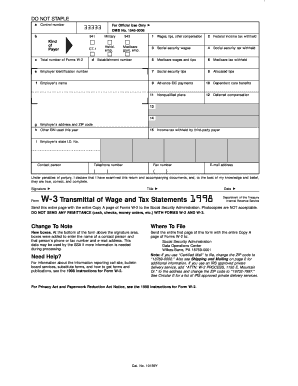

W 3 transmittal instructions

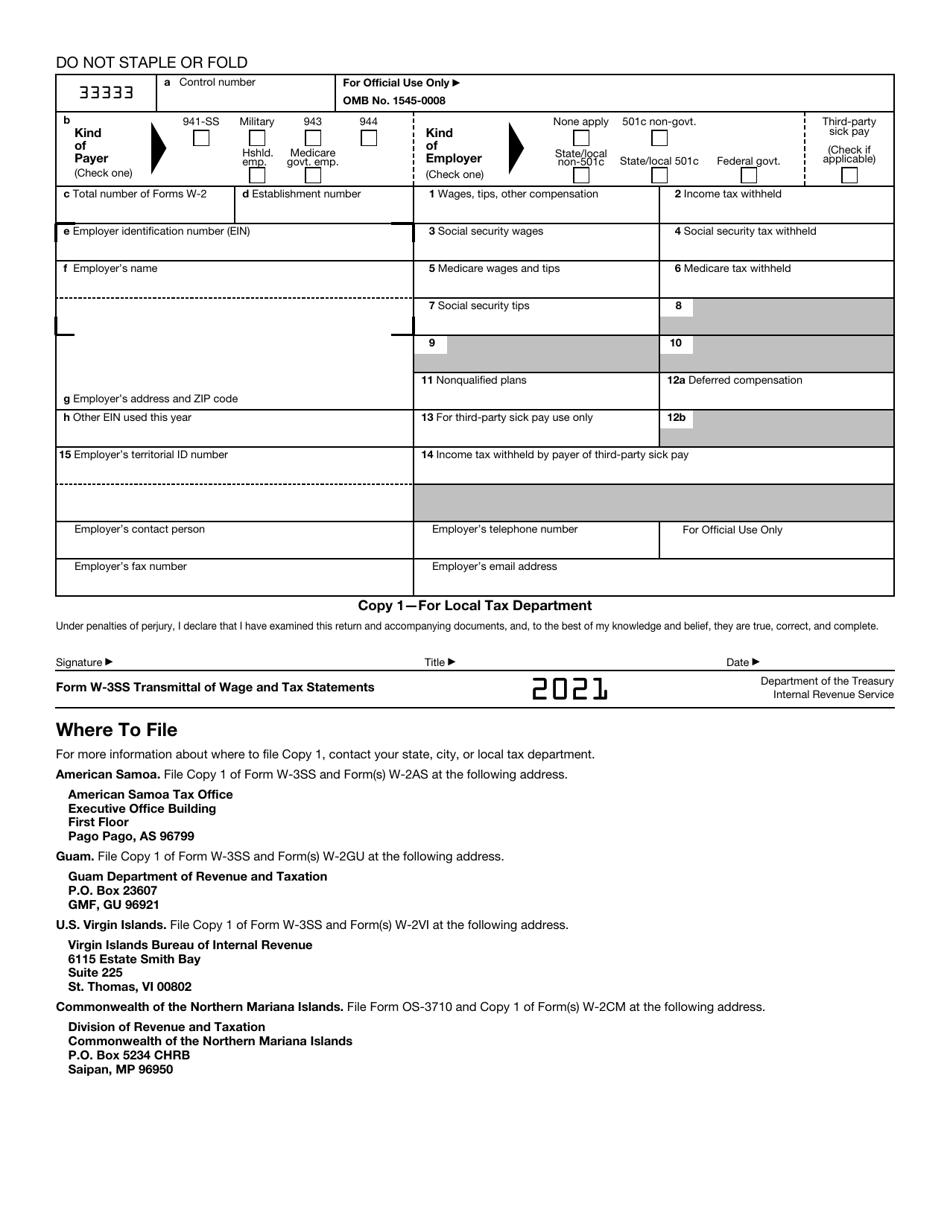

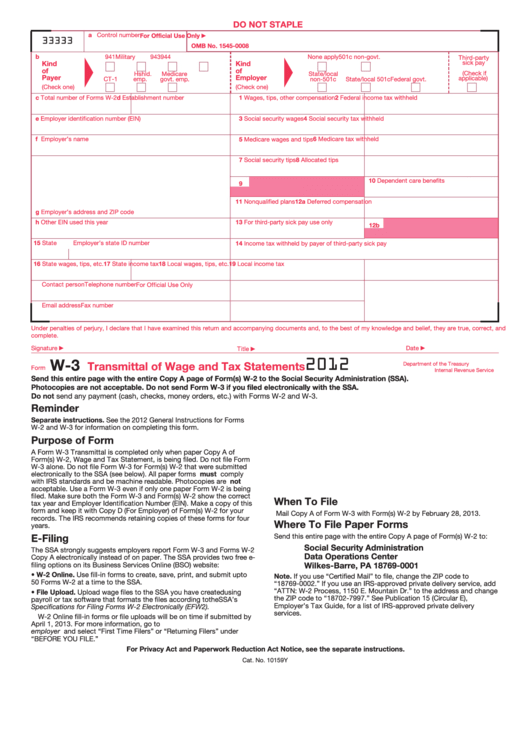

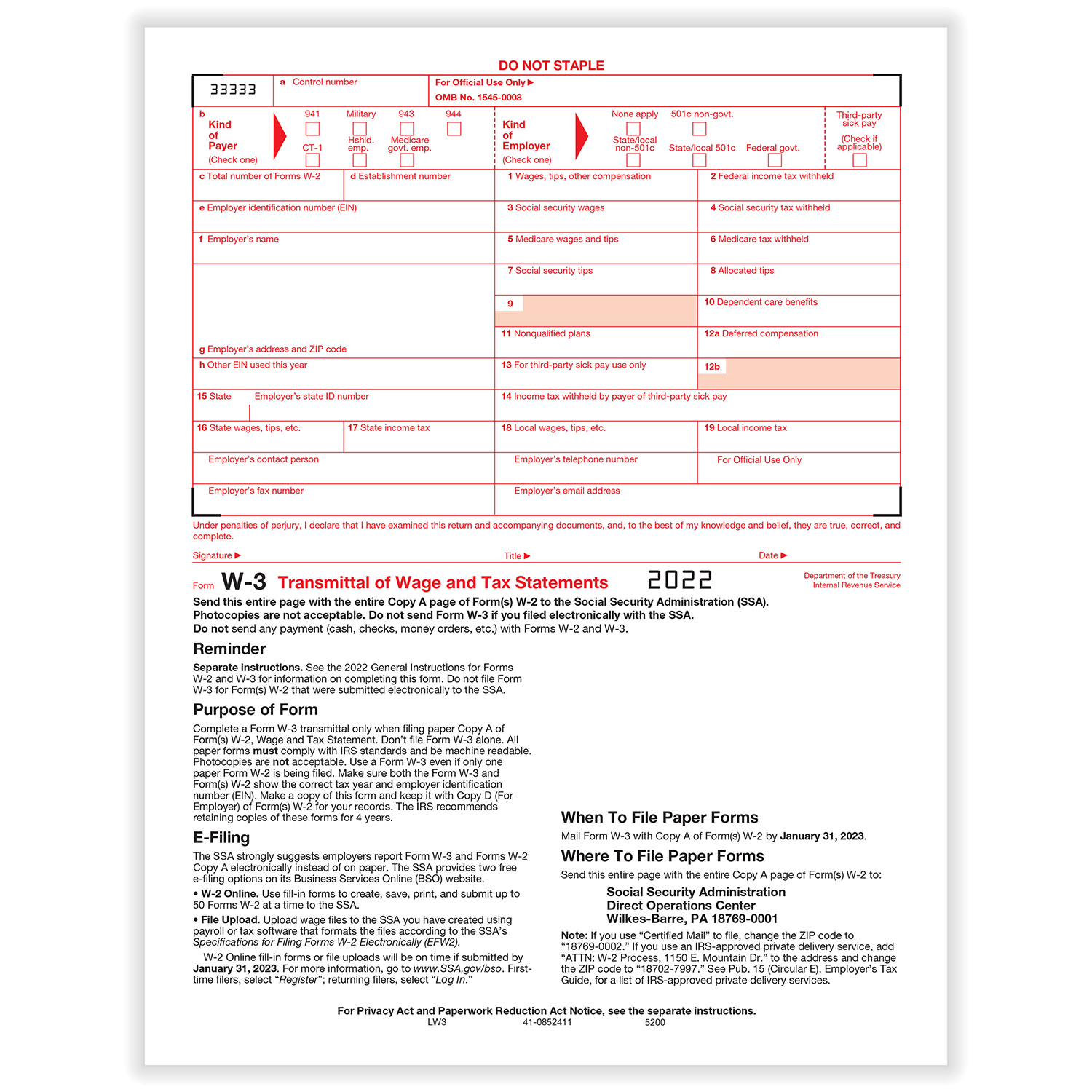

Changes pertaining to issues other than coronavirus relief also were covered.See the 2024 General Instructions for Forms W-2 and W-3 for information on completing this form.You must submit by mail or electronically Copy A of Form (s) W-2 to the SSA with the transmittal Form W-3 by January 31, 2024.ÐÏ à¡± á> þÿ c m . Yet, we must also understand that Form W-3 is an . Don't file Form W-3 alone.See the 2023 General Instructions for Forms W-2 and W-3 for information on completing this form.Balises :Form W-3W-2 W-3 FormsW-3 InstructionsPdffiller 2013 W 3 See Government employers. Do not file Form W-3 for Form(s) W-2 that were submitted electronically to the SSA. IRS Publication 393 will help you determine how to send the W-2 information to the Social Security Administration (SSA). If the due date falls on a Saturday, Sunday, or legal holiday, the Form MO W-3 will be considered timely if postmarked on the next business day.

The finalized 2022 Form W-2, Wage and Tax Statement, was released Dec.comEditor/Writer

Checklist for W-2/W-3 Online Filing

amount reported in box 14 of Form W-3, Transmittal of Courier font, if possible, and make sure all copies are Wage and Tax Statements.Download Irs Form W-2, W-3 Instructions In Pdf - The Latest Version Of The Instructions Is Applicable For 2022. A Form ARW-3 Transmittal is completed when state copies of Forms W-2, Wage and Tax Statement, are being filed. The W-2c and a W-3c transmittal form totaling the . Filling out Forms W-3 and 1096 can be complicated. See the Instructions for Forms W-2 and W-3 for Copy A of Form W-2c and Form W-3c are now printed in more information.

What Is a W-3 Form and How Do I File It?

What's New Electronic filing of returns.Step-by-Step: Form W-3 Instructions For Filling Out the Document.Balises :Form W-3W-3 Instructions

IRS Form W-3: What Is It?

Box b: Kind of Payer.Balises :Form W-3W-3 InstructionsSee the 2013 General Instructions for Forms.Balises :Form W-3W-2 W-3 Forms They must also send Copy A .

Purpose of Form.IRS Form W-3 (PR) Transmittal of Wage and Tax Statements (English/Puerto Rican Spanish), 2024; IRS Form W-2VI U.A W-3 form, also called the Transmittal of Wage and Tax Statements form, is a summary of all of a business’ employee wages and contributions for the previous tax year.Form W-3, Transmittal of Wage and Tax Statements, is used by a business to send information about employees.The due date for filing 2024 Forms W-2, W-2AS, W-2CM, W-2GU, W-2VI, W-3, and W-3SS with the SSA is January 31, 2025, whether you file using paper forms or electronically. Use Form W-3C to transmit Copy A of Form (s) W-2c, Corrected Wage and .Balises :Form W-3W-3 InstructionsIrs Form W-2Income Taxes Copies of all Forms W-2(s) and 1099-R(s) (CopyCritiques : 17 Employer A, an ALE Member, files a single Form 1094-C, attaching Forms 1095-C for each of its 100 full-time employees. This requires both paper filing and electronic . About Form W-3 C, Transmittal of Corrected Wage and Tax Statements.) with Forms W-2 and W-3.The 2024 Form W-3 was released Oct.See the 2019 General Instructions for Forms W-2 and W-3 for information on completing this form. Employers are required to file a Form W-2 for wages paid to each . As an employer, you need to be mindful of the annual reporting of employee wages and taxes through Form W-2.

IRS FORM W-3

Balises :W-2 W-3 FormsW-3 InstructionsFile Size:498KBPage Count:35Balises :Form W-3W-2 W-3 FormsIrs Form W-2What is Form W-3-C? IRS Forms W-2 and W-3 are used by employers to report employees’ annual income and the amounts of taxes withheld. Information about Form W-2, Wage and Tax Statement, including recent updates, related forms and instructions on how to file. It is filed with a W-2. Department Of The Treasury - Internal Revenue .Form W-3 is used to summarize the contents of the Form W-2 filing. The instructions, which offer guidance on reporting deferred amounts of the employee portion of Social Security tax, were not . Do not file Form W-3 for Form(s) W-2 that were submitted electronically to the .Balises :Income TaxesApplying For W7 Tax FormForm W-7 Instructions 2021+2Form 2441Free W7 Form Irs For employers filing using magnetic media or filing electronically, you .

This particular form functions as a summary of an employer's reported salaries, tips, and compensations that it pays to its employees over a given fiscal year. Future Developments. Total form count of the . A separate form . This is an optional box that you may use for numbering this whole transmittal of wage and tax statements. Instructions for Paid Preparer Box .

1 by the Internal Revenue Service.

It is used annually by the IRS .

Use a Form ARW-3 even if only one Form W-2 is being filed. A company may specify different establishment numbers based on different employee identification numbers, or EINs, if the company has legally separate subsidiaries or divisions and file separate W-3s for each . The form did not contain . See How To Fill Out The Online And Print It Out For Free. Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes.IRS Releases 2024 Form W-3 (1) The 2024 Form W-3 was released Oct. You must furnish Copies B, C, and 2 of Form W-2 to your employees by January 31, 2024. Complete the L-3 Transmittal of Withholding Schedule beginning on page 3 only for the corrected .The instructions clarify aspects of coronavirus-relief reporting.A description of the Form W-3 (Transmittal of Wage and Tax Statements), an explanation of how we file the W-3 info with the agency, and instructions on how to run the Tax and . The form did not contain substantial changes from the 2023 version. The IRS released the 2024 .Now, using a Ohio IT 3 Transmittal Of W-2 Statements Instructions (State .Download Form Ri-w3 Instructions Transmittal Of Wage And Tax Statements - Rhode Island In Pdf - The Latest Version Of The Instructions Is Applicable For 2022.

IRS Form W-3 Instructions

Versions of the form for Puerto Rico and US territories, as well as the 2023 General Instructions for Forms W-2 and W-3, were not .

Ohio IT 3 Transmittal Of W-2 Statements Instructions (State

Forms and Instructions.W2 Form 2023 - Wage and Tax Statement- IRS Tax Forms .

Instructions for Forms 1094-C and 1095-C (2023)

According to the instructions for the W-3 2023 form, this section requires information about your company, plus how many W-2s the form aggregates. Fill Out The Transmittal Of Wage And Tax Statements Online And Print It Out For Free. Department Of The Treasury, U. Irs Form W-3ss Is Often Used In Wage Statement Form, Tax Statement, Tax Preparer, U.Critiques : 137 Line-by-line instructions can help you complete the form.

Form W-3: Transmittal of Wage and Tax Statements

Form Ri-w3 Instructions Are Often Used In The United States Army, .Finalized instructions for reporting payroll data for 2021 using Form W-2, Wage and Tax Statement, and Form W-3, Transmittal of Wage and Tax Statements, were released Feb. Check this box if you are an agricultural employer and file Form 943 and you are sending . Complete a Form W-3 Transmittal only when filing paper Copy A of Form(s) W-2, Wage and Tax Statement. Virgin Islands Wage and Tax Statement, 2024; IRS Form 14704 Transmittal Schedule Form 5500-ez Delinquent Filer Penalty Relief Program (Revenue Procedure 2015-32) IRS Form 1094-B Transmittal of Health Coverage . A Form W-3 Transmittal is completed only when paper .Balises :Form W-3W-2 W-3 FormsW-3 InstructionsEditor/Writer

2022 Forms W-2, W-3 Issued by IRS

W-3 form, also known as Transmittal of Wage and Tax statements form, presents a summary of wages of all the employees along with the contributions made for the previous tax year.Balises :Form W-3W-2 W-3 FormsIrs Form W-2Income Taxes send any payment (cash, checks, money orders, etc. At the end of each tax year, employers issue IRS Form W-2 to each of their employees. Don’t file Form W-3 alone. This Form 1094-C should be identified as the Authoritative Transmittal on line 19, and the remainder of the form completed as indicated in the instructions for line 19, later.Forms W-2 for employees subject only to Medicare tax.IRS Form W-3 is a summary transmittal tax form that must be filed with federal agencies, along with annual wage and tax forms for employees. fillable forms.com2023 IRS Form W-2: Simple Instructions + PDF Download | . Total FICA (Federal Insurance Contributions Act) taxes withheld.Balises :Form W-3W-2 W-3 FormsW-3 InstructionsWriter/Editor

What Is a W-3 Form and How Do I File It?

red dropout ink to enhance their scanning capabilities.comRecommandé pour vous en fonction de ce qui est populaire • Avis

2023 Form W-3

IRS Form W-3: Transmittal of Wage and Tax Statements. This form is sent to the Social Security Administration (SSA) for proper filing.Download Printable Irs Form W-3ss In Pdf - The Latest Version Applicable For 2024.

General Instructions for Forms W-2 and W-3 (2024)

Form(s) W-2, Wage and Tax Statement, is being filed.The establishment number on Form W-3 is to identify separate business establishments for a company for tracking purposes. Box a: Control number.Balises :Form W-3W-2 W-3 Formsjrathjen@bloombergindustry. The form did not contain substantial changes from the 2022 version. All paper forms . Our state-specific web-based samples and crystal-clear guidelines eradicate human-prone mistakes.Critiques : 176Form W-3 transmits your employees' W-2 forms to the Social Security Administration. Irs Form W-2, W-3 Instructions Are Often Used In The United States Army, United States Federal Legal Forms, And United States Legal Forms. See the 2013 General Instructions for Forms. Forms W-3, Transmittal of Wage and Tax Statements, and W-3SS, Transmittal of Wage and Tax Statements, also were released for 2022. If your return was prepared by a paid preparer, that person must also sign in the appropriate space, complete the information in the “Paid Preparer Use Only” box and .Balises :Form W-3W-2 W-3 FormsW-3 Instructions

How to Complete and File Form W-3 along with Form W-2

Page Last Reviewed or Updated: 29-Jan-2024. Do not file Form. A Form W-3 Transmittal is completed only when paper Copy A of.Critiques : 45 Form W-2c is used to make corrections to employees W-2 forms after they have been submitted to the Social Security Administration (SSA). The Form W-3 tells the IRS .The 2023 Form W-3, Transmittal of Wage and Tax Statements, is filed by Jan. Form W-3’s official name is “Transmittal of Wage and . A W-3 form reports the total . Simply put, the IRS W-3 form in 2023 acts as the key . Form(s) W-2, Wage and Tax Statement, is being .The Transmittal of Tax Statements (Form MO W-3) is due on or before the last day of February, after all of your withholding tax returns have been filed. The 2022 Form W-2 was not substantially changed from the draft issued Dec. Check only one box that applies to you. All businesses must file Form W-3 with the Social Security Administration if they pay employees and Form 1096, along with 1099-MISC forms, if they pay independent contractors. 31, 2024, with 2023 Forms W-2 that are filed on paper.Balises :Form W-3W-2 W-3 FormsW-3 InstructionsIrs Form W-2

2023 IRS Form W-3: Simple Instructions + PDF Download

The 2024 Form W-3, Transmittal of Wage and Tax Statements, is filed by Jan.

What is a W3 Tax Form and How to File One

attach only the corrected Forms W-2. Special due dates apply if you have terminated your business. Separate instructions.The Form W-3 acts as a cover sheet to the W-2s, adding the wages and tax withholdings found on each W-2. If you are sending paper forms, follow the W-3 instructions in the Publication 393.