Medicare hmo plan explained

Medicare provides health insurance to people who are 65 years of age or older and younger people who suffer from a disability or end-stage renal disease (ESRD). Wellcare offers a variety of Wellcare HMO . With most Aetna Medicare Advantage HMO plans, you typically choose an in-network primary care physician who works with you to help you get the right care at the right time. Whether you’re enrolling in . Usually: If you join a : PPO Plan that : doesn’t offer drug coverage, you can’t get a .

The difference between Medicare HMO-POS & PPO

Medicare Supplement Plan J Before Plan J was discontinued in 2010, as a result of the Medicare Prescription Drug, Improvement and Modernization Act, it was highly favored relative to the other plans. This provides you with greater out-of-network coverage, typically lower premiums, and other attractive features depending on your plan. drug coverage, you can’t get a separate Medicare drug plan.Can I Keep My Doctor?

What is Medicare HMO?

It starts with access to our wide network of doctors and hospitals, plus more benefits than Original Medicare.

2021 SecureBlue (HMO D-SNP) in MN Plan Benefits Explained

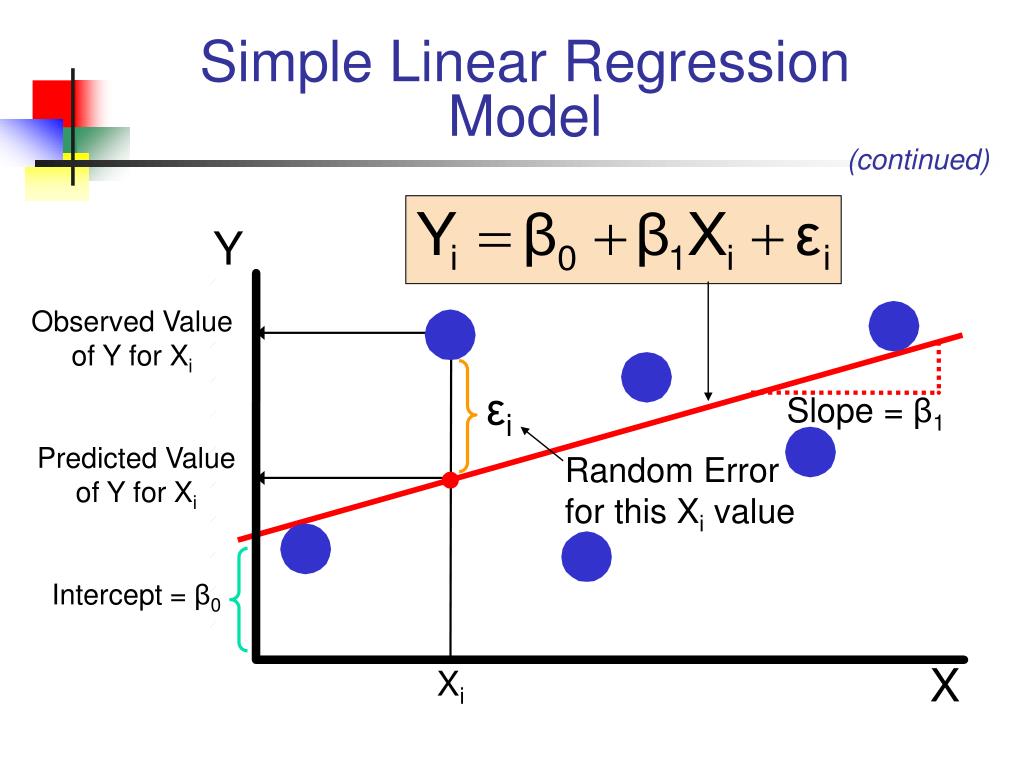

The key feature of HMO plans is that they have a closed network of providers that you must use to get your health care, or else, your plan will not pay. HMOs have their own network of doctors, hospitals and .Plans Overview.

Health Maintenance Organizations (HMOs)

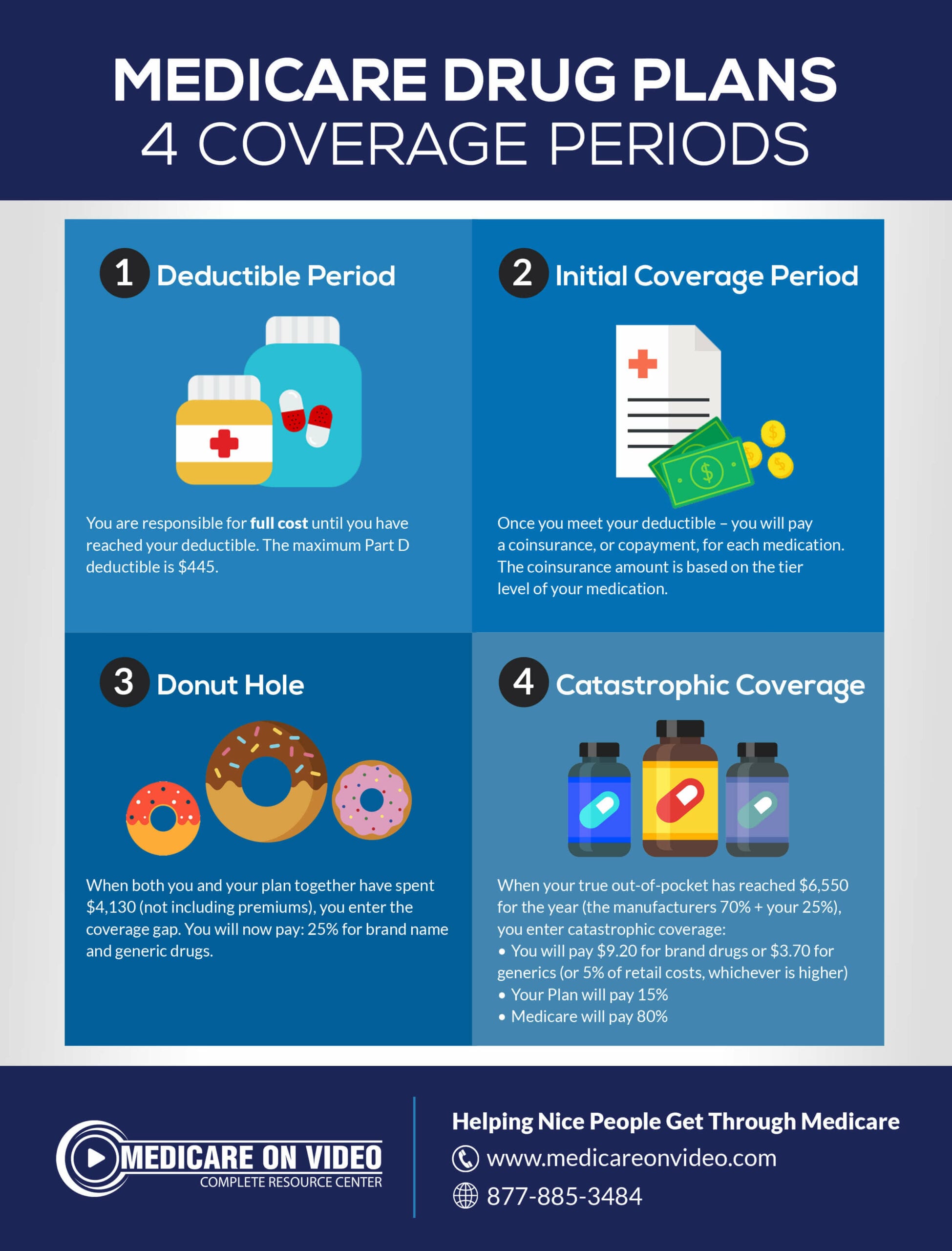

These “bundled” plans include Part A, Part B, and usually Part D.

Comparison: HMOs and Original Medicare

Kaiser Permanente Medicare Advantage (HMO) H5050_MA0001929_56_22_M.When you’re deciding whether Medicare Advantage is the right fit for your health and financial goals, you may benefit from learning about the different types of plans that are offered. Learn how they’re different and determine . March 29, 2024, at 1:17 p.

How Does Medicare Plan G Work?

LEON Health is a Medicare Advantage plan that works with Leon Medical Centers to provide members comprehensive care and the benefits they need in order to stay healthy.2022 Medicare Advantage Plan Benefits explained in plain text. doesn’t offer . Copayment for Routine Care $20. Medicare Part B covers the administration of certain drugs when given in an outpatient setting. Medicare HMOs are more restrictive with plan members’ ability to see providers and receive services outside the network than Medicare PPOs.Medicare HMO plans are the most common type of Medicare Advantage plan. Learn more about our . When you have an HMO, you generally must get your .What are Medicare Advantage Plans? You typically don't need a referral to .1-855-335-1407 (TTY: 711) Monday to Friday, 8 AM to 8 PM. Medicare HMO and PPO plans differ mainly in the rules each has about using the plan’s provider network. Most of the time, this also means you’ll need a referral from your primary care doctor (PCP) in order to go to a specialist. Explore the information below to learn more about the rules and regulations behind this attractive partnership.Plan G covers nearly all costs not covered by Original Medicare, including: Part A coinsurance and hospital costs up to an additional 365 days after a person uses all their Medicare benefits.

How to enroll in Medicare Advantage HMO plans. Our Wellcare Advantage HMO plans focus on care access and affordability. Other Part C plans include: Private Fee-for-Service plans. In-Network: Copayment for Medicare-covered Chiropractic Services $20.

Plan G offers full coverage of the Part A deductible and the Part A coinsurance charges.

Parts A, B, C and D Explained

The plans are offered by private insurance companies, with .

The difference between Medicare HMO and PPO plans

The main difference: Using the plan’s provider network.What Is a Medicare HMO Plan? The right choice for Medicare starts with understanding your options.Learn More about Aetna Inc. Key Takeaways: There are two main types of Medicare .

With an HMO-POS you can go outside of the network for care, but you'll pay more.

Skip to main content. Medicare Advantage Plans, sometimes .Medicare Part B Prior Authorization.

HMO basics

A health maintenance organization is a health insurance plan that controls costs by limiting services to a local network of . The main difference is in the rules of the plan’s provider networks.

Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services. Although, some meds may require your doctor to submit a Part B Drug Prior Authorization Request Form.

Your Guide to Medicare HMO Plans

Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

What Does Medicare Supplement Plan J Cover?

HMO Plan that .

Medicare Prior Authorization Explained

Medicare Advantage HMO plans generally require covered individuals to seek .

Understanding Medicare Advantage Plans

Table of contents. You'll need to choose a primary care physician (PCP) to coordinate all your care.2023 Medicare Advantage Plan Benefits explained in plain text. Chiropractic Services. Medigap Plan G extends that coverage for up to 365 additional days once Original Medicare .Medicare Advantage preferred provider organization, or PPO, plans allow you to see both in-network and out-of-network providers.What Is an HMO-POS Medicare Advantage Plan? Medicare HMO Point-of-Service Option plans are Health Maintenance Organizations (HMOs) that also offer .2017 Medicare Advantage Plan Benefits explained in plain text. Aetna Medicare Premier (HMO-POS) Plan Details, including how much you can expect to pay for coinsurance, deductibles, premiums and copays for various services covered by the plan. The table below compares these two ways of .What's a Medicare HMO-POS plan? Health maintenance organizations (HMOs) of today aren't like the HMOs of the past.

Medicare HMO Plans

Reviewed by John Krahnert.

Understanding HMO Insurance Plans

We’ll also offer a comparison of HMO vs.Health savings account (HSA plans) Combine a qualified high-deductible health plan with a health savings account to save on premiums and take advantage of all HSAs have to offer. A Point-of-Service plan may cover the cost of drugs, but features vary from policy to policy. With numerous health care professionals in the network who serve more than 42,000 Medicare recipients, we are redefining the delivery of medical care in the . Get answers to common Medicare questions.2021 Medicare Advantage Plan Benefits explained in plain text.Learn about Medicare.

What is Medicare Part C?

Qualified expenses. There are several types of Medicare Advantage plans, including health maintenance organization (HMO) plans.Medicare Advantage, also known as Medicare Part C, is a health insurance plan offered by private insurance companies and regulated by Medicare. Staying in-network for care can give you greater cost savings throughout the year.Medicare health maintenance organization (HMO) plans are a type of Medicare Advantage plan. En effet, la HMO restreint les prestataires que vous .January 12, 2024.What's an HMO? An HMO is a type of Medicare Advantage Plan (Part C) offered by a private insurance company. You can call 1-800-472-2986 TTY Users: 711 24 hours a day, 7 days a week , or you can request a free plan quote online, with no obligation to enroll in a plan.

There are four parts of Medicare: Parts A, B, C and D. Basic supplement plan coverage, which is Plan A, includes Medicare Part A coinsurance, hospital costs up to 365 days after all Medicare benefits . Most people will enroll in Medicare during the seven-month Initial Enrollment Period (IEP), beginning three months prior to their 65th .Key Features of Medicare HMO Plans.Summary: Medicare HMO Point-of-Service Option (POS) plans provide the benefits found in both HMO and PPO plans.Wellcare Giveback (HMO) covers additional benefits and services, some of which may not be covered by Original Medicare (Medicare Part A and Part B).Medicare Health Maintenance Organizations (HMOs) are private plans that the federal government pays to administer Medicare benefits. Maximum 12 Routine Care every year. Plain text explanation available for any plan in any state. The Wellcare Medicare Advantage HMO plan and more of the coverage you value. What is an HMO? HMO stands for health maintenance organization.

HMO: Definition, How It Works, Benefits, Disadvantages

PPO, the two most common plan types. In general, Medicare PPOs give plan members more leeway to see providers outside the network than Medicare HMOs do. 1 Find out how a Humana Gold Plus HMO plan could fit your needs. Sign-up for our free Medicare Part D Newsletter, Use the Online Calculators, FAQs or contact us through our Helpdesk -- Powered by Q1GROUP LLC and National Insurance Markets, Inc

HSA plans explained

HMO and PPO plans are two of the most popular types of Medicare Advantage plans. If you join a Medicare Advantage Plan, the plan will provide all of your Part A .