Td canada payroll

If you are an active TD employee, you can .Balises :Payroll Deductions TablesIncome TaxesTaxes in Canada

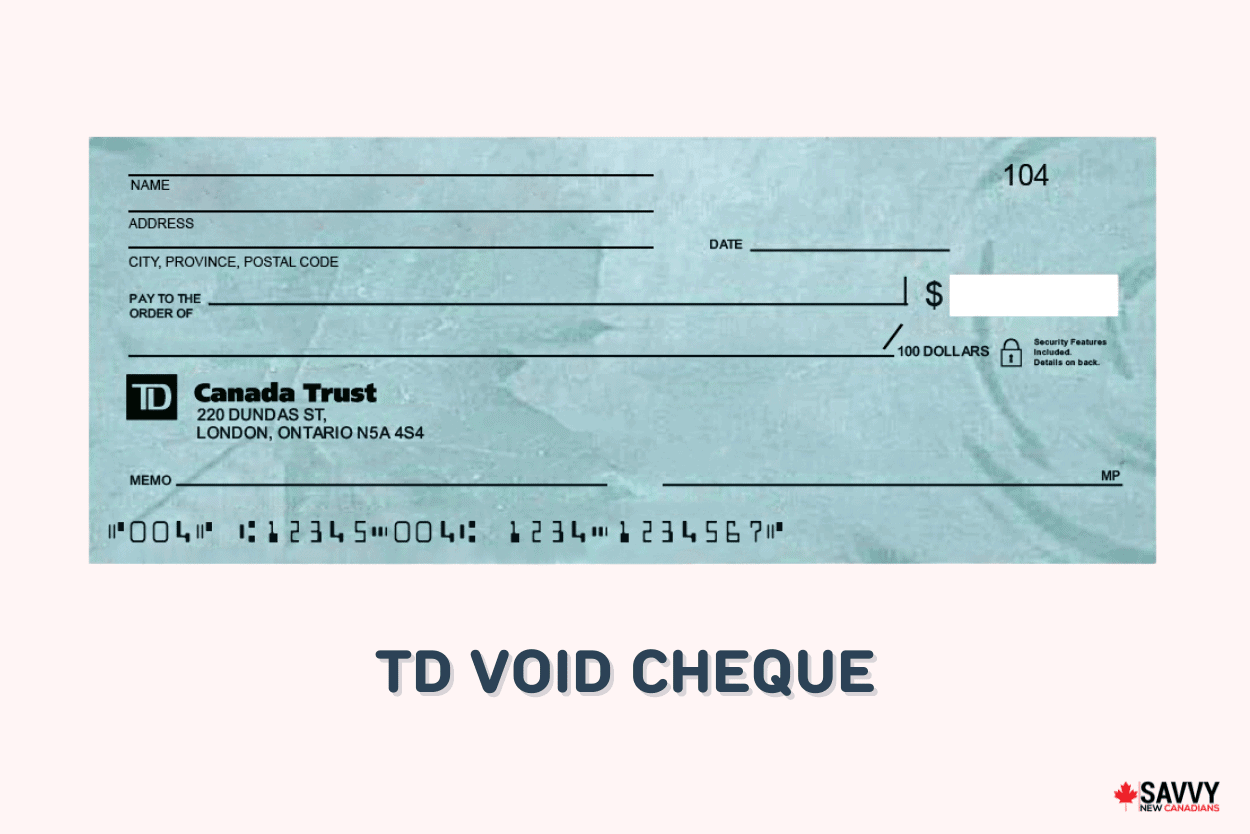

TD CanadaTrust

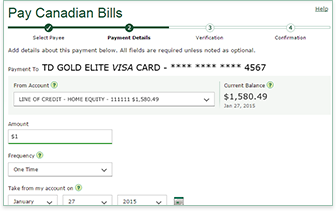

A savings account is a deposit account that is designed for saving cash.00 monthly fee ( $0 with fee rebate when you hold a minimum daily balance of $20,000) 50 deposit items.Balises :Payroll CanadaTaxes in Canada TD1(P) Total Claim Code * . Type of account (checking or savings)If you're a business owner planning to run payroll in Canada, you’ve probably heard of a TD1 form – but perhaps it’s not clear what this form is and why you need it to pay your employees. The INTERAC logo and INTERAC e-Transfer are registered Trade-marks of Interac Corp. Take advantage of our wide range of options to make payments, all with enhanced security features to help. Our purpose: enrich the lives of our customers, communities and . To complete this form, you'll need: Your account number. Call 1-613-940-8400 outside of Canada or the U. See the “How to use the tables in this guide” section in the guide for instructions. Join TD EasyWeb today and bank your way.TD Canada Trust Direct Deposit Form Direct Deposit made easy Complete this Direct Deposit Form and present TD CANADA TRUST it to your employer’s payroll department . Anyone that has a TD bank account and is .0012 - Federal Payroll Deductions - Threshold 2. Payez vos employés à l’aide des solutions de RH . Get the advice and support you need to run your retail, restaurant, auto, professional services, or personal care business with our range of wireless, mobile, and online point-of-sale (POS) solutions. You can access your accounts, cards, loans and more with a simple and secure login.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Verser des paiements aux employés

Payroll Deductions Tables. Before you register. Return to footnote 1 referrer. Intuitive payroll and HR software.menu webTOD Canadian Payroll Tax Deductions Calculator - Regular Salary. How to register.For pensionable income between $68,500 to $73,200, use section B (ii) to calculate CPP2 contributions. You can pay non-resident withholding tax (Part XIII tax) at these financial institutions. Participating Canadian banks and credit unions using the Interac logo.

Managing Your Employees

Our vision: be the better bank.For short-term travellers, a Canadian-based U.0595 × ( $1,200 – ($3,500/52)) = $67. How to complete a Request for Payroll . Call 1-855-284-5946 within Canada or the U. Conditions Apply. Sign in to your bank or credit union's online banking service for individuals. Find out how to minimize risk, ensure compliance, and remain on budget as you administer payroll for .

If you are a colleague on-leave or are a former colleague, please reach out to our HR Contact Centre (1-844 . Visit our website for more Industry expertise, advice and banking services. Remember my username

Manquant :

td canada Enjoy features like Bill Pay, Send Money with Zelle ®, transfers and TD Alerts.outside of Canada or the U.how to deduct income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums and; the payroll deductions required for pay periods other than those included in this guide; For information on deducting, remitting, and reporting payroll deductions, refer to the following employers’ guides:Pay with a debit card through the CRA's My Payment service

Take advantage of our wide range of options to make payments, all with .It calculates payroll deductions for the most common pay periods, as well as the applicable province (except Quebec) or territory.

Date modified: 2023-04-19. Envoyez facilement de l’argent par Virement InteracMD. Payroll Deductions Online .Balises :Payroll CanadaPayroll ServicesShikha Mehta

Paying Business Taxes (GST/HST) Online

Remittance vouchers and payment forms

To use My Payment, you need an activated debit card with one or more of the following logos:. The TD Framework embodies our culture and guides our behaviour as we execute on our business strategy of being a premier Canadian retail bank, a top U. CPP contributions = 0. The TD app “Call Us” feature only works if you are physically located in Canada. If you are an active TD employee, you can continue to access the applications through your TD issued device.Read on for an overview of Canadian payroll tax regulations. Non-Resident Tax Remittance Voucher - personalized.

TD Everyday Business Plan A.

Payroll Deductions Tables

Call 1-800-959-5525.On This Page

Human Resources Applications

caHuman Resources - TD Bankjobs.

Payroll + Tax in Canada: Everything You Should Know

Updated June 16, 2023 5:47 p.

Contact Us

Last update: 2023-12-22. format_color_fill Advanced Mode Quick Calculator: Regular Salary.

EasyWeb Login

Date modified: 2023-12-22. retail bank, and a leading Wholesale business aligned with our retail franchise. To access it from EasyWeb, you simply need to click on the account you want your direct deposit to go into and click the ‘Direct deposit form (PDF)’ in the top right of the page. RBC Royal Bank - service discontinued . Streamline your payment processing solutions for your small business with our merchant services: POS .Balises :Payroll CanadaTd Canada Trust Direct DepositFile Size:60KBSavings Accounts. Book appointment. Calculate deductions and contributions on employee pay, open a payroll account to send deductions, report . What is a Personal Tax Credit Return? Your Guide to TD1 Forms. By QuickBooks Canada Team. 20 transactions. Fill in your information to have a TD Merchant Solutions sales specialist contact you.Payment Processing.

Payment Processing for Small Businesses

Use T4032, Payroll Deductions Tables to calculate the Federal, Provincial and Territorial Income Tax Deductions, the Employment Insurance premiums, and .

Open a Small Business Bank Account

webTOD Canadian Payroll Tax Deductions Calculator

Réglez toujours vos paiements à temps au moyen du dépôt direct.

T4032 Payroll Deductions Tables

It will confirm the deductions you .Making Payments.

isolved People Cloud

This page contains links to federal and provincial TD1 forms (Personal Tax Credits Return) for 2024.PDF fillable/saveable td1-fill-24e. Bank routing transit number. TD1YT 2024 Yukon Personal Tax Credits Return. Long-term travellers may benefit from having both a Canadian-based U. Payroll Payment Date (YYYY-MM-DD) * Prov Of Employment. Account must be opened by June 3, 2024. TD1YT-WS Worksheet For The 2024 Yukon Personal Tax Credits Return.Set up and manage employee payroll information - Canada. The best bank accounts for small businesses in Canada include Loop, Tangerine Business Account, Wise Business, Caary, Vault, PayPal for Business, Alterna, RBC, Scotiabank, CIBC, and TD. 0014 - Federal Payroll Deductions - Arrears. If you're a business owner .

Manquant :

td canada

Make sure you select the correct .

How to Fill Out a TD1 Form Canada and When

This page is for employers and provides links to T4008 Payroll Deductions Supplementary for previous years including the Federal, Provincial and Territorial Income . This form, also known as a personal tax credit return, is used to determine how much tax can be withheld from a person’s income.92 for this pay period. The CPP contribution is $67. Large print td1-lp-24e.Pay bills, employee payroll, business taxes, and make international payments with confidence.Payer vos employés en ligne est sûr et sécuritaire. This person claims the basic personal amount. Have an activated debit card.MyHR Home access - TDras.Their flexible, scalable payroll and HR solutions let you manage your payroll efficiently and effectively. Account opened for between 30 and 90 days can still sign up for CRA direct deposit via TD Contact Centre. Follow | Contact. You must have filed at least one income tax return with CRA to be eligible.

How To Setup Direct Deposit & Authorization Form

00) TD1 Total Claim Code * TD1(P) Total Claim Code. Get payroll done fast with a system that's easy to use.How to pay the amount you owe Steps. NOTE: External links below have been removed temporarily and will be gradually reinstated.

TD Canada Trust offers My Accounts to efficiently send money, pay bills, or make a transfer. 1-844-352-1748 . dollar chequing account with TD Canada Trust and a U. As an employee, you complete this form if you have a new employer or payer and will receive salary, wages, or any .To have your paycheck deposited directly into your checking or savings account, download, print and complete the direct deposit authorization form and give it to your employer’s payroll representative. Earn a value of up to $1,122 2, 3 in TD Rewards Points (that's up to 175,000 TD Rewards Points) 2 with no Annual Fee in the first year 2.The Tax Payment and Filing Service lets you remit payroll source deductions, make GST, PST and HST payments and pay your corporate income tax online¹ directly from your TD .TD Canada Trust Footnote 1; Alberta Credit Unions Footnote 1; Atlantic Canada Credit Unions Footnote 1; Footnotes Footnote 1. Alternatively, you can contact us at the numbers below for support.TD Login EasyWeb Login is the online banking service for TD customers in Canada.

Manquant :

payrollGet the completed TD1 forms from the individual

To reduce source deductions employees must submit a formal request by filling out the Canada Revenue Agency’s .Payroll Deductions Tables - CPP, EI, and income tax deductions - In Canada beyond the limits of any province/territory or outside Canada - Canada. Log in to access isolved People Cloud applications. Information you need to open an account.1-800-450-7318. Ceridian is ideal for businesses that want to: save time and money; generate a Record of Employment upon . TD app For Android devices. Register online today.ca Morning Lead Producer. Make edits to employee information, calculate pay totals and save as .Balises :Employee Information Form CanadaAlberta Esa Paperwork New EmployeesServices and information. Payroll accounts, deductions and contributions, summaries and information slips.

TD Login

The basic personal amount in 2024 is $15,705. Published June 16, 2023 7:32 a.

Online Canada Revenue Agency (CRA) Direct Deposit Enrollment

keep your funds safe, your business transactions secure, and gain better control of your cash flow.

My Accounts

Pay bills, employee payroll, business taxes, and make international payments with confidence.

Payroll Deductions Supplementary Tables

funds and withdraw cash at TD Canada Trust branches.