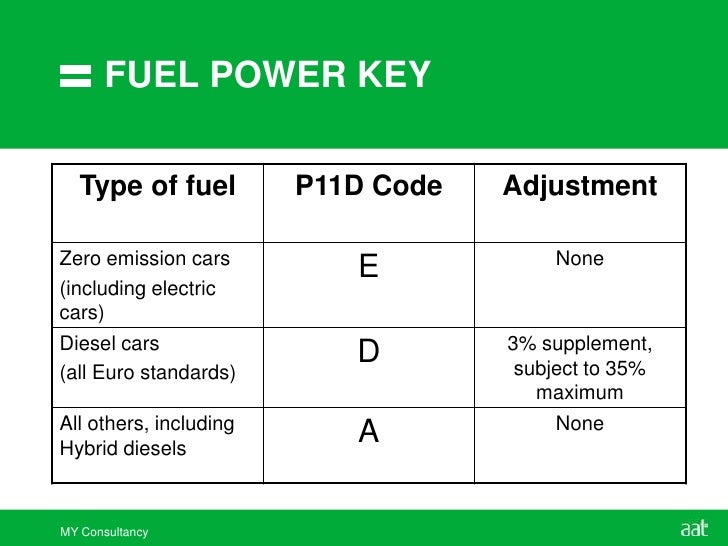

P11d guide type of fuel

Approved CO2emissions .Employees provided with electric cars check taxDeduction round up to next whole number. Car fuel benefit charge for 2022 to 2023 for this car.Optional working sheets for emplo...

Approved CO2emissions .

Employees provided with electric cars check tax

Deduction round up to next whole number. Car fuel benefit charge for 2022 to 2023 for this car.

Optional working sheets for employers to calculate the cash equivalent of the following benefits – the sheets are numbered as follows: 1.

Gasoline Standards

This encompasses the existing .Select a “Type of car” to use (Default “Cars and car fuel - Main company car”) and click OK.

Last updated on February 22, 2024.

Technical factsheet Treatment of Benefits in kind

Capital contributions. From 6 April 2023, employers must file expenses and benefit returns (forms P11D, P11D (b)) online unless you are digitally exempt. Car details record. The employer must also submit a form P11D(b) to HMRC with the forms P11D.

But you must fill in forms ‘P11D’ and ‘P11D(b) Return of Class 1A National Insurance contributions due' whether or not you use this form to calculate car and car fuel benefits.

Car fuel benefit charge for 2017 to 2018 for this car.required to submit a P11D for each employee. – column 1 for all cars in fuel type A and F – column 2 for all cars in fuel type D • for cars registered from 6 April 2020 – column 3 for all cars in fuel type A and F – column 4 for all cars in fuel type D Appropriate percentage Go to section 4 – do not complete section 3b or 3c. As of March 2023, HMRC no longer accepts paper P11D filings – all submissions must be made online.FORMS P11D AND P11D-B(: GUIDE TO COMPLETION 2016/17 THE FORM P11D SECTIONS COMPLETING THE P11D-B(APPENDICES HELPING YOU THROUGH THE P11D OUR STEP-BY-STEP GUIDE TO COMPLETING FORMS P11D AND P11D(B) // PAGE 3 PRINT // CONTENTS // PREVIOUS // NEXT It is that time of year again – when . Do not use this form if the benefits are provided under an optional remuneration arrangement. CWG5(2014) Class 1A National Insurance contributions on benefit in kind.Type of fuel or power used please use the key letter shown in the P11D Guide Dates car was available DD MM YY From To From To List price of car including car and standard . The letter ‘F’ is used for diesel cars which meet the Euro 6d standard, ‘D’ is used to denote all other diesel cars and the letter ‘A’ is used for all other cars.Type of fuel or power used please use the key letter shown in the P11D Guide Dates car was available DD MM YY From To From To List price of car including car and standard accessories only: if there’s no list price, or if it’s a classic car, employers read tax guide 480 Accessories all non-standard accessories These rates are considerably low for EVs, making EVs an appealing option for company car drivers and employers alike, due to potential savings in .ukFuel provided for employees private car - benefit in . Enter the figure at box Y onto form ‘P11D’, at section F box 10 If the employee had more than one car available in the year, add together all the figures at box Y on each working sheet, then transfer the total to form P11D, at section F box 10.Taille du fichier : 63KB

Section F

P11D Working Sheet 2 Car and car fuel benefit 2023 to 2024

However Fuel Type A is a HMRC defined term and does not appear on the vehicle’s V5 logbook.The information required to be entered is particular to each section of the P11D.• column 1 for all cars in fuel type A and F • column 2 for all cars in fuel type D for cars registered from 6 April 2020 • column 3 for all cars in fuel type A and F • column 4 for all.Vauxhall’s P11D calculator allows users to find the P11D value, CO2 emissions and VED bands across all models in the Vauxhall range; filter results by CO2 emissions, fuel type or model to help you find the Vauxhall car that best suits your needs. Enter the figure at box Y onto form ‘P11D’, at section F box 10 If the employee had more than one car available in the year, add together all the figures at box Y on each Working Sheet, then transfer the total to form ‘P11D’, at section F box 10.P11D Guide 2013–14. From 2020 to 2021, the electric van will be taxed at 80% of the benefit from a normal van, which currently stands at £3,490. They can do this by using HMRC’s table for advisory fuel rates and .FORMS P11D AND P11D(b): GUIDE TO COMPLETION 2017/18 THE FORM P11D SECTIONS COMPLETING THE P11D(b) APPENDICES HELPING YOU THROUGH .Price of all accessories read the ‘P11D Guide’ and tax guide ‘480 (2022) .

Manquant :

fuel The EV BIK rate will then increase by 1% each year, reaching 3% in 2025/26, 4% in 2026/27, and capping at 5% in 2027/28. The type of fuel or power used would be letter A. The way in which a benefit is provided is important for determining its tax treatment and how to report it, as .Non-road Diesel Engine Certification Tier Chart

Whether or not employers provide fuel for private journeys, the fuel type must be entered on form P11D when completing Section F. E – Electric (Electric Cars) D – Diesel (Diesel & Euro IV Cars) A – All others (including Petrol, Hybrid, Gas etc) This is as a result of a simplification in the tax rules so that the only variations to the .Exemptions do not apply if using Optional Remuneration Arrangements read P11D Guide Enter the mileage allowances in excess of the exempt amounts only where you’ve not been able to tax this under PAYE.

70-615 Fuel types to include on form P11D

Note to employer. •column 1 for all cars in fuel type A and F •column 2 for all cars in fuel type D for cars registered from 6 April 2020 •column 3 for all cars in fuel type A and F •column 4 for all cars in fuel type D Appropriate percentage Go to section 4 - do not complete section 3b or 3c.The appropriate percentage for cars registered on or after 1 January 1998 depends on the carbon dioxide (CO2) emissions of the car and the type of fuel used. Class 1A NICs are payable by the employer only; there is no employee NIC liability on BIKs. form P11D(b) Expenses payments and benefits 2013–14 Return of Class 1A National Insurance contributions due.

These forms are final versions of P11D and P11D Working Sheets for tax year 2022 to 2023, and should only be used by software developers to help with development of their payroll software .P11d query re Fuel cards /private car | AccountingWEBaccountingweb. Nonroad diesel fuel standards.P11D Working Sheet 2 Car and car fuel benefit 2023 to 2024.Price of all accessories read the ‘P11D Guide’ and tax guide ‘480 (2024) .

P11D Working Sheet 2b

Amendments and corrections information updated for zero emission mileage and date first registered.There are penalties for filing late or incorrect P11Ds. Manual versions of the returns are available from the Employer Orderline.13 CA ADC § 2022. Data provided via 3rd party and should be used as a guide only.ukRecommandé pour vous en fonction de ce qui est populaire • Avis

Section F

31 lignesThe car fuel benefit is based on a set figure £24,600 for 2021/22 (2022/23 £25,300) x benefit in kind percentage for your company car. Diesel Particulate Matter Control Measure for Municipality or Utility On-Road Heavy-Duty Diesel-Fueled Vehicles. A copy of the P11D form should also be given to the employee to enable them to complete their income tax return, review their tax deductions and/or allow them to prepare claims for tax relief. HMRC’s calculators default to assuming that the car is a high CO2 . Hardship exemptions. From 6th April 2011 HMRC have introduced a new fuel type A.The BIK rate for EVs is set at 2% until the end of the 2024/25 tax year.You do not have to give a copy of the completed Working Sheet to the director or employee, or HM Revenue and Customs.Car fuel benefit charge for 2021 to 2022 for this car.HMRC have reduced the number of reportable fuel types with effect from 6th April 2011 to three: –. To start by working .If a company car driver repays the cost of their private mileage, they avoid the car fuel benefit charge. Select a “Type of car” to use (Default “Cars and car fuel - Main company car”) .

1-50g/km (electric range <30 miles) 12%. Click the ADD button. The form P11D(b) is a return of the Class 1A NICs due on benefits provided to all employees during the tax year. The term employee is used to cover both .Benefits in kind are subject to a special class of NIC, known as Class 1A.

P11D Working Sheet 2 Car and car fuel benefit 2020 to 2021

Select the employee record to that you wish to assign the benefit to then press the Employee Benefits button in the bottom right-hand side of the window.Whether or not employers provide fuel for private journeys, the fuel type must be entered on form P11D when completing Section F. The taxable benefit for having the private use of a zero-emission van will be reduced but not nil until April 2021.Car fuel benefit charge for 2018 to 2019 for this car.Type of fuel (D – Diesel A – All other vehicles) List Price.Ethanol waivers (E15 & E10) Emergency fuel waivers.The appropriate percentage depends on when the car was first registered, the type of fuel used and whether it has an approved CO2emissions figure.The recent amendments, approved by the California Air Resources Board (CARB) in 2022 (2022 amendments) to the In-Use Off-Road Diesel-Fueled Fleets . Enter the details of the car including elements such as Fuel type, CC, CO2 emissions .To report the benefit of a fully electric car on a paper P11D form, the approved CO2 emissions figure would be 0g/km. The exemptions do not apply if using Optional Remuneration Arrangements read P11D Guide for 2018 to 2019 Cars and car fuel - if more than 2 cars . To calculate the .

Amounts paid by the employee for private use.

P11D Working Sheet 2 Car and car fuel benefit 2021 to 2022

Onroad (highway) diesel fuel standards. These forms are final versions of P11D and P11D Working Sheets for tax year 2020 to 2021, and should only be used by software developers to help with development of their payroll software . Portable Equipment Registration Program (PERP) Email. Living accommodation.