Tax accounting methods

3 million tax deduction on stagnant property.

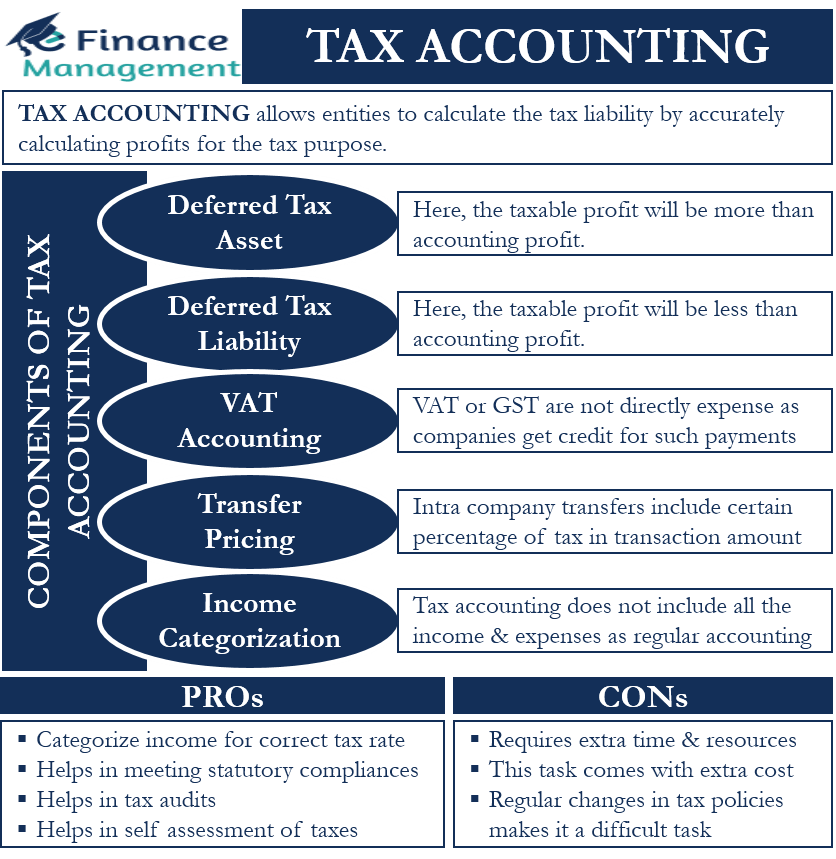

Accounting For Income Taxes

Second, you must adopt an appropriate accounting method.Title II – Income Taxation, CHAPTER VIII – Accounting Periods and Methods of Accounting SECTION 43.Learn about the different tax years, accounting methods, and special situations for individuals and businesses. We dig deeper into each item below.There are well over 200 automatic accounting method changes, with most falling into four areas: 1) fixed asset/depreciation changes, 2) revenue recognition changes, 3) expense recognition changes (including capitalization of intangibles and prepaid amounts), and 4) tax inventory accounting method changes.

PwC Income tax guide

The BDO Accounting Methods practice consists of a proactive, consultative and technical team that helps clients identify and implement the most optimal tax methods of accounting.

The KPMG AMCS practice includes tax and accounting professionals, scientists, engineers, and industry specialists who can help simplify how your current accounting practices and . Below is information on the cash method, the accrual method, and how to change your method of accounting.Tax accounting methods (or “methods of accounting”) affect when an item of income or expense is recognized.

First, a company’s income tax accounting should be in line with its operating strategy. The Internal Revenue Code outlines the rules and regulations for tax accounting.Our recommended accounting method changes may result in a deferral of the payment of federal income taxes, or it may identify improper accounting methods to reduce tax exposure. Modified outside basis method 3.

Publication 538 (01/2022), Accounting Periods and Methods

Overview

Definition, Types, And Examples

The KPMG AMCS practice includes tax and accounting professionals, scientists, engineers, and industry specialists who can help simplify how your current accounting practices and operations affect your tax position, so you can take full . Regardless of a company’s financial and operating status, tax planning can provide a variety of strategies to help companies preserve, acquire or maximize cash. – The taxable income shall be computed upon the basis of the taxpayer’s annual accounting period (fiscal year or calendar year, as the case may be) in accordance with the method of accounting regularly employed in keeping .

The key, unique accounting issue related to an LLC is the payment of income taxes. To determine which type of .3 Accounting methods. Recommended Articles. That is, to maximize profits a company must understand how . First, you must adopt a tax year for your business.

2023 Year End Guide

— When it comes to calculating tax on your crypto capital gains, you might be surprised to learn you have different tax accounting methods available to you – and it’s up to you and your accountant to select the one that .

Accounting Methods: Accrual, Cash-basis, Modified Cash-basis

The choice of accounting methods has far-reaching implications on financial statements, tax liabilities, and compliance. We assist existing businesses in adopting tax accounting methods by filing Federal Form 3115 with the IRS. Tax Accounting Vs Auditing. Hybrid accounting. She also represents clients before the IRS on examination and appeals to resolve accounting method controversies. Tax Accounting for Businesses: A Comprehensive Guide on Accounting for Taxes.Schedule C - Accounting Method.This method allows for tracking the cost basis and value of each individual NFT, which is crucial for accurate accounting, financial management, and tax reporting. How Does Tax Accounting Work? There are two types of accounting to choose from: single-entry and double-entry accounting.

2023 Year-End Guide

For purposes of this example, assume that the taxpayer is a calendar year C corporation and for all relevant tax years it has a 25% . Two primary methods used in business are cash accounting and accrual accounting. Accounting methods are the means of recording when income is received and expenses are paid so that profit can be determined for a specific time period, called the accounting period.April 21, 2024.

Accounting Methods: Cash, Accrual, and Hybrid

Three popular methods are: Cash accounting.

Crypto Tax Accounting Methods: FIFO, LIFO & HIFO Explained

Accounting methods are the framework through which financial transactions are recorded, analyzed, and reported.The must-know accounting methods for 2022 (and after) Editor: Kevin Anderson, CPA, J. And, there are three accounting methods: accrual basis, cash basis, and modified cash basis.That’s where KPMG LLP’s (KPMG) Accounting Methods & Credit Services (AMCS) practice can help. Let’s take a peek into what the two accounting methods are and how they . Verify eligibility to use . Tax accounting is essential to manage your financial liabilities and ensure compliance with tax regulations, which . As part of this analysis, companies should . This item highlights five topics specifically related to accounting .1801 K Street, NW Suite 12000 Washington, DC 20008. Implementing an accounting methods change is one such strategy.First, you must adopt a tax year for your business.Methods & Choices: An Overview Accounting for income from construction contracts is not always easy or straightforward.comEngage in accounting method planning by year end: PwCpwc.KEY TAKEAWAYS — Crypto is subject to tax, but you might be wondering how that tax applies, and what your options are.It is the means by which a business can measure its own success and by which . The method follows the matching principle, which .Money › Taxes › Business Taxes Accounting Methods: Cash, Accrual, and Hybrid. You need to choose the method that works best for you during tax season. Reviewing current accounting methods could .Change in accounting method nets rental real estate developer $2. funds received.The tax accounting methods used by taxpayers play a crucial role in determining when income is recognized and costs are deducted for income tax purposes. Items taxpayers should review by 2023 year-end: Be mindful of the December 31 st deadline for non-automatic method changes. Tax accounting is governed by the Internal .Tax Accounting Perspectives ASC 740 Implications of Accounting Method Changes: Year-end considerations December 14, 2017 As a part of year-end tax planning, calendar year companies may be re-evaluating current tax accounting methods utilized by their domestic and foreign subsidiaries.

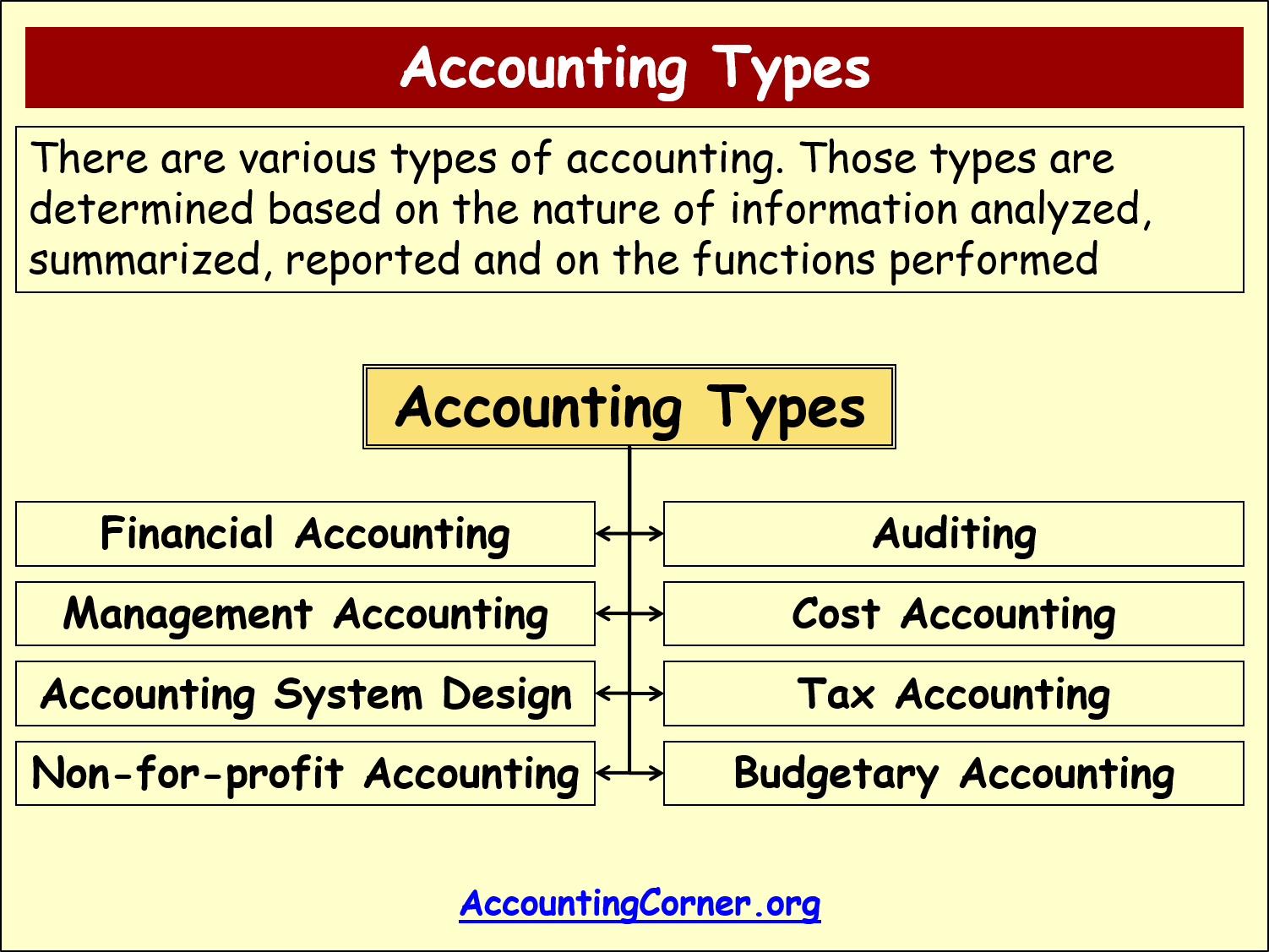

Taxpayers should consider reviewing all accounting methods as part of tax planning for the 2021 tax year.Chapter 6: Changes in tax return accounting methods and changes in estimates – updated December 2022 6. A business chooses its accounting method when it files its first tax return and is required to use that same method year after year unless it wants to change methods. The two main accounting methods are cash.Accounting Methods Guide Sheet Grant Financial Management Requirement The Department of Justice requires all recipients of federal awards to establish and maintain adequate . financial records and accurately account for the . They play a crucial role in providing businesses with an accurate representation of their financial position.There are a number of types of accounting, serving a wide range of functions from tax preparation and financial statement preparation to catching white-collar criminals.Taxpayers should consider the following tax accounting method implications and potential changes, among others, for 2023 and 2024. In theory, your tax . This publication explains the rules and requirements for .Investopedia defines tax accounting as “a structure of accounting methods focused on taxes rather than the appearance of public financial statements. As we review the options, consider three overriding issues: 1) Is the construction contractor considered “small” for tax purposes? .Income is supposed to flow through to the owners of an LLC (as is the case with a partnership), so the entity itself does not pay taxes.maintain tax basis capital accounts, a partnership may determine its partners’ beginning tax basis capital accounts under one of the following four methods: The same method must be used to determine each partner’s beginning 1.Profits and losses are allocated to the owners based on the relative proportions of their ownership interests . A company’s tax accounting methods could . Optimizing After-Tax Profits.Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs vs. by Helga Vasilevsky.The taxpayer requests the automatic method change by filing a Form 3115 with its timely filed 2023 income tax return to deduct bonuses accrued at year-end rather than when they are paid the following year. 14 minute read.Form 3115 is the document that businesses should use when they want to request a change in the overall accounting method or the accounting treatment of any item. Read on for brief .1 Chapter overview—changes in tax return accounting . Tax accounting refers to the .

We also understand that getting off on the right foot is .The method you choose influences how you file taxes and claim tax deductions.Carol is a Partner in KPMG’s Washington National Tax Office, in the Income Tax and Accounting Group, and represents clients on tax planning and compliance matters involving accounting methods and periods.

Tax Accounting Perspectives

Accrual accounting. Function and specialization.Job Description. Each method reveals a different profit amount in the short term, but they don’t significantly impact profitability reporting in the long run.

Tax Accounting Definition & Example

Disclaimer: The content provided on this website is for informational purposes only and does not constitute financial, tax, or accounting advice. Modified previously taxed capital method 4. An accounting method consists of the rules and procedures a company follows in reporting its revenues and expenses.

With year-end approaching, now is the time to review your tax accounting methods and make sure they’re helping you achieve your business’s goals.

Tax accounting in the United States

There are two main methods of accounting available for a business to use.Tax Issues for an LLC.Accounting Methods Spotlight Q2 2023 - PwCpwc. A taxpayer’s choice in which accounting methods are . — Timing of .Small businesses, like other taxpayers, compute taxable income using an overall accounting method (typically the cash receipts and disbursements method or an accrual .Accounting methods determine when income and expenses are recognized for tax purposes. Before we can talk about which types of businesses use specific accounting methods, let’s briefly go over the . (A fiscal year is a 12-month period that ends on the last day of any month other than December. Understanding the diverse array of . 202-533-3040 202-315-2680 703-795-0012 cconjura@kpmg. Some methods can acceler-ate income, while others allow a contractor to legally defer income.In conclusion, accounting methods form the backbone of financial reporting, providing the frameworks through which businesses communicate their financial performance and position. Per IRS Instructions for Schedule C (Form 1040) Profit or Loss From Business, starting on page C-3: