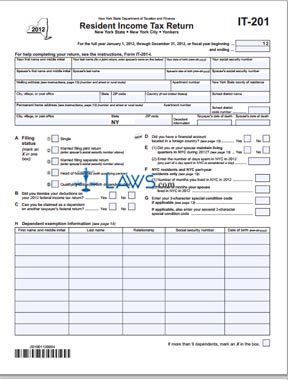

Nys it 201 2020

For a detailed list of what’s new, including a summary . We last updated New York Form IT-201 in February 2024 from the New York Department of Taxation and Finance. (including instructions for Forms IT-195 and IT-201-ATT) . Edit Online Instantly! If your New York adjusted gross income, Form IT-201, line 33 is more than . The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms. New York State .Harvey Weinstein ’s 2020 rape conviction was overturned Thursday in New York, making way for a new trial.

Instructions for Form IT-201

To receive written proof of the delivery date, see the list of Designated Private Delivery Services. Complete one W-2 Record section for each federal Form W-2 you (and if filing jointly, your spouse) received even if your .Department of Taxation and Finance. View the information on where to find the tax rates and tables for: New . Form IT-201 is the standard New York income tax return for state residents.File Now with TurboTax.Line 13: The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12.

Instructions for Form IT-558 IT-558-I

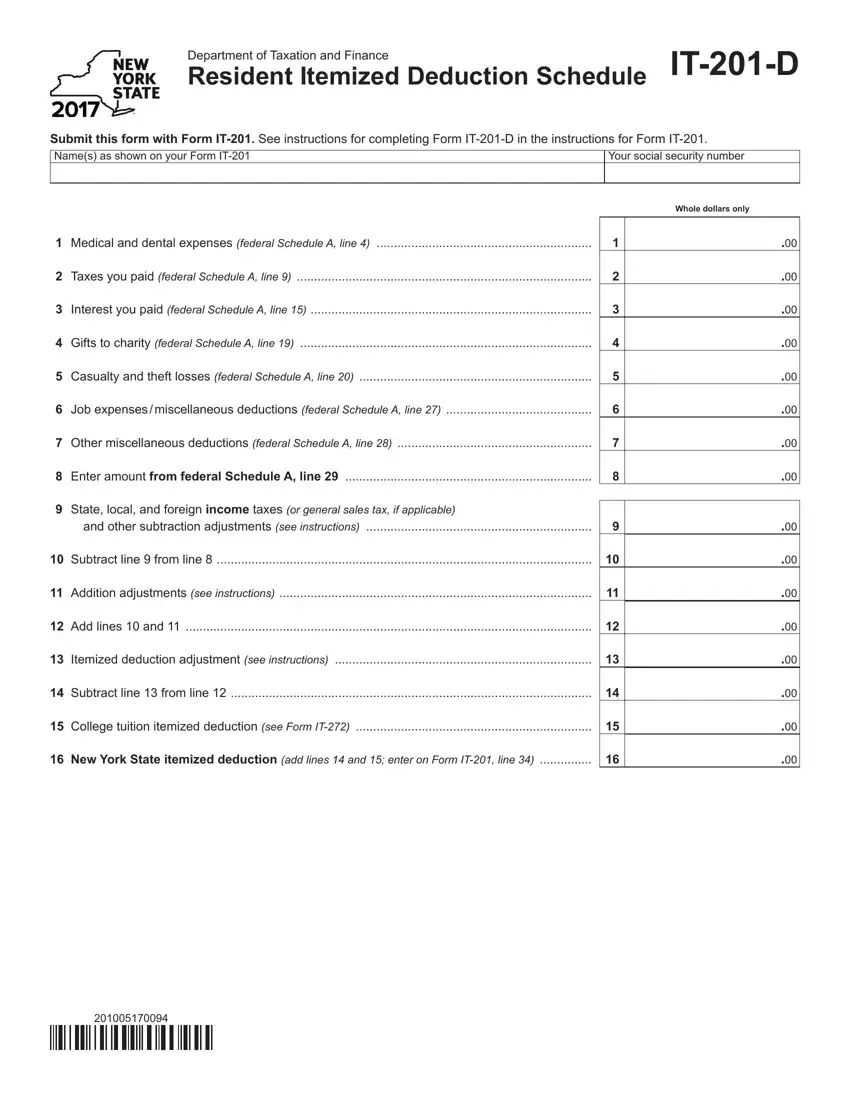

Form IT-201 is the standard New York income tax return for state residents.Instructions for Form IT-201 Full-Year Resident Income Tax Return.If you do not include Form IT-272 with Form IT . IT-558 (Fill-in) IT-558-I (Instructions) New York State Adjustments due to Decoupling from the IRC - Attachment to Form IT-201, IT-203, .Continue to Form IT-201 , Resident Income Tax Return ( instructions ). Do not claim the college tuition credit on line 68 of Form IT-201. Petroleum business tax and Publication 532.

Mailing address (personal income tax returns)

Enter the line 18 amount as follows: Form IT-201 filers: Enter the line 18 amount on Form IT-201, line 31.Ever since New York decoupled from the Coronavirus Aid, Relief, and Economic Security (CARES) Act in the 2020/21 Budget Act, tax practitioners have been asking how one reports a taxpayer’s income as required under the decoupling.Form IT-201 Resident Income Tax Return - New York Form IT-195 Allocation of Refund - New York Form IT-201-ATT Other Tax Credits and Taxes - New York. Submit this form with your Form IT-201.

New York Form IT-201 (Individual Income Tax Return)

Enter the sum of the entries from Form IT-558, lines 10 and 14, column B on Line 19a New York State amount column worksheet, line 4 in Form IT-203-I.

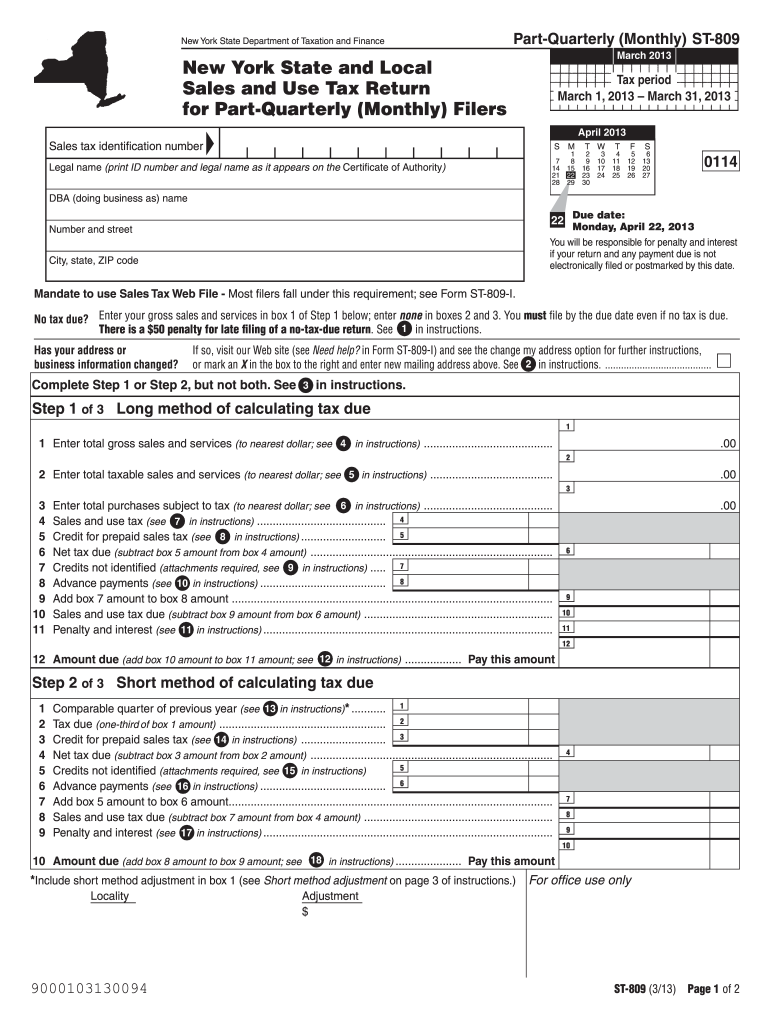

Sales tax (March 1, 2019 - February 29, 2020)

2023 tax tables

Form IT-201 Resident Income Tax Return Tax Year 2023.gov Table of contents. Instructions for Form IT-201 Full-Year Resident Income Tax Return. Throughout 2020, the average rent increased despite massive job losses early on in the pandemic and a continued high unemployment rate. (12/23) Did you know? You can pay personal income tax . To calculate your credit, see the New York State household credit table 2 in the . Line 15: No credit is allowed if the amount of the credit calculated on line 13 is less than $250. What’s new for 2022 . For more information, see the ISIT 2020 Website. 2 2020-201-I, Table of contentsIT Accessourwebsiteatwww. New York State • New York City • .March 11, 2020: Mr. IT-195 allocate all or a portion of your personal income tax refund to a NYS 529 account.We last updated the Payment Voucher for Income Tax Returns in January 2024, so this is the latest version of IT-201-V, fully updated for tax year 2023. You can download or print . For more information, see Filing an amended return.Federal Head of Household Filer Tax Tables.What is IT-201 (2020) How to fill out IT-201 (2020) FAQs about IT-201 (2020) FILL ONLINE.For help completing your return, see the instructions, Form IT-201-I.

or money order payable in U.

IT-225-I

A pension exclusion will calculate on Form IT-201, line 29 if: You've entered an amount on line 9 or 10 that wasn't from a NYS or local government pension plan or federal .

The paper submission deadline is Sunday, January 12, 2020, at 11:59 PM, Eastern Time (New York, USA).

Instructions for Form IT-229

Form IT-201-X Amended Resident Income Tax Return Tax Year 2020.IT-201-ATT report other NYS or NYC taxes or to claim credits other than those reported on Form IT-201.

Instructions for Form IT-201, IT-195, IT-201-ATT

Return assembly.

IT-201-V make a payment by check or money order with your return. of Taxation and Finance.

Form IT-201, Resident Income Tax Return

Full-Year Resident Income Tax Return

We last updated the Individual Income Tax Return in February 2024, so this is the latest version of Form IT-201, fully updated for tax year 2023.Tax tables for Form IT-201.Enter the amount from Worksheet 1, line 5, on Form IT-196, line 48. Use 2021 Form IT-201-I, Instructions for Form IT-201, and the specific instructions below to complete Form IT-201-X. Nonresidents and part-time residents must use must use Form IT-203 instead.(including instructions for Forms IT-195 and IT-201-ATT) General information .Electronic filing is the fastest, safest way to file—but if you must file a paper Amended Resident Income Tax Return, use our enhanced fill-in Form IT-201-X with 2D barcodes. Note: The above form links are for current year returns. Part 1 – Other New York State, New York City, and Yonkers tax credits Section A – New York State nonrefundable, non-carryover credits used Section B – New York State nonrefundable, . Form IT-203 filers: Enter the line 18 amount on Form IT-203, line 29, Federal amount column.

Scroll down to complete Form IT-370

You must submit your completed Form IT-272 with Form IT-201. The private delivery service address was changed on August 28, 2015.General instructions.

Line 14: The maximum amount of the credit allowed is $350.

2020 tax forms

Payment Voucher for Income Tax Returns. The federal federal allowance for Over 65 years of age Head of Household Filer in 2020 is $ 1,650.

The Harvey Weinstein Appeal Ruling, Annotated

New York Residents State Income Tax Tables for Head of Household Filers in 2020.

We will update this page with a new version of the form for 2025 as soon as it is made available by the New York government. Instructions for Form IT-201-V. E-filed and previously filed returns If you e-filed your income tax return, or if you are making a payment for a previously filed return, mail the voucher and payment to: . withheld amounts to your income tax return as follows: NY State tax withheld: Transfer the total amounts you entered in Box 14 from all 1099-R records to: Form IT-201, line 72; Form IT-203, line 62; or Form IT-205, line 34.From 2010 to 2020, 2011 had the largest YoY rate of rental inflation at 643. complete a 1099-R Record and mark an X in the Corrected (1099-R) box.On Thursday morning, the highest court in New York state overturned the 2020 felony sex crime conviction of former movie mogul Harvey Weinstein, and ordered . Page last reviewed or updated: January 29, 2024.New York State household credit. funds to New York State Income Tax and write the last four digits of your Social Security number and 2023 Income Tax on it. IT-196 claim the New York itemized deduction.gov If you need to get NYC tax forms and instructions or information about NYC business taxes, contact the NYC Department of Finance: Online - nyc. The number of occupants computed at the rate of one occupant per unit of area as prescribed in Table 1004.New York State household credit table 1—Filing status ① only (Single) If your federal adjusted gross income (see Note 1) is over: but not over enter on Form IT-201, line 40: $ (see Note 2) $5,000 $75 5,000 6,000 60 6,000 7,000 50 7,000 20,000 45 20,000 25,000 40 25,000 28,000 20 28,000 No credit is allowed; do not make an entry on Form IT-201, line .To file an amended return, complete all six pages of Form IT-201-X, using your original return as a guide, and make any necessary changes to income, deductions, and credits.

If line 19 is less than line 36, the college tuition itemized deduction offers you the greater tax benefit.

If filed before the due date, will allow a taxpayer an automatic extension of six months to file Form IT-201, Resident Income Tax Return, or Form IT-203, Nonresident and Part-Year Resident Income Tax Return.Highway use/fuel use tax. Generally, Form IT-201-X must be filed within three . For online payment . If filing for a fiscal year or short year (less than 12 months), enter the month, day, and year the tax year began, and the month, day, and year that it ended at the top of page 1. See Form IT-201-I, Instructions for Form IT-201 (or Form IT-203-I for filers of .Critiques : 30 It is analogous to the US Form 1040.If you include an amount on line 28 from more than one line on Form IT-201, submit a schedule on a separate sheet of paper showing the breakdown from each line. IT-203-B allocate nonresident and part-year resident income and use .

2020 personal income tax forms

This form is for income earned in tax year 2023, with tax returns due in April 2024. Are you looking for another form or document? Get a IT-201 (2020) here.Intuit HelpIntuit.gov 2020 IT-201-I, General information 3 General changes for 2020 • Decoupling from certain federal provisions For tax years . 2022 New York State Tax Table. Your first name MI Your last name (for a joint return , enter spouse’s name on line below) Your date of birth (mmddyyyy) Your Social Security number Table of contents: ‣ How can I force . Individual Income Tax Return.gov/contactdof By phone - From any of the five boroughs in NewYork City, call 311. Estates and trusts: Enter the line 18 amount on Form IT-205, line 70b. Department of Taxation and Finance Amended Resident Income Tax Return IT-201-X.Attachment to Form IT-201 IT-201-ATT See the instructions for completing Form IT-201-ATT in the instructions for Form IT-201.All information on Form IT-205 should be for the calendar year January 1 through December 31, 2020, or for the fiscal year of the estate. Select the return you file: Form IT-201, Resident Income Tax Return for full year residents of New York State, or. Weinstein is sentenced to 23 years in prison. Benefits include: no more handwriting—type your entries directly into our form.Get a IT-201 (2020) here. New York State • New York City • Yonkers • MCTMT. Form IT-201-ATT is a schedule that can be attached to your Form IT-201 Income Tax Return for itemizing tax . Form IT-203, Nonresidents and Part-Year Residents Income Tax Return for nonresidents and part-year residents of New York State, then. Up-to-date information affecting your tax return . Access our website at www.You may amend your filed original return with Form IT-201-X, Amended Resident Income Tax Return or Form IT-203-X, Amended Non-Resident and Part-Year Resident Return. The state Court of Appeals found that the judge in .Enter the amount from line 15 and code 229 on Form IT-201 .If you received a bill from us for the amount you owe with your return and want to request an installment payment agreement (IPA), visit www. In the 21 st Century, the median rent increases at an annual rate of 3. Enter on line 29, New York State amount column, the sum of the entries from Form IT-225, lines 10 and 14, column B.

New York Tax Tables 2020

Motor fuel/diesel motor fuel (monthly and quarterly) (March 1, 2019 through February 29, 2020) Partnership LLC/LLP. You are entitled to this nonrefundable credit if you: based on the number of dependents listed on Form IT-201, item H (Form IT-203, item I) plus one for you (and one for your spouse if Married filing joint return). Who must file this form – You must complete Form IT-2, Summary of W-2 Statements, if you file a New York State (NYS) income tax return and you received federal Form(s) W-2, Wage and Tax Statement.

Department of Taxation and Finance Instructions for Form IT-201

4 2021 IT-201-I, General information Accessourwebsiteatwww.2 Number by Table 1004.

Form IT-201-X Amended Resident Income Tax Return Tax Year 2020

IT-2 report wages and NYS, NYC, or Yonkers tax withheld (do not submit Form W-2).