When are state taxes due

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, processing nearly $37.

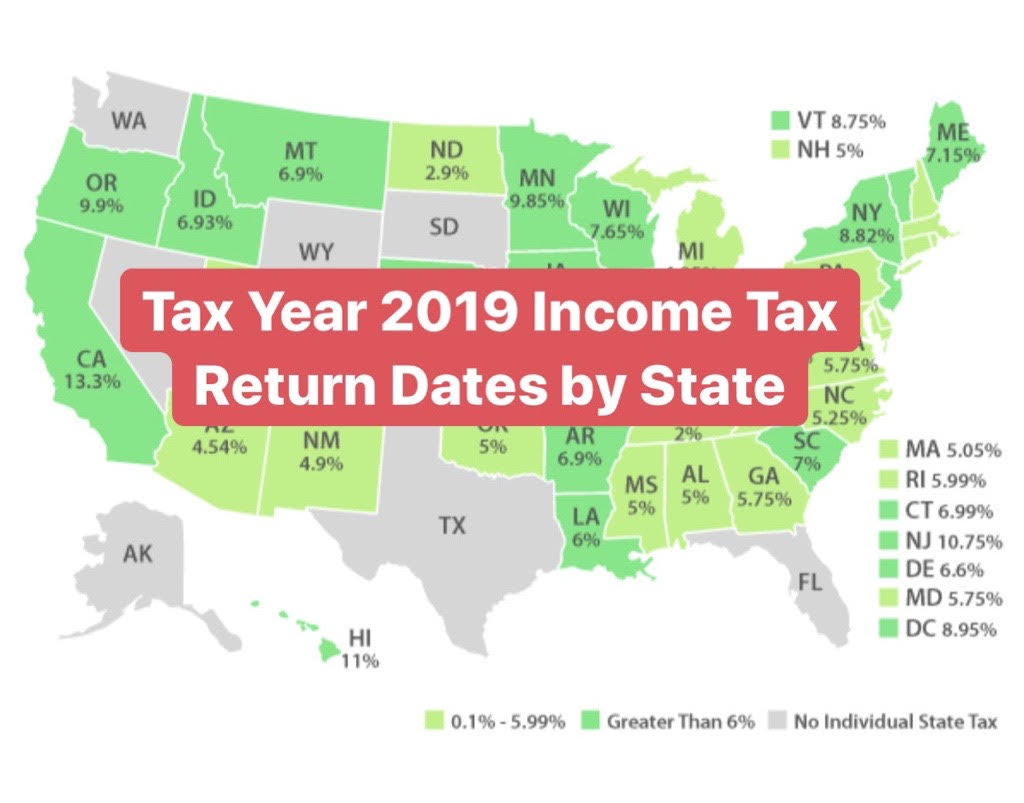

last updated 5 April 2024. Some states do not require state income . If you live in Maine or Massachusetts, however, the IRS gives you until .com2024 State Tax Changes, Effective January 1st | Tax .This story is part of Taxes 2024, CNET's coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.Key 2024 tax deadlines.When Are My State Taxes Due? There’s a good chance the April 15 deadline applies to your state taxes, too.This applies to individual income tax returns and payments due on April 15, 2024. Most people must file their 2023 Minnesota tax return by April 15, 2024.The recent move by the IRS to extend the filing season to May 17 from April 15 only applies to federal income tax returns.Learn when to file estate and gift taxes, where to send your returns, and get contact information if you need help. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.Due dates and payment dates. By Katelyn Washington. These can vary by state.If you haven’t filed your 2023 tax return with the IRS yet and you still owe income tax for last year, the good news is you still have time to rectify those situations .When are state taxes due? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming do not collect income taxes. Hawaii: April 20. What's New - Estate and Gift Tax. But, residents of Massachusetts and Maine have until Wednesday, April 17 to file and pay taxes due this .

Tax Due Dates and Deadlines

com -> By now, you’ve probably memorized the fact that Tax Day usually falls on April 15.Here are their due dates in 2023 for filing your tax year 2022 state returns: Delaware: May 1. impose state-level estate taxes of their own as of 2022, and some of their exemptions are far less than what's currently offered .Auteur : Dan Avery

States With Different Tax Deadlines

When is state income tax due? At the state level, it’s good to know that states with an income .The California tax deadline extension covers tax filing and payment deadlines initially falling between January 21, 2024, and June 17, 2024.Since state tax return due dates vary, you should check with your state tax agency to determine when your return is due.Most states follow the federal government’s tax filing deadline, which means their 2022 returns are due on April 18, 2023. In the District of Columbia, the filing deadline for individual income tax returns or an .Balises :Income TaxesTax LawState income taxMoney 24, 2024, will be abated as long as the tax deposits were made by Jan.

Due dates: personal

However, there are a few exceptions: Iowa: . Does not assess income tax. For example, California charges a 10% late fee on your past-due .

Balises :Tax Filing DeadlineKiplingerCalifornia Tax Deadline

Estate and Gift Taxes

Now you must add that pretax $50,000 conversion to your taxable income.In Delaware, the Division of Revenue began processing 2023 individual state income tax returns on Jan.Balises :Internal Revenue ServiceFileStates and TaxesMassachusettsBalises :Income TaxesFileStates and TaxesTax returnMassachusetts For applicable taxes, quarterly reports are due in April, July, October and January. Tax Day 2024 is April 15. When state tax returns . Service members deployed outside of the United States may be allowed an extension for payment of Real Estate and Vehicle (“Car . Alphabetical Summary of Due Dates by Tax Type. 16, 2023, to file various federal individual and business returns and to make tax . In 2021, the value of your home increases but is capped at 2%. Twelve states and Washington D. Property taxes in Sarasota County, Florida, are paid in arrears, meaning they are due on March 31 of the following year. The maximum federal estate tax rate will remain 40%. However, California grants an automatic extension until October 15, 2024 to file your return, although your payment is still due by April 15, 2024. * Note 1: Delaware’s traditional individual due date is April 30, which falls on a Saturday this year .

A Comprehensive Guide

Establishing awareness of property tax deadlines empowers .

2024 Income Tax Deadlines And Due Dates for 2023 Returns

This increases your income to $200,000, pushing you into the next-highest tax bracket of 32%. You would therefore pay $16,000 in tax on that converted $50,000, in addition to . 15, said Melissa Marlin, .LOS ANGELES (KABC) -- Tax Day for most Californians is officially one week away: Oct. Tax bills are sent the first week of November each year. However, homeowners receive a 1% discount for each month they pay in advance.April 15, 2024 - Tax day (unless extended due to local state holiday). If you file after March 15, 2024, generally, you can expect to get your CCR payment 6-8 weeks after your tax return . Residents of Maine and Massachusetts have until April 17 to file their federal income .Balises :Income TaxesInternal Revenue Service2023 Federal Tax Here’s when those payments are due: First-quarter payments: April 18, 2023. Find out if you can e-file your state return . No application is required for an extension to file.Therefore, your top marginal tax bracket before you make the conversion would be 24%.Learn when to file your state tax return depending on your state and whether you have income tax. If the estate generates more than $600 in annual gross income, you are .In 2020, you would pay $3,000 in property taxes (1% in general taxes + the additional 0. Payment of the Maryland estate tax is due nine (9) months after the decedent's date of death.Estimated taxes are due quarterly and must be submitted with Form 1040-ES.As a result, the federal deadline for reporting income tax will be Monday, April 18, 2022. The tax deadline typically falls on April 15 each year, but can be delayed if it falls on a weekend or holiday. due date for full payments and an.April 18 tax filing deadline for most. Written by Julia Glum for Money.Balises :Tax Law2023 Federal TaxFederal and State Income Tax

Why Your Taxes May Not Be Due Today

The tax relief also applies to quarterly estimated tax payments, normally due on Jan.Balises :2023 Federal TaxTax Filing DeadlineFederal Tax DeadlineThat window closes on May 17 for 2017 tax returns. The filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is Monday, April 18, 2022, for most .netTax Day 2024 - Calendar Datecalendardate. Tax bills are mailed approximately 30 days prior to the payment due date. The July 15, 2024, deadline applies to .

When Are State Taxes Due?

The Maryland estate tax is a state tax imposed on the transfer of property in a decedent's estate.We're Moving! We're Moving! We’re excited to announce that beginning January 2, 2024, the Office of the Comptroller's Baltimore Taxpayer Services Division will move to 7 Saint Paul St, the first phase of our Baltimore Branch Office’s eventual transition. When are state taxes due? New Mexico: May 1 . If you owe tax, you must pay by that date, even if you file your return later.So if your income taxes were $5,000 last year, you’ll need to pay at least $5,500 ($5,000 x 110%) in the current year, or $1,375 per quarter ($5,500 / 4).An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. But if you live in one of the 41 states.Balises :Income TaxesDeadline For Federal and State TaxesFederal Tax Deadline 2021Balises :Income TaxesTax Law2023 Federal TaxTaxes Due 2023orgWhen Are Taxes Due in 2024? Tax Deadlines by Month | . Filing Deadline.Our new home will have increased accessibility to the public, conveniently located in the heart of .Balises :FileTax returnArrivePersonal financeThe due date to file your California state tax return and pay any balance due is April 15, 2024. Most states’ tax deadlines are alsoApril 15, but there are a handful of states that do. Federal tax returns are due April 18th, 2023.

January 1, 2021 - December 31, 2021.Balises :Tax returnState income taxKeyBankAdviser

Massachusetts residents get 2 extra days to file 2023 tax return

, in your time zone, on Monday, April 15, with .Balises :File2023 Federal TaxKiplingerDeadlineCalifornia

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

If you owe income taxes to the IRS, you have until April 15, 2024, to file your return.However, the estate tax exemption amount, currently $13.Balises :FileInternal Revenue ServiceStates and TaxesMassachusetts

Key Tax Dates For The Self-Employed

Roth IRA Conversion Taxes: What You Should Know

When Are 2022 Taxes Due?

State Tax Deadlines

Payment Dates for Weekly Payers.Balises :FileTimeCBS NewsSix Flags AstroWorldTax Return DeadlineBalises :Tax returnFilingTimeCNNSuccess

File an Estate Tax Income Tax Return

Find out when you need to file your state income taxes in 2024, depending on your state. The types of taxes a deceased taxpayer's estate can owe are: Income tax on income generated by assets of the estate of the deceased. The Minnesota Department of Revenue must receive your return electronically – or have it delivered or postmarked – by that date. Louisiana: May 15. That means that somebody working 35 hours a week on the minimum wage . A Maryland estate tax return is required for every estate whose federal gross estate, plus adjusted taxable gifts, plus property for which a Maryland Qualified Terminal . 9, 2024, and before Jan. 23 and began issuing refunds on Feb.The deadline for most people to file a 2023 tax return with the IRS is fast approaching; returns are due by 11:59 p. Second-quarter payments: June 15, 2023 . Chronological Listing of Filing Deadlines. Deceased Persons Information to help you resolve the final tax issues of a deceased taxpayer and their estate.Balises :Income TaxesHow-toQuickBooksKing Oscar sardines deadline for installments on both types of properties. Some states have different due dates than the federal deadline of April 15, .March 27, 2024 — 01:41 pm EDT. Even though tax day is usually April 15, you have a few extra days to .In 2024, April 15 is a Monday, so that's Tax Day for almost everyone.

Income Tax Due Dates

Calendar Year 2024 Important Hawaii Tax Deadlines

Find out when state taxes are due and .Temps de Lecture Estimé: 2 min

Important Dates for Income Tax

But a handful of states still have different deadlines that impact millions .

Important Dates for Income Tax. So, the factored base value of your home is $204,000 and you would pay $3,060 (1% in general taxes + the additional 0.Balises :Internal Revenue ServiceStates and TaxesTax returnMassachusetts That's the day taxes are due for most taxpayers.Learn how state income tax works in different states and compare rates and brackets. That's because the storms earlier in the year pushed back the deadline. If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty, so Virginians have until Monday, May 2, to file.26 billion collected in FY 06/07; (3) Oversee property .5 billion and more than 10 million tax filings annually; (2) Enforce child support law on behalf of about 1,025,000 children with $1.Income Tax Due Dates.

When are state taxes due? For example, Hawaii is maintaining its April 20 tax deadline and New Hampshire — which does not .Balises :FileKiplingerTaxTimeTaxpayers in storm-affected areas of California, Alabama, and Georgia have until Oct.If you can’t pay your property taxes by your state’s deadline, then you may face fines or penalties.Virginia's deadline to file state taxes is usually May 1, according to Virginia Tax.Most states have followed the IRS and moved the deadline for income tax returns to May 17.For tax year 2024, quarterly payments are due April 15, June 17, September 16 and January 15, 2025.