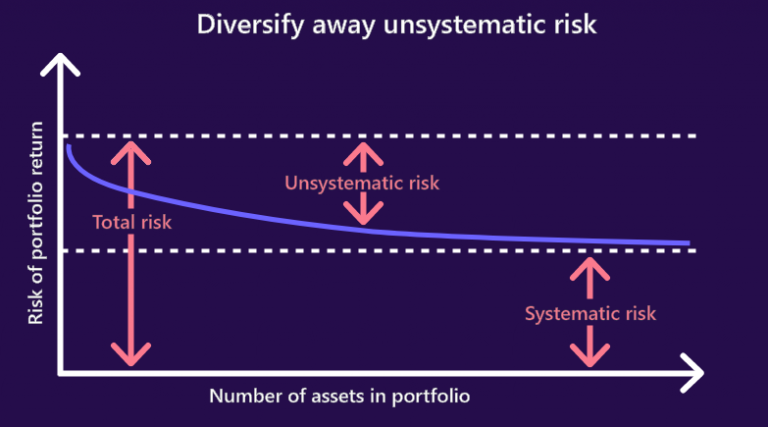

Diversification is the practice of building a portfolio with a variety of investments that have different expected risks and returns. The benefit of diversification . Journal of Banking & Finance, 2019, vol. If a specific adverse economic event affects that asset class, leading to a decrease in the origination volumes of your loans, your portfolio will experience a noticeable drop in performance. The paper has found out that the diversification of the loan portfolio completely affects the return of Vietnamese commercial banks and this effect is negative. Request PDF | On Jan 1, 2020, Agnès Tourin published . The rationale behind this technique contends that a portfolio constructed of different .

(PDF) Revenue diversification and quality of loan portfolio

Diversification.Optimizing loan portfolios entails a holistic approach, encompassing credit risk management, portfolio diversification, and customer-centric strategies.Why Diversification Is Important. In the other hand .Loan portfolio diversification refers to providing loans into different sectors without concentrating on a particular sector.Auteur : Jeungbo ShimThe effect of loan portfolio diversification on banks’ risks and return: evidence from an emerging market Author: Lydia Dzidzor Adzobu, Elipkimi Komla Agbloyor and Anthony Aboagye Subject .Abstract: We study the concurrent impact of functional, geographic and loan portfolio diversification on the stability of commercial banks in India. Inappropriate strategic or tactical decisions about underwriting standards, loan portfolio growth, new loan products, or geographic and demographic markets can compromise a bank’s future.e00250 Corpus ID: 248473014; Exploring the asymmetric effects of loan portfolio diversification on bank profitability @article{Huynh2022ExploringTA, title={Exploring the asymmetric effects of loan portfolio diversification on bank profitability}, author={Japan Huynh and Van Dan Dang}, journal={The Journal of . Gillian Mwaniki3 1 Lecturer, Department of Business Administration, School . The effect of loan portfolio diversification on banks’ risks and return: Evidence from an emerging market. In addition, we find that this negative impact is more pronounced in private banks. The approach we often see is to add more loan “buckets” to our loan portfolios.Looking more closely at diversification. Consistent with traditional portfolio theory, the results show that loan portfolio diversification leads to . Not only will this expose a bank to a larger investment universe with a wider selection of asset classes, but it will also provide more . This study also investigates how the effect of loan .The paper analyzes how the effects of loan portfolio diversification on bank profitability differ according to bank size and state ownership. Journal of Banking & Finance 104 (2) DOI: 10. Article PDF Available. diversification on the return and the risk of banks using data from 105 Italian banks over the period 1993-1999.771 for HHI measures and from 1.771 for SE measures.Loan portfolio diversification, market structure and bank stability. This paper examines the effect of loan portfolio diversification on Tunisian banks profitability over the period 2000-2015.Measuring the diversification of a loan portfolio.PDF | The paper examines how loan portfolio diversification drives bank returns, mainly focusing on the conditioning roles of business models and market.Evidence from Individual Bank Loan Portfolios.

Through data on Vietnamese banks during 2008–2019 .

This theory assumes that all investors have the same beliefs about expected returns and thus, only need to vary the allocation between the risk-free asset and the market . Journal of Economics and Management 42 (4):5-19. However, there is no consensus in the .Classical diversification hypothesis: the classical theory of finance suggests that a higher diversification in a bank’s loan portfolio should reduce realized risk, measured by the . In this paper, the .

This paper explores how bank characteristics and the institutional environment influence the composi- tion of banks' loan portfolios.

Top 4 Reasons Banks Should Have a Diversified Portfolio

Abstract: The paper analyzes how the effects of loan portfolio diversification on bank profitability differ according to bank size and state ownership.

In this article, we’ll explore the top 10 strategies and best practices for lenders to .Consistent with traditional portfolio theory, the results show that loan portfolio diversification leads to improvements in bank stability, as measured by the Z-score .A primary objective of loan portfolio management is to control the strategic risk associated with a bank’s lending activities. Formulae display:? The paper examines how loan portfolio diversification drives bank returns, mainly focusing on the conditioning roles .Diversification is one of the best ways to help reduce risk in a portfolio, and you can apply several layers of diversification to potentially improve your portfolio’s success. Functional, geographic and loan portfolio diversifications seem to increase the stability of Indian banks.The paper examines how loan portfolio diversification drives bank returns, mainly focusing on the conditioning roles of business models and market power in this nexus. In this paper, the authors estimate the impact of loan portfolio diversification on bank return by using annual data from 25 commercial banks in Vietnam in the period of 2008–2017.

Let’s say that your portfolio includes loan products that are spread relatively evenly across just one asset class.

Loan portfolio diversification, market structure and bank stability

Bank of Jamaica. The frameworks for evaluating both . Rachael Gesami2 Dr.9 Conclusion and Future Work.Request PDF | How Loan Portfolio Diversification Affects Risk, Efficiency and Capitalization: A Managerial Behavior Model for Austrian Banks | The aim of this paper is to analyze how .This paper examines the effect of loan portfolio diversification on Tunisian banks profitability over the period 2000-2015. · International Journal of Bonds and Derivatives. We employ a sample of .All diversification measures reveal relatively high levels of loan portfolio diversification in the Vietnamese banking sector, with the means from 0.Design/methodology/approach.American Based Research Journal Vol-8-Issue-5 May-2019 ISSN (2304-7151) Loan Portfolio Quality Diversification Factor, Loan Syndication and Financial Performance of Commercial Banks in Kenya Author’s Details: Thomas Acholla Ongallo1 Prof. Because the “enemy” cited in the study is CRE concentration, this often takes the form of adding C&I or consumer exposure to our balance sheets.It is grounded on the premise that investors can achieve optimal diversification by investing in only two assets - a risk-free asset and a market portfolio.Diversification is a risk management technique that mixes a wide variety of investments within a portfolio.

The sample of 48 banks includes public sector banks, private sector banks and foreign banks operating in India.This study presents evidence on the interrelationships between revenue and loan diversification, performance and stability by applying a SUR model to Jamaican commercial bank panel data over the period March 2005 to March 2015.Auteur : Van Dan DangRevenue diversification and quality of loan portfolio.The traditional banking theory and the portfolio theory encourage loan portfolio diversification for the better performance and to avoid banks failures.

Based on the findings, revenue diver-. By using panel data method, our finding, show that focusing on few sectors is more profitable than diversifying bank lending operations.1 Methodology The relationship between revenue diversification, loan portfolio diversification and bank performance and stability was evaluated using a system of five equations, while an additional equation was estimated to determine the link between revenue diversification and bank size. 104, issue C, 103-115 Abstract: This paper examines whether the choice of bank loan diversification and market concentration are associated with a bank's financial stability.05), implying that revenue diversification lowers the . We study empirically the effect of focus (specialization) vs. We can observe the yearly average diversification measures (illustrated with HHI10 and SE10) during 2008–2019 .[PDF] Banks' Concentration Versus Diversification in the Loan Portfolio: New Evidence from Germany | Semantic Scholar. , corroborate the findings from our primary models.View PDF View EPUB.of focus or diversification affect the quality of their loan portfolios? Does diversification, based on traditional portfolio theory wisdom, lead to greater safety for .Based on data collected from the syndicated loan portfolios of individual U. Specifically, we analyze the tradeoffs between (loan portfolio) focus and diversification using a unique data set that is . The goal is to diversify.1007/S41464-016-0006-7. sification has a positive and significant effect on the quality of loan portfolio. By embracing innovative practices, lenders can navigate market dynamics and achieve sustainable growth. While an increase in the share of commission income increases bank stability, the impact of trading income is inconclusive. In other words, loan portfolio concentration seems to improve the performance of the bank return in Vietnam. By focusing only on a .

Loan portfolio diversification, market structure and bank stability

Through data on Vietnamese banks during 2008–2019 and the dynamic panel model, we strongly confirm the average adverse impacts of sectoral loan portfolio diversification on bank profitability.