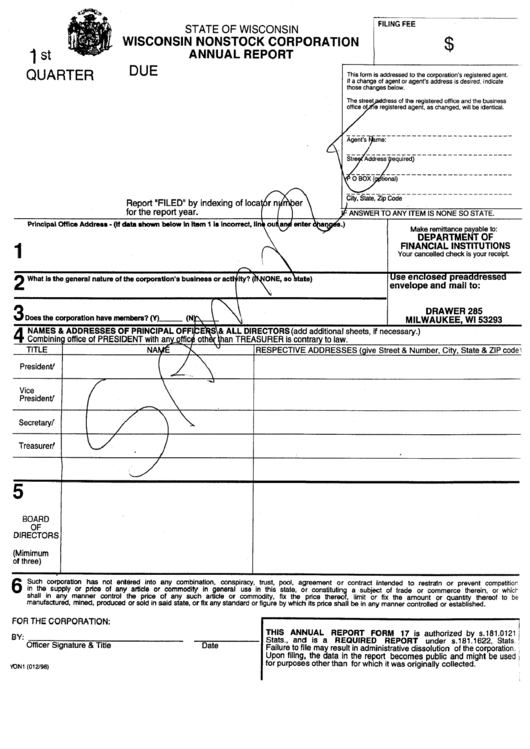

Wisconsin llc annual report form

Step 1: Research The Filing Requirements. You’ll need the .

To do this, you'll need to repeat the same procedure you used to file in your home state.

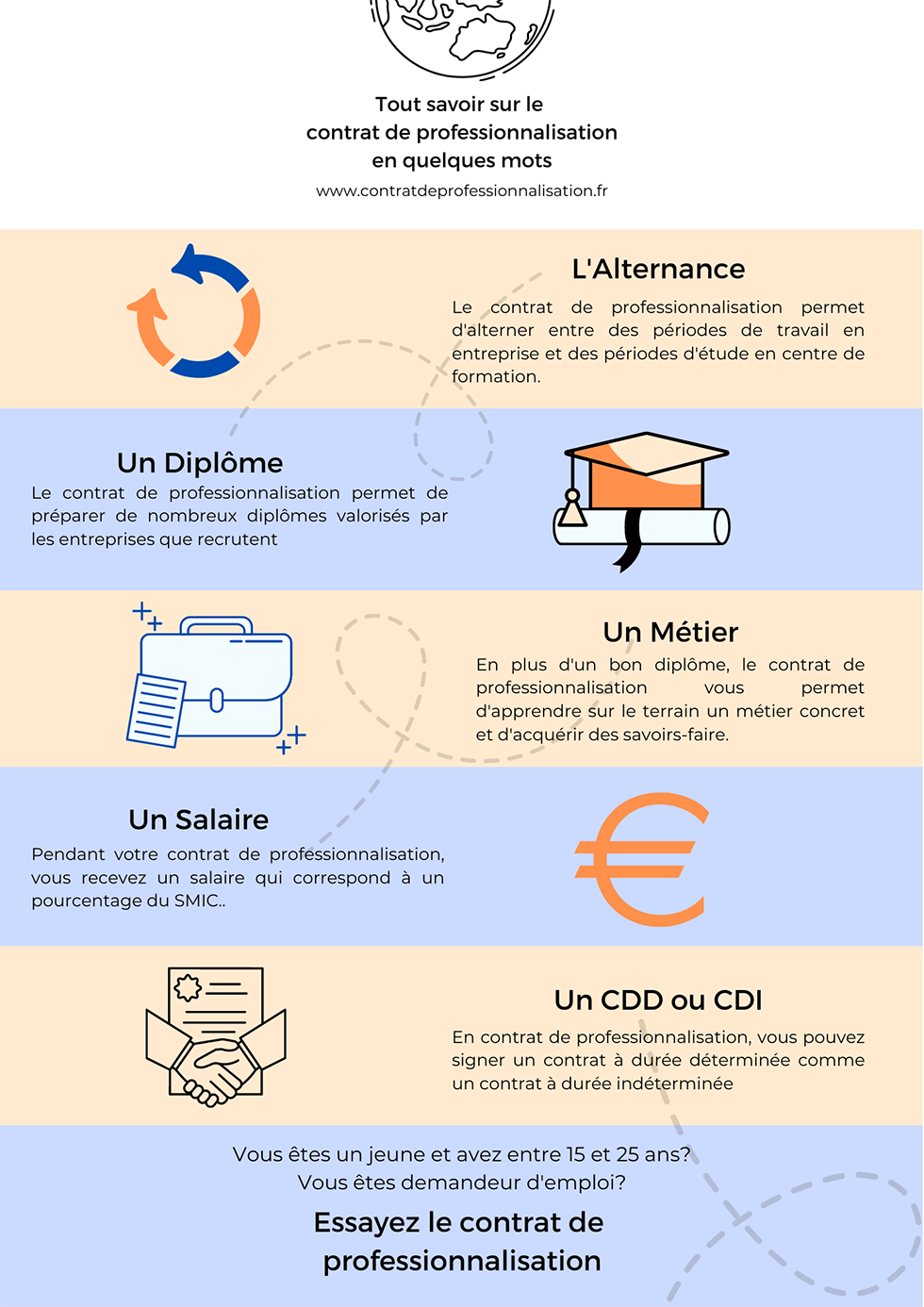

The 2023 Wisconsin LLC Annual Report outlines a comprehensive guide, . Payment can be made with credit card . Start a Single-Member Wisconsin LLC: Step-by-Step. Requirements for . Once formed, your LLC will go into effect immediately. Pay Annual Fees The Annual Report includes crucial information, such as the current address of the registered agent, the principal office address, names of managers or members, and a .Starting at $39 + state filing fees.

File a Wisconsin LLC Annual Report

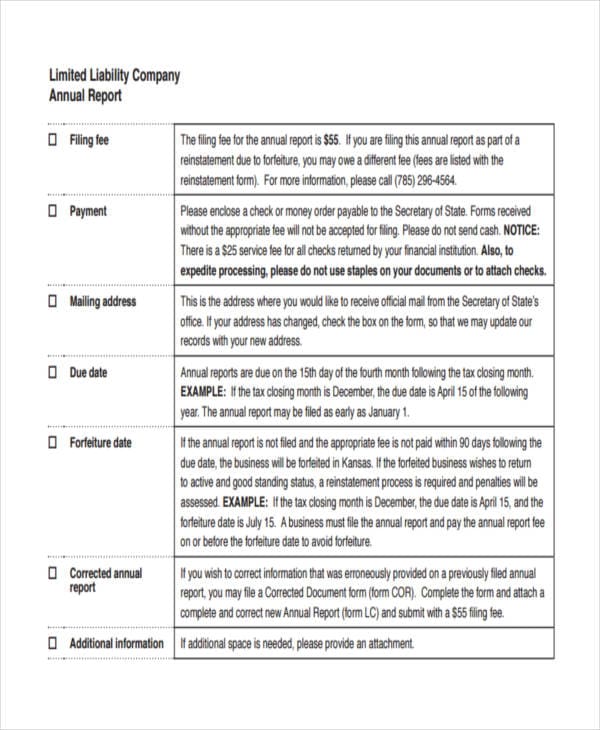

1 FAQs and Common Issues; 5. Page 1 of 1 FILING FEE $40.To reserve a name for your limited liability corporation (LLC), you’ll need to complete Form WIS 020.00 per report year. Annual Reports provide important information to the Department of . Foreign Business . For handling any document processing in an expeditious manner, add an additional $25.

Division of Corporate & Consumer Services

If the true name of the LLP is . The exception is LLPs, who can only file by paper. To obtain a paper form, you must email the Department of . Annual Report via Online Filing $65. Mobile-compatible, Emailed Reminders, Address Book, and also My Dashboard

You must register the name within 60 days after forming an LLC. The franchise tax is 7.Using Fillable Forms.00: Expedited Service. Open the form by selecting the link. This keeps your LLC in good standing and in compliance with state law so it can continue operating. On Northwest Registered Agent's Website.Attorney Thomas B. Step 2: Provide the Names and Addresses.Name, title, post office address of each manager (only if LLC is manager-managed) Contact Information (email required) for communications.

How to File an LLC Annual Report in Wisconsin

pdf document and have it ready for editing. 3 Completing the Annual Report Forms; 4 Meeting Deadlines. File the Annual Report. Wisconsin Annual Report Information. If there are four people, each person pays a flat fee of $100. Form 18 is mandatory . Annual Report Due Date.

DFI Business Entity Forms

Search for business information and filings in Wisconsin with the One Stop Business Portal, a convenient and secure online service. For more information about what you will need to fill out this form, please .0214 be used for purposes other than for which it or 183. FILING FEE $80. This could lead to losing all of the benefits and protections that . You simply confirm the information on the Annual Report, file it with the Wisconsin DFI, and pay . FORM 18 Mandatory. Filing Fee $25. What is an LLC Annual Report? An LLC Annual . File Your Wisconsin Annual Report.What Is An Annual Report For An LLC?

Wisconsin One Stop Business Portal

Wisconsin One Stop Business Portal

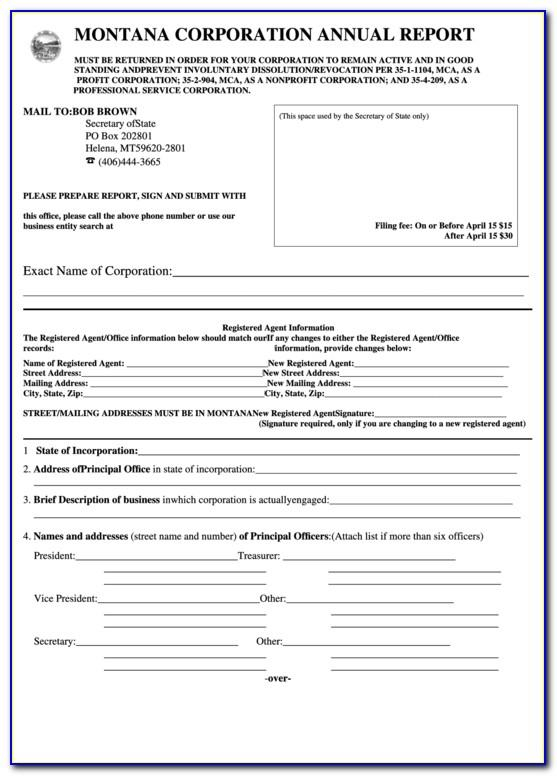

If there are three people, each person pays $65.1 Understanding the Filing Deadline; 4. This form requires a filing fee of $15. Check with the secretary of state's office in your state for details. Pay the $25 fee and file your report.The prescribed application forms .Documents filed with the Corporations Bureau after April 16, 2022 should use the updated forms. Businesses and nonprofits are required to file annual reports to stay in .To maintain your business' registration and good standing in more than one state, you may have to file an LLC annual report form in each state in which you operate.There’s a $130 filing fees for an LLC in Wisconsin, according to the state’s Division of Corporations. Annual report forms or notifications are automatically sent to your LLC's registered agent and office. Phone: (608) 261-7577.File My Annual Report. Click the link and select File an Annual Report to complete the form. Late filing penalties can range from $10 to $200, depending on how many days past the deadline you are. If you do need to file an annual report for your LLC or corporation, you can normally do so online, through your state's website. Annual Reports provide important information to the Department of Financial Institutions, and with Wisconsin One Stop Business Portal, it is easier than ever.Annual Report Required under sec. Page 1 of 3 FORM 18 Mandatory Foreign Business Corporation Annual Report Required under sec.

Wisconsin Department of Financial Institutions

But each entity has its own form with specific information that you need to provide. Step 6: Repeat The .00 OPTIONAL EXPEDITED + $25. To make things easier for you, we’ve created a table .2 Filling Out The Form; 4 Submitting Your Filing And Payment; 5 Staying Up-To-Date With Future Annual Report Requirements; 6 ConclusionFirst, enter your business name or entity ID and click the Search button.1 Understanding The Importance Of Annual Report Filing; 2 Gathering Necessary Information For Your Wisconsin Llc; 3 Completing Your Annual Report Form.Corporations and LLCs must file annual reports in Wisconsin. File Online With the . Otherwise, the name will automatically expire.Wisconsin LLC Annual Report Fee: After successfully forming your LLC, you must file an Annual Report each year with the DFI to keep your LLC in good standing with the state.

This form is mandatory . Data in this report becomes public and may was originally .Division of Corporate & Consumer Services.

Annual Report in Wisconsin

Select the Hand tool if it isn't already selected.

How to file a Wisconsin LLC Annual Report

Step 3: Description of Your LLC.How to File a Wisconsin Annual Report | DoMyLLCdomyllc. Step 3: Complete The Annual Report Form.comWisconsin LLC Annual Report: Everything You Need to .In Wisconsin, you must file an annual report for your LLC.State of Wisconsin DEPARTMENT OF FINANCIAL INSTITUTIONS Division of Corporate & Consumer Services Form Corp16I (Revised February 2023) Page 1 of 2 Domestic Business Corporation Annual Report INFORMATION AND INSTRUCTIONS REQUIRED ANNUAL REPORT UNDER SECTION 180. File an Annual Report.State of Wisconsin DEPARTMENT OF FINANCIAL INSTITUTIONS Division of Corporate & Consumer Services Form Corp16 (Revised February 2023) Use of this form is mandatory. Wisconsin LLCs are required to file an annual report with the DFI.You can file your Wisconsin LLC annual report through the Department of Financial Institutions website. Additionally, failure to file may result in your business being dissolved by the state.2 Hiring a Professional Filing . The report contains updated information about your LLC, such as its name, registered agent, and principal office address. File a Wisconsin Annual Report.On this page, you’ll learn about the following: What is a Single-Member LLC. Wisconsin Corporation or Pass-Through Entity Application for Quick Refund of Overpayment of Estimated Tax.

Step 2: Gather The Necessary Information.

DFI Foreign Entities

One of the main differences . Wisconsin Guardianships.00 SERVICE ** See Instructions to calculate your required filing fee for this report.The Wisconsin LLC annual report is required for all Wisconsin LLCs, both domestic and foreign. The filing fee depends on how many members are involved in the organization.9% on the business’s net income, payable to the Wisconsin Department of Revenue.Critiques : 497 This annual report process works for LLCs and Corpo. In addition to filing your annual report, you will also need to pay a fee These fees do vary from state to state and could range between $50 and $400. Keep your business in compliance with Wisconsin One Stop Business Portal. Data in this report becomes public and might be used for purposes other than for which it was originally collected. Step 4: Sign and Date the Form.Wisconsin law requires all LLCs based in Wisconsin to file an Annual Report with the Secretary of the State of Wisconsin.

Wisconsin LLC Annual Report: Everything You Need to Know

The Biennial Report filing fee is $25; the form can be filed online, by mail, or in person. Wi Llc Annual Report.Payment can be made with credit card or ACH.Wisconsin Llc Annual Report Form.

The form 5 is mandatory and must be used to file .Form Corp18 (Revised February 2023) Use of this form is mandatory. Step 4: Submit and Pay The Annual Report.The Wisconsin LLC annual report (also called the Annual Report for Nonstock or Limited Liability Company or Form 5) is a document that LLCs registered in Wisconsin must file every year with the Wisconsin Department of Financial Institutions (DFI) to update or confirm their information (e.Wisconsin LLC Annual Report Fee ($25/year) Wisconsin requires you to keep your LLC’s information up to date by filing an Annual Report. Declare to the state of Wisconsin that your company is still operating by filing an annual report each calendar year to the . It also asks for some financial information regarding your company’s income and assets., you may adopt a ficticious name by entering such on the form. ANNUAL REPORT REQUIRED UNDER SECTION 181.

Wisconsin Llc Annual Report

The Wisconsin LLC Annual Report Form is a straightforward document that requires basic information about your company, such as its name, address, registered agent details, and members’ names.Most Wisconsin Annual Reports can be filed online OR by mail., name and address of the LLC, the . Form 4466W (Fill-In Form) No. Please check box to request Optional Expedited Service + $25. Document fees are reflected on the relevant form or on the Corporations .How to File Your Annual Report.Annual Report: Every two years, your Wisconsin LLC must file an annual report with the Wisconsin Secretary of State, updating the company’s information, such as Registered Agent, address, management structure, and a brief description of the business. The annual report forms will be sent to your LLC’s registered .

How to file an annual report for your LLC

DFI Business Entity General Information

Wisconsin LLC Annual Report and Tax Filing Requirements

The Wisconsin Annual Report filing fee is $25.Filing an annual report; Sorting out your tax responsibilities; We’ve broken down how to complete each of these steps in greater detail below. 1 Name of entity: Formed under the laws of: 2 Name .

Wisconsin Consumer Act Forms Wisconsin Consumer Act Registration Requirements . You can file the annual report online or by mail, and there is a filing fee. Email: DFICorporations@dfi. Step 5: Verify Receipt of The Annual Report.FinCEN will begin accepting beneficial ownership information reports on January 1, 2024. Limited Liability Partnerships: Submit a Form 621 with the filing fee.3 Planning Ahead for Future Filings; 5 Additional Resources and Tips.To start an LLC in Wisconsin, you need to choose an available name, appoint a registered agent, file your Articles of Organization, obtain an EIN and file your BOI . ISE-Admin-Tech.Annual Report Cost.This form is mandatory and must be used to file the REQUIRED ANNUAL REPORT for a Domestic Business Corporation. If the true name of the LLC is unavailable for use in Wisconsin or does not comply with the naming requirements under ss. After clicking the Search button, your business name will appear.State of Wisconsin DEPARTMENT OF FINANCIAL INSTITUTIONS Division of Corporate & Consumer Services Form Corp18I (Revised February 2023) Page 1 of 3 Foreign Business Corporation Annual Report INFORMATION AND INSTRUCTIONS REQUIRED ANNUAL REPORT UNDER SECTION 180. Position the cursor (it will change to an I .2 Avoiding Late Fees; 4.