Private medical insurance vs medicare

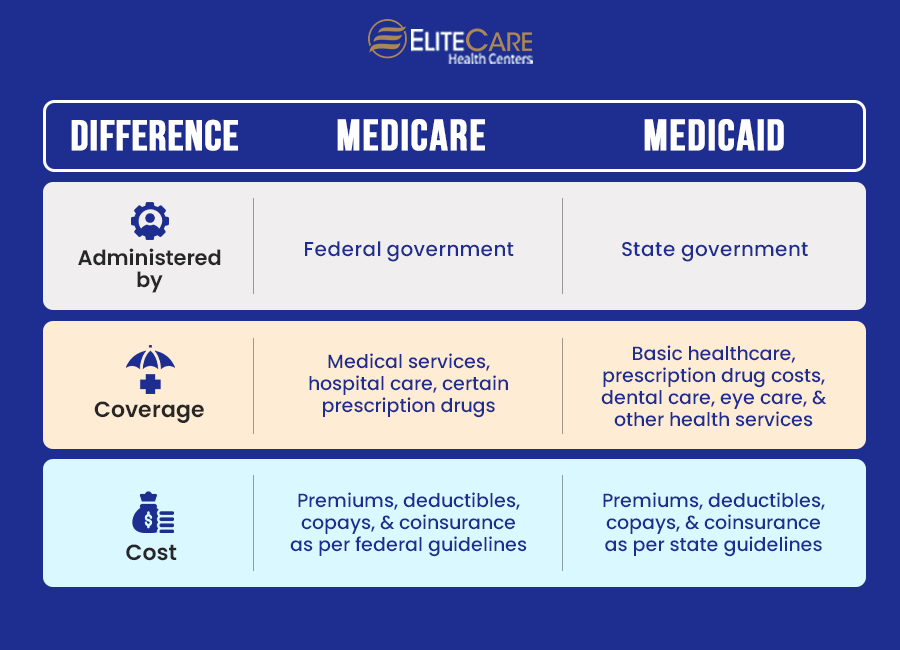

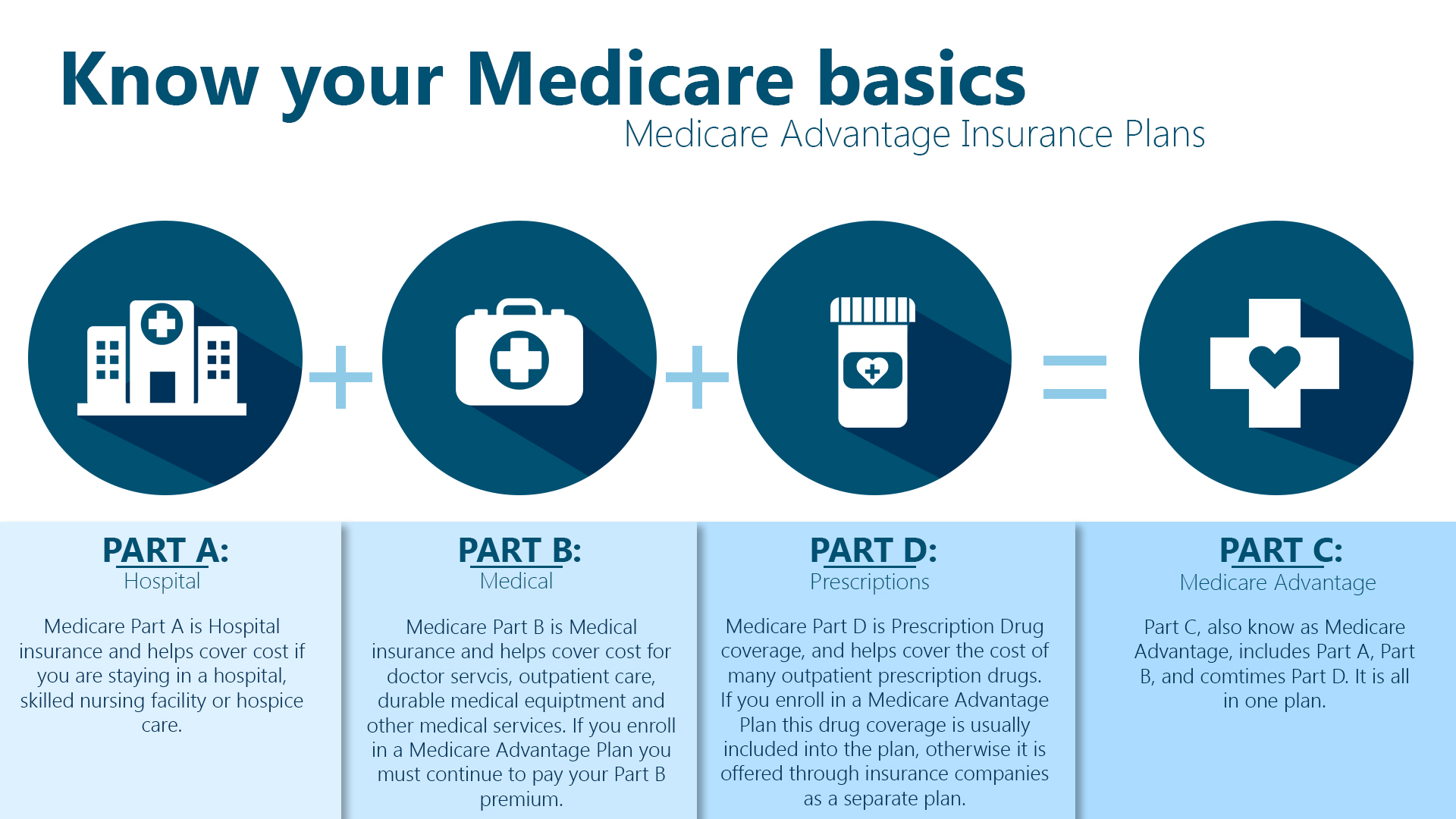

These costs can include copayments, coinsurance, and .Original Medicare is typically less expensive and more widely accepted than private health insurance.6%; Medicaid, 18.As mentioned, Medicare is a government health insurance program that provides hospital coverage (Medicare Part A), outpatient services (Medicare Part B) and prescription drug coverage (Medicare Part D).

Can You Have Private Insurance and Medicare?

Medicare Medical Savings Account (MSA) Plans - These plans include a high deductible plan that will not begin to pay benefits until the high annual deductible is .Long-term care.

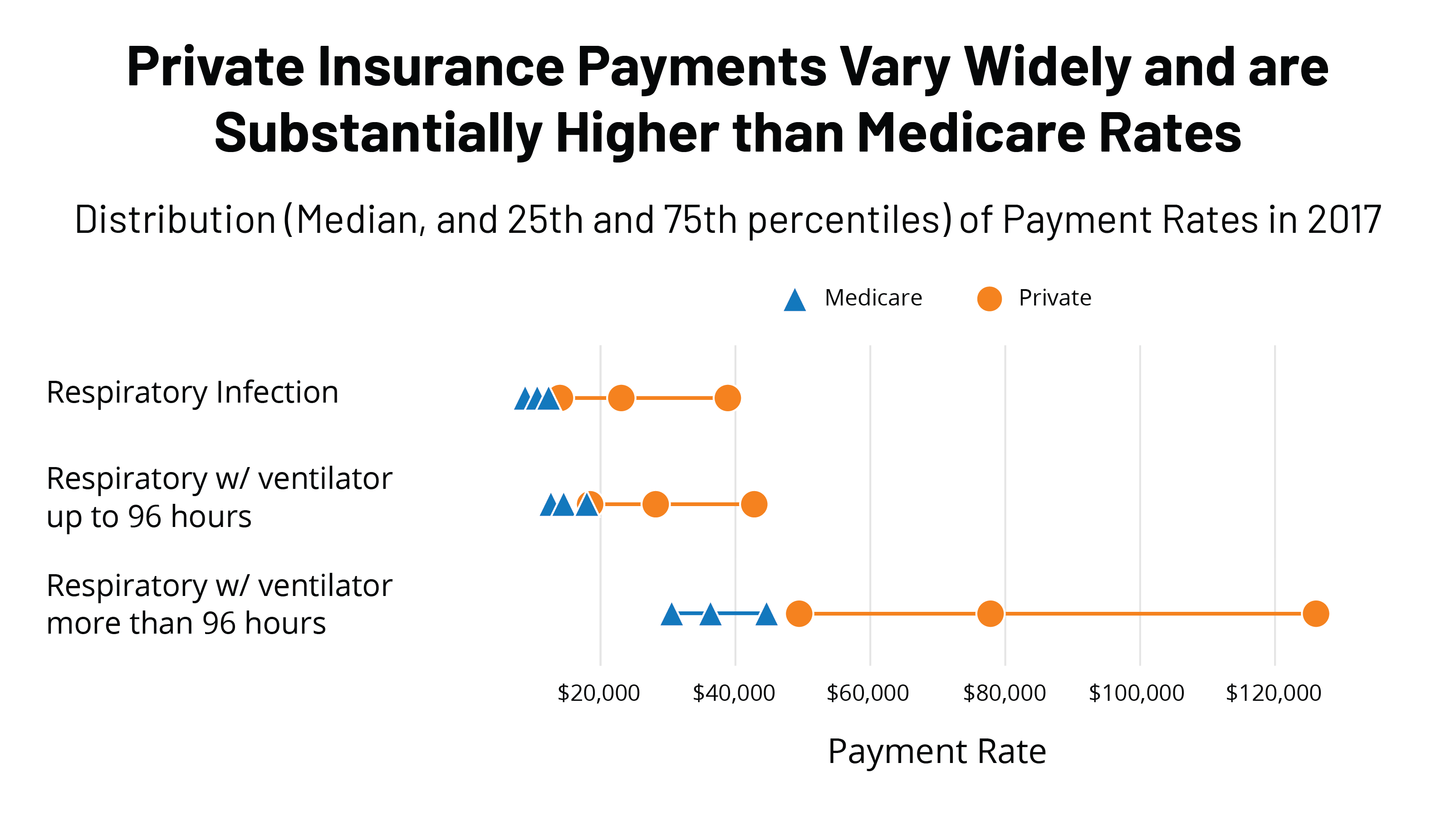

Private insurance payment rates for inpatient hospital .However, if you purchase private health insurance through your employer, the average premium is $5,969 after your employer pays their portion.

VA Health Care And Other Insurance

When weighing your options, your first .

Published March 22, 2023 | By Sharon O'Day. There are some significant differences between Medicare and private .4%) and those with individually purchased private insurance (22. A Medigap policy can help cover some of . You’ve qualified for Medicare, but is it better to keep your private insurance? Can you have both? What’s the difference in coverage between Medicare and standard private insurance? These are .Private health insurance pays for medical treatment to get you better, while critical illness pays out a lump sum to help offset any loss in income.In 2024, the standard monthly premium for Medicare Part B enrollees is $174. With Medicare, that will never be the case. The average premium for Medicare Part B is .The difference between private health insurance and Medicare is that Medicare is mostly for individual Americans 65 and older.Original Medicare vs. Private health insurance and Medicare.For your reference, Medicare monthly premiums can cost up to $170. And it can cover you from diagnosis to treatment. 5 On the other hand, the average cost of private health insurance for individuals is $456 per month. In this case, your retiree coverage is your secondary insurance.There are several differences between private health insurance vs Medicare.3%) than among individuals in the other groups (Medicare, 15. Understanding Medicare and private insurance is essential for retirees when selecting healthcare coverage. It’s not backed by the government and . It also excludes therapies such as speech pathology, osteopathy and remedial massage. But the healthcare system isn’t easy to navigate. Merril Matthews, PhD, “ Medicare’s Hidden Administrative Costs: A Comparison of Medicare and the Private Sector ” , . So yes, Medicare needs better cost controls, but it's already cheaper–and . Below is a summary of basic costs for people with Medicare. You’ll pay a monthly fee for your policy.

What are the Medicare premiums and coinsurance rates?

Medicare doesn’t cover the cost of ambulances, glasses/contact lenses or hearing aids.The government will cover all costs related to your hospital admission and you won’t be charged any out-of-pocket costs.Temps de Lecture Estimé: 9 min If you have other forms of health care coverage (like a private insurance plan, Medicare, Medicaid, or TRICARE), you can use VA health care benefits along with these plans. For most people, Part A is premium-free, while Part B has a standard monthly premium, which is .

Medicare Vs Private Health Insurance: Which Is Better?

Private insurance plans, including Medicare Advantage, tend to be restricted to a specific network.

Medicare and Retiree Insurance

When there's more .

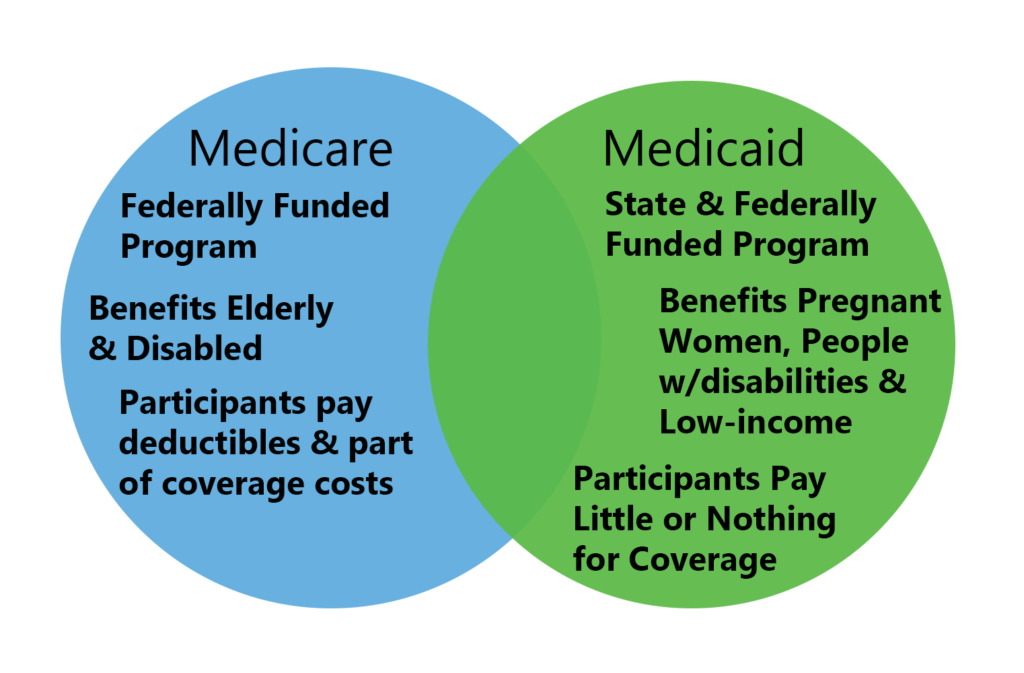

Medicare is the health insurance program for qualified Americans that’s run by the federal government.The first rule of Medicare and private insurance is an easy one: if you’ve got creditable coverage, you don't need to sign up for Medicare. If you’re covered under an employer-provided plan, COBRA, or TRICARE, you can have both Medicare and private . However, premiums are higher for individuals earning more than $103,000 per year. On the other hand, Medicaid is a government and state-run program that helps provide insurance to those with low income.

Do I Need Medicare If My Spouse Has Insurance?

Medicare is a federal health insurance program that pays the hospital and medical care for US citizens aged 65 and older.What insurance covers. Many insurers offer combined hospital and general cover. Thus, it works like a Medicare .Medicare Private Fee-for-Service Plans – In these plans, you may go to any Medicare-approved primary care doctor, specialist, or hospital that will accept the terms of the private plan's payment.When combined with employer-group insurance, Medicare is typically your primary coverage.A closer look at the data shows that, contrary to Goodman and Saving’s claims, Medicare delivers health care more efficiently than private insurers.3%; and VHA or military, 11. The study's bottom line: Medicare outperforms private sector plans in terms of patients' satisfaction with quality of care, access to care, and overall insurance ratings.Part D premium: Varies by plan; average is $34.Health and disability. Your deductibles will usually be lower and your insurance will cover more treatment options. If your employer has less than 20 employees, Medicare is generally . As more Americans continue to work beyond age 65, many have to decide whether to hold onto their employer-sponsored health plan .

How Medicare works with other insurance

While Medicare pays for much of the cost associated with healthcare services and supplies, it doesn’t pay for everything. In this section.Medicare is a federal government-run program that provides health insurance to those who have a disability or are over 65 years old.70 per month in 2024. Part A premium: Typically $0. Individuals with . Private health insurance may help to cover some health care costs that we don’t.Private health cover is divided into three areas: hospital, extras and ambulance.The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance .There’s also Medicare Supplement Insurance, or Medigap, which is additional insurance you can buy from private health insurance companies to cover certain deductibles, . Not always, but usually.

Medigap, also known as Medicare Supplement Insurance, is the simpler of the two. 2 The income requirements vary from state . Non-ACA plan options : You can learn more about Medicare Supplement, Medicare Advantage, Medicaid, and employer-based plans through private sites. Many people find they need a .50 in 2024 for basic coverage.Provided by private health insurance companies, Medigap policies are designed to fill the “gap” in Original Medicare by paying some of the healthcare costs not covered by Parts A and B. Medicare consists of Part A and Part B for hospital and medical insurance and Part C and Part D for flexibility and prescription drugs. Generally speaking, if you have Original Medicare and retiree insurance, Medicare will act as your primary insurance, paying your health care bills first. However, whether Medicare is primary or secondary to group insurance depends on a few factors, such as the size of the employer and the reason for Medicare coverage. Most people do not have to pay a premium for Medicare Part A, but those who do need to pay a premium will pay $274 or $499 per month in 2022.

Employer Insurance. Private Health Insurance At a Glance.Health insurance can help cover your medical expenses, including hospital visits, preventative care, prescription drugs, and wellness treatments.Health insurance is an insurance policy that covers the costs of private healthcare. You can use Medicare along with a private insurance plan .Reports of medical debt were more common among individuals who had employer-sponsored private insurance coverage (23. Premium for the Medicare Advantage . It also covers some people living with disabilities.Costs: Medicare Advantage Vs. It is important to realize that Medicare is not a health insurance company in itself. Anyone age 65 or older qualifies for Medicare. It can also be called private medical insurance. Sanders said, Private insurance companies in this country spend between 12 and 18 percent on administration costs. Private health insurance can fill the gaps . This will then cover all or some of the cost of any treatment that you need, as long as your treatment is covered by . private insurance, and costs. Private health coverage . Original Medicare.

Medicare Is More Efficient Than Private Insurance

VA health care and other insurance. Part B premium: Starts at $174.

VA Dental Insurance Program (VADIP) Vision care. general treatment cover for services like dental and physio.Your employer will determine whether this type of coverage is available to you.Eight studies compared private insurance and Medicare payment rates for inpatient hospital services. Both Medicare and private health insurance can help cover the costs of medically necessary and .My personal experience, (family of 4), health conditions come out of left field, and with private health insurance, you will be in a position to see a specialist within days and get things sorted quickly. There are no income requirements for Medicare.Insurance for travelers: If you’re seeking a plan that specifically provides medical coverage abroad, you may want to shop on private insurance sites.

A critical illness could be defined differently by each policy, but could include Alzheimer's or presenile dementia, cardiac arrest, deafness, loss of speech, paralysis of a limb, stroke or brain injury. I have had many family members rely on Medicare alone, and, essentially, be on waiting lists for years for health issues. We’ve even seen group insurance deductibles are high as $5,000+. The second is that group plans often have a really horrible deductible. Part A: (Hospital .Ultimately, the choice between private health insurance and Medicare depends on individual circumstances, including age, health status, healthcare . Private Health Insurance. When you enroll in a private insurance policy, you’re subject to the terms of that policy.

Medicare vs Private Insurance

There are 2 types of private health insurance: hospital cover for things like accommodation and theatre fees.Medicare is better on all counts, according to a major 2002 study by the Commonwealth Fund. Most private health insurance lets you: choose your own surgeon or other specialist. The cost of administering the Medicare program, a very popular . For a deep dive on creditable coverage, Your spouse's private insurance coverage is creditable if they work for a company with at least 20 employees. Medicare is partly funded by the Medicare levy, which is 2% of your taxable income, though some people can be exempt or pay less.