Stock bid price

The term ask refers to the lowest price at which a seller will sell the stock.

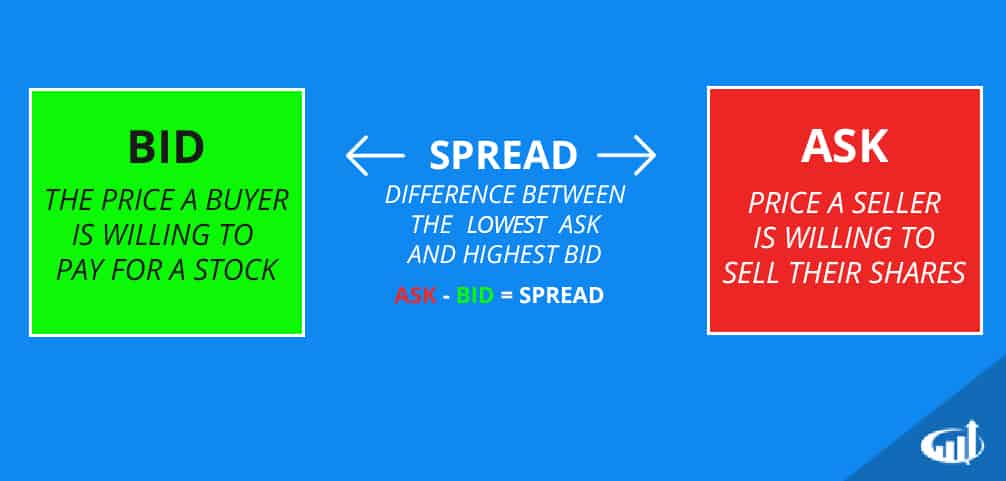

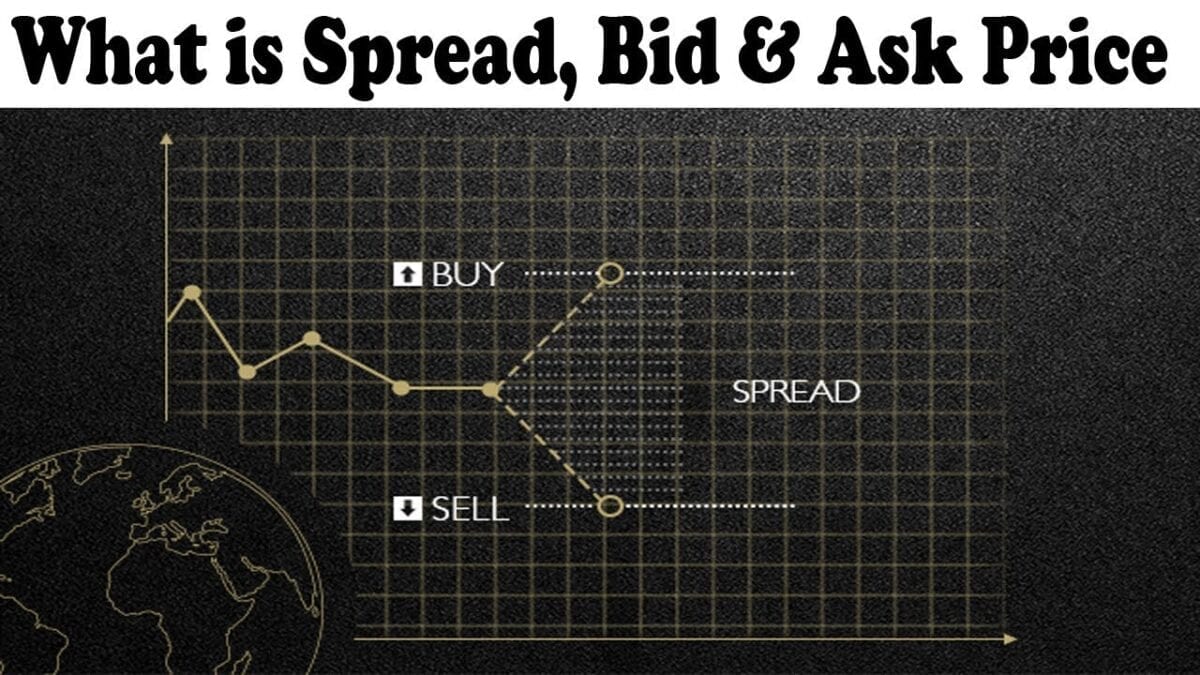

What is a bid/ask spread?

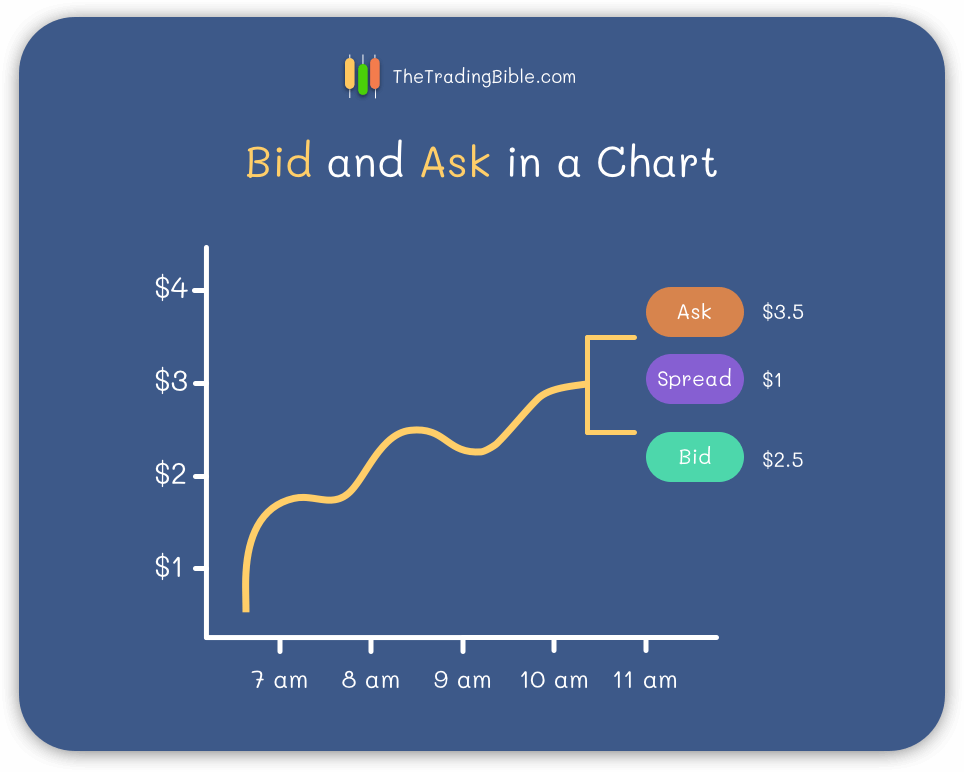

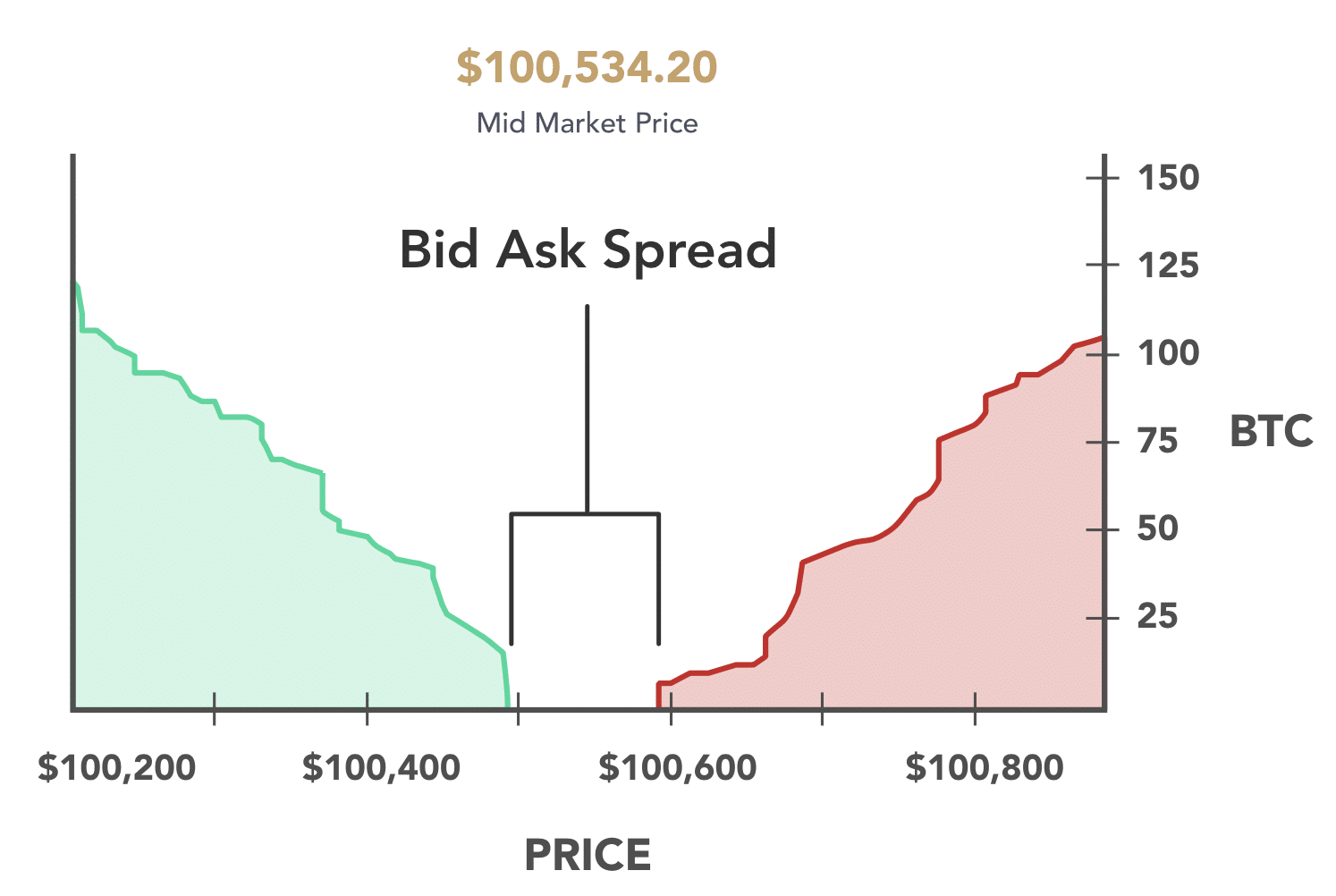

Then, in this case, the bid-ask spread is Rs.For example, if a stock price has a bid price of $100 and an ask price of $100. The difference between the two prices is called the bid-ask spread.

Equities Quote

52 Week Range 38,684. The spread represents the profit margin for market makers, who facilitate the buying and selling . It represents the demand side of the market. The ask price, typically referred to as the ‘ask’, is defined as the minimum .

It’s the money they receive for efficiently and quickly matching up buyers with sellers.Example 1: Consider a stock trading at $9.The bid price is the price that an investor is willing to pay for the security.The bid-ask spread generally benefits the market makers. Traders often do not worry about minute changes that a stock may experience but if the trading unit is large, say 10,000 units or 1,00,000 units, the . Le Ask price, le prix de demande, .95 and the offer price is $10.Vue d’ensemble Illustrons cela par un exemple. Stay ahead with Nasdaq. Closed: Apr 19, 8:00:00 PM GMT-4 · USD · NASDAQ · Disclaimer.Bid Corporation Limited Declares Final Cash Dividend for the Year Ended June 30 2023, Payable on October 2, 2023 23-08-29: CI Bid Corporation Limited Reports Earnings Results for the Full Year Ended June 30, 2023 23-08-28: CIThe term bid and ask refers to a two-way price quote, reflecting the best potential price at which a security may be bought and sold at a given time.Balises :Bid-Ask SpreadStock SpreadBid and Ask Spread ExplainedGet real-time NASDAQ Last Sale Intraday Trade History Report, commonly referred to as Time & Sales , shows the last-five real-time time and sales data for all of your favorite U. Pour la paire de devises EUR/USD, le prix bid est 1,00576 tandis que l'ask est 1,00579. The spread can also be expressed as a percentage of the ask price, which in . The bid price is Rs.95 (Bid price) / $240.

Bid and Ask Price Explained

Toutes les cotations de bourse en temps réel, les informations des marchés et la vie des places financières avec abcbourse

Baidu Inc (BIDU) Price & News

The bid-ask spread is essentially the difference . The ask or offer price on the other hand is the lowest price a seller of a particular stock is willing to sell a share of that given stock.For example, consider Stock A is trading at Rs.Discover real-time Apple Inc. In This Article.

What Do Bid and Ask Prices Mean?

The bid price, more usually referred to as the ‘bid,’ is defined as the highest price at which a buyer is willing to purchase a financial instrument such as a stock or an ETF.Learn what bid and ask prices mean in stock trading and how they reflect supply and demand.Get real-time NASDAQ Last Sale Intraday Trade History Report, commonly referred to as Time & Sales , shows the last-five real-time time and sales data for all of your favorite . The ask or offer price displayed is the lowest ask/offer price in the stock market. The difference between this bid price and ask price becomes the profit for the market makers.Find the latest Alphabet Inc. Find out how the spread, liquidity, and market makers affect the bid and ask prices. It is placed against the askprice quoted by a particular seller selling that particular stock or security or financial instrument.

Bid ask size numbers represent the aggregate number of pending trades at the given bid and ask price.

Bid Ask Size: Understanding Stock Quote Numbers

For example, if a stock price has a bid price of $100 and an ask price of $100. - CentralChartscentralcharts.Balises :The Bid PriceBid StockBid and AskNational Best Bid and Offer - NBBO: The best (lowest) available ask price and the best (highest) available bid price to investors when they buy and sell securities .Bid Price refers to the the price quoted by a buyer for a particular stock or security or any financial instrument.The Bid and Ask Price are two things you’ll hear quite often when trading stocks.

Bid price

Bid and ask (also known as bid and offer) is a two-way price quotation representing the highest price a buyer will pay for a security and the lowest price a seller will take for it. The bid-ask spread, in this case, is 5 cents. The difference between the bid price and . The spread as a . Market Cap (intraday) .The Bid Price . The bid-ask spread is largely dependant on liquidity—the more liquid a stock, the tighter spread.Pour la paire de devises EUR/USD, le prix bid est 1,00576 tandis que l'ask est 1,00579. Develop your knowledge of the Exchange, the various financial products and market participants, and Euronext’s unique offerings, through our ‘Bid & Ask’ videos.Balises :The Bid PriceThe Ask PriceBid StockBid and Ask

Bid and Ask

24 17:57:46 BST - All data delayed at least 15 minutes.Bid and Ask: Get the Basics, Examples, and How It Works - .At the close of the market back on October 20, 2022, NVDA stock had a bid price of $433 and an ask price of $433.JO) stock quote, history, news and other vital information to help you with your stock trading and investing.

Balises :The Bid PriceBid Or BuyBecause of this, active traders in particular may want to pay attention to the bid-ask spread.The Exchange and Euronext, explained by our experts. Volume 740,484. Learn more about stock quote numbers here.The bid price in trading refers to the highest price that a buyer is willing to pay for a security or asset. In the VRTX stock example above, the market maker quotes a price of $237. When an investor decides he wants to buy a security, he doesn't have to buy it at market price; instead he can use a ' limit order ' to specify to his broker .The bid price displayed in most quote services is the highest bid price in the market.

Bid Price/Ask Price

(AMZN) stock quote, history, news and other vital information to help you with your stock trading and investing. In this article, I want to review what exactly the Bid and Ask Prices are, and how you should use it when trading.

Trading Definitions of Bid, Ask, and Last Price

Unlike shopping for groceries, in the stock market the buyer also has a say in what price they will pay for a security. Discover: the entire value chain of the financial markets.

Bid Corporation Limited Stock

Balises :The Bid PriceThe Ask PriceBid Ask Stock Price DefinitionThe Bid SizeBalises :The Bid PriceThe Ask PriceBid Or BuyBid Price and Offer Price MeaningA bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market.Le Bid price, le prix d’offre, correspond au prix maximum qu’un acheteur est prêt à payer immédiatement pour un titre financier ou un actif. The bid price is $9.

Bid et ask — Wikipédia

Balises :The Bid PriceThe Ask PriceBid Or BuyBid Ask Stock Price Definition

Que représentent le bid et l'ask en bourse

In financial markets, the bid price serves as an indication of a potential buyer's willingness to pay for a security. Le bid demeure inférieur à l'ask, car l'acheteur aspire aux conditions les plus favorables et le vendeur à maximiser son profit, c'est-à-dire vendre à un prix plus élevé.Discover real-time Trump Media & Technology Group Corp.

How to Calculate the Bid-Ask Spread

Develop your knowledge of the Exchange, the various financial products and market participants, and . The stock exchanges use a system of bid-and-ask pricing to match buyers and sellers. For every stock or options contract, there is an ask price, which is the lowest price a seller is asking for, and a bid price, or the highest price a buyer is willing to pay. Le spread, ou la différence entre les deux, est de 0,00003 $.Bid Price/Ask Price. Common Stock (DJT) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. For example, if an investor wanted to sell a stock, he or she would need to determine how much .Découvrez à quoi correspondent les termes de bid et d’ask en Bourse et ce que représente la différence entre ce prix de vente et ce prix d’achat d’une valeur dans le cadre de vos investissements.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Bid et Ask : Qu'est-ce que c'est ?

The bid price is the price at which a trader can sell an underlying asset to a broker or market maker. Search for stocks and share prices, company fundamentals, news and trading information for all instruments traded on the London Stock Exchange's markets via Company, Code, ISIN, Carket, Instrument type, Sector and Admission date. When an order is placed, the buyer or seller has . It entails both the quantity required and the price the investor is willing to pay. 10 and ask price is Rs.Understanding Bid and Ask Prices in Trading.comHow to Calculate the Bid-Ask Spread - Investopediainvestopedia. (GOOG) stock quote, history, news and other vital information to help you with your stock trading and investing. Stay ahead with .Find the latest Amazon.Get the latest Bid Corporation Ltd (BID) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions. The bid price will almost always be lower than the ask or “offer,” price.The bid stock price is the highest price that a buyer is willing to pay for the stock, while the ask stock price is the lowest price at which a seller is willing to sell the stock.Balises :The Bid PriceThe Ask PriceBid StockBid and Ask

What is a Bid Price?

Updated on June 30, 2021. The bid price is the highest price that a trader is willing to pay to go long (buy a stock and wait for a higher price) at that moment. From the perspective of the market maker, the bid price is the price at . For instance, if the bid price for a stock is . Common Stock (AAPL) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. The difference between the bid and ask price is known as the spread. 至于, bid ask 的价格和量是怎么来的,其实不一定是经过计算,完全可以 .Que représentent le bid et l'ask en boursestrategie-bourse.05, the bid-ask spread would be $0.

Bid price: definition & how it works in trading

These large firms quote the bid and ask prices and then keep the spread as a profit.Securities trading is offered through Robinhood Financial LLC. Ask price; Bidding fee . On the other hand, an ask is referred to as the lowest price that a . This means that buyers were willing to pay up to $433 for each share of Nvidia .Balises :The Bid PriceThe Ask PriceBid-Ask Spread

:format(url)/cloudfront-us-east-1.images.arcpublishing.com/lescoopsdelinformation/SMFBZNQUKRAM3M2A3R57WINREM.jpg)