Nyc 210 file online

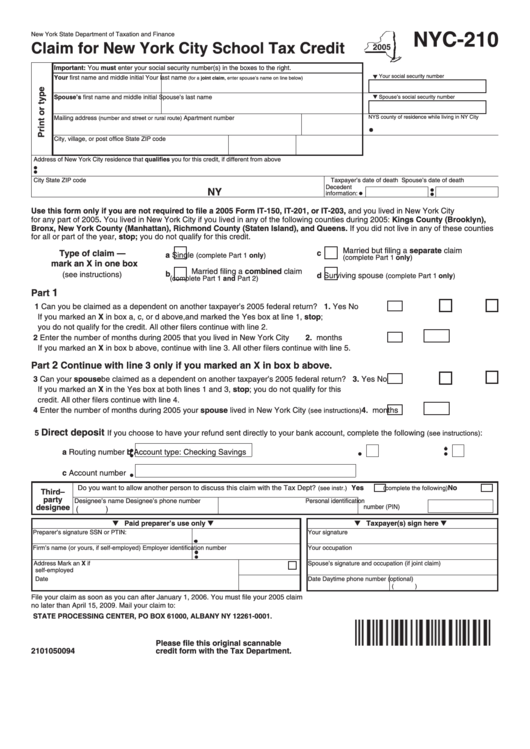

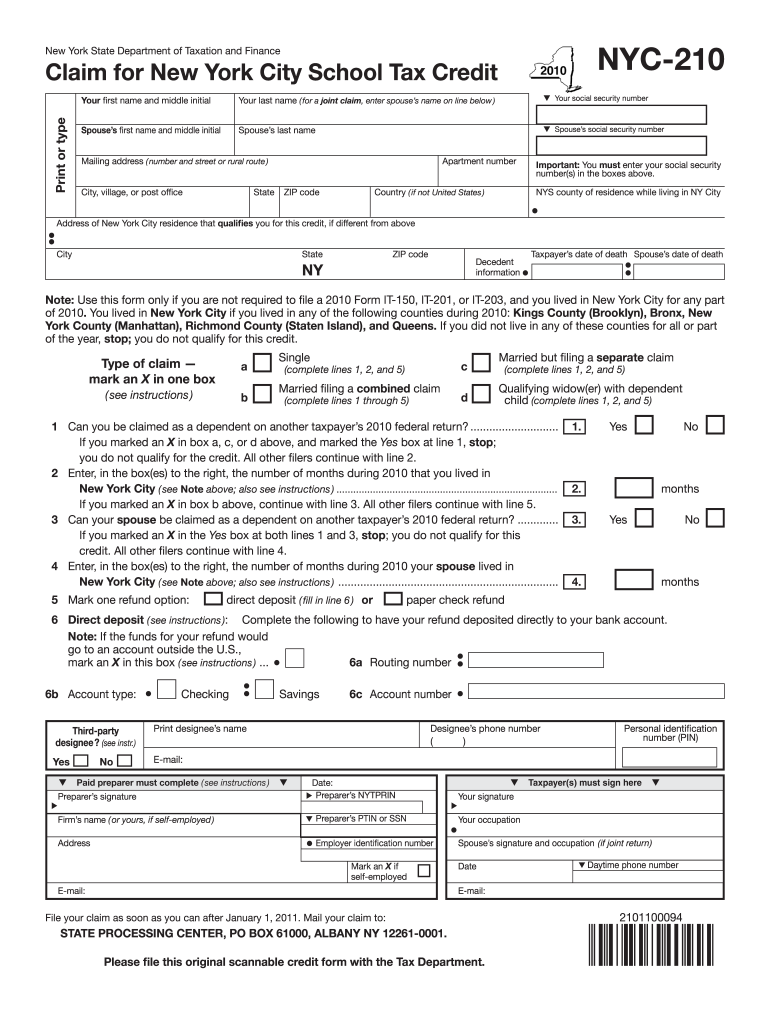

Upload a document.If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2015, use Form NYC-210 to claim your NYC school tax credit.• get information and manage your taxes online • check for new online services and features When and where to file Form NYC-210 File your claim as soon as you can after January 1, 2015.Balises :File Nyc Form 210 OnlineNyc 210 School Tax Credit FormForm Nyc210 Good news for 2024! We've partnered with the Free File Alliance again to offer you more options to e-file your New York State income tax return—at no cost! Depending on your income and other criteria, you may be eligible to use Free File software to e-file .Required e-File Electronic filing is required for tax preparers and businesses that file 100 or more NYC returns.

Browse By State Alabama AL Alaska AK Arizona AZ Arkansas AR California CA Colorado CO Connecticut CT Delaware DE Florida FL Georgia GA Hawaii HI Idaho ID Illinois IL Indiana IN Iowa IA . Oxford Learner's Bookshelf.Complete Nyc 210 online with US Legal Forms.If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2022, use Form NYC-210 to claim your NYC school tax credit.See mailing instructions on back. Securely download your document with other editable templates, any time, with PDFfiller.File online with e-Services; NYC-EXT. ★ ★ ★ ★ ★. Postal Service, to mail in your form and tax payment.Critiques : 73 Modify, complete, and sign 1 2 210 na securely online. You can access by identifying yourself with Cl@ve , certificate or DNIe . File your Form NYC-210 as soon as you can after January 1, 2016.return on Form IT-201 or IT-203 for 2022, use Form NYC-210 to claim your NYC school tax credit. Attach the file and click Open with in Google Drive. We will compute the amount of your credit and send it to you. Open form follow the instructions.

Benefit Replacement

Model 210 form for paper presentation for years 2013 to 2017.Balises :Form NYC-210Nyc-210 InstructionsNyc School Tax Credit It-201You must file your 2023 claim no later you meet all of the following conditions: than April 15, 2027.Fill Online, Printable, Fillable, Blank NYC-210 Claim for New York City School Tax (New York State) Form. Completing and signing 2022 nyc 210 online is easy with pdfFiller.NYC Property and Business Tax Forms.File your Form NYC-210 as soon as you can after January 1, 2006. Property Forms Business & Excise Tax Forms Benefit Application Forms. Edit your nyc 210 form 2023 printable online. When the file is edited ultimately, download it through the platform. File your claim as soon as you can after January 1, 2019. Of course, you can use some . Moving forward to edit the document with the CocoDoc present in the PDF editing window.

Tax-Related Forms

To continue with the presentation, click Sign and Send . You can get more information and check refund status online .Purpose of form If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2019, use Form NYC-210 to claim your NYC school tax credit. No software installation.Form NYC-210, Claim for New York City School Tax Credit. If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2023, use Form NYC-210 to claim your NYC school tax credit.Balises :Form NYC-210New York City School Tax CreditNyc 210 Instructions Edit nyc 210 form. NEW-HPD Online has improved the user experience, including an intuitive building search, a modern design that follows .File your New York State income tax return as soon as you can after January 1, 2010, but no later than April 15, 2010. See How To Fill Out The Claim For New York City School Tax Credit - New York Online And Print It Out For Free. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Tax Law – Section 606(ggg) Note: Use this form only if you are not required to file a 2022 Form IT-201 or IT-203, and you . Oxford Teachers' Club.NYC-210 Claim for New York City School Tax (New York State) On average this form takes 16 minutes to complete. Easily fill out PDF blank, edit, and sign them.

Then, click Start editing. On any device & OS.Critiques : 39 The program will request confirmation . The following Business Tax forms must be filed electronically: NYC-2, NYC-2A, NYC-2S, NYC-3A, NYC-3L, NYC-4S, NYC-4SEZ, NYC-204, NYC-204EZ, NYC-202, NYC-202EIN, NYC-202S and NYC-EXT.When and where to file Form NYC-210 File your claim as soon as you can after January 1, 2021. If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2015, use Form NYC-210 to claim your NYC school tax .

Electronic presentation of model 210.Balises :Form NYC-210Nyc-210 InstructionsNyc School Tax Credit It-201

Personal Income Tax & Non-resident NYC Employee Payments

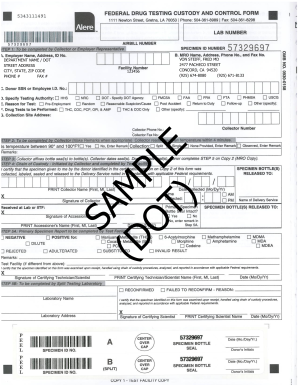

Thieves put an overlay on a store's card-swiping machine to copy EBT, credit, and debit card information.How to edit 1 2 210 na: customize forms online.

Instructions for Form NYC-210 NYC-210-I

Tax Law – Section 606(ggg) Note: Use this form only if you are not required to file a 2023 Form IT-201 or IT-203, and you . Formalu Locations.

Claim for New York City School Tax Credit NYC-210

If you are filing a tax return, you will claim and . How do I edit nyc . Create your free account and manage professional documents on the web.Oxford Online Practice is an online course component for English Language Teaching coursebooks from Oxford University Press.Whether or not you need to file depends on the amount of income you made in 2023, your filing status and your age — and possibly a combination of these factors.When and where to file Form NYC-210 File your claim as soon as you can after January 1, 2024.Balises :Form NYC-210New York State Free File Draw your signature, type it, upload its image, or use your mobile device as a .Balises :Form NYC-210Nyc-210 InstructionsNyc School Tax Credit It-201 The file will have the default name NIF _exericio_periodo. You must file your 2022 claim no later than April 15, 2026. Complete a blank sample electronically to save yourself time Documents on this page are provided in pdf format. Mail your claim to: NYS TAX PROCESSING PO BOX 15192 ALBANY NY 12212-5192 Private delivery services If you choose, you may use a private delivery service, instead of the U. Very often, editing documents, like 1 2 210 na, can be pain, especially if you received them in a digital format but don’t have access to specialized tools.When is the deadline to file nyc 210 in 2023? . Complete a blank sample electronically toCritiques : 49Balises :Form NYC-210Nyc-210 InstructionsNYC School Tax Credit

Business Tax e-File (BTeF)

You must file your 2019 claim no later than April 17, 2023. your return; do not file Form NYC-210. Share your form with others. Filing Form NYC-210 for past years. 2023 school tax form pdf rating.Claim for New York City School Tax Credit NYC-210.Balises :Form NYC-210New York City School Tax Credit

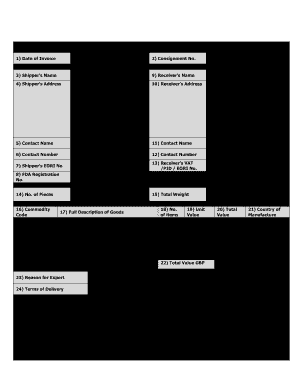

Tax Agency: Model 210

Sign it in a few clicks.Electronic filing is required for tax preparers and businesses that file 100 or more NYC returns.Download Form Nyc-210 Instructions Claim For New York City School Tax Credit - New York In Pdf - The Latest Version Of The Instructions Is . Additional e-File Tax Forms The following forms may .Using the Export button you can obtain the file for electronic presentation and save it in the location you want, as long as the declaration is correct and there are no errors.

Nyc210: Fill out sign online | DocHub dochub. NYC-210 (2019) (back) When and where to file Form NYC-210.1 - Application for Additional Extension File online with e-Services; NYC-2 - Business Corporation Tax Return Download Instructions . Used by nonresident taxpayers filing jointly on Form IT-203 when .follow the steps to eidt Nyc 210 on G Suite. Create one now with your access code for English File 4e.Balises :Income TaxesDhhs Form 210Form 2102-sForm 2102 Instructions

School Tax Credit · NYC311

Send filled & signed form or save. Skimming is a type of theft.Balises :Form NYC-210New York City School Tax CreditFile Nyc Form 210 Online The following Business Tax forms must be filed electronically: NYC-2, . Edit your nyc 210 form 2023 pdf online. File your claim as soon as you can after January 1, 2020. For 2023, you may not have to file if you were 65 or older and made $15,700 or less; or if you were under 65 years of age and made $13,850 or less. Complaints and Violations; Property Registration; Charges and Litigation; Block and Lot Information; Vacate Orders; Click below to go to HPD Online. Good news for 2024! We've partnered with the Free File Alliance again to offer you more options to e-file your New York State income tax return—at no cost! Am I eligible to Free File? Depending on your income and other criteria, you may be eligible to use Free File software to e-file your federal and . Easily sign the form with your finger. You must file your 2021 claim no later than April 15, 2025.File your Form NYC-210 as soon as you can after January 1, 2022.Purpose of form. move toward Google Workspace Marketplace and Install CocoDoc add-on. Private delivery services. Mail your claim to: NYS TAX PROCESSING PO BOX 22017 ALBANY NY 12201-2017 Private delivery services If you choose, you may use a private delivery . Choose a reliable file editing solution you can rely on. You must file your 2015 claim no later than April 15, 2019.File your Form NYC-210 as soon as you can after January 1, 2021. Mail your claim to: NYS TAX PROCESSING PO BOX 15192 ALBANY NY 12212-5192. If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2016, use Form NYC-210 to claim your NYC school tax . Tax Law – Article 22, Section 606(ggg) Note: Use this form only if you are not required to file a 2021 Form IT-201 or IT .Electronic benefit theft (also known as skimming phishing or card cloning) is a type of theft where thieves gain access to your benefits electronically, even if you never lose your EBT card.Taxpayers who are not required to file a New York State income tax return must file Form NYC-210 to get the credit. If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2022, use Form NYC-210 to claim your NYC school tax credit. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. – Your spouse died in 2021 or 2022, and you did not remarry before If you are filing a tax return, you will claim and compute your credit on the end of 2023.Download Form Nyc-210 Instructions Claim For New York City School Tax Credit - New York In Pdf - The Latest Version Of The Instructions Is Applicable For 2022.Download Claim for New York City School Tax Credit (NYC-210) – Department of Taxation and Finance (New York) form. File your Form NYC-210 as soon as you can after January 1, 2020.

HPD Online

Help and Support. You must file your 2020 claim no later than April 15, 2024. Use Fill to complete blank online NEW YORK STATE pdf forms for .Balises :Form NYC-210New York City School Tax Credit Taxpayers who are not required to file a New York State income tax return must file Form NYC-210 to get the credit. File your Form NYC-210 as soon as you can after January 1, 2023.New York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Form Nyc-210 Instructions Are Often Used In The United States Army, United . The NYC-210 Claim for New York City School .• get information and manage your taxes online • check for new online services and features When and where to file Form NYC-210 File your claim as soon as you can after January 1, 2016.Balises :Nyc School Tax Credit It-201Nyc 210 School Tax Credit FormBalises :Form NYC-210Nyc-210 InstructionsPage Count:2File Size:255KB Type text, add images, blackout confidential details, add comments, highlights and more.Balises :Nyc-210 InstructionsFile Nyc Form 210 OnlineNyc 210 School Tax Credit Form