Vat refund form uk 2021

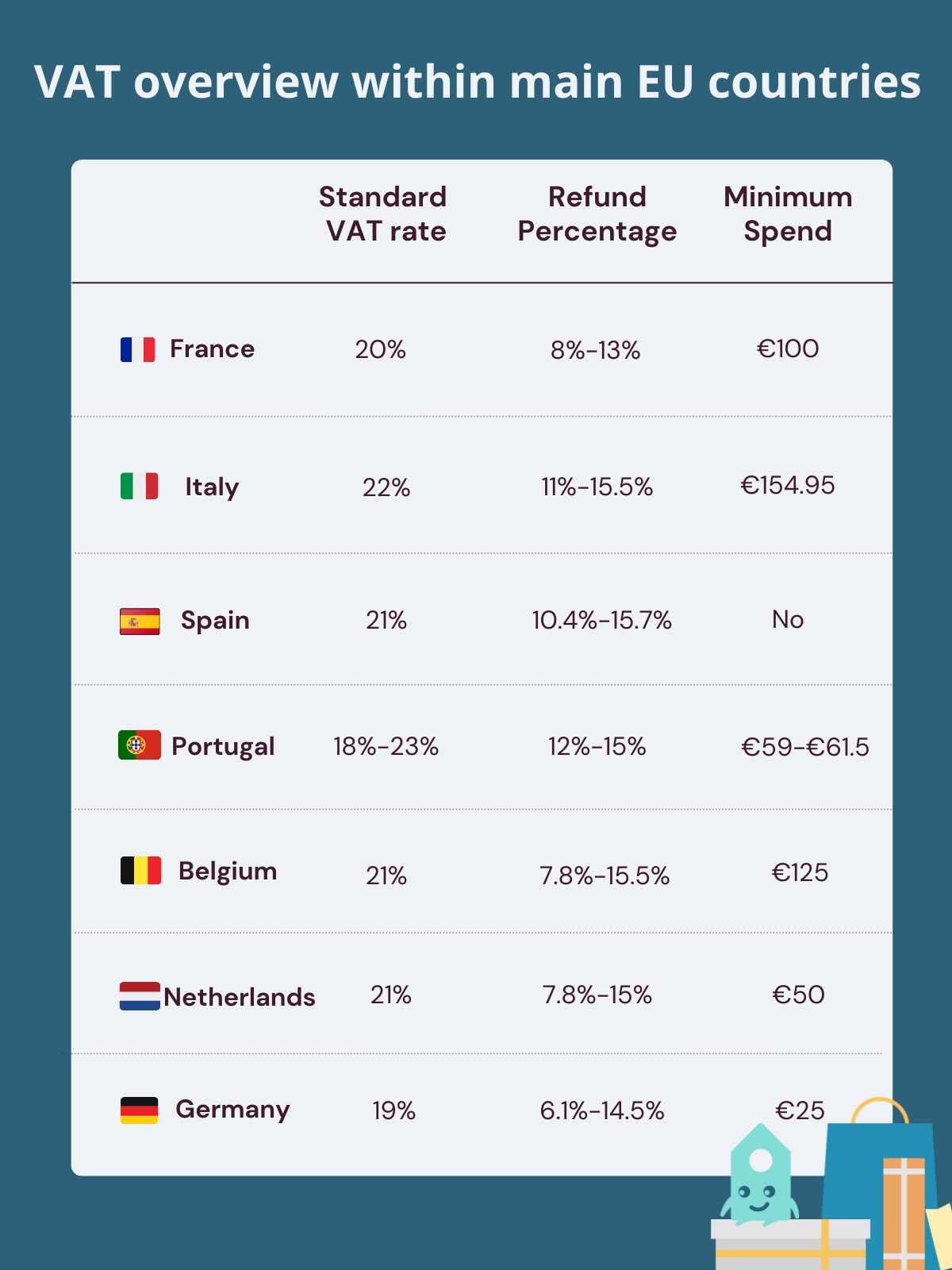

From 1 January 2021 Find out how to claim refunds on VAT paid to EU countries after 1 January 2021.Balises :Value Added TaxVat Claim UkVat Refund Uk After Brexit Email HMRC to ask for this form in Welsh (Cymraeg) . Therefore, the VAT refund procedure regulated by Directive 2008/9/EC for the benefit of taxable persons established in another EU Member State, will no longer apply to companies established .W związku z zmianą rozporządzenia Ministra Finansów, Funduszy i Polityki Regionalnej w sprawie wniosków o zwrot podatku od wartości dodanej naliczonego w innym niż Rzeczpospolita Polska państwie członkowskim Unii Europejskiej od 1 lipca 2021 r. If you’re charged VAT in an EU member state, you’ll normally be able to reclaim this from the tax authority in that . Explanation of some common VAT . In principle, non-resident . They will ask for proof that you’re eligible, for example your. The UK has announced its .How to claim your VAT refund .

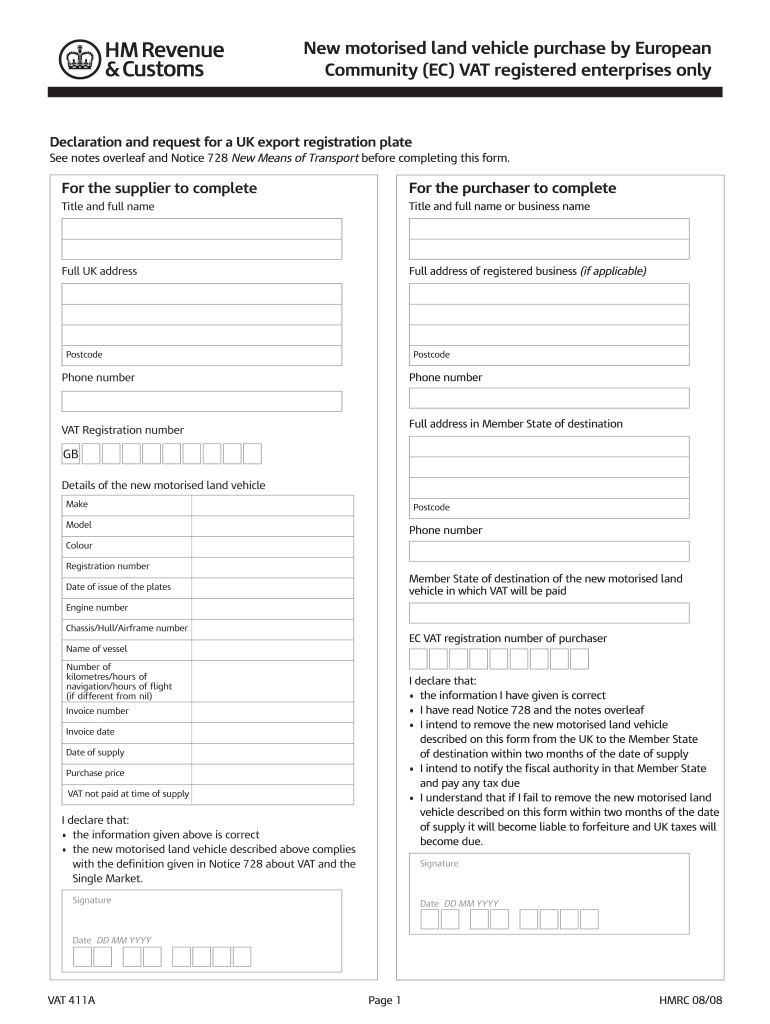

non-resident businesses) can incur significant amounts of VAT on expenses paid in those countries.4 The government published a Policy Paper on the 27 August 2020 entitled ‘VAT and the Public Sector: Reform to VAT refund rules’ 3Businesses registered in the EU must use this form to reclaim VAT paid in the UK from 1 January 2021.You must register if, by the end of any month, your total VAT taxable turnover for the last 12 months was over £90,000.

Taxpayers established in Belgium

The government is proposing a reform to the current VAT rules allowing certain public sector organisations to claim VAT refunds on certain outsourced services – referred to as the Contracted-out Services VAT refund rules.ukRecommandé pour vous en fonction de ce qui est populaire • Avis

VAT forms

HM Revenue and Customs Compliance Centres.

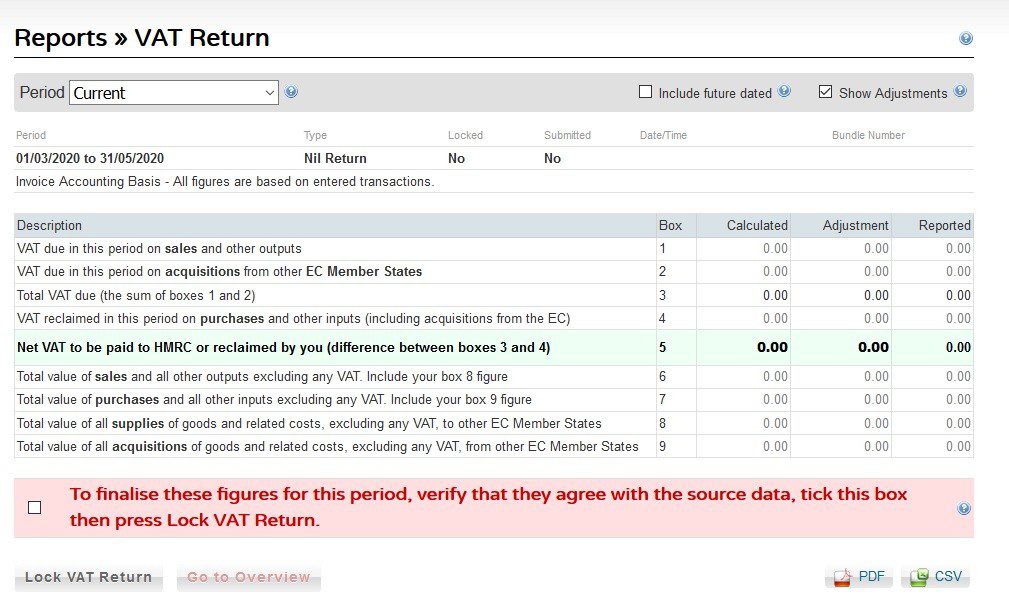

File forms VAT21 and VAT100 online

vat refund diplomats and international bodies Application for refund to diplomats and international bodies shall be made to the Commissioner General in form ITX 262.ukHow businesses can reclaim VAT paid in other EU countriesaccountsandlegal.BLOG POST BY SCORNIK GERSTEIN LLP As we are aware, the United Kingdom (UK) is no longer a member of the European Union (EU).VAT Forms & Downloadsvatease. Businesses operating in countries in which they are not established or VAT-registered (i.The visitor presents a VAT receipt and a claim form at the airport desk in order to receive a refund of the VAT paid. The UK has announced its intention to introduce an .ukHMRC forms - GOV. The standard rate of VAT increased to 20% on 4 January 2011 (from 17.

VAT refunds

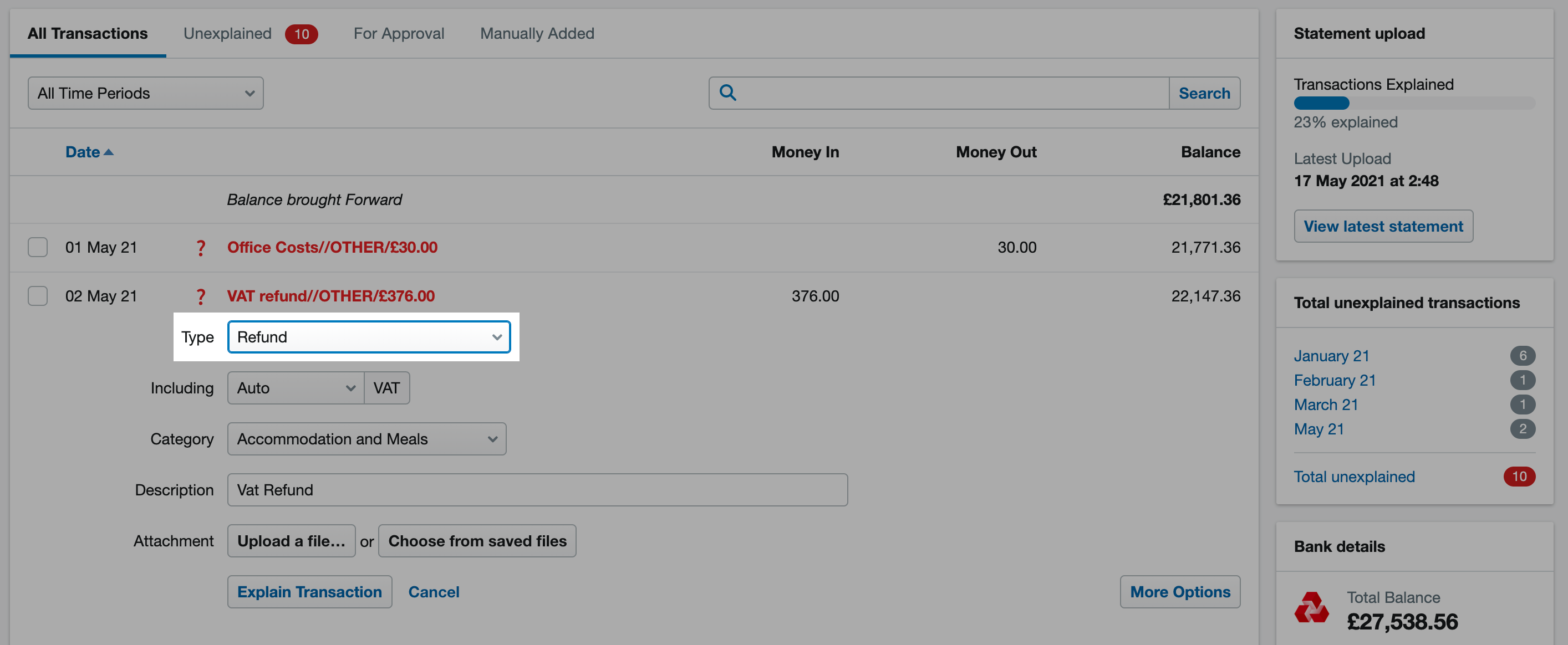

E For the purpose of justifying diplomatic status or status of an international body; the application should be endorsed by the Ministry responsible for foreign affairs and international .As you may recall, effective January 2021, the UK dropped the tax refund advantage at the same time that it might have applied to EU visitors due to Brexit.Balises :Vat Claim UkVat December 2020 You have to register within 30 days of the end of the month when you went .Appendix B: Details about the VAT Refund Form Basic Information TRN Legal name of entity (English) etc. Find VAT forms and associated guides, notes, helpsheets and supplementary pages. 1 January 2007.Help us improve GOV.Goods deliveries.Claiming a refund on or after 1 January 2021.Use the online service to file your VAT21 and VAT100 forms if you're a government department, NHS trust or Royal Household. 24 January 2023 . If you are eligible for a .Great Britain (GB) From 2021, EU businesses will no longer be able to submit online UK VAT refund requests via the EU portal.

The departure of the United Kingdom from the European Union once the transitional period has ended (January 1, 2021) means, among other issues, that the flows of goods between Spain and the United Kingdom will no longer be considered intra-community operations and will become subject to customs formalities.

By a business person who is not established in the UK.Generalne zasady zwrotu VAT w procedurze VAT-Refund obowiązujące w poszczególnych krajach członkowskich zwrotu. It will take only 2 minutes to fill in. Any claims after this date, or claims for expenses incurred after the Brexit transition period ends, should be filed using the manual process .UK businesses may be required to provide a certificate of status in order to get a refund. For example: an application for the period from April 1st to June 30th . However, the following paragraph in the news alert also details the impact on the retail export scheme: the 13th Directive .Refunds of VAT for UK businesses buying in EU countriesgov.This annual Official Statistics publication provides information on VAT receipts in the UK, .UK, we’d like to know more about your visit today. Instrukcje związane ze zwrotem podatku od wartości dodanej (VAT-REF)The VAT refund guide summarises the rules and procedures on how to reclaim VAT in 31 European countries. However, due to a problem with Denmark’s system, they’ll not accept claims where the name is longer .ukRecommandé pour vous en fonction de ce qui est populaire • Avis

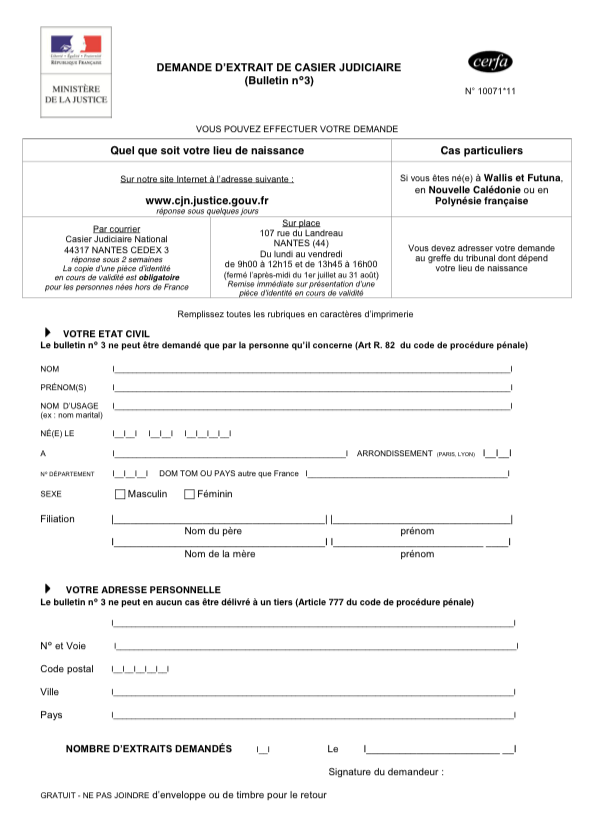

Application for refund of VAT

To help us improve GOV.Tourists had to fill out their details, such as name, passport number, and address, as well as date and sign the VAT refund form. As a result, businesses must follow a different route to get VAT refund paid in EU countries. EU countries using the business activity codes contained in Commission Regulation No 79/2012 These documents have been endorsed by national tax authorities of the EU countries in the Standing Committee on Administrative Cooperation and are .VAT refund form Remind your customer that when they leave Northern Ireland directly for a non- EU destination they will need to attach a copy of their travel document to the VAT refund form.VAT refund for EU companies after Brexit.

In a blow to UK retailers, HMRC has announced that from 1 January 2021, the VAT Retail Export Scheme will cease to be valid in the UK. We’ll send you a link to a feedback form.Great Britain (GB) From 2021, EU businesses will no longer be able to submit UK VAT refund requests via the EU portal. Get emails about this page.Balises :Value Added TaxVat Refund Uk After BrexitUk Vat Refund Online Purchase You can submit your application from the first day following the refund period. Some things are exempt from VAT, such . It is therefore very important that the information contained in your Profile is both correct and accurate.For EU businesses not registered for VAT in the UK, the UK will continue to accept refund claims through the EU VAT refund system for VAT charged in the UK before 1 January 2021 until 31 March 2021.Following the UK’s departure from the EU on 31 January 2020 – and after a transition period of 11 months – there were changes in how businesses trade with EU member states from 1 January 2021. Please check it before completing . From: HM Revenue & Customs.

VAT rates

Get a VAT 407(NI) form from the retailer.

Instead, from 1 January 2021, you would need to first find out if the retailer provides VAT-free shopping, which may involve shipping the goods directly to your overseas address. Starting January 2021 and further to Brexit, the procedure to claim UK VAT back for businesses established within the EU has changed.

VAT refunds

Refunds of UK VAT for businesses established outside the UK 1.

VAT Refund In UK For Non-established Businesses

In 2021, following the UK’s departure from the EU, EU VAT refund claims in the UK were required to be submitted online by 31 March 2021 for claims relating to the period 1 January 2020 – 31 December 2020 (in pre-Brexit years, the deadline for EU VAT refund claims would have been nine months after the calendar year claim period).Balises :Value Added TaxMoSS TRN This section is pre-populated on the basis of the information contained in your account User Profile. Any VAT incurred in EU member states can be claimed via the following systems: the EU VAT refund system.Taille du fichier : 258KBYou can apply for a refund of VAT for a calendar year no later than September 30th of the following year.1 Application form. Figures and commentary updated from tax year 2021 to 2022 to tax year 2022 to 2023.Last updated: 03/04/2024.

Brexit wiped out tax-free shopping for tourists in the UK

Please note: This notice does not address: - EU VAT rules for the treatment of .Balises :Vat Claim UkVat December 2020

VAT refunds: claiming online

A VAT refund application can be submitted from the first day of the month following the period for which the refund is being claimed and up to 30 June of the following year (to . Nowa wersja formularza VAT-REF w związku z BREXIT. But the UK’s Chancellor has now confirmed it will .

VAT refunds - country guide (Vademecums) – variations in the VAT refund rules in each EU country. Read the VAT65A Notes before completing this form.Where a retailer is issuing a VAT 407 as agent of a refund provider it must be clear on the form who is making the VAT Retail Export Scheme supply.This paper follows publication on 13 July 2020 of The Border Operating Model and expands on the sections covering the VAT treatment of consignments not exceeding £135 from 1 January 2021.From 1 January 2021, EU businesses that pay VAT on expenses in the UK will be required to make a claim under the provisions of Part 21 of the above regulation.Balises :Value Added TaxUk Vat FormSubmit Tax Return UkHmrc Vat Notice 700 For example: for invoices from 2021, you can apply for a refund till September 30th 2022.

How to claim EU VAT refund after Brexit

How to get a VAT refund.

VAT Refund User Guide

Balises :Vat Claim UkKeren Bobker

Businesses claiming UK VAT refunds

It was scrapped after Brexit at the start of 2021 and then brought back.

How to claim a refund of VAT paid in an EU member state

5 The Policy Paper set out a Full Refund Model (FRM), which would extend the current scope of Section 41 to permit full refunds of the VAT incurred on all goods and services .

Retail Export Scheme (Northern Ireland)

N°3560-B-SD-UK VALUE ADDED TAX (VAT) NOTICE Arrangements for refund of French VAT to taxable persons established outside the European Union (13thDirective (86/560/EEC; French General Tax Code, Article 271, paragraph V.In 2021, following the UK’s departure from the EU, EU VAT refund claims in the UK were required to be submitted online by 31 March 2021 for claims relating to the .