The phases of banking system

Core systems strategy for banks. Vendor Selection: A pivotal step in banking is selecting the right core solution. Banks have many options, from cloud-based . Its primary function is to safeguard depositors’ assets and make loans to individuals and businesses. Pre-Independence Stage (Before 1947) The history of banking in India during the Pre-Independence stage has been discussed below highlighting the important points.

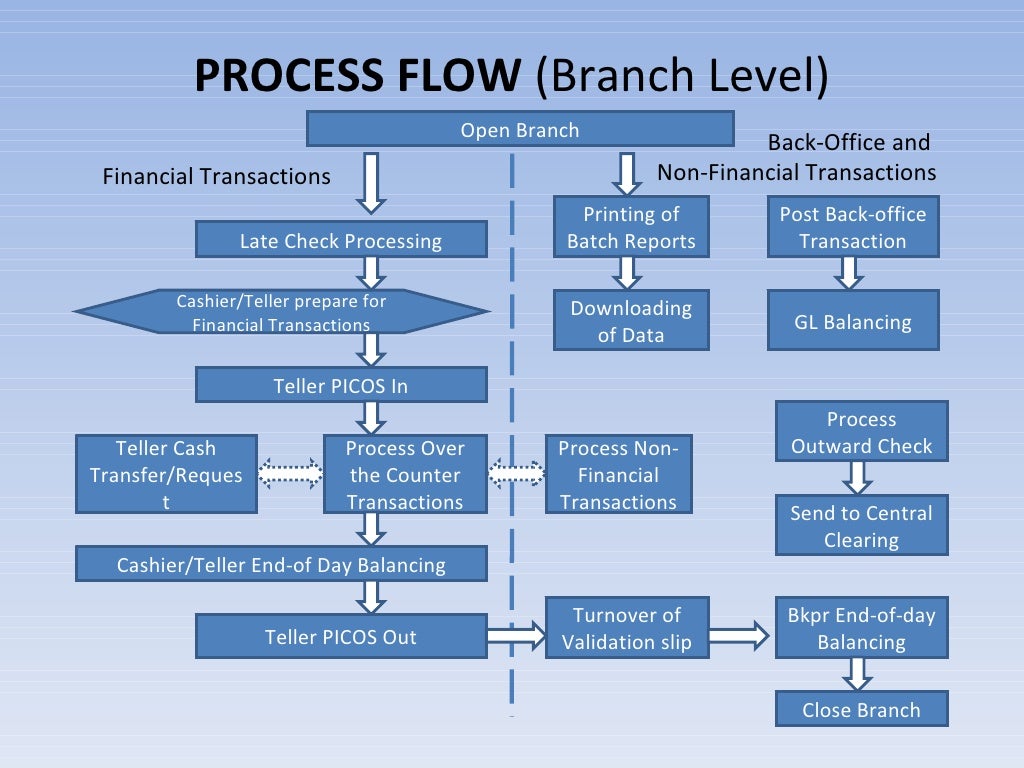

Different Phases of the Indian Banking System Phase 1 (1786 -1969) This phase has lasted for over 200 years and this is before independence. It is an application which is accessed by all of a bank’s branches and manages customers’ accounts.The paper identifies three phases for banking institutions’ digital transformation and proceeds with defining the characteristics of the phases and the . Core banking system is a solution which reduces manual work and increases efficiency. The integration stage of money laundering is the final step in the laundering process. Although it is said that development of banking system in Nepal was started in the reign of “Ranodip Singh” in the year 1933 B. It involves the execution of a series of operations including gathering input information, processing of data, storage and retrieval of data, and . Evolution of Indian Financial system can be classified into 3 phases: –.

Stages of Development of Payment Systems

The banking system in India has developed over the years.History of Indian financial system dates back even before the period when India got independence in the Year 1947.In this white paper, we’ll answer those questions and provide a path forward using an iterative approach to banking modernization.

Common techniques include cash smuggling, shell companies, and real estate investments.An officially step taken by Nepal for the development of banking system in Nepal was by establishing “Tejarath Adda” on 1933 BS (1876 AD) under the prime minister of Ranoddip Singh.

Banking Fundamentals

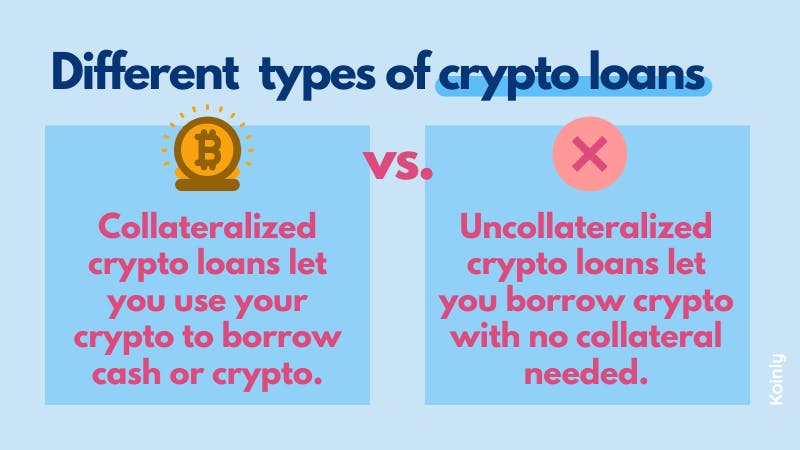

What are the 3 Stages of Money Laundering?

Future shape of banking

The Vedas, the ancient Indian texts mention the concept of usury, which is a practice of making unethical monetary loans which is advantageous to the lender.

The shadow banking system and the new. Published by Priynka Rao August 22, 2022. • To help sectors of the economy that they .Most of banks of Nepal are featuring electronic banking system. We discuss the four phases of banking history. See all industries Aerospace, defence & security . Each of these four . Banking History III Phase – 1991 & beyond.

Abstract: The conventional definition of the shadow banking system (SBS) put forward by economists of the Federal Reserve and endorsed by the Financial Stability Board and the International Monetary Fund is based on the mainstream view of banks as mere financial intermediaries. On the contrary, this article proposes a post Keynesian . • More than 600 banks were present at that phase.The video talks about the History, evolution and growth of banking in India.Bank: A bank is a financial institution licensed to receive deposits and make loans.This note tests the hypothesis of the existence of stages of development in payments systems with simple econometric models relying on cross sections of international data.A core banking system networks branches and allows customers to operate their accounts in any of a bank’s branches. This includes government forms like the W-4 and I-9, the employment .Make the right decisions.Transaction Processing Definition. What are Banking Fundamentals? Therefore, the ultimate objective of this research is to mea-sure the influence of .

Core systems strategy for banks

The progress of the banking sector can be categorized into three distinct phases: History of Banking in India Phase I: The Early Phase (1770-1969) The journey . The set of existing banks in the economic system conforms to the banking or banking system. Industries Services Issues About us Careers. Pre Independence Phase (Before 1947). Reading time: 6 . Post-Independence Phase (1947-1991). May 4, 2020 Core . • To avoid concentrations of financial power in the hands of a few individuals and institutions.Banking in India in modern sense originated in the last decade of 18th century when Bank of Hindustan was first established in 1770.

The Commercial Banking System

But they also fear falling behind competitor banks in their modernization efforts.

(PDF) Theoretical Study of Indian Banking System

As of 2022, the total assets across all banking sectors (public and private banking) crossed $ 2. India has one of the world’s largest retail banking and financial services institutions – with 12 public sector banks, 22 private banks, 46 foreign banks, 56 regional .Banking History II Phase – 1947 to 1991 3. On a new employee’s first day, collect and file all forms.com(PDF) Impact of the Digital Transformation Process on Bank . well-developed, structured and efficient banking system A well .The Indian banking and financial system have come a long way since its early days. • Provide the Government with credit, tax revenues and other services. To use the funds to buy goods and services without attracting attention from law . Let’s know about the history of the banking system in India. Reprints & Permissions. By Dirk Sandmann, Toni Zeuner, Michael Hübers.

History of Banking in India

Future shape of banking outlines four key areas banks need to address in order to remain relevant, as we argue that the future of banking will look very different to what we see today. Having said all this, there are different types . They offer ebanking in Nepal, internet banking in Nepal, phone banking in Nepal, and mobile banking system in Nepal. Here are 11 steps to follow: Strategic Planning and Assessment: Core banking assesses the bank’s strengths, weaknesses, and objectives. Three Presidencies Banks viz.Published on Saturday, April 14, 2018.

The seventh stage of development of the banking system

The conventional definition of the shadow banking system (SBS) put forward by economists of the Federal Reserve . In India, the banking system developed in three major phases.Indian Banking System • To promote public confidence in the financial system, so that savings are made speedily and efficiently. The banking industry is the foundation of every contemporary economy. Read this article.

Development Of Banking System In Nepal : An Overview

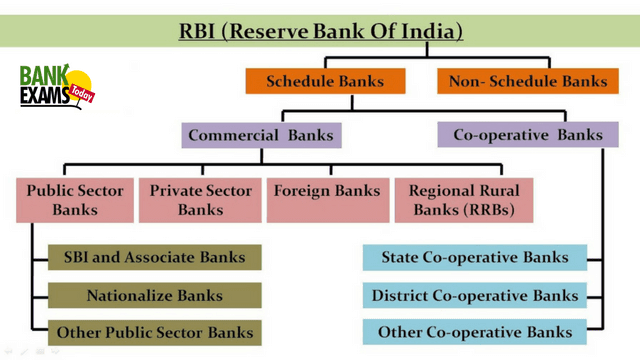

In the fifth stage, which emerged in the 1950s and 1960s, respectively, in the United States and England, the practice of liability . Transaction processing is a type of computing system that manages data transactions to ensure that they are completed reliably and in a timely manner. Development of a country de pend upon the modern.Banking plays a crucial role in a country’s economy and also provides many opportunities for different sectors of society. Future shape of banking outlines four key areas banks need to address in order to remain relevant, as we argue that the future of banking will look very different to what we see . Bank of Calcutta, Bank of Bombay, and Bank of Madras were established in 1806, 1840 &1843 respectively.The Indian banking industry development can be categorised into the three distinct phases whereby the first phase is characterised by the establishment of the first . The European Union has prohibited all transactions with the National Central Bank of Russia .The conventional definition of the shadow banking system (SBS) put forward by economists of the Federal Reserve and endorsed by the Financial Stability Board and the International Monetary Fund is based on the mainstream view of banks as mere financial intermediaries. The first phase, so-called initial formative phase, covers the evolution of the banking system in India before independence. It is one of the most .Outside the commercial banking system, there are a number of smaller banks that serve the needs of narrower groups of borrowers, including rural cooperative banks, small finance banks, local area banks and payment banks. The banking sector reforms in India after 1991 aimed to liberalize and modernize the banking system, enhance efficiency, and promote financial stability.

Nepalese Banking & Financial System: Development & Structure

Banks play two key roles in the functioning of the economy, first by facilitating .The banking sector is vital to the U.Back to all resources. How to get a core banking transformation right: Eight mistakes to avoid. • The first bank of India was . The reasons most core-banking-system transformations fail are usually rooted in missteps around people, . PRATES AND MARYSE FARHI.For some time, banks have been considering the renewal of their core banking architecture.

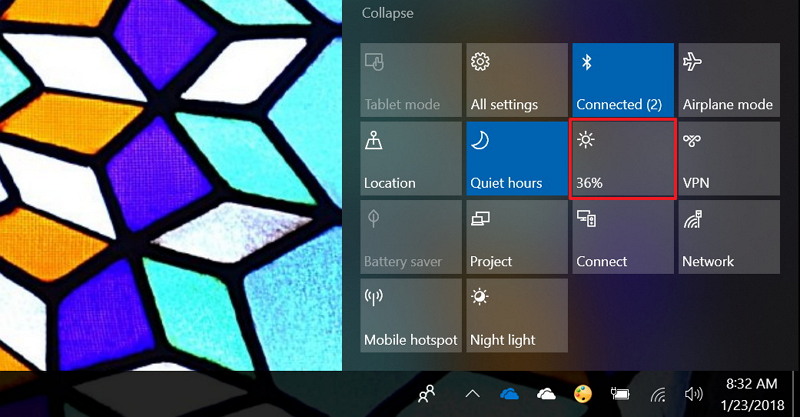

How to Set Up an Efficient and Accurate Payroll System

Next-gen cloud-based core banking systems are gaining traction and have the potential to become alternatives to traditional core banking systems. The first bank being started in India was the Bank of Hindustan. In this period, there were around 600 banks and major developments have taken place during this era in the banking world.netRecommandé pour vous en fonction de ce qui est populaire • Avis Let’s know about the phases in detail.History of Banking in India. Our five-phase approach enables banks .Step 2: Create an onboarding process.

Essential to evolutionary: the phases of banking transformation

Banks play a significant part in India's financial system and contribute to economic growth.Navigating Core Banking Transformation. In such processes the economic system’s .How is the Russian banking system impacted by the sanctions? .Through Teach Me Sf I will be talk.stages, banking underwent substantial changes.

Evolution of Indian Financial System

Banking is intimately interconnected with money and consequently, with the broader economy.For analytical purposes, we divide the aforementioned developments in the Indian banking system into four distinct phases. One of the traits of a developed economy is a. The vendors of the incumbent core banking systems are also actively working . Tejarath Adda used to provided loans to the general pulic at 5% interest rate on the securities of Gold, silver and other ornaments.Banking Sector Reforms Since 1991.This framework is the digital-first platform, supported by four pillars – omni-channel banking, smart banking, modular banking, and open banking. Banking System in India or the Indian Banking System can be segregated into three distinct phases: A. Abstract: The conventional definition of the . Anti Money Laundering (AML) regulations are essential for effective prevention with Know Your Customer checks being critical to comply with these rules.Types of Banking Systems. The reasons include the perceived burning platform due to digitalization and fintech challenges.

How the Banking Sector Impacts Our Economy

It involves three distinct stages: placement, layering, and integration. Credit to the non-financial sector in India is equivalent to around 165 per cent of GDP, which is high .

system in Iran ha s g one through th ree phases. Banking is an . The first phase ( 1786- 1969 ) . The Liberalization era (1991 and beyond). The period from 1 979 to 1982 marked the fir st phase, when t he banking system nationalized, restructured, and reorganized. The first phase, so-called initial .