Types of corporate mergers

Access to Capital.Types of Mergers: Horizontal, Vertical, and Conglomerate Explained - Stock Market Prep. The role of each type of firm is to help successfully seal a deal for its clients, but they do differ in their approach and .

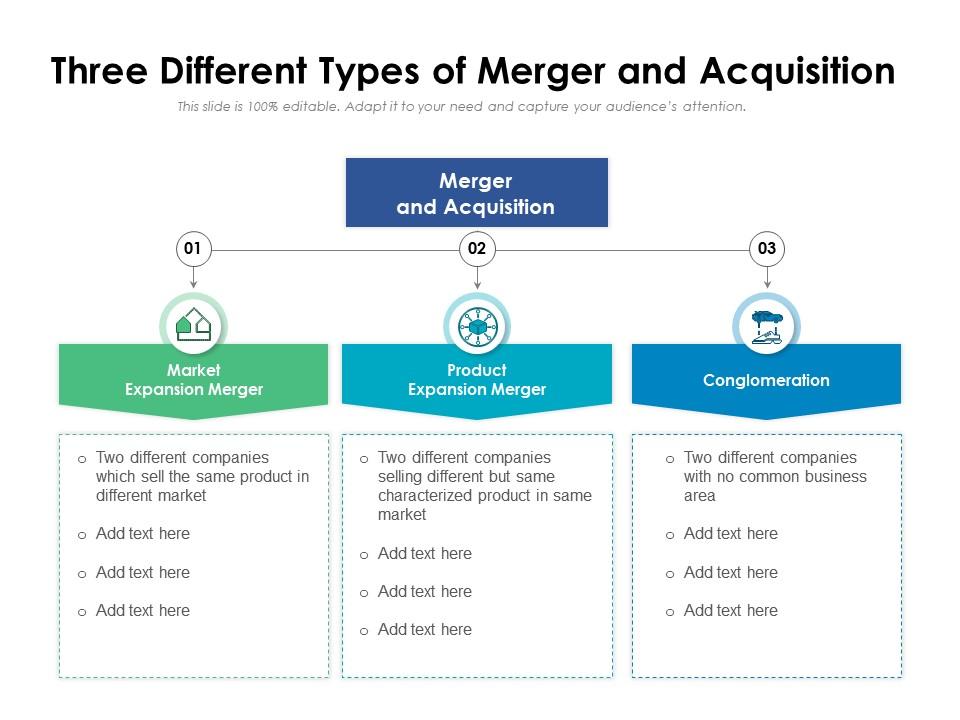

Types of Mergers and Acquisitions (M&A) The following lists the different types of mergers and acquisitions: Merger.The main types of mergers are horizontal mergers, vertical mergers, congeneric mergers, conglomerate mergers, reverse mergers, accretive mergers, . The term chosen to describe the merger depends on the economic function, purpose of the . Mergers and Acquisitions. A merger is when two or more . In a merger-type of reorganization, a subsidiary corporation is absorbed into a parent company, following any applicable state law or merger statute.In simple mathematical terms, synergies make 2 + 2 = 5. Congeneric/Product extension merger. These terms are sometimes used .The five major types of mergers are conglomerate, congeneric, market extension, horizontal, and vertical. Table of Contents. Lawyers involved in M&A face challenges on many fronts, beginning with the complex nature of legal and compliance requirements. Horizontal Acquisition. A merger and acquisition (M&A) case represents a challenging environment from a lawyer’s perspective.And when executed well, merging with the right partner can help take your business to exciting new heights.comA blueprint for M&A success | McKinseymckinsey.Each type of merger serves a distinct purpose.net

5 Types of Mergers and Acquisitions with Examples

Market-extension or product-extension . In this guide, we’ll outline the acquisition process from start to finish, describe the various types of acquisitions (strategic vs. In essence, other corporate entities are integrated into an existing entity.There are commonly five types of mergers, which are.But this merger was much more than a simple combination of businesses: under the leadership of the new CEO, Daniel Vasella, Ciba-Geigy and Sandoz were transformed into an entirely new company. There are several different types of synergies: cost synergies, revenue synergies, and financial synergies.

Merger

Triangular merger.

Mergers and Acquisitions: Understanding Takeovers

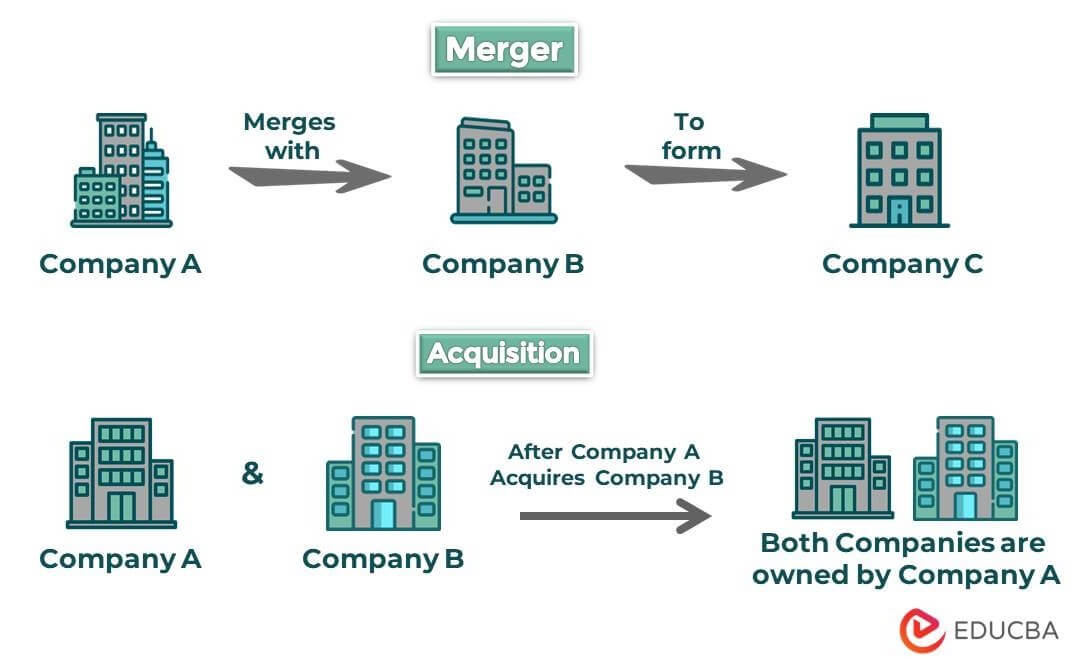

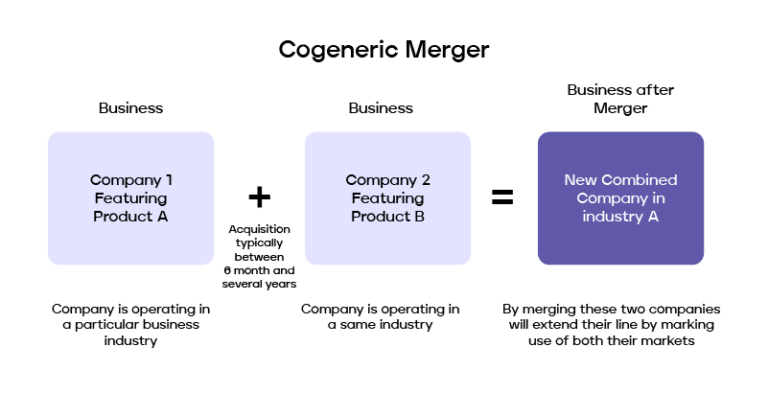

A company merger occurs when two firms come together to form a new company with one combined stock. Congeneric merger. In this type of merger, companies operating in a similar line of industries but offering different products, generally, complementary in nature, tend to merge as a strategic measure to increase the profitability of both the companies. A merger can be defined as the collaboration of two or more companies to form a new company in an expanded form. Market-extension or product-extension merger.Understanding the types of mergers and acquisitions is important, as their global value may reach $2.Different Types of Mergers & Acquisitions 1.comRecommandé pour vous en fonction de ce qui est populaire • AvisA vertical merger occurs when two or more firms, operating at different levels within an industry's supply chain. How a Merger Works. In an acquisition, one company purchases another outright. Conglomerate Merger – A merger between companies that operate in various industries. Types of Mergers.

What is merger with example? Merger Examples Mergers can occur within all industries and between companies of all sizes.What is Merger and Acquisition? Mergers and acquisitions are the most popular means of corporate restructuring or business combinations in comparison to amalgamation, takeovers, spin-offs, leverage buy-outs, buy-back of shares, capital re-organization, sale of business units and assets, etc. When two businesses come together to form a new company, a merger occurs.Corporate reorganizations can be complicated; finding legal help doesn’t have to be. Conglomerate merger. Using the merger as a catalyst for change, Vasella and his management team not only captured $1. Conglomeration . Horizontal Merger – When a merger takes place between two companies, who engage in the same activity will be considered as a horizontal merger. A horizontal merger is when two companies who sell the same product or cater to the same demographic come together to .4 billion in cost synergies but .

Mergers and acquisitions

This company is the result of a merger between Anheuser . Bringing companies together via M&As has the potential to transform industries.wallstreetmojo. Synergies are the source of value creation in M&A; however, it’s possible for companies to experience value-destructive dis-synergies.A hostile takeover is an unfriendly takeover attempt by a company or raider that is strongly resisted by the management and the board of directors of the target firm.The various types of mergers include horizontal, vertical, congeneric, and conglomerate mergers, as well as market extension and product extension mergers.Challenges in Mergers and Acquisitions (M&A): Corporate Lawyers perspective. Vertical merger.

Mergers and acquisitions (M&A) refer to transactions involving two companies that combine in some form.

The six types of successful acquisitions

wallstreetprep. financial buys), discuss the importance of synergies (hard and soft synergies), and identify . The merger results in the addition of a . These types of .

What are the Different Types of Corporate Mergers?

Congeneric mergers.consuming and lengthy. Cash Merger – When a shareholder gets cash instead of a share at .3 Co-generic Merger.There are five basic types of mergers: horizontal, vertical, market-extension, product-extension, and conglomerate, each serving different purposes and involving companies in distinct relationships. The increase in value is due to synergies.7 types of Merger and Acquisition.Types of mergers.The core goal of corporate law and governance is to improve outcomes for participants in businesses organized as corporations, and for society, relative to what could be achieved through contract, property, and other less “regulatory” bodies of law. What are the types of corporate law? The types of corporate law include corporate governance, mergers and acquisitions, securities law, contract law, employment law, intellectual property law, and tax law. Now, let's explore the six main categories of mergers and their unique characteristics in-depth: Horizontal Mergers. Some prominent examples of mergers include: Anheuser-Busch InBev. The terms mergers and acquisitions are often used interchangeably, but they differ in meaning.

A merger is the voluntary fusion of.

5 Types of Company Mergers

Types of Mergers: Horizontal, Vertical, and Conglomerate Explained

Types of Mergers and Acquisitions (M&A)

Let's explore this complex topic.

6 Types of Mergers

Mergers & Acquisitions Strategies and Advisory

There are five commonly-referred to types of business combinations known as mergers: conglomerate merger, horizontal merger, market extension merger, vertical merger and product extension merger. Statutory merger. Leave a Comment / Investor / By S.

What Merger and Acquisition (M&A) Firms Do

Mergers and acquisitions, often shortened to M&A, is an umbrella term that is applied to many types of corporate consolidations.This type of merger allows the companies to group together their products or services and access a larger set of consumers.

Definition, Types, and Examples

The most common types of mergers/acquisitions are horizontal, vertical, conglomerate, concentric, and reverse. A type of merger where two companies are in the same or related industries but do not offer the same products. Corporate restructuring refers to the . With a concentric merger, a company merges with another company that sells products or services to the same customers. A merger is a corporate strategy of combining two separate business entities of roughly the same size into a single company to increase their .Different Types of Mergers & Acquisitions . 60-101 (2004) (analyzing such transactions). Although a merger is typically thought of as an equal split in which each side maintains 50 . The corporate form creates a simple, and often vastly simpler, alternative: a buyer can purchase all of the stock (and thus control) of the corporation that 4 Julie Wulf, Do CEOs in Mergers Trade Power for Premium? Evidence from “Mergers of Equals,” 20 J. If you’re thinking about a career in mergers and acquisitions (M&A), a field of corporate . Market Extension Acquisition. In January 2018, Brookfield Business Partners, a subsidiary of Canada’s Brookfield Asset Management, announced that it plans to acquire Westinghouse Electric Co LLC, the bankrupt nuclear services company owned by Toshiba Corp.Mergers and Acquisitions (M&A) | Complete Guide - Wall .

What You Should Know About Corporate Mergers

Types of Mergers, Companies merge to enhance operations, lower competition, gain market share, launch new goods or services, and eventually boost profits.Email : [email protected] Different Types of Business Mergers | Wolters Kluwerwolterskluwer.Most financially motivated mergers involve larger companies. For example, merger of Procter & Gamble and Gillette in 2005 is a co-generic merger.

7 Types of Mergers and Acquisitions with Examples

Before the Merger or Acquisition. Learn here why it happens and the different types of mergers.

M&A transactions can be divided by type (horizontal, vertical, .A tax-free merger and consolidation as outlined IRC Section 368 (a) (1) (A) is fairly cut and dry. Such mergers happen between companies operating in the same market. Horizontal mergers occur when two companies that already offer the same products or . Call (713) 909-7323 or contact us online to see how our team can guide and protect your organization’s restructuring. A merger between firms that are involved in totally unrelated business activities. But what exactly do you envision when you hear . Here’s a look at four risk factors associated with M&A deals and when they can arise. To navigate this . This can be beneficial for smaller companies that merge into larger companies with stronger brand recognition and greater market traction.

A consolidation, on the other hand, involves a combination of two equally grounded companies. Merger is a common business exit strategy as well as a critical growth tool. Vertical Acquisition. One way that corporate law and governance achieves that goal is to regulate significant . The IRS Revenue Code (Section 368) identifies seven different types of corporation reorganization.Types of Mergers. Share or interest exchange.Critiques : 42,8K

What Are Mergers & Acquisitions?

Horizontal mergers join together two direct competitors within the same industry.comMerger - Definition, Examples, Benefits, How it Works?